Every year, all Canadian taxpayers are required to file a tax return. In order to do so, you will need to have certain documentation on hand. One of the most important forms that you will need is called the T3012A E. This form is used to report taxable benefits and allowances received from your employer throughout the year. If you fail to file this form, you could face penalties from the Canada Revenue Agency (CRA). So, what exactly is this form and what information do you need to provide? Let's take a closer look. The T3012A E is used by taxpayers to report taxable benefits and allowances they receive from their employers during a calendar year. The form can be filled out by either the employee or the employer, depending on who pays for which benefits. Some of the most common types of benefits and allowances that are reported on this form include: transportation costs, parking expenses, medical premiums, dental premiums, home office expenses, and moving expenses. It's important to

| Question | Answer |

|---|---|

| Form Name | Form T3012A E |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | RRIF, rrsp overcontribution form, yyyy, rsp overcontribution form |

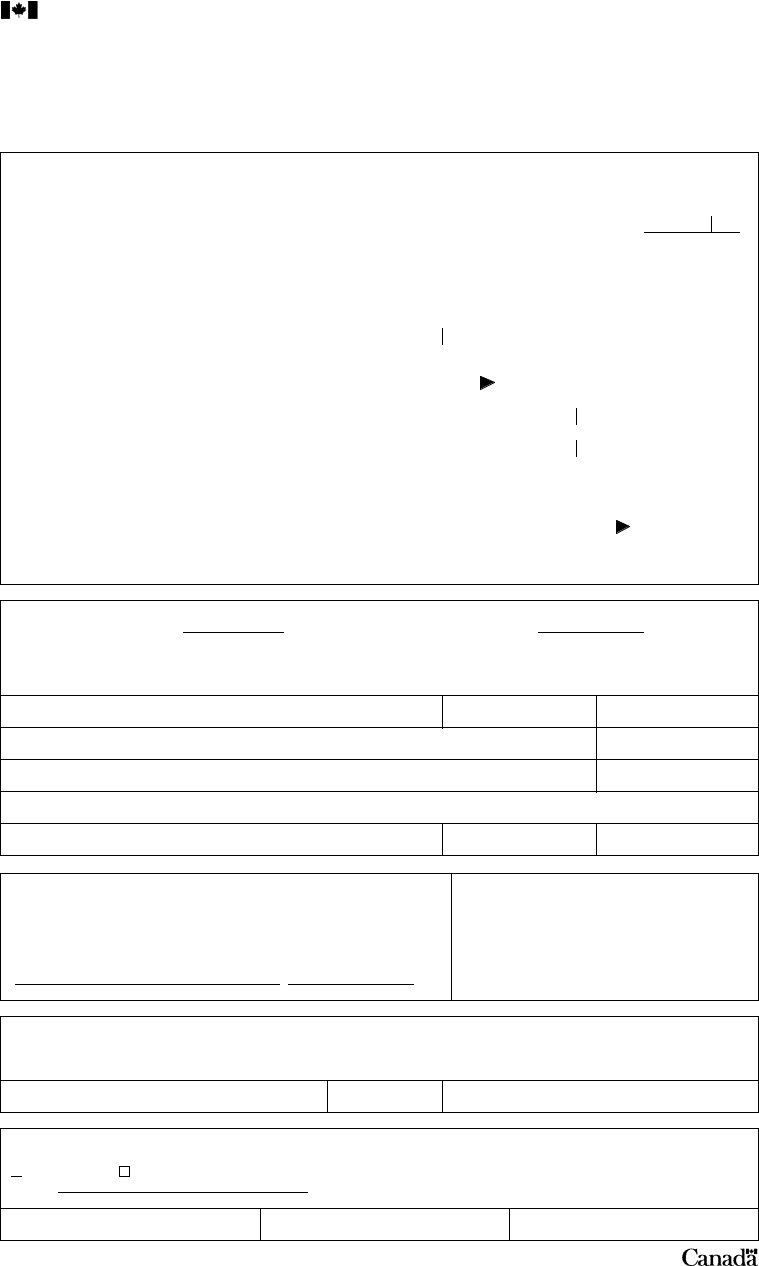

Canada Customs |

Agence des douanes |

|

|

|

and Revenue Agency |

et du revenu du Canada |

TAX DEDUCTION WAIVER ON THE REFUND OF YOUR |

||

|

|

UNUSED RRSP CONTRIBUTIONS MADE IN |

|

|

|

|

|

(year) |

|

”Use this form for contributions you made after 1990. Use a separate form for each registered retirement savings plan (RRSP) and for each year.

