You could complete idaho tax commission form st 133 exemptions without difficulty using our online PDF tool. The editor is constantly maintained by our team, getting new awesome features and becoming better. Here's what you'd want to do to get going:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" in the top section of this site.

Step 2: Using our state-of-the-art PDF editor, it is easy to do more than merely complete blanks. Try all of the features and make your documents seem sublime with customized text added in, or fine-tune the original content to excellence - all that comes along with an ability to incorporate almost any images and sign the document off.

Pay close attention when filling out this pdf. Ensure that every field is filled out correctly.

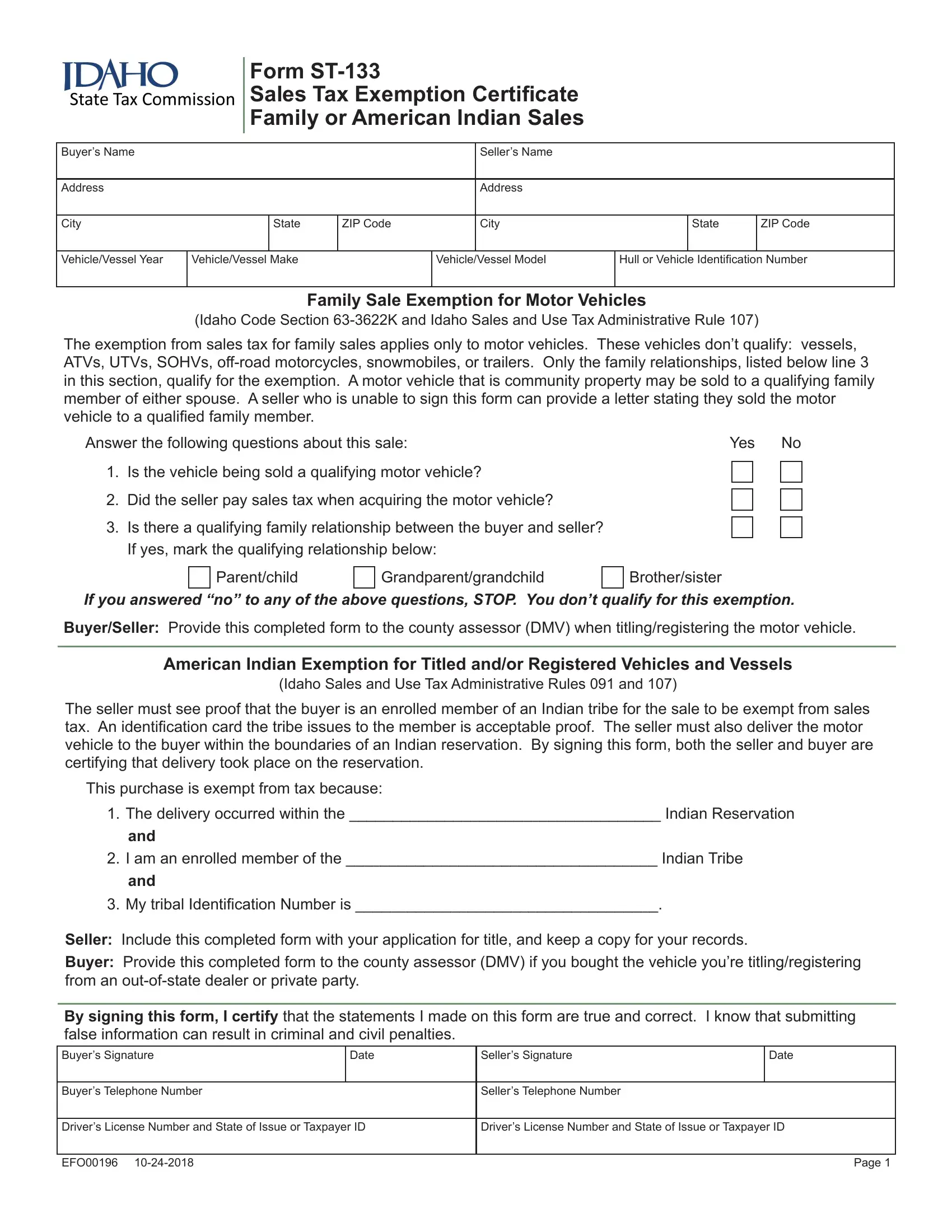

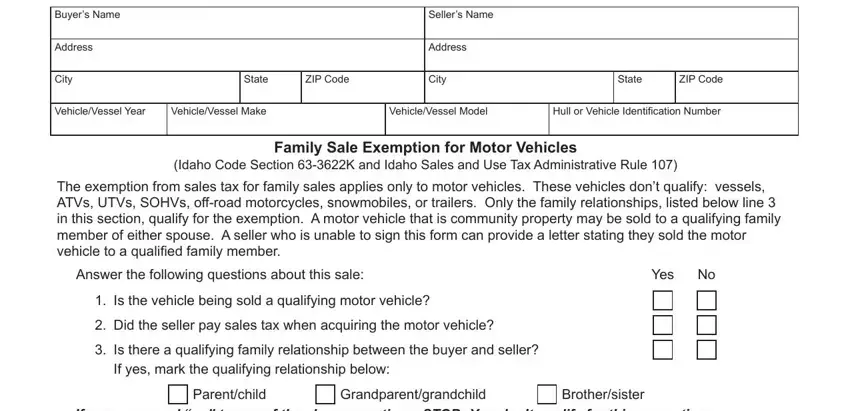

1. When completing the idaho tax commission form st 133 exemptions, ensure to include all of the important blank fields in its corresponding form section. This will help facilitate the process, allowing your details to be processed swiftly and properly.

