When working in the online PDF editor by FormsPal, you can complete or alter 556x right here. The editor is consistently upgraded by us, receiving cool functions and growing to be greater. To begin your journey, take these basic steps:

Step 1: First of all, open the editor by clicking the "Get Form Button" above on this webpage.

Step 2: The editor enables you to change your PDF in a variety of ways. Improve it with any text, adjust existing content, and include a signature - all close at hand!

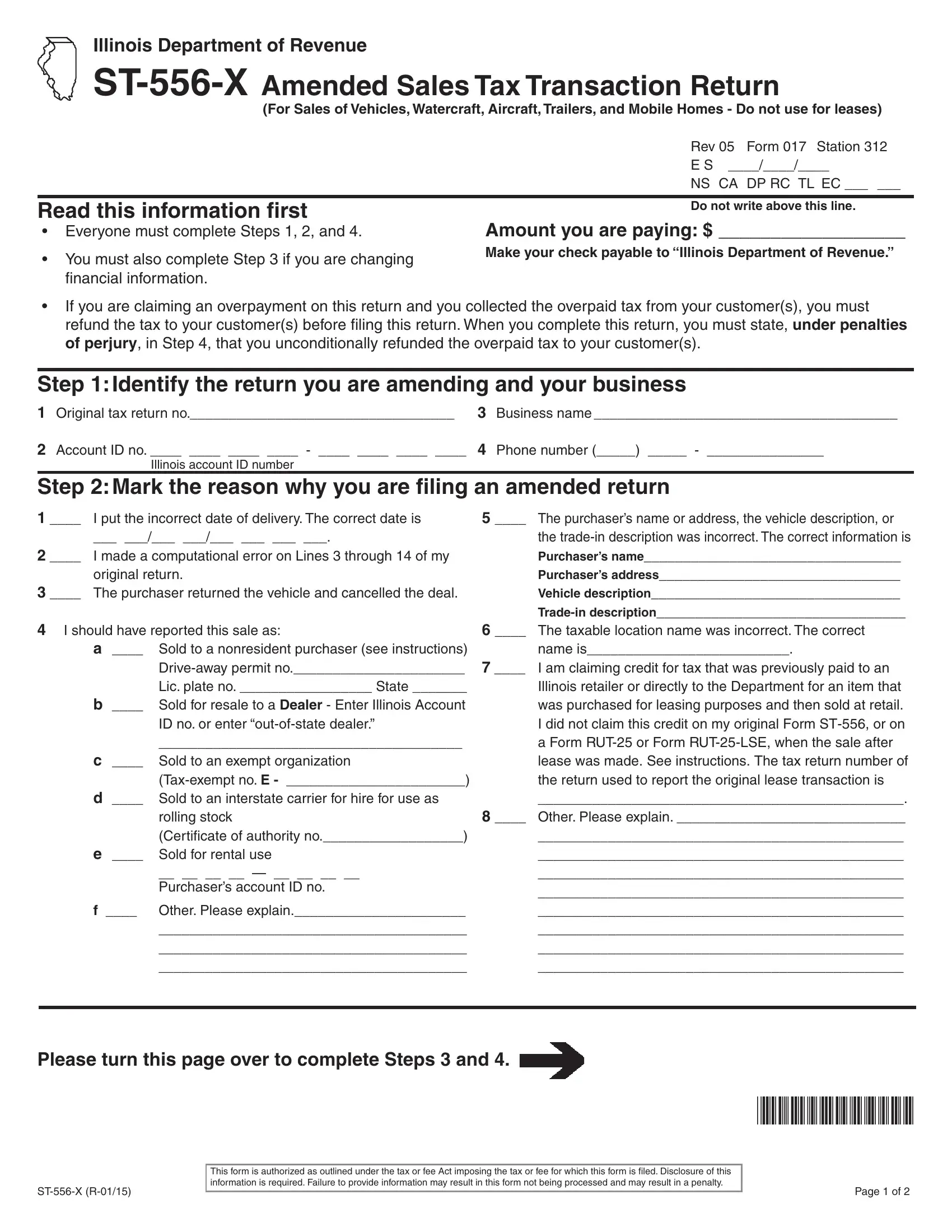

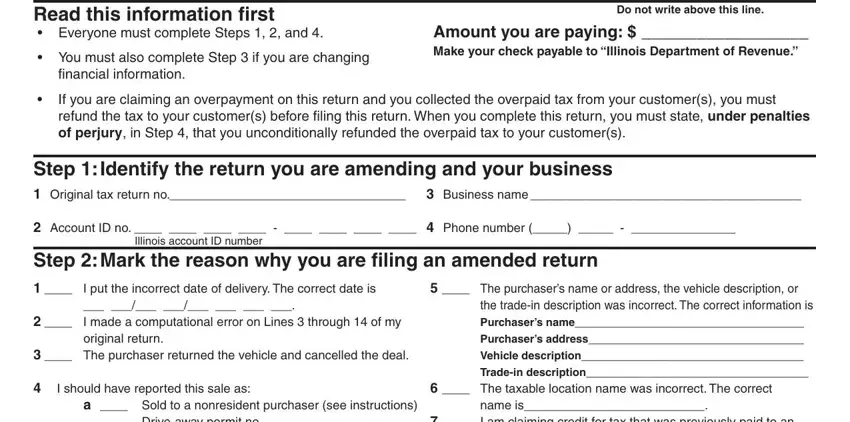

This PDF doc requires specific details; to ensure accuracy, don't hesitate to adhere to the guidelines below:

1. While filling in the 556x, make certain to complete all of the necessary blanks in the associated area. It will help hasten the work, allowing your details to be handled promptly and properly.

