Should you would like to fill out form expense claim, you won't have to download any programs - just use our online PDF editor. Our team is relentlessly endeavoring to improve the tool and insure that it is much better for people with its cutting-edge functions. Bring your experience one step further with continually improving and great options we provide! Starting is easy! All you need to do is adhere to the following simple steps below:

Step 1: First, access the editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: This tool offers you the ability to work with PDF forms in a variety of ways. Change it by writing any text, correct existing content, and include a signature - all at your disposal!

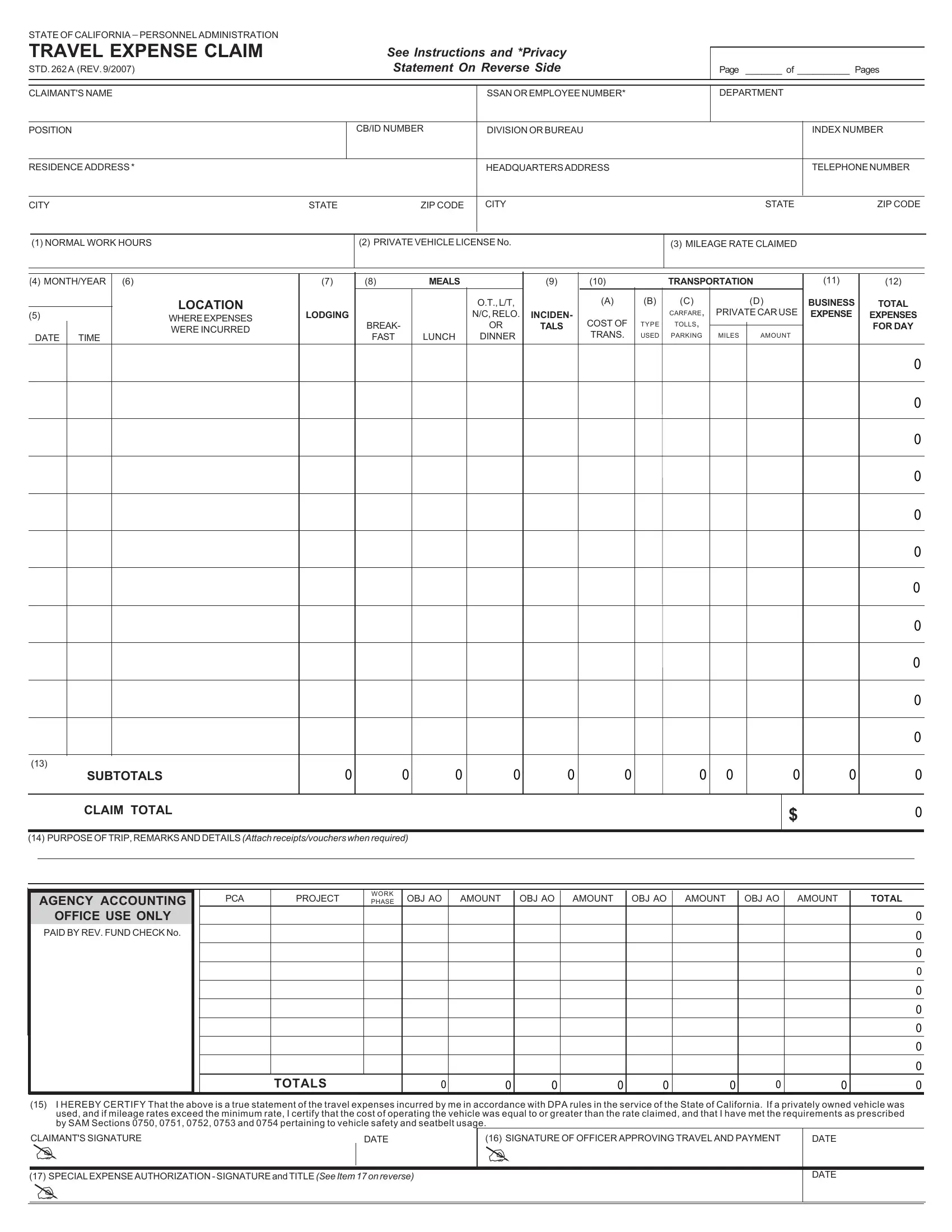

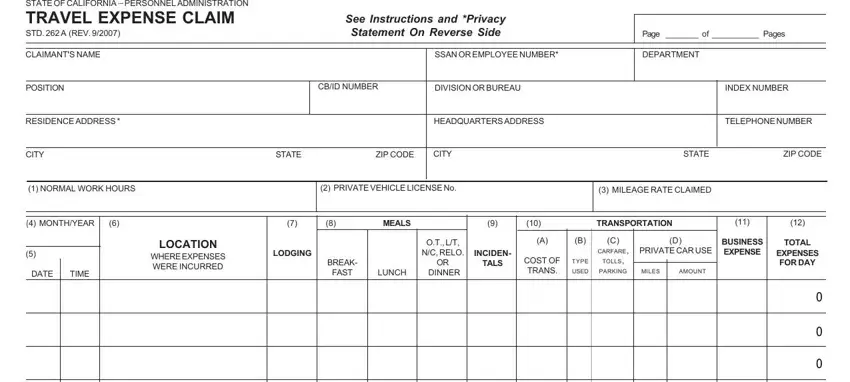

This document will require particular data to be entered, so make sure to take some time to enter precisely what is asked:

1. While completing the form expense claim, ensure to complete all of the important blank fields in the corresponding section. It will help facilitate the work, allowing for your information to be processed fast and properly.

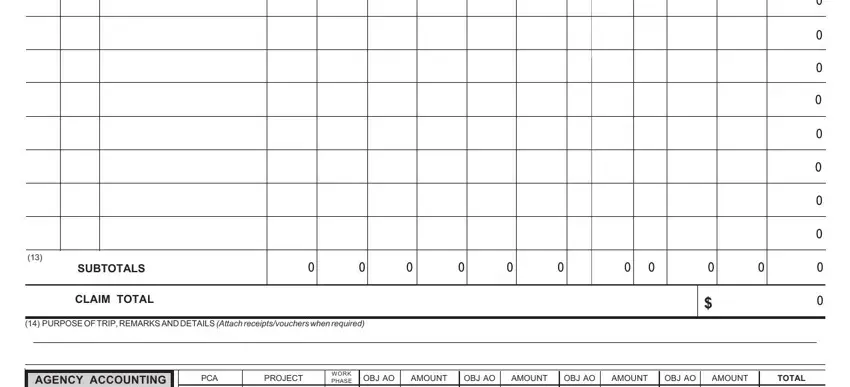

