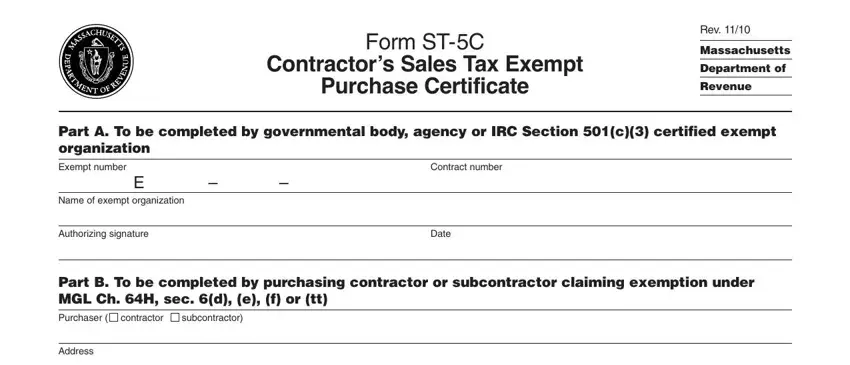

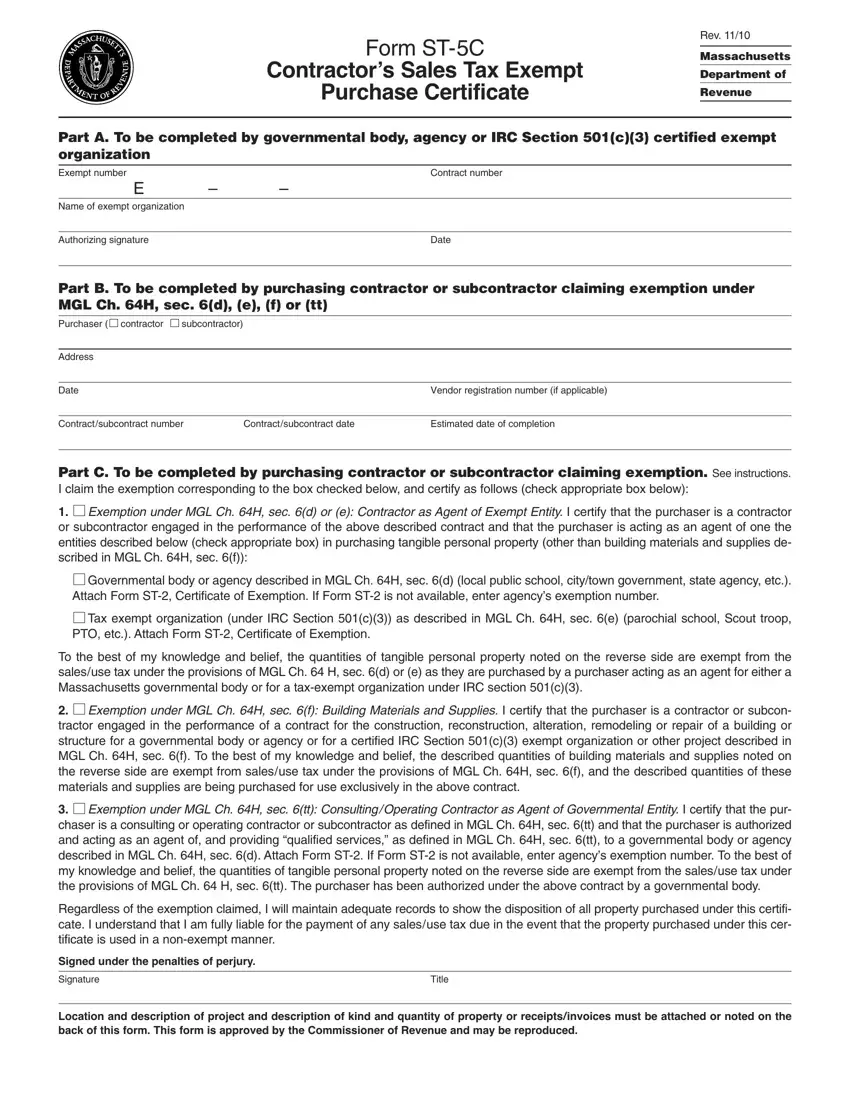

Part A. To be completed by governmental body, agency or IRC Section 501(c)(3) certified exempt organization

Exempt number |

|

Contract number |

E |

– |

– |

Name of exempt organization |

|

|

|

|

|

Authorizing signature |

|

Date |

Part B. To be completed by purchasing contractor or subcontractor claiming exemption under MGL Ch. 64H, sec. 6(d), (e), (f) or (tt)

