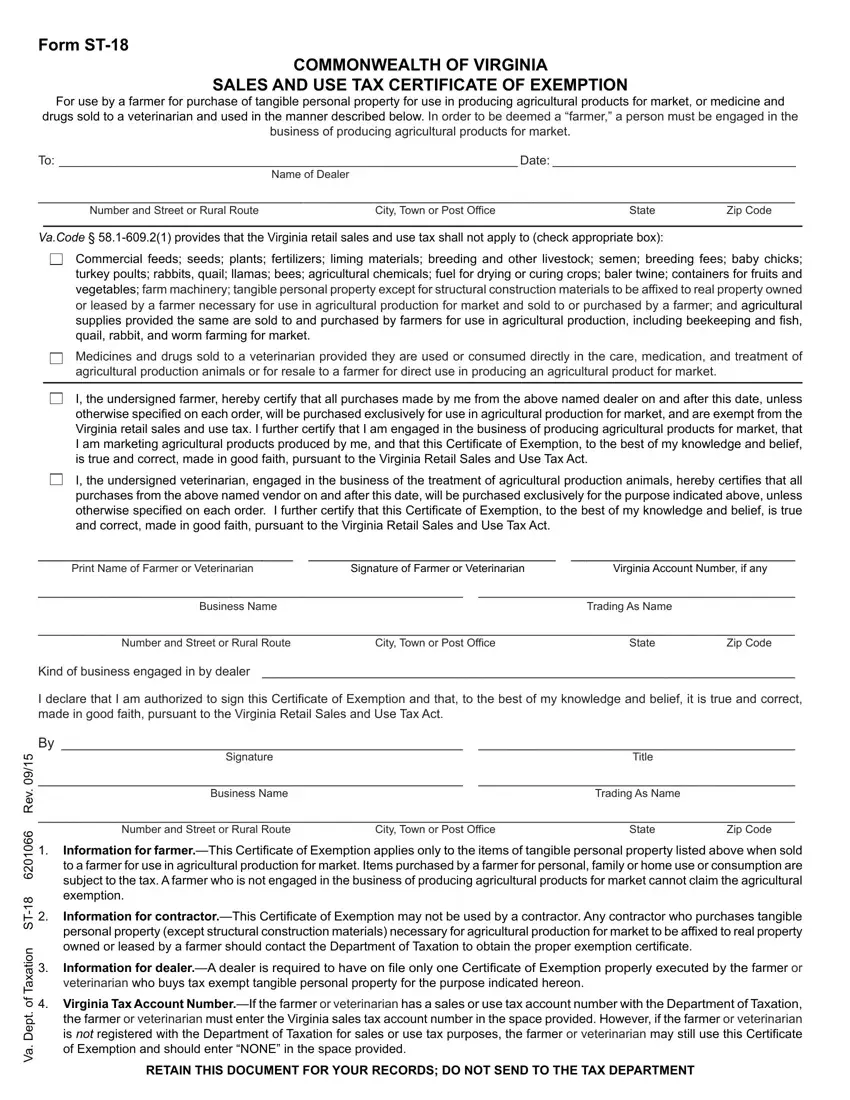

Form ST-18

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by a farmer for purchase of tangible personal property for use in producing agricultural products for market, or medicine and

drugs sold to a veterinarian and used in the manner described below. In order to be deemed a “farmer,” a person must be engaged in the

business of producing agricultural products for market.

To:___________________________________________________________________ Date:____________________________________

Name of Dealer

__________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Office |

State |

Zip Code |

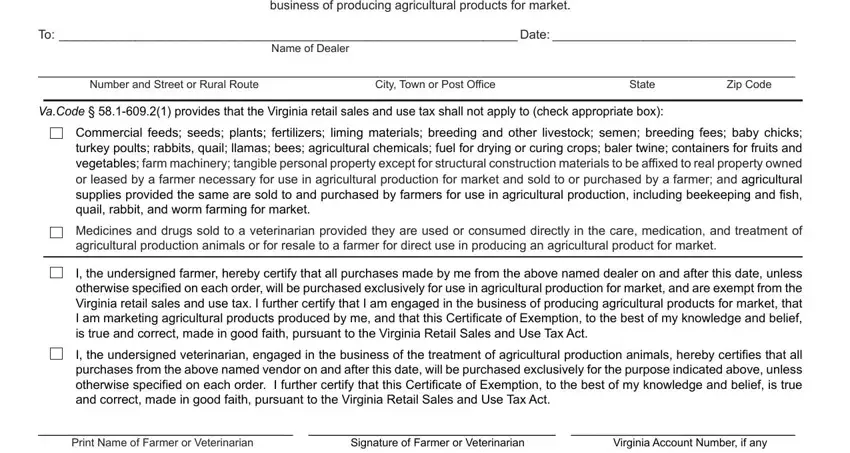

Va.Code § 58.1-609.2(1) provides that the Virginia retail sales and use tax shall not apply to (check appropriate box):