”On the line in the title of this form, enter the year you made the RRSP contributions.

”Complete parts 1 and 2 and submit this form to your tax centre, separately from your return. The tax centre will complete Part 3 and return the form to you. Complete Part 4 and submit it to your RRSP issuer. After the RRSP issuer has completed Part 5, attach copy 2 to your return for the year you or your spouse or

Part 1 – Calculating your eligible unused RRSP contributions

1.Enter the total RRSP contributions you made to your own RRSPs and your spouse or

Do not include the following:

”contributions that you cannot deduct for any year because you or your spouse or

”direct transfers (including transfers of excess amounts) of lump sums from registered pension plans, deferred

2.Enter the part of the line 1 amount that you contributed in the

first 60 days of the year you indicated in the title. |

2 |

|

|

|

|

1

3. Enter the part of the line 2 amount that you deducted or intend to |

|

|

|

|||||

deduct from your income for the year before the year you indicated |

|

|

|

3 |

||||

|

|

|||||||

in the title. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

income for the year you indicated in the title. |

+ |

4 |

|

5.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

|

income for any year after the year you indicated in the title. |

+ |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

||

6. |

If we have already approved one or more of these forms (T3012A) for you for the year you |

|

|

|

|

|

|

|

|

indicated in the title, add the amounts that you designated to be refunded in Part 2 of all of them. |

+ |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

Enter the total. |

|

|

|

|

|

||

|

= |

|

|

|

– |

|

|

|

7. |

Add lines 3, 4, 5, and 6. |

|

|

|

|

|

||

|

|

|

|

|||||

|

|

|

|

|

|

|||

8. |

Line 1 minus line 7. This is the amount of unused RRSP contributions that your RRSP issuer may be able to refund to you |

= |

|

|

||||

|

|

|||||||

|

without withholding tax. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 – Designating the amount to be refunded

7

8

Of the line 1 amount, I contributed $to the following RRSP. Of this amount, I designate $to be refunded.

I understand that the amounts I designate to be refunded from this RRSP and any other RRSPs cannot be more than the line 8 amount. I confirm that one or both of the following conditions apply to me:

”when I made the contributions, I expected to deduct them for the year that I contributed them, or the preceding year; or

”I did not make the contributions intending to withdraw them later and deduct an amount from my income for the withdrawal.

RRSP issuer

RRSP name

Contract or plan number

Annuitant's name

Social insurance number

Contributor's name (if other than annuitant)

Social insurance number

Contributor's address

Contributor's signature

Date

Telephone number

()

Part 3 – Canada Customs and Revenue Agency's approval (do not complete)

For the above RRSP, the issuer can refund the amount the contributor designated in Part 2 without withholding tax.

Authorized person's signature |

Date |

Do not use this area

Part 4 – Requesting the refund from the RRSP issuer

Of the total amount designated in Part 2, I (we) request a $ |

refund. I (we) understand that I (we) can only apply for a refund of an |

|

amount that has not already been withdrawn. |

|

|

Contributor's signature

Date

Annuitant's signature (if other than contributor)

Part 5 – RRSP issuer's certification

Of the total unused amount designated in Part 2, we have refunded $ |

|

as an unused contribution to either |

the contributor or indicating

the annuitant indicated in Part 2. We have issued, or will issue, a T4RSP slip for this amount for |

