When you wish to fill out TBRT, you won't need to download any sort of programs - just make use of our online PDF editor. The tool is continually updated by our staff, getting useful features and turning out to be better. Getting underway is easy! What you need to do is follow the following simple steps below:

Step 1: Access the PDF form in our tool by clicking the "Get Form Button" above on this page.

Step 2: Using this state-of-the-art PDF tool, you may do more than just fill out blank form fields. Express yourself and make your documents seem high-quality with custom text put in, or adjust the original content to perfection - all that supported by an ability to insert just about any graphics and sign the document off.

This PDF form will need specific information; in order to guarantee accuracy, be sure to take note of the following recommendations:

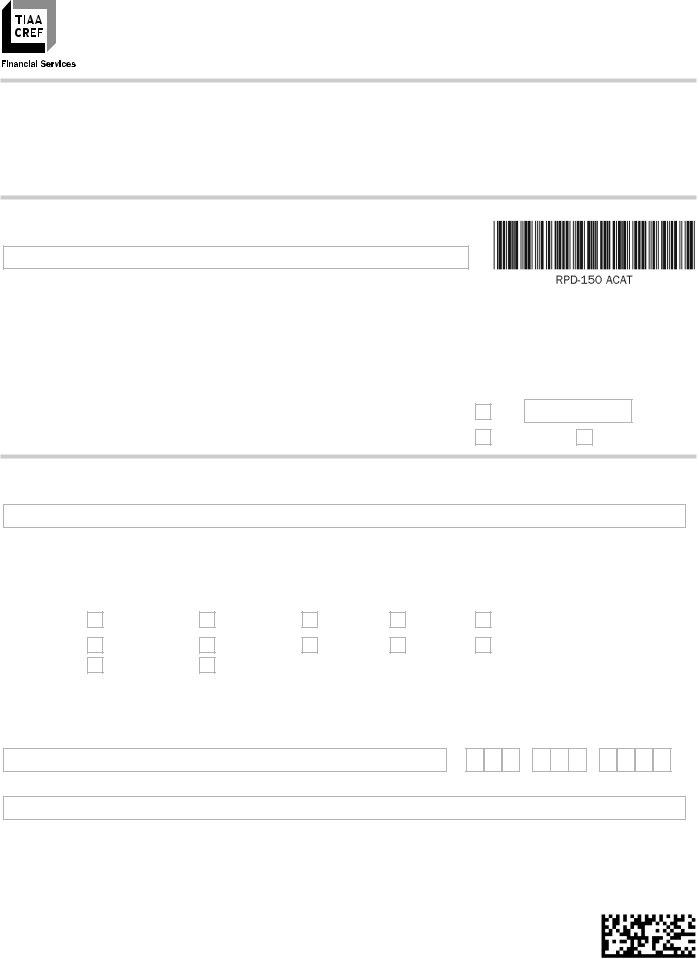

