The SU-2 Form, designated by the U.S. Department of Agriculture (USDA) and facilitated by the Commodity Credit Corporation, is a pivotal document for processors seeking to obtain nonrecourse sugar loans under the Sugar Loan Program. This form not only serves as an application but also encloses a comprehensive framework designated to ensure both the eligibility and integrity of the applicant through a series of detailed information requirements. It encompasses a wide range of data points, from basic identification details of the processor and storage facility information to precise figures concerning the quantity and type of sugar for which the loan is sought. Moreover, it mandates processor certification to ensure compliance with specific regulatory obligations and stipulates the importance of transparent and accurate information with warnings about the legal implications of fraudulent claims. Designed to operate within the legal parameters set by the Privacy Act of 1974, the Food, Conservation, and Energy Act of 2008, and other relevant statutes, the form emphasizes voluntary participation with a clear note on the repercussions of non-compliance or incomplete submissions. The SU-2 Form underscores a commitment to fairness and non-discrimination in all USDA activities, reinforcing these values through its procedural requirements and the overarching legal and ethical standards it upholds.

| Question | Answer |

|---|---|

| Form Name | Form Su 2 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | SU2 aer loan form fillable |

This form is available electronically.

U.S. DEPARTMENT OF AGRICULTURE |

|

Commodity Credit Corporation |

APPLICATION FOR NONRECOURSE SUGAR LOAN

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this form is 7 CFR Part 1435, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Food, Conservation, and Energy Act of 2008 (Pub. L.

This information collection is exempted from the Paperwork Reduction Act as it is required for the administration of the Food, Conservation, and Energy Act of 2008 (see Pub. L.

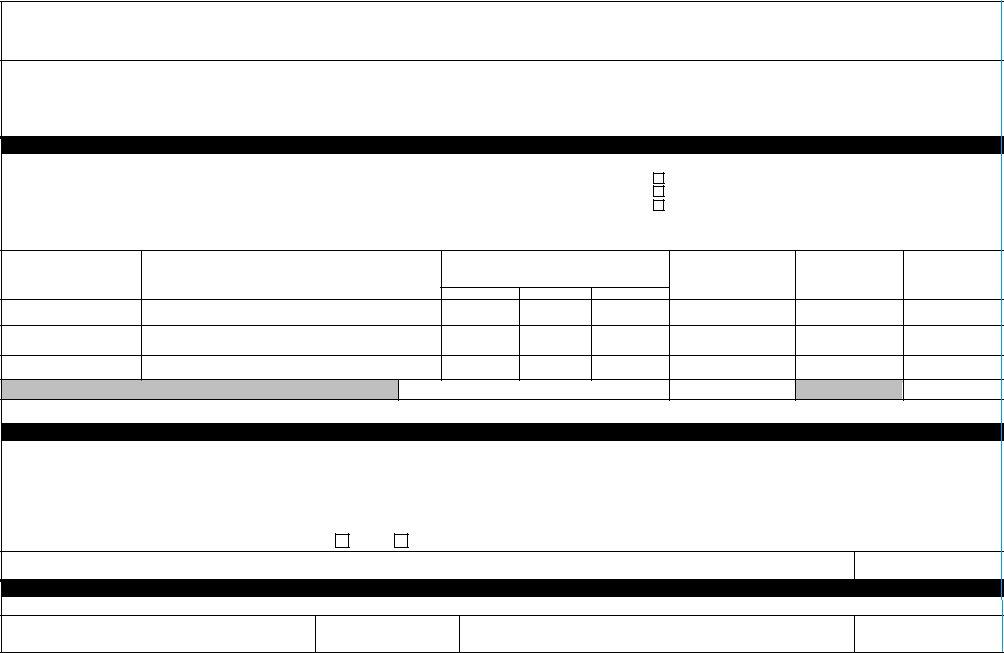

PART A – PROCESSOR, LOAN, AND COMMODITY INFORMATION

1.NAME AND MAILING ADDRESS OF PROCESSOR

(Including Zip Code)

|

2. STORAGE FACILITY INFORMATION |

3. |

CROP YEAR |

4A. COMMODITY: |

5. STATE & COUNTY CODES AND |

|

|

|

|

|

|

B. Initial Loan |

LOAN NUMBER |

|

A. Total Capacity (Lbs.) |

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

C. Repledged Loan |

|

|

B. Ineligible quantity in storage (Lbs.) |

|

|

|

||

|

|

|

|

D. Supplemental Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Eligible quantity in storage (Lbs.) |

|

6. |

LIENHOLDER(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.

WAREHOUSE

NUMBER

8.

LOCATION OF FACILITY

9.

TYPE OF SUGAR

(Check one below)

Sugar Cane |

Sugar Beet |

In Process |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.

QUANTITY FOR LOAN

(Lbs.) 1/

11.

LOAN RATE PER LB.

12.

LOAN VALUE

$

13. TOTALS:

1/ Loans on cane sugar will be made on actual pounds (commercial weight). Adjustments for polarity will be made upon settlement based on independent sampling and testing at the processor's expense. The schedule of premiums and discounts to be used is available in the

PART B – PROCESSOR CERTIFICATION

14.I hereby request a Commodity Credit Corporation (CCC) loan on the

the sugar loan regulations (7 CFR Part 1435), (3) the quantity for loan is in existence, is stored where indicated, and will be maintained and safely stored throughout the loan period and afterward as directed by CCC; and (4) the quantity for loan is free and clear of all liens, security interests and encumbrances, except as shown above. The processor specified in Part A Item 1 of this application certifies that the quantity of sugar pledged as collateral for loan is eligible sugar as defined in 7 CFR Part 400 Crop Insurance, or (3) 7 CFR Part 718 Controlled Substances, the processor has not pledged as collateral for such a loan a quantity sugar which is equivalent to the quantity derived from such producer's sugar beets or sugar cane. In the event CCC determines that such ineligible sugar has been pledged as collateral for a loan, the processor agrees to immediately redeem a quantity of the loan collateral equal to the ineligible quantity, as determined by CCC.

I further certify that the gallons of

Are you or any |

|

YES |

NO |

14A. PROCESSOR’S SIGNATURE |

|

14B. TITLE |

|

|

|

||

|

|

|

|

14C. DATE

PART C – COUNTY FSA OFFICE CERTIFICATION

This certifies that the

15A. FOR COUNTY FSA COMMITTEE

15B. DATE

15C. COUNTY OFFICE NAME AND ADDRESS

15D. TELEPHONE NUMBER

(Include Area Code)

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the bases of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202) 720

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866)