(year), |

|

as the refund recipient. |

|

|

Authorized person's signature

Position or office

Date

Privacy Act personal information bank number |

|

T3012A E (03) |

(Ce formulaire est disponible en français.) |

Copy 1 – For the plan issuer – Keep for your records

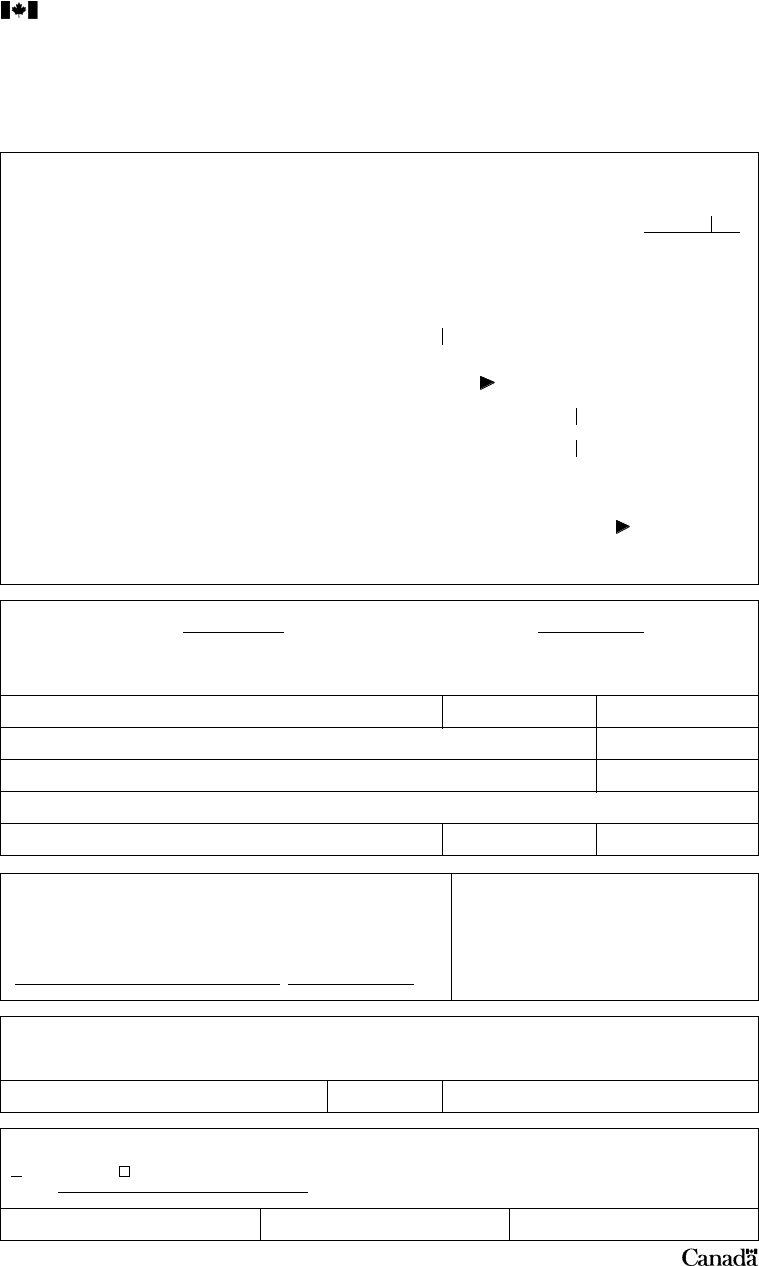

Canada Customs |

Agence des douanes |

|

|

|

and Revenue Agency |

et du revenu du Canada |

TAX DEDUCTION WAIVER ON THE REFUND OF YOUR |

||

|

|

UNUSED RRSP CONTRIBUTIONS MADE IN |

|

|

|

|

|

(year) |

|

”Use this form for contributions you made after 1990. Use a separate form for each registered retirement savings plan (RRSP) and for each year.

”On the line in the title of this form, enter the year you made the RRSP contributions.

