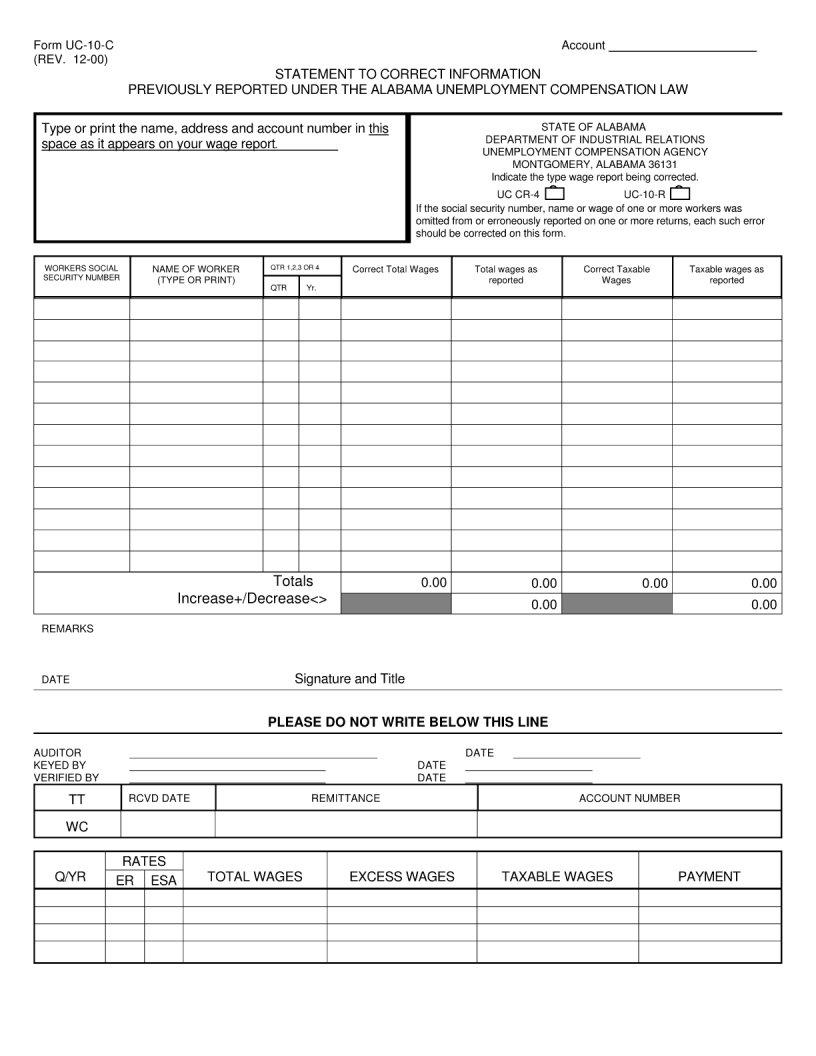

Navigating the complexity of unemployment compensation involves understanding various forms and documents, among which the UC-10 C form stands out due to its pivotal role in the process. This particular form serves as a crucial instrument for employers as it pertains to the realm of unemployment insurance benefits. In essence, it functions as a means for employers to report any severance, vacation, or other types of payments made to employees who are separating from their employment. The importance of accurately completing and submitting this form cannot be overstated, as it directly influences the determination of an individual’s eligibility for unemployment compensation. By meticulously detailing the specific payments made to departing employees, the form assists in ensuring that the calculation of unemployment benefits is done with a high degree of precision. For businesses, the form also plays a critical role in managing financial liabilities related to unemployment insurance, underscoring the necessity for both clarity and accuracy in its completion. Therefore, the UC-10 C form embodies a vital link in the chain of unemployment insurance processing, bridging the gap between employer reporting and the accurate determination of unemployment benefits.

| Question | Answer |

|---|---|

| Form Name | Uc 10 C Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | uccr4, alabama uc cr4, alabama unemployment tax forms, blank form uc cr4 |