Managing the minnesota have form document is not difficult with this PDF editor. Stick to the following actions to obtain the document instantly.

Step 1: The first thing is to click on the orange "Get Form Now" button.

Step 2: You'll find all the functions you can undertake on your file once you've entered the minnesota have form editing page.

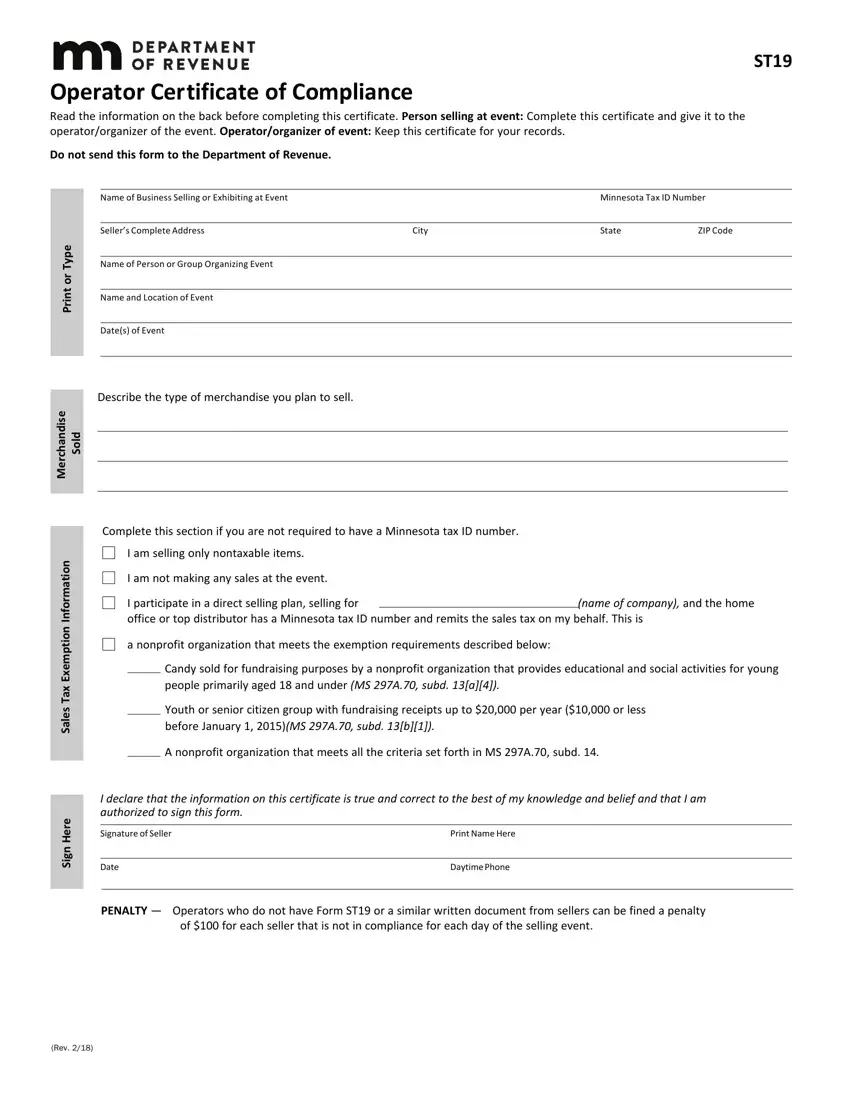

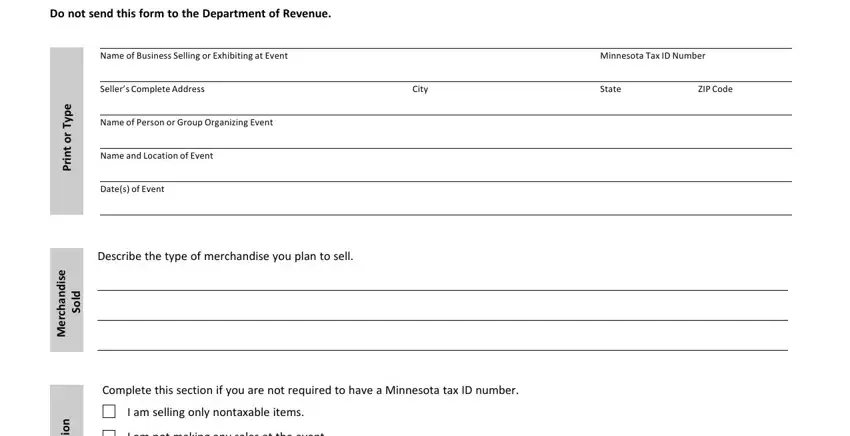

Complete the minnesota have form PDF by providing the details meant for every part.

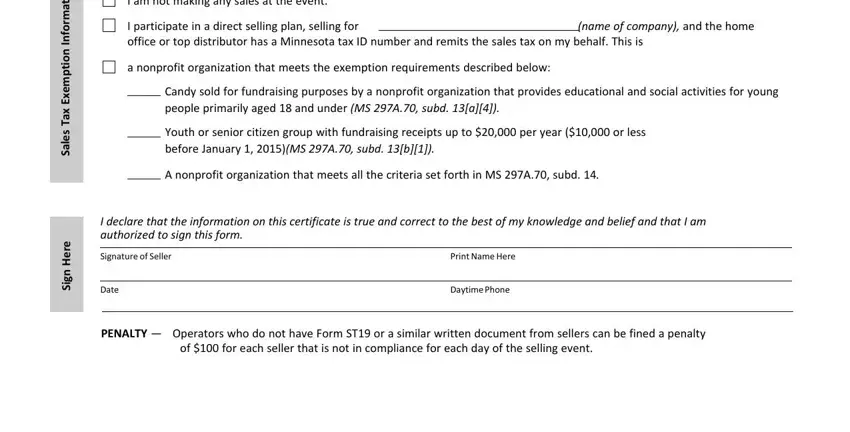

Remember to note your data within the box I am not making any sales at the, I participate in a direct selling, name of company and the home, a nonprofit organization that, Candy sold for fundraising, Youth or senior citizen group with, A nonprofit organization that, I declare that the information on, Print Name Here, Date, Daytime Phone, PENALTY Operators who do not have, of for each seller that is not in, n o i t a m r o f n, and n o i t p m e x E.

In the A registration application Form, Most sales tax forms and fact, For information related to sellers, Well provide information in other, Operatorsorganizers of craft, If a seller is not required to, All operators including operators, Certain individual sellers are not, The seller makes sales of or less, during the calendar year and, The seller provides a written, and This isolated and occasional sales area, emphasize the relevant information.

Step 3: Hit the "Done" button. Now you can upload the PDF file to your electronic device. Aside from that, you may send it via email.

Step 4: Produce a copy of any document. It would save you some time and allow you to keep clear of troubles in the long run. Also, your details will not be shared or viewed by us.