It really is quite simple to fill in the svat invoice format. Our PDF tool was meant to be easy-to-use and assist you to fill in any document easily. These are the basic actions to follow:

Step 1: First, hit the orange button "Get Form Now".

Step 2: You can now change the svat invoice format. Feel free to use our multifunctional toolbar to add, erase, and adjust the text of the form.

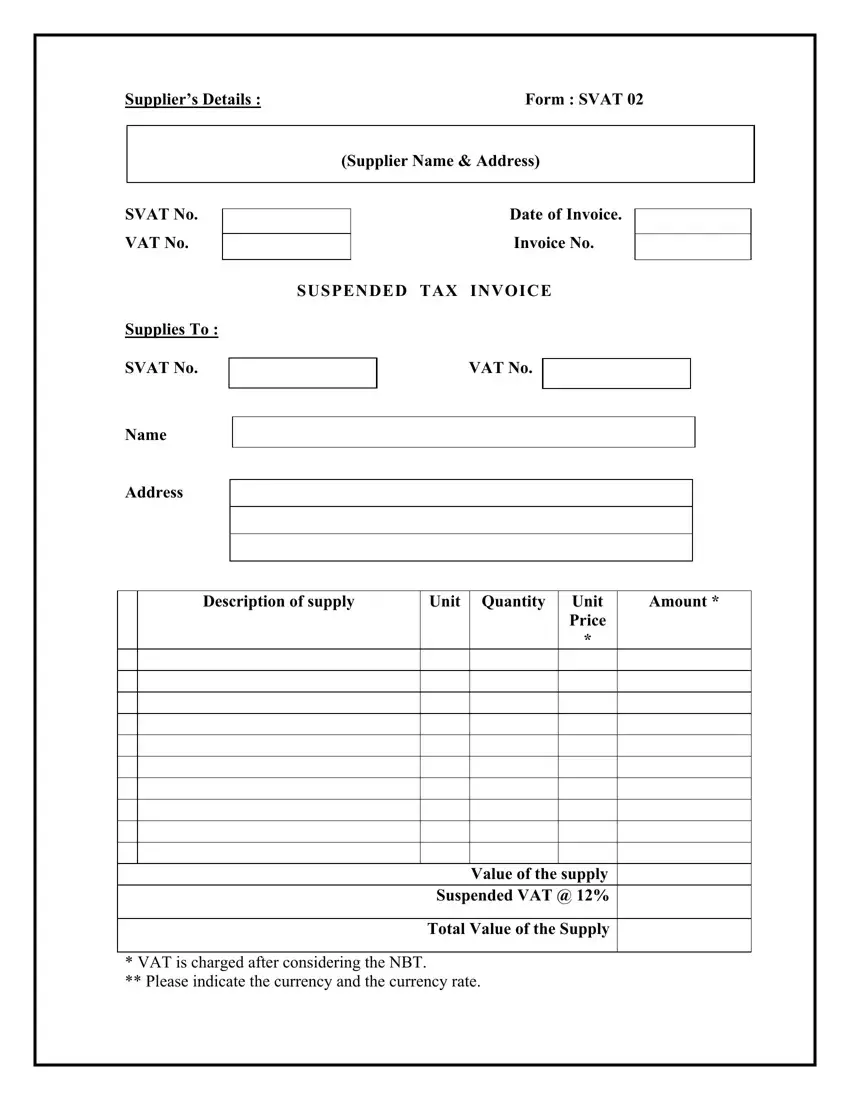

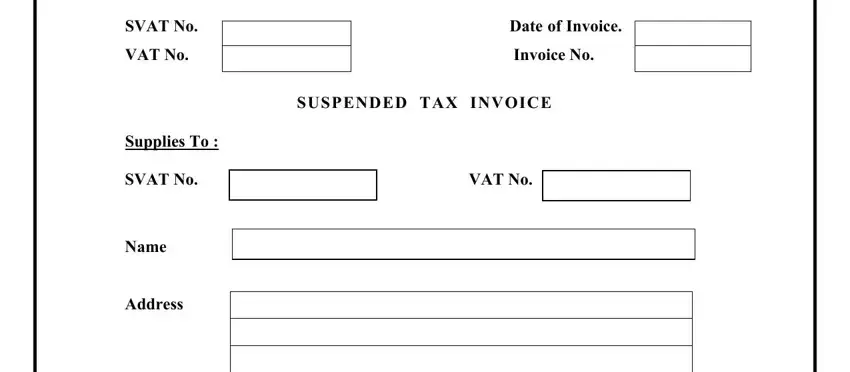

You have to enter the next details if you would like create the document:

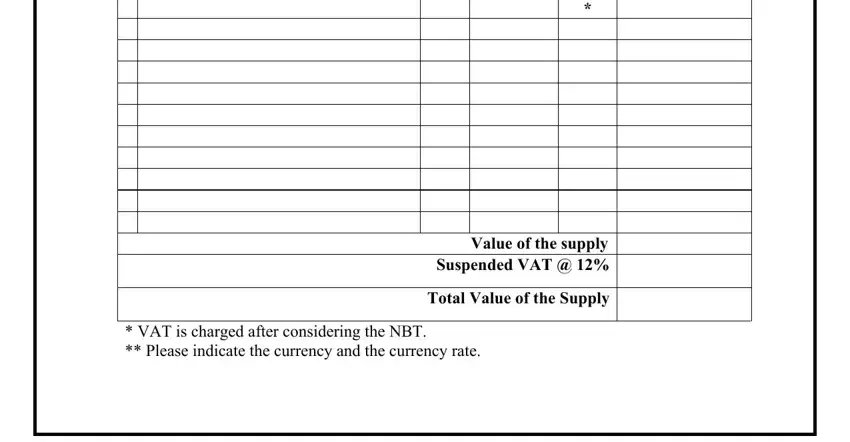

Note the demanded particulars in the area Unit Quantity Unit Price, Value of the supply Suspended VAT, Total Value of the Supply, and VAT is charged after considering.

Jot down the vital information in part.

Step 3: Select the Done button to make sure that your finished file could be exported to any kind of gadget you pick out or forwarded to an email you indicate.

Step 4: Prepare minimally two or three copies of your form to stay away from any potential issues.