The PDF editor was made with the intention of allowing it to be as effortless and easy-to-use as it can be. All of these steps are going to make filling out the pa100 fast and simple.

Step 1: You can select the orange "Get Form Now" button at the top of the following website page.

Step 2: The moment you enter our pa100 editing page, there'll be all the functions you can take with regards to your template at the top menu.

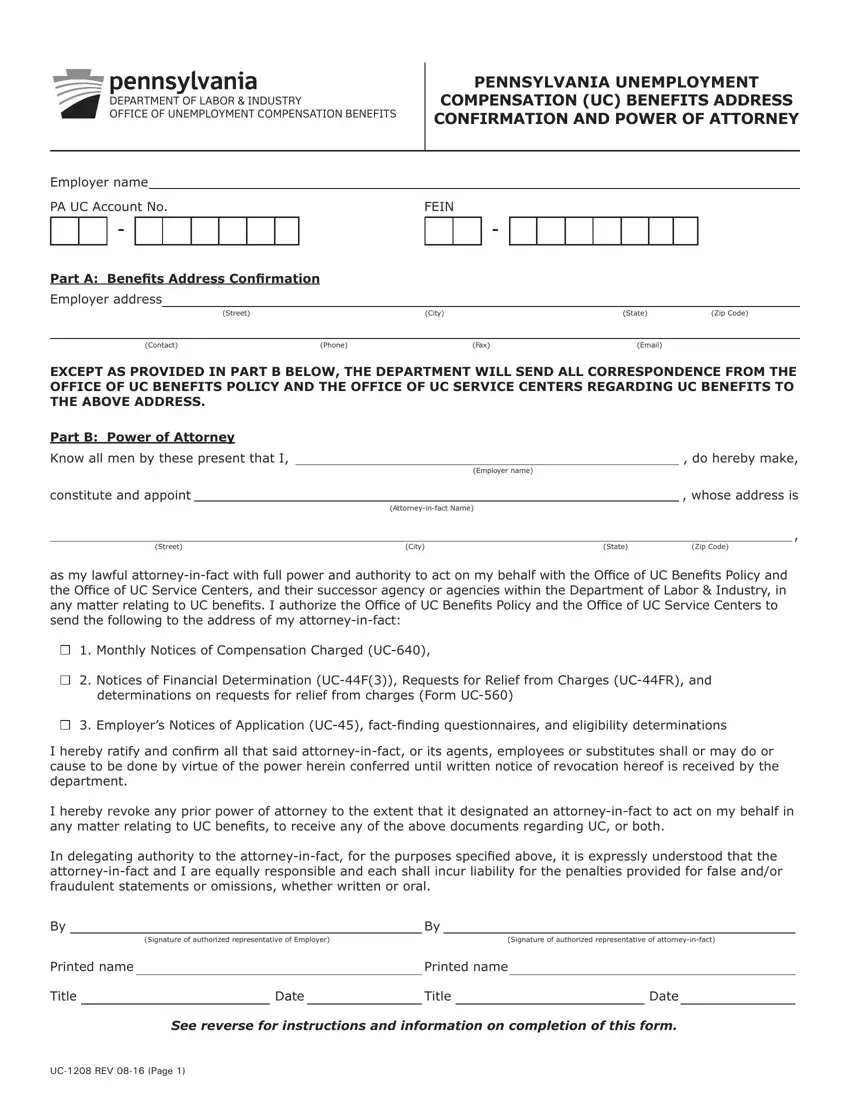

Provide the appropriate details in every single part to fill out the PDF pa100

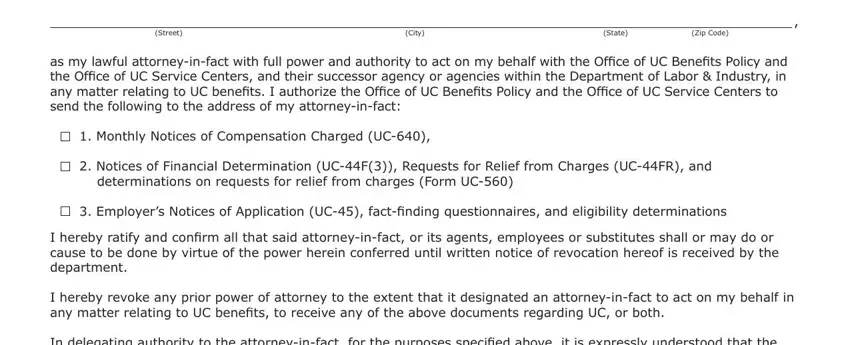

You need to type in the information within the segment Street, City, State, Zip Code, as my lawful attorneyinfact with, Monthly Notices of Compensation, Notices of Financial, Employers Notices of Application, I hereby ratify and confirm all, I hereby revoke any prior power of, and In delegating authority to the.