Commercial feeds; seeds; plants; fertilizers; liming materials; breeding and other livestock; semen; breeding fees; baby chicks; turkey poults; rabbits, quail; llamas; bees; agricultural chemicals; fuel for drying or curing crops; baler twine; containers for fruits and vegetables; farm machinery; tangible personal property except for structural construction materials to be affixed to real property owned or leased by a farmer necessary for use in agricultural production for market and sold to or purchased by a farmer; and agricultural supplies provided the same are sold to and purchased by farmers for use in agricultural production, including beekeeping and fish, quail, rabbit, and worm farming for market.

Medicines and drugs sold to a veterinarian provided they are used or consumed directly in the care, medication, and treatment of agricultural production animals or for resale to a farmer for direct use in producing an agricultural product for market.

I, the undersigned farmer, hereby certify that all purchases made by me from the above named dealer on and after this date, unless otherwise specified on each order, will be purchased exclusively for use in agricultural production for market, and are exempt from the Virginia retail sales and use tax. I further certify that I am engaged in the business of producing agricultural products for market, that I am marketing agricultural products produced by me, and that this Certificate of Exemption, to the best of my knowledge and belief, is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

I, the undersigned veterinarian, engaged in the business of the treatment of agricultural production animals, hereby certifies that all purchases from the above named vendor on and after this date, will be purchased exclusively for the purpose indicated above, unless otherwise specified on each order. I further certify that this Certificate of Exemption, to the best of my knowledge and belief, is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

_________________________________ |

_________________________________ |

_ _____________________________ |

Print Name of Farmer or Veterinarian |

Signature of Farmer or Veterinarian |

Virginia Account Number, if any |

_______________________________________________________ _________________________________________

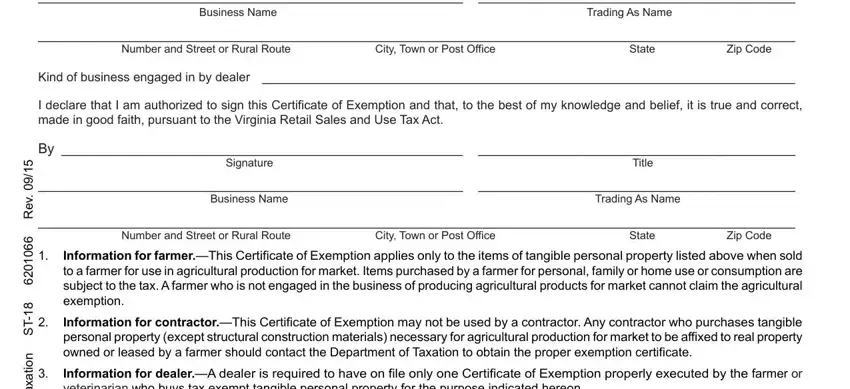

Business NameTrading As Name

__________________________________________________________________________________________________

Number and Street or Rural RouteCity, Town or Post OfficeStateZip Code

Kind of business engaged in by dealer _ _____________________________________________________________________

I declare that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

Va. Dept. of Taxation ST-18 6201066 Rev. 09/15

By _____________________________________________________ |

_________________________________________ |

Signature |

Title |

_______________________________________________________ |

_________________________________________ |

Business Name |

Trading As Name |

__________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Office |

State |

Zip Code |

1.Information for farmer.—This Certificate of Exemption applies only to the items of tangible personal property listed above when sold to a farmer for use in agricultural production for market. Items purchased by a farmer for personal, family or home use or consumption are subject to the tax. A farmer who is not engaged in the business of producing agricultural products for market cannot claim the agricultural exemption.

2.Information for contractor.—This Certificate of Exemption may not be used by a contractor. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market to be affixed to real property owned or leased by a farmer should contact the Department of Taxation to obtain the proper exemption certificate.

3.Information for dealer.—A dealer is required to have on file only one Certificate of Exemption properly executed by the farmer or veterinarian who buys tax exempt tangible personal property for the purpose indicated hereon.

4.Virginia Tax Account Number.—If the farmer or veterinarian has a sales or use tax account number with the Department of Taxation, the farmer or veterinarian must enter the Virginia sales tax account number in the space provided. However, if the farmer or veterinarian is not registered with the Department of Taxation for sales or use tax purposes, the farmer or veterinarian may still use this Certificate of Exemption and should enter “NONE” in the space provided.

RETAIN THIS DOCUMENT FOR YOUR RECORDS; DO NOT SEND TO THE TAX DEPARTMENT