”Complete parts 1 and 2 and submit this form to your tax centre, separately from your return. The tax centre will complete Part 3 and return the form to you. Complete Part 4 and submit it to your RRSP issuer. After the RRSP issuer has completed Part 5, attach copy 2 to your return for the year you or your spouse or

Part 1 – Calculating your eligible unused RRSP contributions

1.Enter the total RRSP contributions you made to your own RRSPs and your spouse or

Do not include the following:

”contributions that you cannot deduct for any year because you or your spouse or

”direct transfers (including transfers of excess amounts) of lump sums from registered pension plans, deferred

2.Enter the part of the line 1 amount that you contributed in the

first 60 days of the year you indicated in the title. |

2 |

|

|

|

|

1

3. Enter the part of the line 2 amount that you deducted or intend to |

|

|

|

|||||

deduct from your income for the year before the year you indicated |

|

|

|

3 |

||||

|

|

|||||||

in the title. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

income for the year you indicated in the title. |

+ |

4 |

|

5.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

|

income for any year after the year you indicated in the title. |

+ |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

||

6. |

If we have already approved one or more of these forms (T3012A) for you for the year you |

|

|

|

|

|

|

|

|

indicated in the title, add the amounts that you designated to be refunded in Part 2 of all of them. |

+ |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

Enter the total. |

|

|

|

|

|

||

|

= |

|

|

|

– |

|

|

|

7. |

Add lines 3, 4, 5, and 6. |

|

|

|

|

|

||

|

|

|

|

|||||

|

|

|

|

|

|

|||

8. |

Line 1 minus line 7. This is the amount of unused RRSP contributions that your RRSP issuer may be able to refund to you |

= |

|

|

||||

|

|

|||||||

|

without withholding tax. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 – Designating the amount to be refunded

7

8

Of the line 1 amount, I contributed $to the following RRSP. Of this amount, I designate $to be refunded.

I understand that the amounts I designate to be refunded from this RRSP and any other RRSPs cannot be more than the line 8 amount. I confirm that one or both of the following conditions apply to me:

”when I made the contributions, I expected to deduct them for the year that I contributed them, or the preceding year; or

”I did not make the contributions intending to withdraw them later and deduct an amount from my income for the withdrawal.

RRSP issuer

RRSP name

Contract or plan number

Annuitant's name

Social insurance number

Contributor's name (if other than annuitant)

Social insurance number

Contributor's address

Contributor's signature

Date

Telephone number

()

Part 3 – Canada Customs and Revenue Agency's approval (do not complete)

For the above RRSP, the issuer can refund the amount the contributor designated in Part 2 without withholding tax.

Authorized person's signature |

Date |

Do not use this area

Part 4 – Requesting the refund from the RRSP issuer

Of the total amount designated in Part 2, I (we) request a $ |

refund. I (we) understand that I (we) can only apply for a refund of an |

|

amount that has not already been withdrawn. |

|

|

Contributor's signature

Date

Annuitant's signature (if other than contributor)

Part 5 – RRSP issuer's certification

Of the total unused amount designated in Part 2, we have refunded $ |

|

as an unused contribution to either |

the contributor or indicating

the annuitant indicated in Part 2. We have issued, or will issue, a T4RSP slip for this amount for |

(year), |

|

as the refund recipient. |

|

|

Authorized person's signature

Position or office

Date

Privacy Act personal information bank number |

|

T3012A E (03) |

(Ce formulaire est disponible en français.) |

Copy 2 – For the contributor – Attach this copy to your income tax and benefit return after all areas are completed