2. Once your current task is complete, take the next step – fill out all of these fields - SUBTOTALS, CLAIM TOTAL, PURPOSE OF TRIP REMARKS AND, AGENCY ACCOUNTING, PCA, PROJECT, WORK PHASE, OBJ AO, AMOUNT, OBJ AO, AMOUNT, OBJ AO, AMOUNT, OBJ AO, and AMOUNT with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

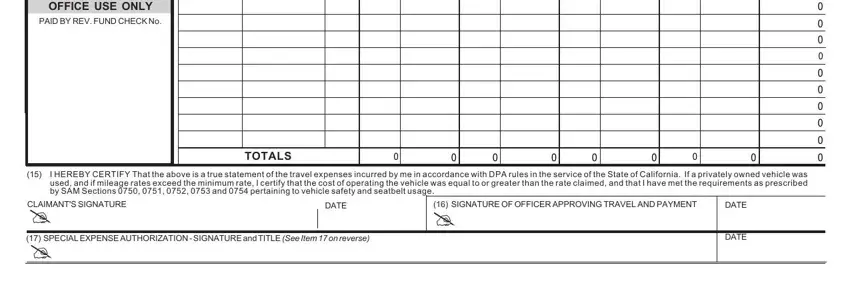

3. Completing OFFICE USE ONLY, PAID BY REV FUND CHECK No, I HEREBY CERTIFY That the above is, TOTALS, CLAIMANTS SIGNATURE, cid cid, SPECIAL EXPENSE AUTHORIZATION, DATE, SIGNATURE OF OFFICER APPROVING, cid, DATE, and DATE is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Those who work with this form frequently make some errors while completing TOTALS in this area. Be sure you revise what you enter right here.

Step 3: Be certain that your details are accurate and just click "Done" to proceed further. Download your form expense claim the instant you sign up for a 7-day free trial. Instantly use the pdf file within your FormsPal cabinet, along with any edits and changes automatically synced! When you work with FormsPal, it is simple to fill out documents without stressing about personal information breaches or records being shared. Our protected software helps to ensure that your private data is kept safe.