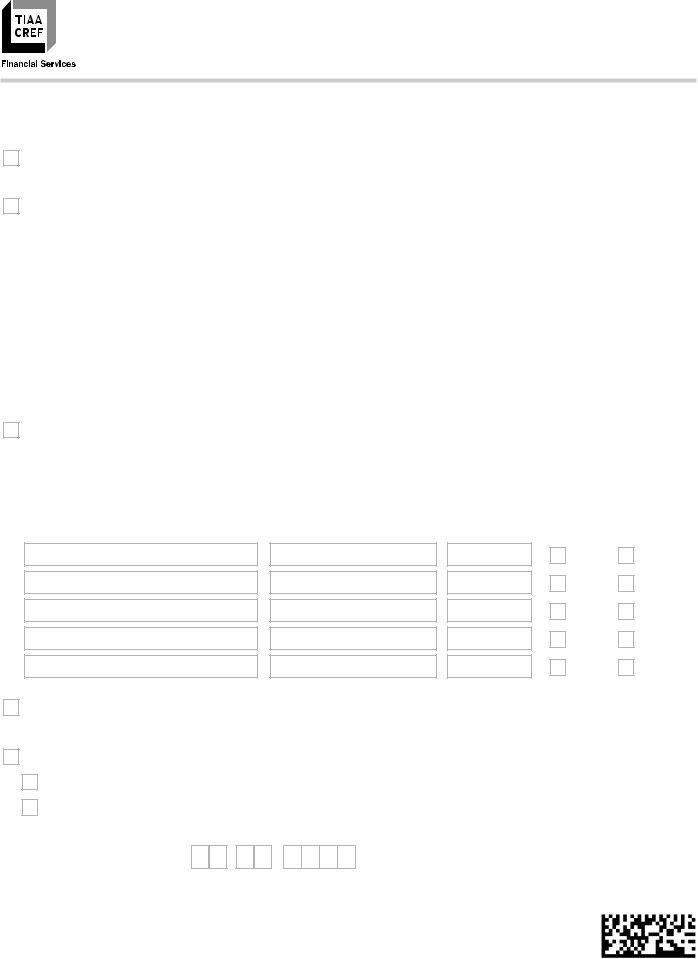

1. The TBRT needs particular information to be inserted. Ensure the next blanks are complete:

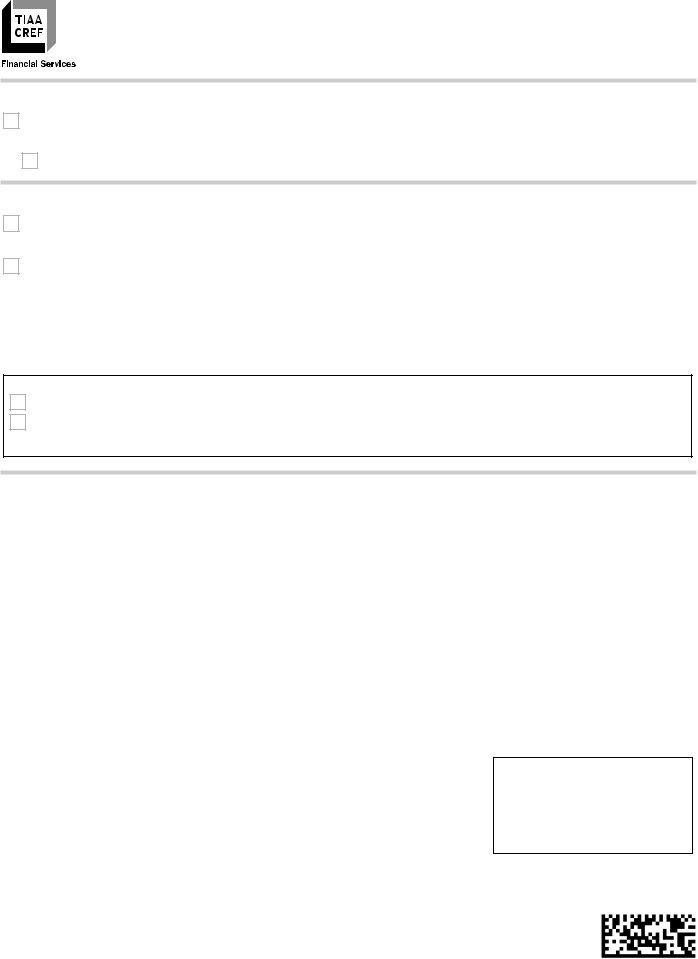

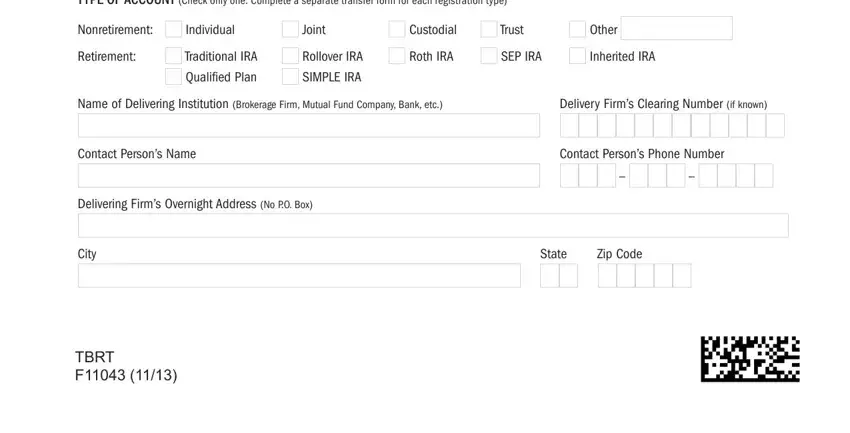

2. Once your current task is complete, take the next step – fill out all of these fields - TYPE OF ACCOUNT Check only one, Nonretirement, Individual, Joint, Custodial, Trust, Other, Retirement, Traditional IRA, Qualified Plan, Rollover IRA SIMPLE IRA, Roth IRA, SEP IRA, Inherited IRA, and Name of Delivering Institution with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

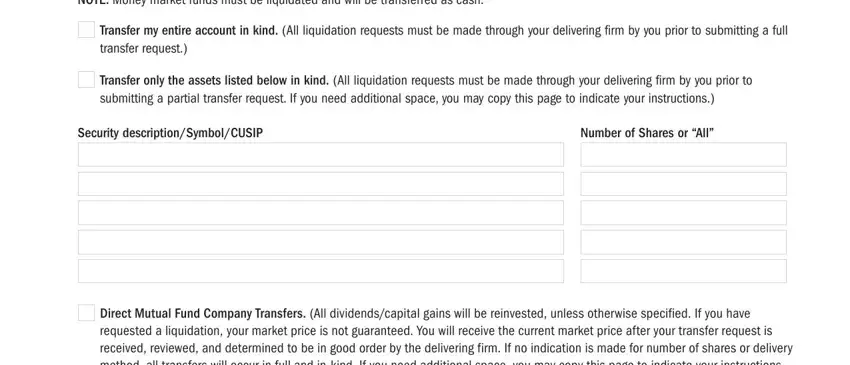

3. Completing NOTE Money market funds must be, Transfer my entire account in kind, Transfer only the assets listed, Security descriptionSymbolCUSIP, Number of Shares or All, and Direct Mutual Fund Company is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

