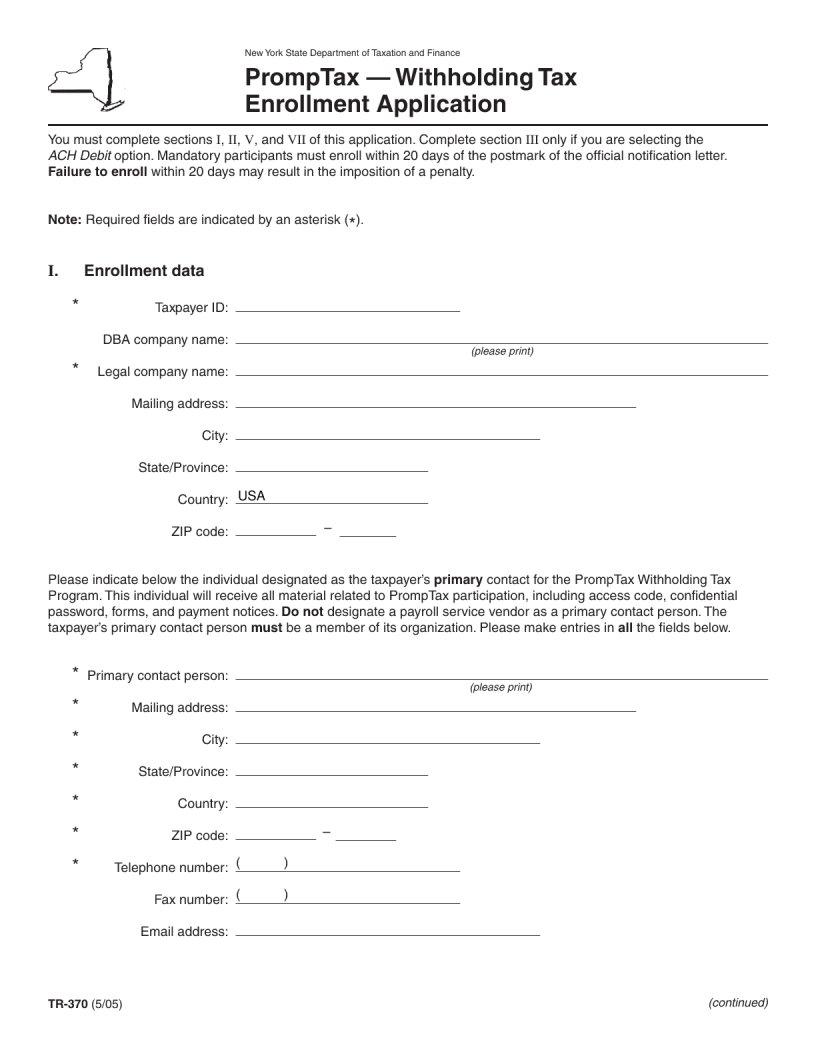

Understanding the complexities of legal forms is crucial for individuals navigating through various processes, and the TR-370 form is no exception. This document plays a vital role in particular legal proceedings, serving as a cornerstone for specific applications. It’s designed to streamline certain procedures, ensuring that all necessary information is collected efficiently and accurately. The importance of accurately completing the TR-370 cannot be overstated, as it directly impacts the outcome of the related processes. Not only does it require detailed personal and case-specific information, but it also mandates strict adherence to guidelines for submission. Whether you are completing this form for the first time or seeking a refresher on its requirements, understanding its function, the type of information it gathers, and how it fits into the wider legal context is essential. This introduction aims to shed light on these major aspects, providing a solid foundation for anyone looking to familiarize themselves with the TR-370 form.

| Question | Answer |

|---|---|

| Form Name | Form Tr 370 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | NYS Prompt Tax Application nys prompt tax form |