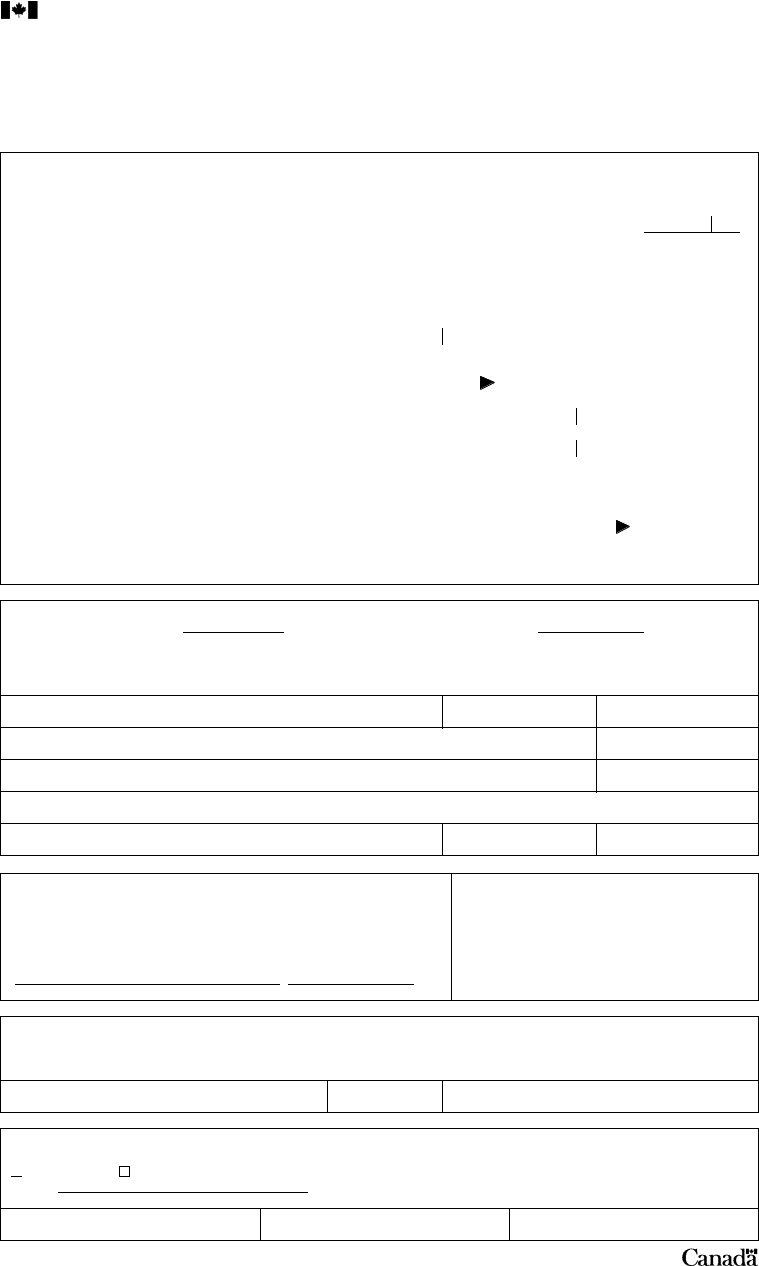

Canada Customs |

Agence des douanes |

|

|

|

and Revenue Agency |

et du revenu du Canada |

TAX DEDUCTION WAIVER ON THE REFUND OF YOUR |

||

|

|

UNUSED RRSP CONTRIBUTIONS MADE IN |

|

|

|

|

|

(year) |

|

”Use this form for contributions you made after 1990. Use a separate form for each registered retirement savings plan (RRSP) and for each year.

”On the line in the title of this form, enter the year you made the RRSP contributions.

”Complete parts 1 and 2 and submit this form to your tax centre, separately from your return. The tax centre will complete Part 3 and return the form to you. Complete Part 4 and submit it to your RRSP issuer. After the RRSP issuer has completed Part 5, attach copy 2 to your return for the year you or your spouse or

Part 1 – Calculating your eligible unused RRSP contributions

1.Enter the total RRSP contributions you made to your own RRSPs and your spouse or

Do not include the following:

”contributions that you cannot deduct for any year because you or your spouse or

”direct transfers (including transfers of excess amounts) of lump sums from registered pension plans, deferred

2.Enter the part of the line 1 amount that you contributed in the

first 60 days of the year you indicated in the title. |

2 |

|

|

|

|

1

3. Enter the part of the line 2 amount that you deducted or intend to |

|

|

|

|||||

deduct from your income for the year before the year you indicated |

|

|

|

3 |

||||

|

|

|||||||

in the title. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

income for the year you indicated in the title. |

+ |

4 |

|

5.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

|

income for any year after the year you indicated in the title. |

+ |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

||

6. |

If we have already approved one or more of these forms (T3012A) for you for the year you |

|

|

|

|

|

|

|

|

indicated in the title, add the amounts that you designated to be refunded in Part 2 of all of them. |

+ |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

Enter the total. |

|

|

|

|

|

||

|

= |

|

|

|

– |

|

|

|

7. |

Add lines 3, 4, 5, and 6. |

|

|

|

|

|

||

|

|

|

|

|||||

|

|

|

|

|

|

|||

8. |

Line 1 minus line 7. This is the amount of unused RRSP contributions that your RRSP issuer may be able to refund to you |

= |

|

|

||||

|

|

|||||||

|

without withholding tax. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 – Designating the amount to be refunded

7

8

Of the line 1 amount, I contributed $to the following RRSP. Of this amount, I designate $to be refunded.