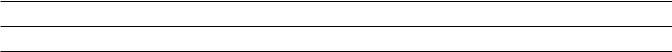

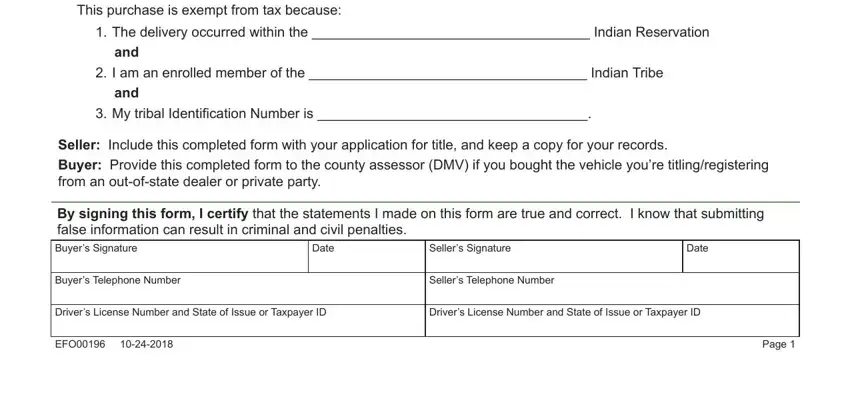

2. The third step would be to submit the following blank fields: This purchase is exempt from tax, The delivery occurred within the, and, I am an enrolled member of the, and, My tribal Identification Number, Seller Include this completed form, Buyer Provide this completed form, By signing this form I certify, Buyers Signature, Date, Sellers Signature, Date, Buyers Telephone Number, and Sellers Telephone Number.

A lot of people generally get some things wrong when filling in This purchase is exempt from tax in this section. Ensure you reread whatever you enter right here.

Step 3: Always make sure that your details are accurate and then press "Done" to finish the project. After getting afree trial account here, you will be able to download idaho tax commission form st 133 exemptions or email it right away. The PDF file will also be readily accessible in your personal cabinet with your each edit. Here at FormsPal, we do everything we can to ensure that your details are stored private.