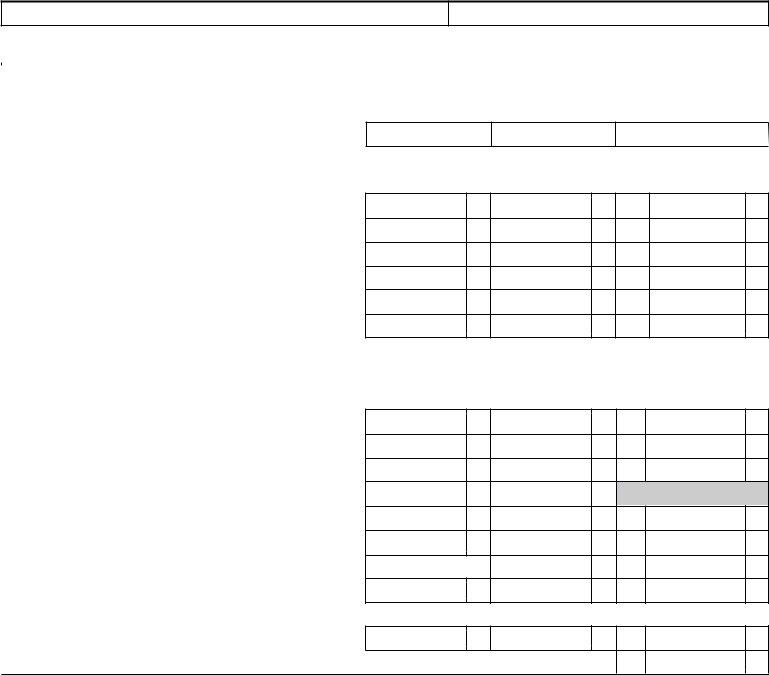

Every year, businesses across various sectors engage with a multitude of forms and tax obligations, among which the T 204A Annual form stands out for its significance in reporting and tax reconciliation. This comprehensive document is designed as a cornerstone for businesses to declare their taxable sales over the fiscal period, ensuring compliance with state taxation standards. It requires a detailed account of sales, including but not limited to wine, beer, and spirit sales, beverage sales, and other tangible personal property sales. In essence, the form acts as a declaration by the taxpayer, affirming under penalty of perjury, that all information contained within is accurate to the best of their knowledge. Besides sales reporting, the form encompasses sections for deductions like exempt sales, interstate sales, and sales for resale, further refining the taxable income figure. Its completeness is crucial for calculating the total tax due or identifying any possible tax refunds for overpayments during the specified period. Additionally, the T 204A form serves as a medium for businesses to report paid sales tax on cigarettes and other specific items, integrating multiple layers of transactional details critical for tax reconciliation with the Rhode Island Division of Taxation. The process underscored by the T 204A form not only supports the state’s tax collection efforts but also ensures businesses can accurately manage their financial responsibilities, potentially easing the annual tax burden through diligent reporting and documentation.

| Question | Answer |

|---|---|

| Form Name | Form T 204A Annual |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Alcoholic Beverage Annual Rec and Instr 2013 alcohal beverage reconciliation form |

TRTT

TTRU

TT

TLLL

R

TR

UU

UTRURTLLLQURR

RL§

UU

a

Taxpayer

dress

itytwrpstffice |

ate |

Zde |

Telepheuer

iladdress

de

aveyusldrclsedyurbusiess

Yes fyeswhatdate

fouflonsoltls turnlstlllo |

tonsoslnntftonnumr |

|

||

nlungtgtlotonnumrftrrmor |

tnlotonsplsttsprtlstng |

|

||

foumultpllotonsutflnulls |

turnsoumustflnnulforlo |

ton |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

forompltnglnstrougompltulsnonpg

TtaletTaxablelesfrtheperidec |

(nmustqultllsfrompgl |

n |

utftaxltiplylieby |

|

|

|

|

|

|

|

|

|

Ttaltaxduerettedfrtheperiduarythruheceer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

paidsalestaxciarettesfrtheperiduarythruhe |

|

ceer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

reditbalacefayperlieftheualRec |

|

ciliatireturrT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

lestaxdueadpaidtatherstateiteicludedi |

|

edulelie |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TtalTaxiddliesthruh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