I understand that the amounts I designate to be refunded from this RRSP and any other RRSPs cannot be more than the line 8 amount. I confirm that one or both of the following conditions apply to me:

”when I made the contributions, I expected to deduct them for the year that I contributed them, or the preceding year; or

”I did not make the contributions intending to withdraw them later and deduct an amount from my income for the withdrawal.

RRSP issuer

RRSP name

Contract or plan number

Annuitant's name

Social insurance number

Contributor's name (if other than annuitant)

Social insurance number

Contributor's address

Contributor's signature

Date

Telephone number

()

Part 3 – Canada Customs and Revenue Agency's approval (do not complete)

For the above RRSP, the issuer can refund the amount the contributor designated in Part 2 without withholding tax.

Authorized person's signature |

Date |

Do not use this area

Part 4 – Requesting the refund from the RRSP issuer

Of the total amount designated in Part 2, I (we) request a $ |

refund. I (we) understand that I (we) can only apply for a refund of an |

|

amount that has not already been withdrawn. |

|

|

Contributor's signature

Date

Annuitant's signature (if other than contributor)

Part 5 – RRSP issuer's certification

Of the total unused amount designated in Part 2, we have refunded $ |

|

as an unused contribution to either |

the contributor or indicating

the annuitant indicated in Part 2. We have issued, or will issue, a T4RSP slip for this amount for |

