PAYEES can be completed in no time. Just use FormsPal PDF editing tool to complete the task fast. FormsPal development team is relentlessly endeavoring to develop the tool and help it become much better for people with its cutting-edge features. Take advantage of the latest revolutionary opportunities, and discover a heap of emerging experiences! If you are looking to get going, here is what it will take:

Step 1: Click on the "Get Form" button above. It is going to open up our pdf editor so that you can begin completing your form.

Step 2: With this state-of-the-art PDF tool, it is easy to do more than merely fill out forms. Express yourself and make your docs look great with custom textual content incorporated, or tweak the original content to excellence - all backed up by an ability to add stunning photos and sign the PDF off.

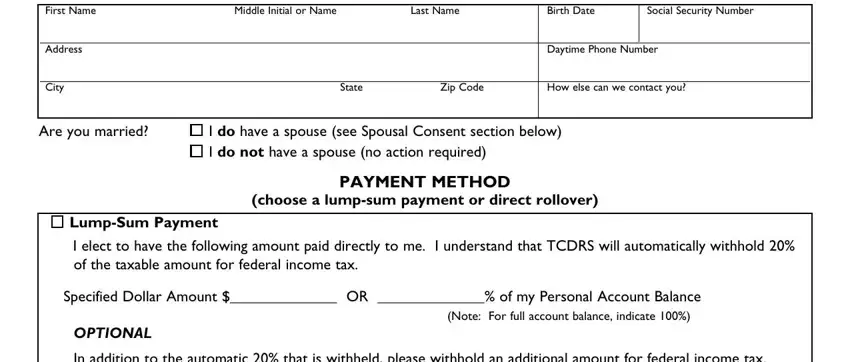

This document will need you to enter specific details; to ensure correctness, make sure you heed the next recommendations:

1. Whenever filling out the PAYEES, make certain to include all essential blank fields in the corresponding part. It will help facilitate the work, allowing your information to be processed efficiently and properly.

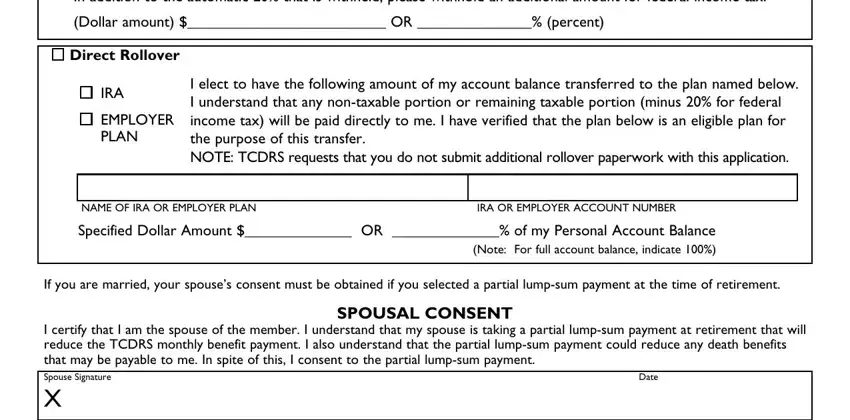

2. Soon after the prior section is done, go on to enter the applicable information in all these: In addition to the automatic that, Dollar amount OR percent, Direct Rollover, IRA, EMPLOYER PLAN, I elect to have the following, NAME OF IRA OR EMPLOYER PLAN, IRA OR EMPLOYER ACCOUNT NUMBER, Specified Dollar Amount OR of my, If you are married your spouses, SPOUSAL CONSENT, I certify that I am the spouse of, and Date.

In terms of Direct Rollover and I elect to have the following, make certain you get them right in this section. These two are certainly the key ones in this form.

Step 3: Always make sure that your information is right and press "Done" to finish the task. Join us now and easily get access to PAYEES, ready for download. Every single change made is handily preserved , making it possible to modify the pdf later as needed. When using FormsPal, you can easily complete forms without worrying about database incidents or records being shared. Our secure system ensures that your personal information is maintained safely.