Purchaser (

contractor

contractor  subcontractor)

subcontractor)

Address

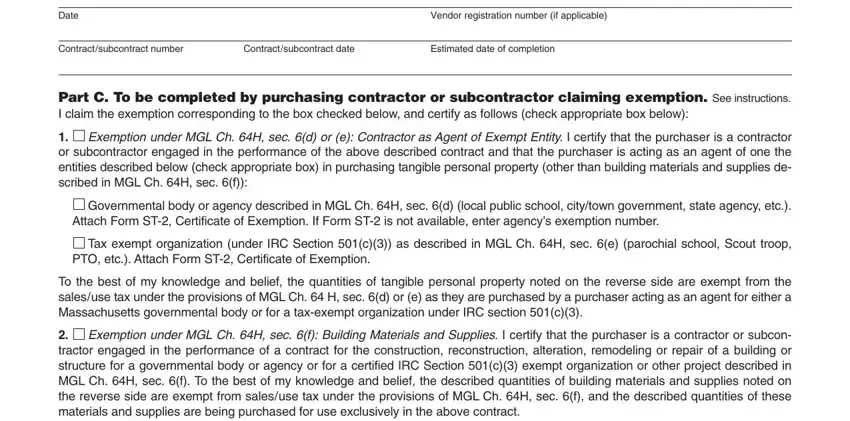

Date |

|

Vendor registration number (if applicable) |

|

|

|

Contract/subcontract number |

Contract/subcontract date |

Estimated date of completion |

Part C. To be completed by purchasing contractor or subcontractor claiming exemption. See instructions.

I claim the exemption corresponding to the box checked below, and certify as follows (check appropriate box below):

1. Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity. I certify that the purchaser is a contractor or subcontractor engaged in the performance of the above described contract and that the purchaser is acting as an agent of one the entities described below (check appropriate box) in purchasing tangible personal property (other than building materials and supplies de- scribed in MGL Ch. 64H, sec. 6(f)):

Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity. I certify that the purchaser is a contractor or subcontractor engaged in the performance of the above described contract and that the purchaser is acting as an agent of one the entities described below (check appropriate box) in purchasing tangible personal property (other than building materials and supplies de- scribed in MGL Ch. 64H, sec. 6(f)):

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form ST-2, Certificate of Exemption. If Form ST-2 is not available, enter agency’s exemption number.

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form ST-2, Certificate of Exemption. If Form ST-2 is not available, enter agency’s exemption number.

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form ST-2, Certificate of Exemption.

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form ST-2, Certificate of Exemption.

To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the sales/use tax under the provisions of MGL Ch. 64 H, sec. 6(d) or (e) as they are purchased by a purchaser acting as an agent for either a Massachusetts governmental body or for a tax-exempt organization under IRC section 501(c)(3).

2.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies. I certify that the purchaser is a contractor or subcon- tractor engaged in the performance of a contract for the construction, reconstruction, alteration, remodeling or repair of a building or structure for a governmental body or agency or for a certified IRC Section 501(c)(3) exempt organization or other project described in MGL Ch. 64H, sec. 6(f). To the best of my knowledge and belief, the described quantities of building materials and supplies noted on the reverse side are exempt from sales/use tax under the provisions of MGL Ch. 64H, sec. 6(f), and the described quantities of these materials and supplies are being purchased for use exclusively in the above contract.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies. I certify that the purchaser is a contractor or subcon- tractor engaged in the performance of a contract for the construction, reconstruction, alteration, remodeling or repair of a building or structure for a governmental body or agency or for a certified IRC Section 501(c)(3) exempt organization or other project described in MGL Ch. 64H, sec. 6(f). To the best of my knowledge and belief, the described quantities of building materials and supplies noted on the reverse side are exempt from sales/use tax under the provisions of MGL Ch. 64H, sec. 6(f), and the described quantities of these materials and supplies are being purchased for use exclusively in the above contract.