(year), |

|

as the refund recipient. |

|

|

Authorized person's signature

Position or office

Date

Privacy Act personal information bank number |

|

T3012A E (03) |

(Ce formulaire est disponible en français.) |

Copy 3 – For the contributor – Keep for your records

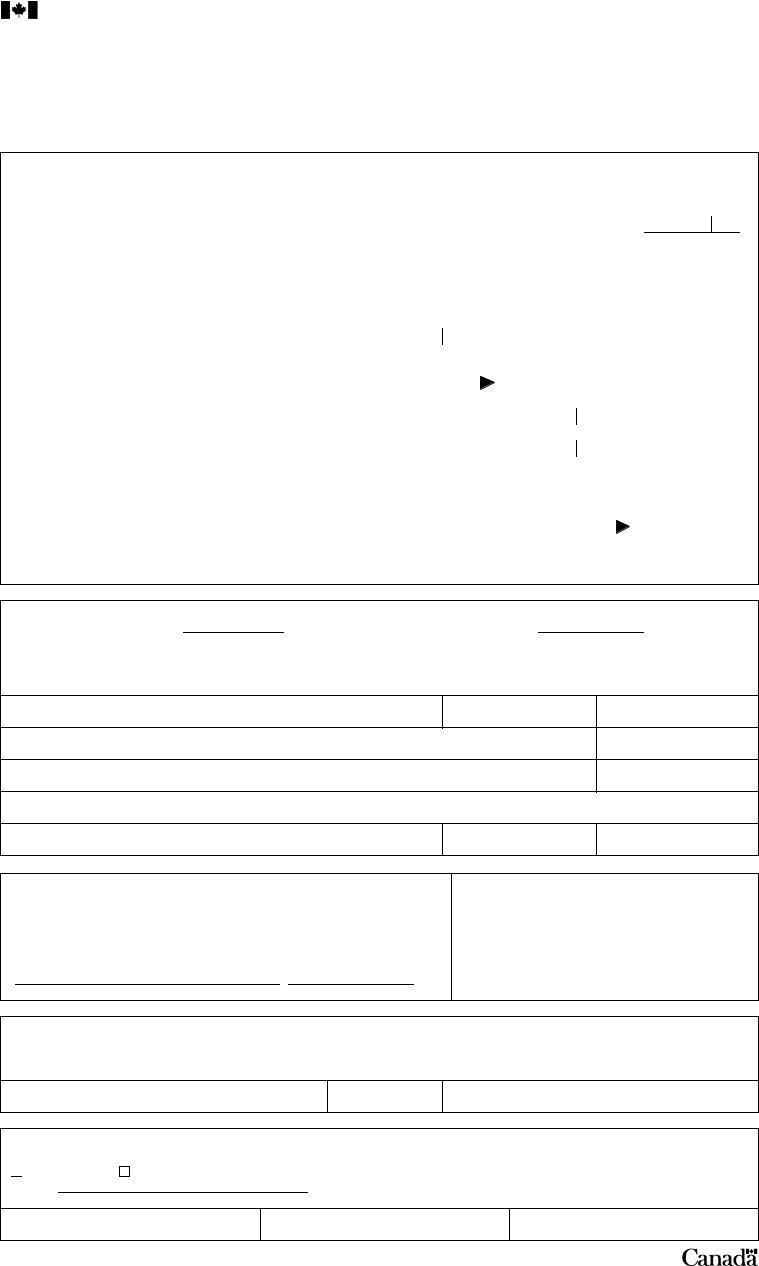

Canada Customs |

Agence des douanes |

|

|

|

and Revenue Agency |

et du revenu du Canada |

TAX DEDUCTION WAIVER ON THE REFUND OF YOUR |

||

|

|

UNUSED RRSP CONTRIBUTIONS MADE IN |

|

|

|

|

|

(year) |

|

”Use this form for contributions you made after 1990. Use a separate form for each registered retirement savings plan (RRSP) and for each year.

”On the line in the title of this form, enter the year you made the RRSP contributions.

”Complete parts 1 and 2 and submit this form to your tax centre, separately from your return. The tax centre will complete Part 3 and return the form to you. Complete Part 4 and submit it to your RRSP issuer. After the RRSP issuer has completed Part 5, attach copy 2 to your return for the year you or your spouse or

Part 1 – Calculating your eligible unused RRSP contributions

1.Enter the total RRSP contributions you made to your own RRSPs and your spouse or

Do not include the following:

”contributions that you cannot deduct for any year because you or your spouse or

”direct transfers (including transfers of excess amounts) of lump sums from registered pension plans, deferred

2.Enter the part of the line 1 amount that you contributed in the

first 60 days of the year you indicated in the title. |

2 |

|

|

|

|

1

3. Enter the part of the line 2 amount that you deducted or intend to |

|

|

|

|||||

deduct from your income for the year before the year you indicated |

|

|

|

3 |

||||

|

|

|||||||

in the title. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

income for the year you indicated in the title. |

+ |

4 |

|

5.Enter the part of the line 1 amount that you deducted or intend to deduct when calculating your

|

income for any year after the year you indicated in the title. |

+ |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

||

6. |

If we have already approved one or more of these forms (T3012A) for you for the year you |

|

|

|

|

|

|

|

|

indicated in the title, add the amounts that you designated to be refunded in Part 2 of all of them. |

+ |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

Enter the total. |

|

|

|

|

|

||

|

= |

|

|

|

– |

|

|

|

7. |

Add lines 3, 4, 5, and 6. |

|

|

|

|

|

||

|

|

|

|

|||||

|

|

|

|

|

|

|||

8. |

Line 1 minus line 7. This is the amount of unused RRSP contributions that your RRSP issuer may be able to refund to you |

= |

|

|

||||

|

|

|||||||

|

without withholding tax. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 – Designating the amount to be refunded

7

8

Of the line 1 amount, I contributed $to the following RRSP. Of this amount, I designate $to be refunded.

I understand that the amounts I designate to be refunded from this RRSP and any other RRSPs cannot be more than the line 8 amount. I confirm that one or both of the following conditions apply to me:

”when I made the contributions, I expected to deduct them for the year that I contributed them, or the preceding year; or

”I did not make the contributions intending to withdraw them later and deduct an amount from my income for the withdrawal.

RRSP issuer

RRSP name

Contract or plan number

Annuitant's name

Social insurance number

Contributor's name (if other than annuitant)

Social insurance number

Contributor's address

Contributor's signature

Date

Telephone number

()

Part 3 – Canada Customs and Revenue Agency's approval (do not complete)

For the above RRSP, the issuer can refund the amount the contributor designated in Part 2 without withholding tax.

