This PDF editor was built with the aim of allowing it to be as effortless and user-friendly as possible. All of these actions are going to make creating the 79 monthly quick and easy.

Step 1: Click on the button "Get Form Here".

Step 2: Right now, you can start editing the 79 monthly. The multifunctional toolbar is available to you - add, remove, change, highlight, and perform similar commands with the content in the document.

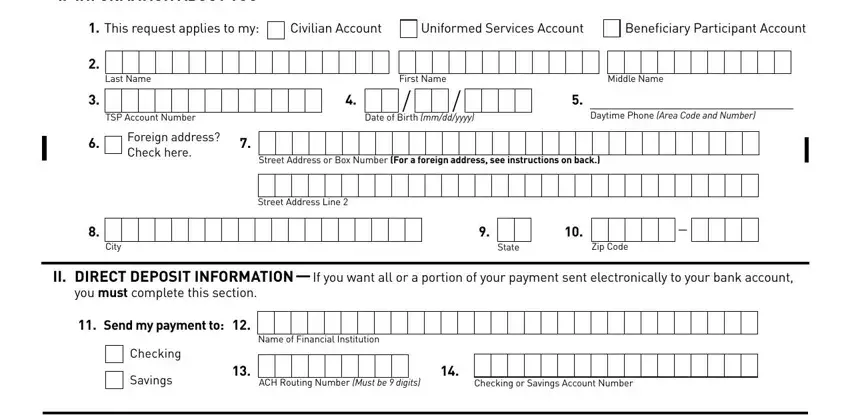

To be able to create the document, enter the content the system will require you to for each of the next segments:

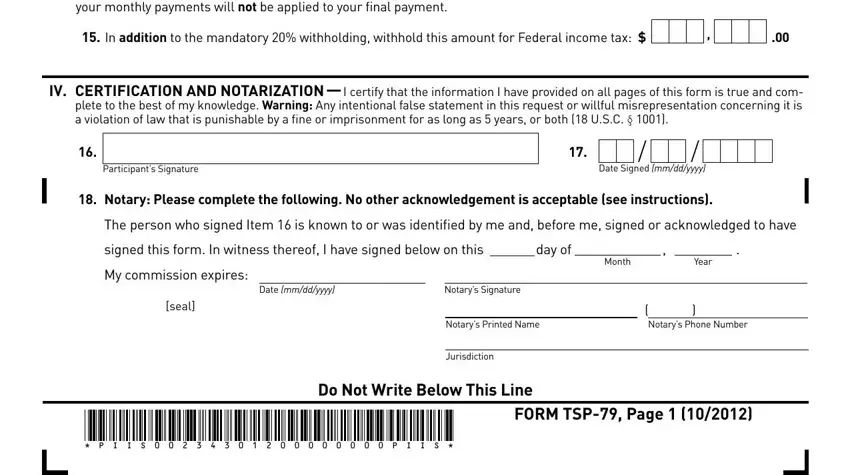

Within the section Participants, Signature Date, Signed, mm, dd, yyyy day, of Month, Year, My, commission, expires seal, Date, mm, dd, yyyy Notary, s, Signature Notary, sPrinted, Name Jurisdiction, Do, Not, Write, Below, This, Line Notary, s, Phone, Number PI, IS, PI, IS and FORM, TSP, Page note the information the application demands you to do.