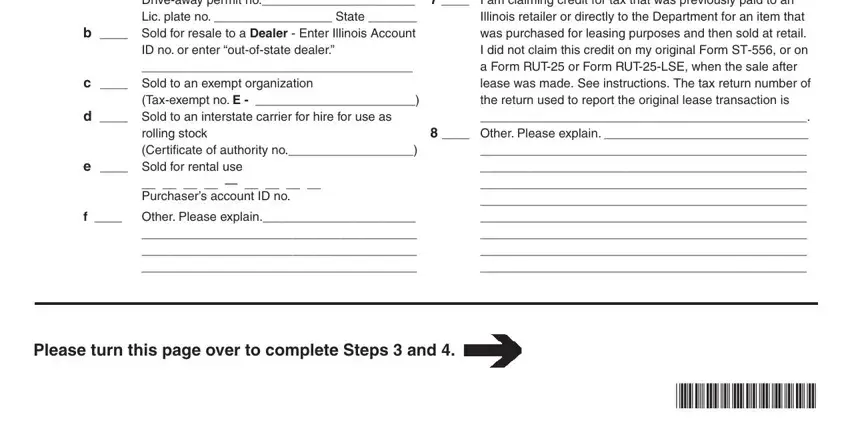

2. The next part is usually to submit these blanks: I should have reported this sale as, a Sold to a nonresident purchaser, ID no or enter outofstate dealer, Taxexempt no E, rolling stock Certificate of, c Sold to an exempt organization, d Sold to an interstate carrier, Purchasers account ID no, The taxable location name was, name is I am claiming credit for, and Please turn this page over to.

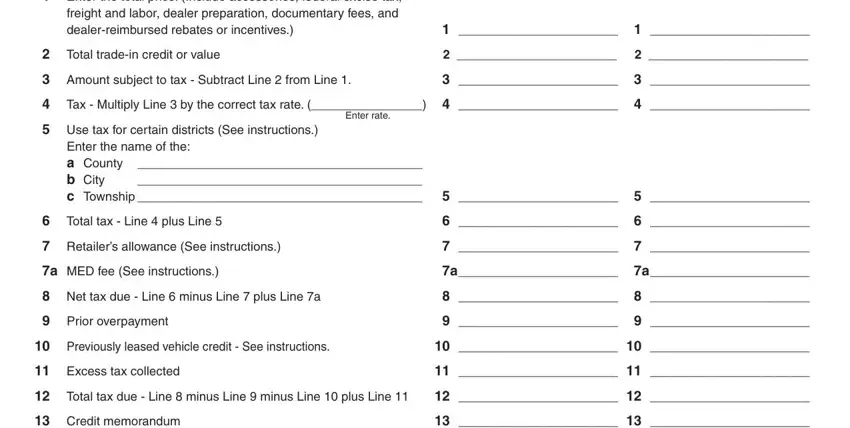

3. Completing Round to the nearest whole dollar, dealerreimbursed rebates or, freight and labor dealer, Total tradein credit or value, Amount subject to tax Subtract, Tax Multiply Line by the, Enter the name of the a County b, Enter rate, Total tax Line plus Line, Retailers allowance See, a MED fee See instructions, a a, Net tax due Line minus Line, Prior overpayment, and Previously leased vehicle credit is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

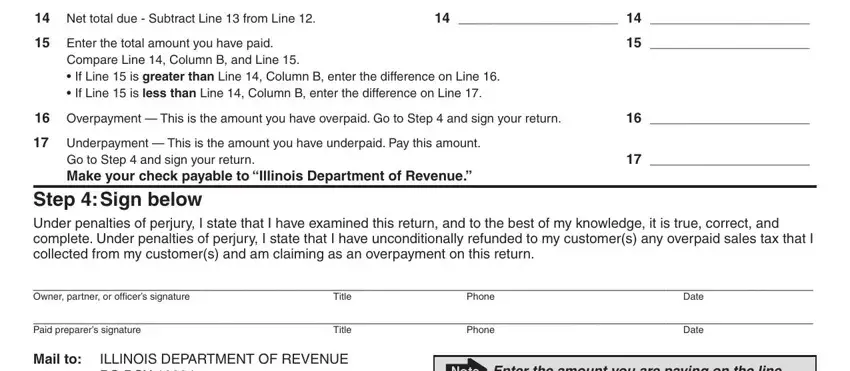

4. Filling out Credit memorandum, Net total due Subtract Line, Enter the total amount you have, Compare Line Column B and Line, cid If Line is greater than Line, Overpayment This is the amount, Go to Step and sign your return, Underpayment This is the amount, Owner partner or officers signature, Phone, Title, Date, Paid preparers signature, Phone, and Title is crucial in this fourth stage - you should definitely don't rush and fill in each and every blank area!

It is easy to make a mistake while filling in the Owner partner or officers signature, so be sure you go through it again before you finalize the form.

Step 3: Once you have looked again at the information you given, click on "Done" to finalize your FormsPal process. Join us now and easily access 556x, ready for downloading. Each and every modification made is conveniently preserved , which enables you to edit the file at a later time if required. With FormsPal, you're able to complete forms without worrying about personal information leaks or entries being shared. Our secure software helps to ensure that your private information is stored safely.