Understanding the nuances of tax compliance is essential for businesses operating within New York State, and the ST-809 form plays a critical role in this landscape. Issued by the Department of Taxation and Finance, this document is designed for part-quarterly (monthly) filers, covering sales and use tax returns for specific periods, exemplified by the October 2021 timeframe from October 1, 2021, to October 31, 2021. It requires businesses to furnish detailed information, including sales tax identification numbers, legal names, DBA (doing business as) names, and addresses. Importantly, the form also stipulates a due date (e.g., November 22, 2021, for the October period) by which the completed return and any owed payments must be submitted to avoid penalties and interest on late filings. Additionally, the ST-809 form embraces technology through its mandate for most filers to use the Sales Tax Web File system, thereby streamlining the filing process. The form accommodates two methods for computing taxes due— the long and short methods—offering flexibility in how businesses can calculate their liabilities based on gross sales, purchases subject to tax, prepaid sales tax credits, and other factors. This adaptability ensures that businesses can accurately report their tax obligations, reinforcing the importance of timely compliance and the potentially significant implications of failing to do so, including the specific mention of a $50 penalty for the late filing of a no-tax-due return. With detailed instructions for changes in business information and guidance on allowing third parties to discuss the return with the tax department, the ST-809 form encapsulates a comprehensive approach to sales and use tax filing in New York State.

| Question | Answer |

|---|---|

| Form Name | St 809 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 2013, 809, Designees, ST-809-I |

Department of Taxation and Finance |

||

New York State and Local |

|

October 2021 |

|

Tax period |

|

Sales and Use Tax Return |

|

|

|

October 1, 2021 – October 31, 2021 |

|

for |

|

|

|

|

|

|

|

|

Sales tax identification number

Legal name (print ID number and legal name as it appears on the Certificate of Authority)

DBA (doing business as) name

Number and street

City, state, ZIP code

|

November 2021 |

|

|

|

||||

S |

M |

T |

W |

T |

F |

S |

|

|

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

7 |

8 |

9 |

10 |

11 |

12 |

13 |

|

0822 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

|

|

21 |

22 |

23 |

24 |

25 |

26 |

27 |

|

|

28 |

29 |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22Due date:

Monday, November 22, 2021

You will be responsible for penalty

and interest if your return and any payment due is not electronically filed or

postmarked by this date.

Mandate to use Sales Tax Web File - Most filers fall under this requirement. See Form

No tax due? Enter your gross sales and services in box 1 of Step 1 below; enter none in boxes 2 and 3. You must file by the due date even if no tax is due. There is a $50 penalty for late filing of a

Has your address or |

If so, visit our website (see Need help? in instructions) and see the change my address option for further instructions, |

business information changed? or mark an X in the box to the right and enter new mailing address above. See instructions |

|

|

|

Complete Step 1 or Step 2, but not both. |

|

Step 1 Long method of calculating tax due (see instructions) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Enter total gross sales and services (to nearest dollar) |

|

|

|

1 |

|

.00 |

||||

|

|

|

|

|

|||||||

2 |

Enter total taxable sales and services (to nearest dollar) |

|

|

|

2 |

|

.00 |

||||

|

|

|

|

|

|||||||

3 |

........................................................................Enter total purchases subject to tax (to nearest dollar) |

|

|

|

3 |

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Sales and use tax |

|

|

4 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||

5 |

Credit for prepaid sales tax |

|

|

|

|

|

|

|

|

||

|

5 |

|

|

|

|

|

|||||

6 |

..........................................................................Net tax due (subtract box 5 amount from box 4 amount) |

|

|

|

6 |

|

|

||||

7 |

Credits not identified (attachments required) |

|

|

|

|

|

|

|

|

||

|

7 |

|

|

|

|

|

|||||

8 |

Advance payments |

|

|

|

|

|

|

|

|

||

|

8 |

|

|

|

|

|

|||||

9 |

..................................................................................................Add box 7 amount to box 8 amount |

|

|

|

|

9 |

|

|

|||

10 |

Sales and use tax due (subtract box 9 amount from box 6 amount) |

|

|

|

|

|

|

||||

|

|

|

10 |

|

|

||||||

11 |

Penalty and interest |

|

|

|

|

|

|

|

|

||

|

|

|

|

11 |

|

|

|||||

12a |

Amount due (add box 10 amount to box 11 amount) |

|

|

|

|

|

|||||

|

|

|

12a |

|

|

||||||

12b |

Amount paid |

|

|

|

|

|

|

|

|||

|

|

|

|

12b |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 2 Short method of calculating tax due (see instructions) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Comparable quarter of previous year |

|

|

1 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

2 |

Tax due |

|

|

2 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

3 |

Credit for prepaid sales tax |

|

|

3 |

|

|

|

|

|

||

4 |

..........................................................................Net tax due (subtract box 3 amount from box 2 amount) |

|

|

4 |

|

|

|||||

|

|

|

|

|

|

||||||

5 |

.....................................Credits not identified (attachments required) |

