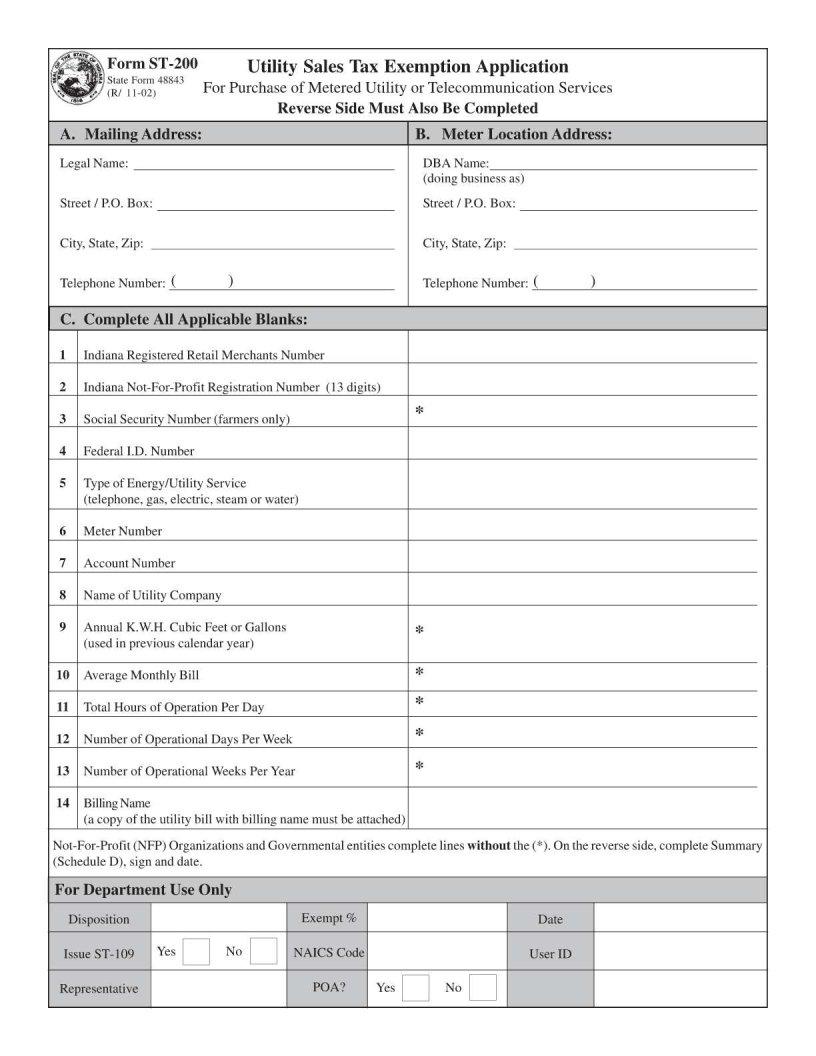

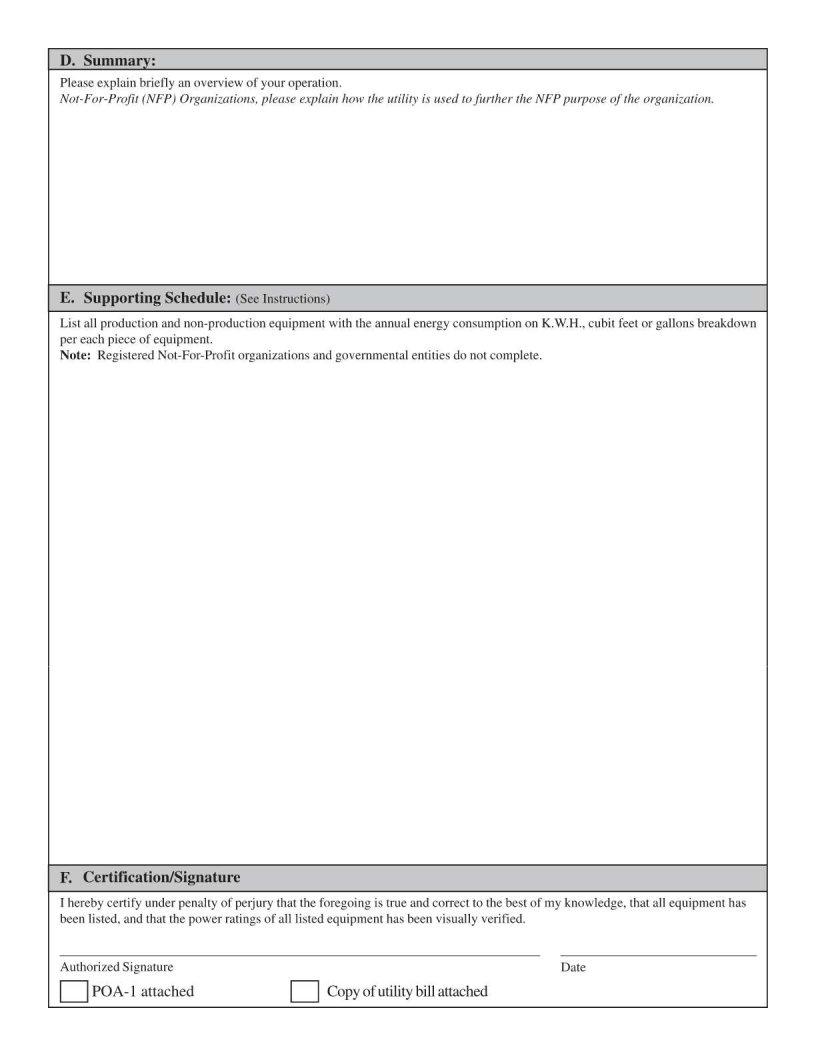

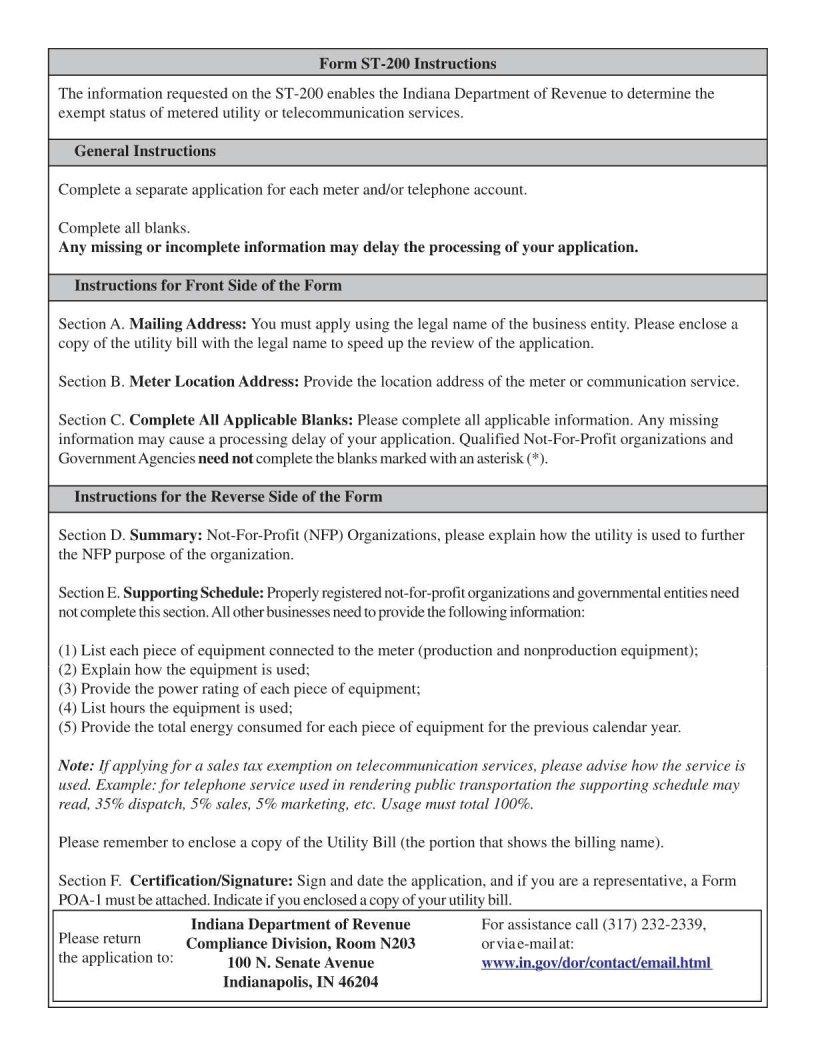

The process of managing taxes and complying with state regulations is a critical aspect for any business, and understanding the nuances involved can often be daunting. Enter the ST-200 form, a linchpin for businesses operating within certain jurisdictions that necessitates a deep dive into its significance, requirements, and the procedures for its completion. This form serves as a declaration, often pivotal for businesses, to align with specific state tax obligations, ensuring they remain in good standing within their operating region. Its application ranges from acknowledging tax liabilities to facilitating the accurate collection and remittance of taxes owed. Navigating the intricacies of the ST-200 form not only aids businesses in fulfilling their legal obligations but also underscores the importance of thoroughness in tax reporting and compliance. By comprehensively understanding this form, businesses position themselves to better manage their fiscal responsibilities, avoid common pitfalls associated with tax filings, and leverage potential benefits under the law.

| Question | Answer |

|---|---|

| Form Name | Form St 200 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | cubit, Indiana, ST-200, nonproduction |