Lieshuldeuallieflieisrethalie |

thereisa |

lnu |

easeretpaytttheRhde |

|

|

||||

sladivisifTaxatiadsediwiththisualR |

ecciliatieistructisfradditialifrti |

|

|

||||||

flieisrethaliethereisa |

rtu |

Thisautwillbecreditedtthe |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

salestaxpayts |

otprmustsumt“lmforfunformtts |

|

|

|

|

|

|

|

|

ronltonnorrtorrfunoftorp |

mnt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

herebycertifythathavepersalkwledeftheifr |

|

ticstitutithisreturthatallstatetsctaied |

hereiaretrue |

||||||

crrectadcletetthebestfkwledeadbelief |

|

adthatthisreturisdeuderpealtyfperjury |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

affir |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

aturefwerparterrauthrizedfficer |

|

|

|

|

ate |

|

|

||

Titlefauthrizedfficerraetsiiretur

rTual Revd

a

Taxpayer

ttnton tflrsounfltsformonln Vstttpsrgotton

V

U

lstgor

aieadspiritssales

beradltbeveraesales

cthersaleslsalestlistedliearb

rossslslnsn

U stfpersalprpertyperRL

TTdliesdad

U

glutonsls

adadfdiredietsfrhucsuti

bResale

cterstate

dtraizatis

ederaladate

therexetraizatis& rfitsRL

e ieadspiritseceerly |

xxxxx |

fthereductistseparatelylistedabve

ecify____________________________________

Ttaleductisdliesathruhf

tllstrtlngfromlnrrtopgln

a

b

c

d

a

b

c

d

d

e

f

prepareeliragesRernnal

Renliainsarielelineanpageenmpleeall

linesnpageiningeleaneableles

liberagesalesneall salesfrearinanarelaeReslanbsiness esiningansalesempfrma

aWineanspirissales

beranmalberagesales

erallersales

rsssaleslinesabananeneralnisline

ersfangiblepersnalprperprase siefReslanafreefrsesragernsmp inbinissaeringearrsfpersnal prperprasefrresaleansbseqenlsern smebringearraeranbeingsls

inenislineeamnfanerransainsring

earsbjeesalesansea(egelerigas

esefreaingrliginganpraseipan fea

Rlinesananener alnisline

neallsalesaareempfrm

salesa

afereamnfeinsneapprpriaelines

faalegaleinaesnaisnline

enereamnnlinefanpreaespinfe ein

ineenlineanspirisalesfremnf emberareempanallableasaeinfr

gR linesarg fanenereamnnisline

R bralinegfrmlinean

enereamnnislineannlinenpage fe liragesRernnalRenliain

ttt btrs,ctsr

stttpsrtt

|

|

ereamnfrmlinefebafel |

i |

ragesRernnalRenliain |

|

Rlipl |

|

lineimes(anenereamnnisline |

|

R ereamnfsalesanse |

|

apaifreperinarrgember |

|

ereamnf |

|

prepaisalesangareespraseringeperi |

|

narrgember |

|

R R R RR |

|

ereamnfeibalan(ifanperlinef |

r |

nalRenliainRernrm |

|

ere |

|

amnfsalesapaianersaeniemsine |

in |

eleline |

|

linesrganener |

e |

amnere |

|

inesleqallineflineisgreaer |

anline |

ereisabalaneRemipaneisinf |

|

ainalngienalRenliainfrm |

|

flineislessanlineisiseamn |

rpai |

rpanssallbeappliesbseqenfilingperis |

f |

isreiarefninseafilea“laimfrRefn |

” |

frmierenliain |

|

ffilerliragesRernnal |

|

Renliainaillneesbmiaseparae |

|

paper“laimfrRefn”frm |

|

enebmfpage |

isse |

inmsbempleeansignebanarizener |

|

parnerrffir |

|

lfrmsnbefnneisinfain’sebsie |

|

ttptrtrssscs |

|

ilrmpleeliragesRernnal |

|

Renliainfrm |

|

R isinfain |

|

neapilill |

|

enR |

|

nassing |

|

rfaeassingina( |

|