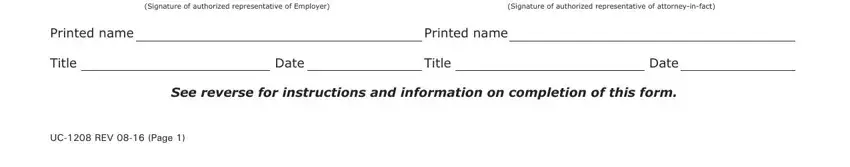

Jot down the vital particulars in Printed name, Title, Signature of authorized, Signature of authorized, Printed name, Date, Title, Date, See reverse for instructions and, and UC REV Page section.

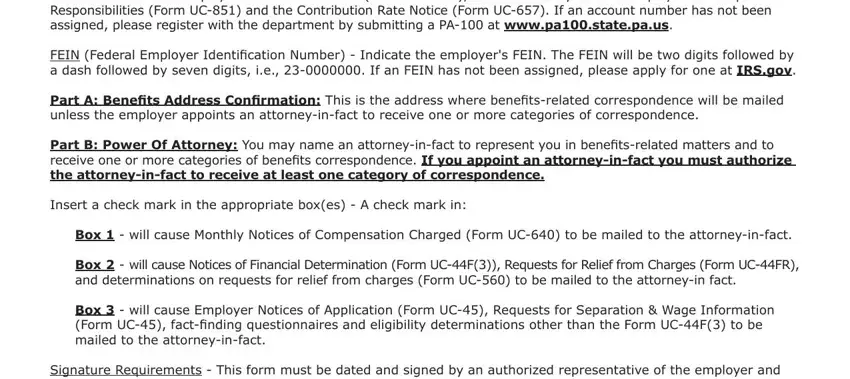

Be sure to describe the rights and obligations of the parties in the PA UC Account Number Indicate the, FEIN Federal Employer, Part A Benefits Address, Part B Power Of Attorney You may, Insert a check mark in the, Box will cause Monthly Notices, Box will cause Notices of, Box will cause Employer Notices, and Signature Requirements This form field.

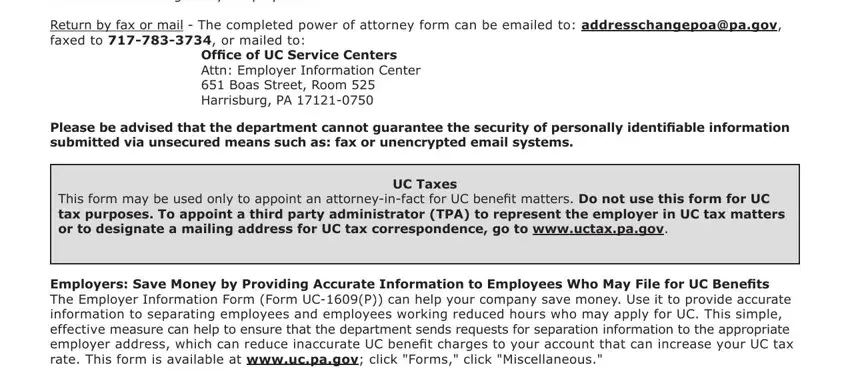

Finish by reviewing the following areas and filling them in accordingly: Signature Requirements This form, Return by fax or mail The, Office of UC Service Centers Attn, Please be advised that the, This form may be used only to, UC Taxes, and Employers Save Money by Providing.

Step 3: Press the "Done" button. Now it's easy to export the PDF document to your device. In addition, you can easily send it by email.

Step 4: Come up with a duplicate of each file. It will certainly save you some time and allow you to prevent issues in the future. By the way, your data will not be revealed or monitored by us.