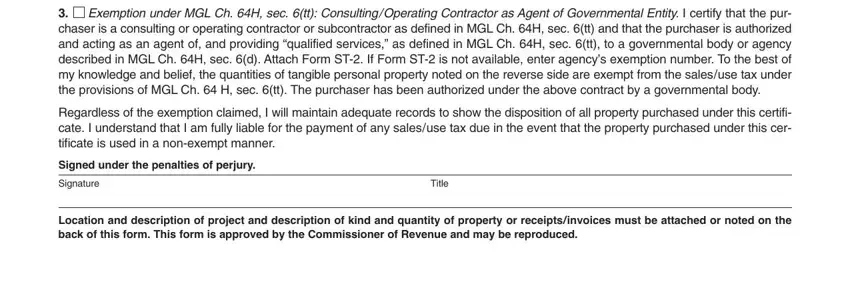

3. Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity. I certify that the pur- chaser is a consulting or operating contractor or subcontractor as defined in MGL Ch. 64H, sec. 6(tt) and that the purchaser is authorized and acting as an agent of, and providing “qualified services,” as defined in MGL Ch. 64H, sec. 6(tt), to a governmental body or agency described in MGL Ch. 64H, sec. 6(d). Attach Form ST-2. If Form ST-2 is not available, enter agency’s exemption number. To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the sales/use tax under the provisions of MGL Ch. 64 H, sec. 6(tt). The purchaser has been authorized under the above contract by a governmental body.

Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity. I certify that the pur- chaser is a consulting or operating contractor or subcontractor as defined in MGL Ch. 64H, sec. 6(tt) and that the purchaser is authorized and acting as an agent of, and providing “qualified services,” as defined in MGL Ch. 64H, sec. 6(tt), to a governmental body or agency described in MGL Ch. 64H, sec. 6(d). Attach Form ST-2. If Form ST-2 is not available, enter agency’s exemption number. To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the sales/use tax under the provisions of MGL Ch. 64 H, sec. 6(tt). The purchaser has been authorized under the above contract by a governmental body.

Regardless of the exemption claimed, I will maintain adequate records to show the disposition of all property purchased under this certifi- cate. I understand that I am fully liable for the payment of any sales/use tax due in the event that the property purchased under this cer- tificate is used in a non-exempt manner.

Signed under the penalties of perjury.

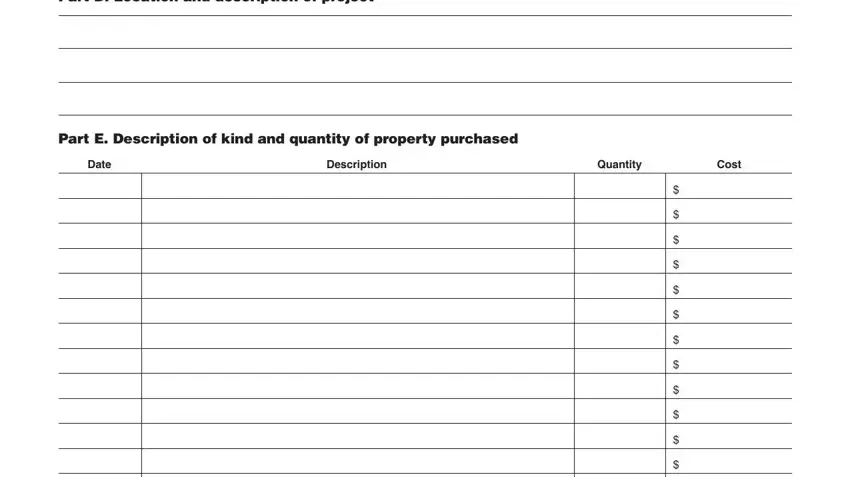

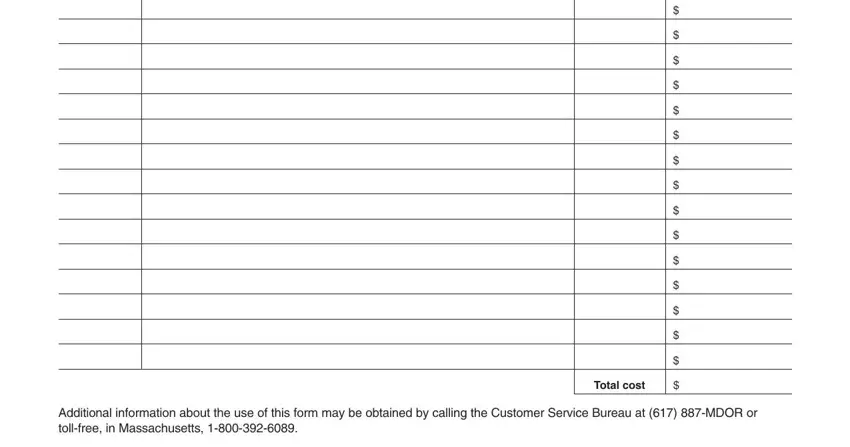

Location and description of project and description of kind and quantity of property or receipts/invoices must be attached or noted on the back of this form. This form is approved by the Commissioner of Revenue and may be reproduced.

contractor

contractor  subcontractor)

subcontractor) Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity.

Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity.  Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form  Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies.  Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity.

Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity.

printed on recycled paper

printed on recycled paper