Authorized person's signature |

Date |

Do not use this area

Part 4 – Requesting the refund from the RRSP issuer

Of the total amount designated in Part 2, I (we) request a $ |

refund. I (we) understand that I (we) can only apply for a refund of an |

|

amount that has not already been withdrawn. |

|

|

Contributor's signature

Date

Annuitant's signature (if other than contributor)

Part 5 – RRSP issuer's certification

Of the total unused amount designated in Part 2, we have refunded $ |

|

as an unused contribution to either |

the contributor or indicating

the annuitant indicated in Part 2. We have issued, or will issue, a T4RSP slip for this amount for |

(year), |

|

as the refund recipient. |

|

|

Authorized person's signature

Position or office

Date

Privacy Act personal information bank number |

|

T3012A E (03) |

(Ce formulaire est disponible en français.) |

Copy 4 – For the Canada Customs and Revenue Agency

Who can use this form?

Use this form if you want us to authorize your RRSP issuer to refund your unused RRSP contributions without withholding tax. You have to meet all of the following conditions:

”You made the contributions to your own or your spouse's or

”You have not designated the refund as a qualifying withdrawal to have your

”No part of the refund was a

”You or your spouse or

-in the year you contributed them;

-in the following year; or

-in the year that we sent you a Notice of Assessment or Notice of Reassessment for the year you contributed them, or in the following year.

In addition, it has to be reasonable for us to consider that one or both of the following conditions apply:

”you reasonably expected you could fully deduct the RRSP contributions for the year you contributed them or the immediately preceding year; or

”you did not make the unused RRSP contributions intending to withdraw them and deduct an offsetting amount.

Do not use this form if any of the following situations apply to the person who is receiving the refund (you or your spouse or

a)You received the unused RRSP contributions in the form of a commutation payment from a matured RRSP.

b)You received or will receive a RRIF payment that is more than the minimum amount for the year, and the payment is for unused RRSP contributions that were transferred to the RRIF.

c)A registered pension plan excess amount was transferred to an RRSP or a RRIF in the year or a previous year, and you have to include an RRSP or RRIF amount in your income as a result.

If situation a) or b) applies, use Form T746, Calculating Your Deduction for Refund of Unused RRSP Contributions.

If situation c) applies, use Form T1043, Deduction for Excess Registered Pension Plan Transfers You Withdrew From Your RRSP or RRIF.

If you have already withdrawn your unused RRSP contribution without using this form, use Form T746 to calculate the amount you are entitled to deduct.

How to complete this form

Parts 1 and 2

Line 1 – If you contribute to an RRSP in the

Complete parts 1 and 2 and send all four copies of the form to your tax centre. Do not send the form with your tax return. If the amount you are designating to be refunded was transferred from the RRSP you contributed it to, to another RRSP, attach a note explaining the transfer details and a copy of any documentation of the transfer. If you completed

Form T2033, Direct Transfer Under Paragraph 146(16)(a) or 146.3(2)(e), to document the transfer, attach a copy of it.

Part 3

After we have approved the amount that the plan issuer can refund without withholding tax, we will return copies 1, 2, and 3 to you with Part 3 completed.

Part 4

After we have completed Part 3 and returned the form to you, complete Part 4 and send all three copies to your plan issuer.

Part 5

The issuer completes Part 5 and returns copies 2 and 3 to you.

Reporting the refund on your return

When you complete your return for the year you receive the refund, enter on line 129 "RRSP income" and line 232 "Other deductions," the total unused contributions that you made to your own or your spouse's or

After you have deducted the amount you entered on line 232 from your income as an "Other deduction," you cannot deduct it on line 208 "RRSP deduction" as an RRSP contribution for any year.

We will reduce your unused RRSP contributions available to carry forward to later years by the amount of your refund.

Tax on excess contributions

You may have to pay tax if the total of the amounts on lines 5 and 8 of this form is more than $2,000. For more details, see the section called "Unused RRSP contributions" in Chapter 2 of the income tax guide called RRSPs and Other Registered Plans for Retirement and Form

Printed in Canada