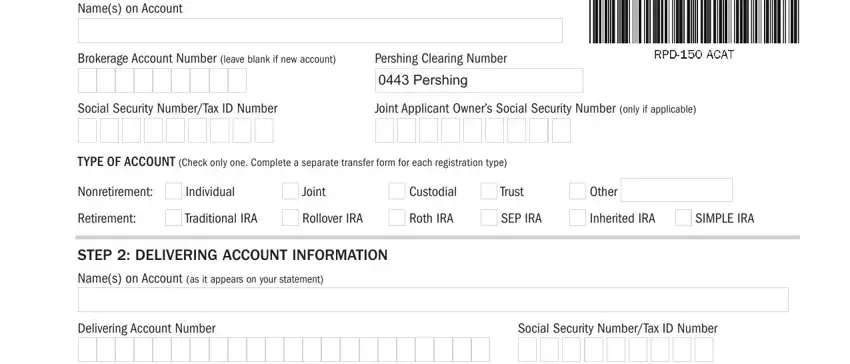

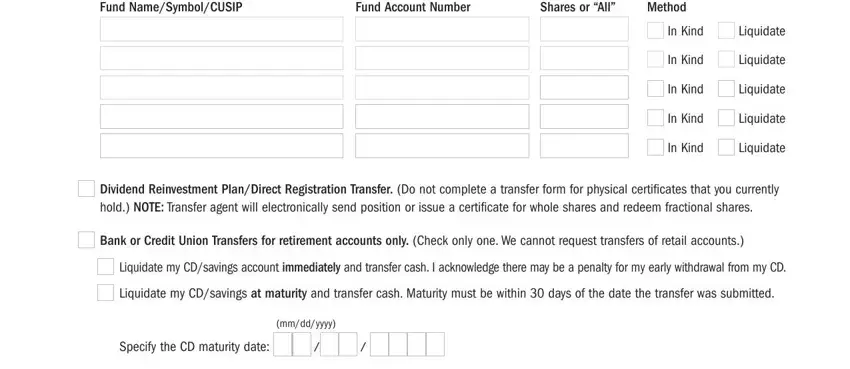

4. To move ahead, this next part involves typing in a few blank fields. Examples include Fund NameSymbolCUSIP, Fund Account Number, Number of Shares or All, Method, In Kind, Liquidate, In Kind, Liquidate, In Kind, Liquidate, In Kind, Liquidate, In Kind, Liquidate, and Dividend Reinvestment PlanDirect, which you'll find vital to continuing with this form.

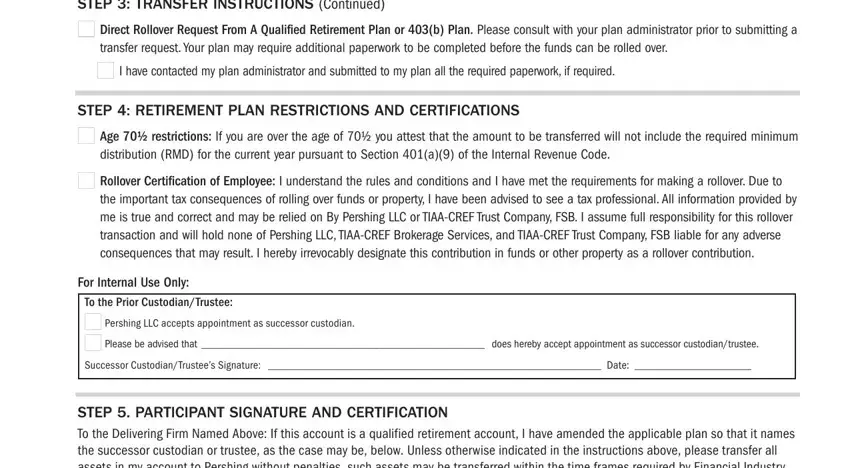

5. The very last notch to conclude this PDF form is critical. Be sure to fill in the displayed blanks, such as STEP TRANSFER INSTRUCTIONS, Direct Rollover Request From A, I have contacted my plan, STEP RETIREMENT PLAN RESTRICTIONS, Age restrictions If you are over, Rollover Certification of Employee, For Internal Use Only, To the Prior CustodianTrustee, Pershing LLC accepts appointment, STEP PARTICIPANT SIGNATURE AND, and To the Delivering Firm Named Above, before using the pdf. If you don't, it could give you an unfinished and probably nonvalid document!

Concerning I have contacted my plan and Rollover Certification of Employee, be sure that you double-check them in this section. The two of these are surely the most important ones in this document.

Step 3: When you have reread the information in the blanks, click on "Done" to complete your form at FormsPal. After creating a7-day free trial account with us, it will be possible to download TBRT or send it via email without delay. The PDF file will also be easily accessible via your personal account page with all of your adjustments. FormsPal guarantees safe form tools devoid of data recording or distributing. Rest assured that your information is in good hands with us!