|

5 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Advance payments |

|

|

|

|

|

|

|

|

||

|

6 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

7 |

...................................................................................................Add box 5 amount to box 6 amount |

|

|

|

|

7 |

|

|

|||

|

|

|

|

|

|

|

|

||||

8 |

Sales and use tax due (subtract box 7 amount from box 4 amount) |

|

|

8 |

|

|

|||||

|

|

|

|

|

|

||||||

9 |

Penalty and interest |

|

|

|

|

9 |

|

|

|||

|

|

|

|

|

|

|

|

||||

10a |

Amount due (add box 8 amount to box 9 amount) |

|

|

|

|

|

10a |

|

|

||

|

|

|

|

|

|

|

|

||||

10b |

....................................................................................................................................Amount paid |

|

|

|

|

10b |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

*Include short method adjustment in box 1 (see Short method adjustment on page 3 of instructions.) |

For office use only |

|

|||||||||

|

|

Locality |

Adjustment |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90000110210094

Page 2 of 2 |

Sales tax identification number |

|

|

|

|

|

|

|

|

0822 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3 Sign and mail this return (see instr.) |

|

Must be postmarked by Monday, November 22, 2021, to be considered filed on time. |

|||||||||||||||||||||||||

Please be sure to keep a completed copy for your records. |

See below for complete mailing information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Third – |

|

|

Do you want to allow another person to discuss this return with the Tax Dept? (see instructions) |

Yes |

|

|

(complete the following) No |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

Personal identification |

|

|

|

|

|

|||||||||||||||

|

|

Designee’s name |

|

|

Designee’s phone number |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

party |

|

|

|

|

|

( |

) |

|

|

|

|

|

number (PIN) |

|

|

|

|

|

|||||||||

designee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Designee’s email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of authorized person |

|

|

|

|

Official title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

person |

|

|

Email address of authorized person |

|

|

|

|

|

|

|

Telephone number |

|

|

|

|

|

Date |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

Firm’s name (or yours if |

|

|

|

|

|

|

Firm’s EIN |

|

|

|

|

|

|

|

Preparer’s PTIN or SSN |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Signature of individual preparing this return |

Address |

|

|

|

|

|

City |

|

|

|

|

|

|

|

State |

|

ZIP code |

|||||||||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Email address of individual preparing this return |

Telephone number |

|

Preparer’s NYTPRIN |

|

|

|

|

|

NYTPRIN |

|

Date |

|||||||||||||||

(see instr.) |

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

excl. code |

|

|

|

|

|||

*See Paid preparer’s responsibilities in instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Where to file your return and attachments |

|

|

|

|

|

|

|

|

|

|

|

|

|

November 10, 2021 |

|||||||||||||

Web File your return at www.tax.ny.gov (see instructions). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

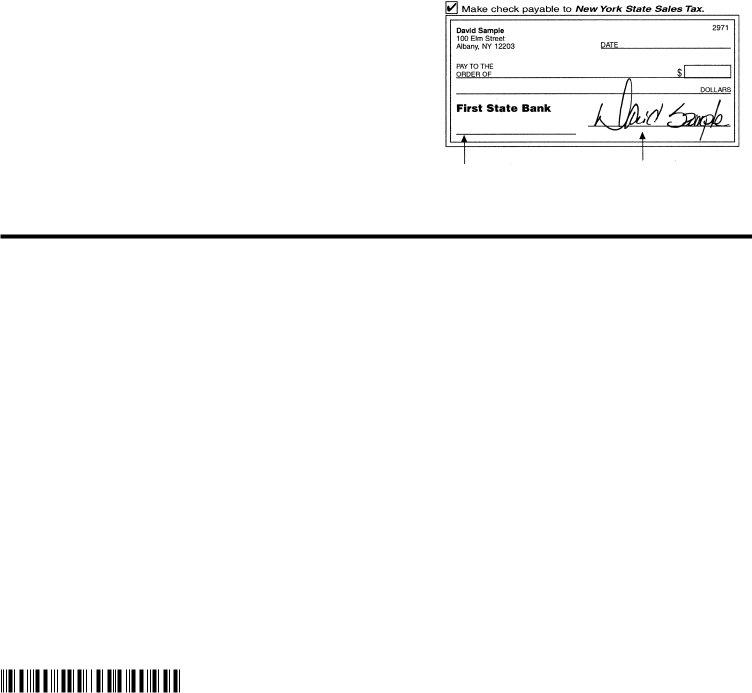

(If you are not required to Web File, mail your return and |

|

|

|

|

|

New York State Sales Tax |

|

X,XXX.XX |

|||||||||||||||||||

attachments to: NYS Sales Tax Processing, PO Box 15172, |

|

|

|

|

|

(your payment amount) |

|

|

|

|

|||||||||||||||||

Albany NY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

If using a private delivery service rather than the U.S. Postal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Service, see Publication 55, Designated Private Delivery |

|

10/31/21 |

|

|

|

|

|

|

|

|

|

||||||||||||||||

Services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Don’t forget to write your sales tax ID#, |

Don’t forget to |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

sign your check |

||||||||||||

Need help?

See Form

90000210210094