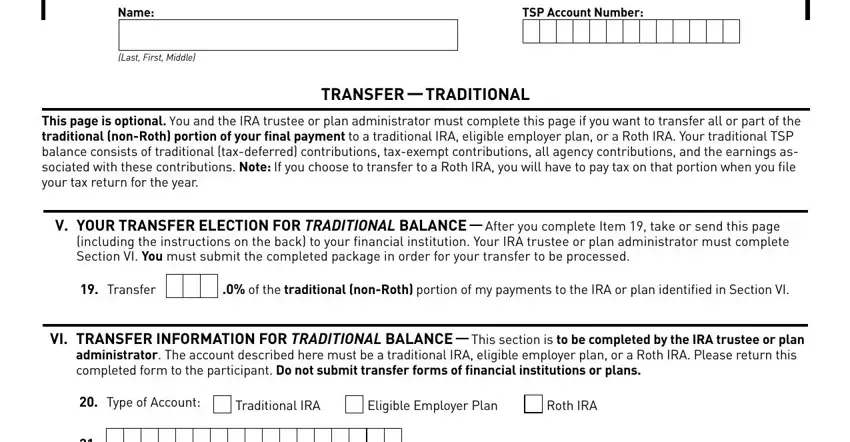

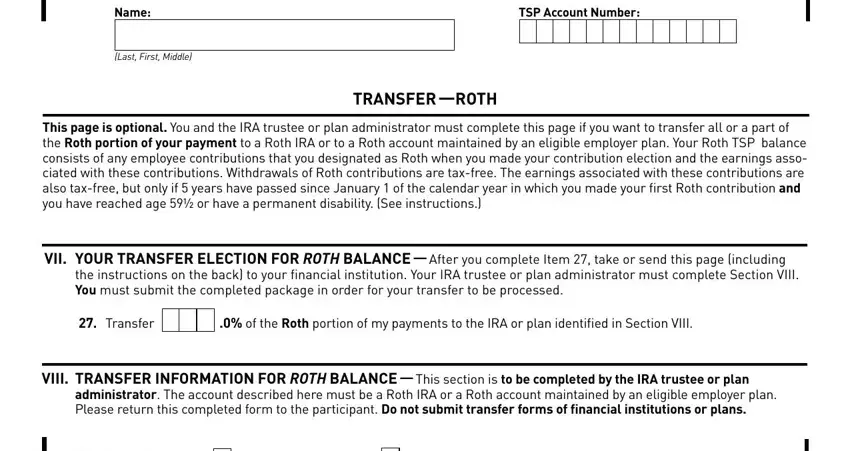

Write the fundamental particulars when you're within the Name, Last, First, Middle TSP, Account, Number TRANSFER, TRADITIONAL Transfer, Type, of, Account Traditional, IRA Eligible, Employer, Plan and Roth, IRA section.

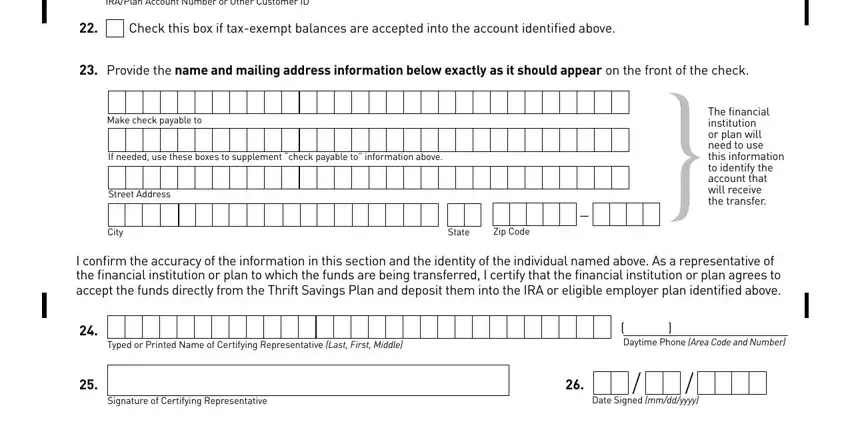

In the paragraph Make, check, payable, to Street, Address City, State, Zip, Code The, nanci, al Daytime, Phone, Area, Code, and, Number Signature, of, Certifying, Representative and Date, Signed, mm, dd, yyyy specify the rights and obligations.

Look at the sections Name, Last, First, Middle TSP, Account, Number TRANSFER, ROTH and Transfer and next complete them.

Step 3: Select the Done button to confirm that your completed file is available to be exported to any type of gadget you decide on or delivered to an email you indicate.

Step 4: To prevent any issues in the long run, you should prepare minimally a couple of copies of the file.