In the realm of personal taxation within British Columbia, Canada, the Worksheet for the 2013 British Columbia Personal Tax Credits Return, or TD1BC-WS, emerges as an essential tool for individuals aiming to accurately calculate and claim partial amounts on the TD1BC form. This specific worksheet serves as a guide for those eligible for various credits, including the age amount, spouse or common-law partner amount, eligible dependant amount, caregiver amount, and amount for infirm dependants age 18 or older. Each section of the worksheet meticulously outlines the process for calculating these claims based on estimated net income, presenting a range of monetary thresholds to determine eligibility. Crucially, it underscores the importance of keeping the completed worksheet for personal records, rather than submitting it to employers or payers, emphasizing its role in the preparatory phase of tax return filing. The worksheet is designed not only to aid taxpayers in maximizing their personal tax credits but also to safeguard against potential errors in reporting to the Canada Revenue Agency (CRA). By delineating specific income ranges and corresponding claims, the TD1BC-WS ensures that individuals aged 65 and older, those supporting a spouse, common-law partner, or dependants, and caregivers for infirm dependants navigate their tax returns with confidence and precision.

| Question | Answer |

|---|---|

| Form Name | Form Td1Bc Ws E |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | td1bc ws 13e td1bc 2013 form |

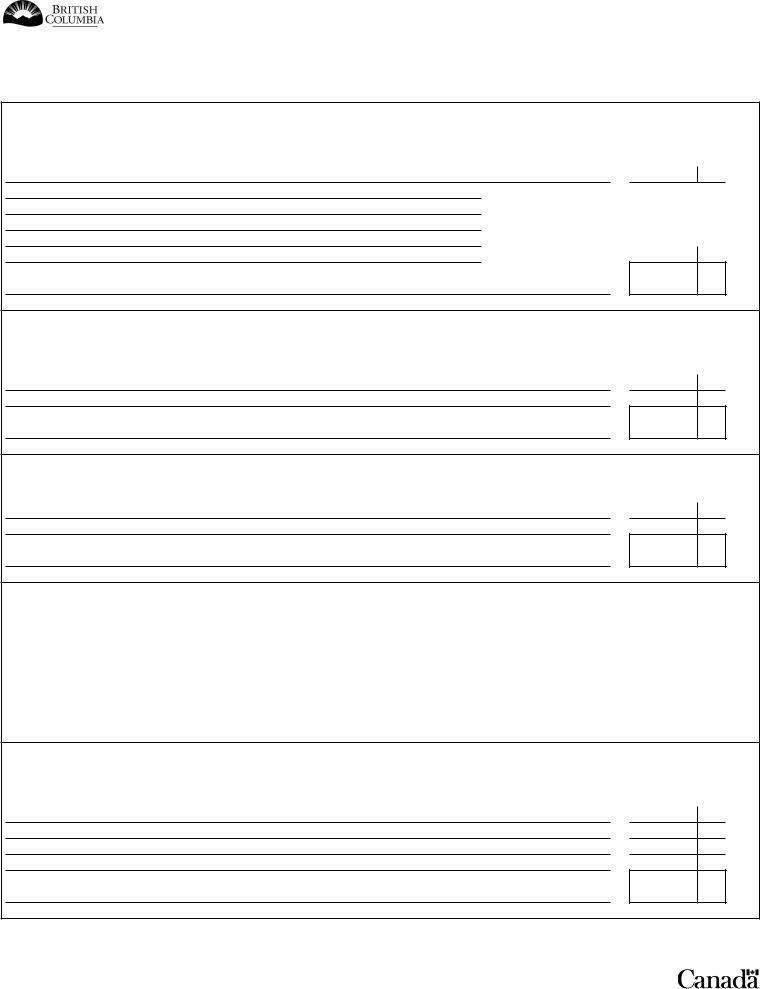

Worksheet for the 2013 British Columbia Personal Tax Credit Return

Complete this worksheet if you want to calculate partial claims for the following amounts on Form TD1BC, 2013 BRITISH COLUMBIA PERSONAL

TAX CREDITS RETURN.

Do not give your completed worksheet to your employer or payer. Keep it for your records.

Line 2 of Form TD1BC – Age amount

If you will be 65 or older on December 31, 2013, and your estimated net income from all sources will be between $32,911 and $62,385, calculate your partial claim as follows:

Maximum amount

Your estimated net income for the year

Base amount

Line 2 minus line 3 (if negative, enter "0")

Applicable rate

Multiply line 4 by line 5.

Line 1 minus line 6

Enter this amount on line 2 of Form TD1BC.

4,421 00

|

|

2 |

00 |

3 |

|

32,911 |

||

|

4 |

|

|

|

15% 5

|

|

|

|

|

|

1

6

7

Line 6 of Form TD1BC – Spouse or

If your spouse's or

Base amount

Your spouse's or

Line 1 minus line 2

Enter this amount on line 6 of Form TD1BC.

9,746 00

1

2

3

Line 7 of Form TD1BC – Amount for an eligible dependant

If your dependant's estimated net income for the year will be between $886 and $9,746, calculate your partial claim as follows:

Base amount

Your dependant's estimated net income for the year

Line 1 minus line 2

Enter this amount on line 7 of Form TD1BC.

Line 8 of Form TD1BC – Caregiver amount

9,746 00

1

2

3

If your dependant's estimated net income for the year will be between $14,600 and $18,914, calculate your partial claim as follows:

Base amount |

|

18,914 |

00 |

Your dependant's estimated net income for the year |

|

|

|

Line 1 minus line 2 (maximum $4,314) |

|

||

Enter the amount you claimed for this dependant on line 7 of Form TD1BC. |

|

|

|

Line 3 minus line 4 |

|

|

|

Enter this amount on line 8 of Form TD1BC. |

|

||

|

|

|

|

1

2

3

4

5

Line 9 of Form TD1BC – Amount for infirm dependants age 18 or older

You cannot claim this amount for a dependant for whom you claimed the caregiver amount on line 8 of Form TD1BC. If your dependant's estimated net income for the year will be between $6,872 and $11,186, calculate your partial claim as follows:

Base amount

Your infirm dependant's estimated net income for the year

Line 1 minus line 2 (maximum $4,314)

Enter the amount you claimed on line 7 of Form TD1BC for this dependant.

Line 3 minus line 4

Enter this amount on line 9 of Form TD1BC.

11,186 00

1

2

3

4

5

(Vous pouvez obtenir ce formulaire en français à |