It shouldn’t be challenging to obtain uc 253 form through our PDF editor. This is the way it is possible to rapidly make your document.

Step 1: Choose the orange button "Get Form Here" on the website page.

Step 2: You'll find all of the functions you can undertake on your file after you have entered the uc 253 form editing page.

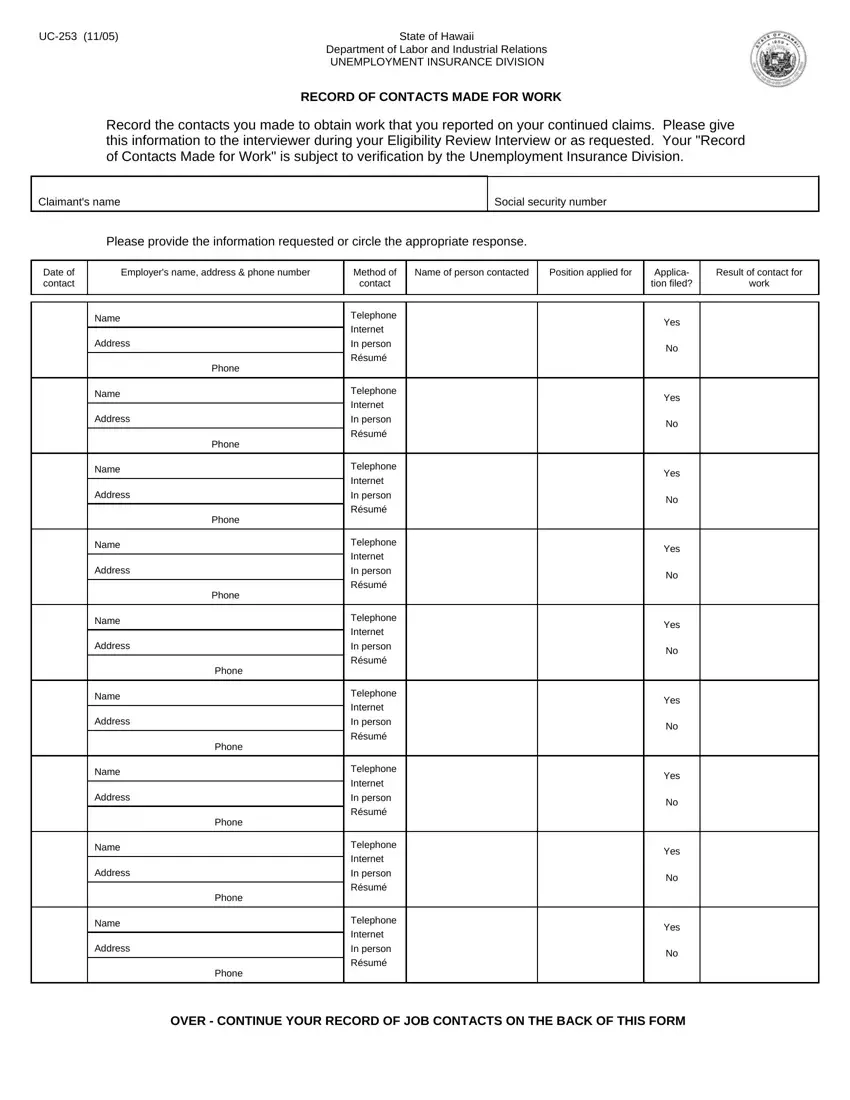

These particular areas will frame the PDF template that you'll be creating:

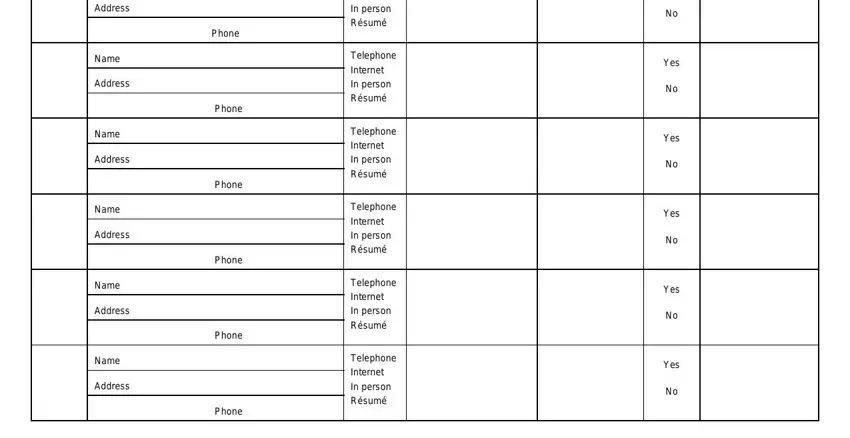

The program will need you to submit the Address, Name, Address, Name, Address, Name, Address, Name, Address, Name, Address, Phone, Phone, Phone, and Phone part.

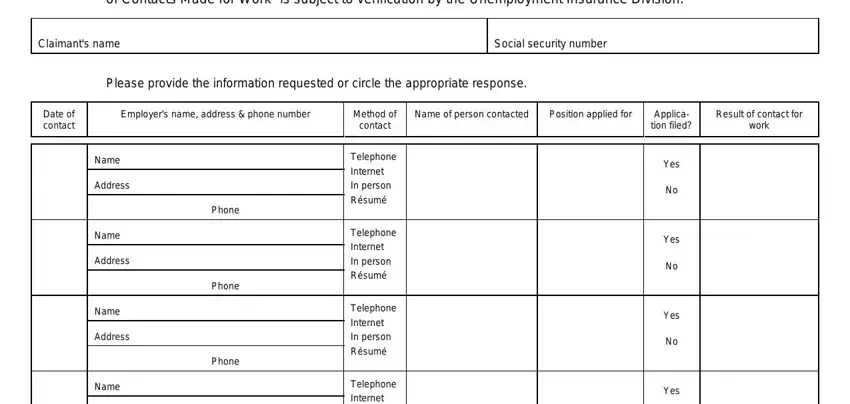

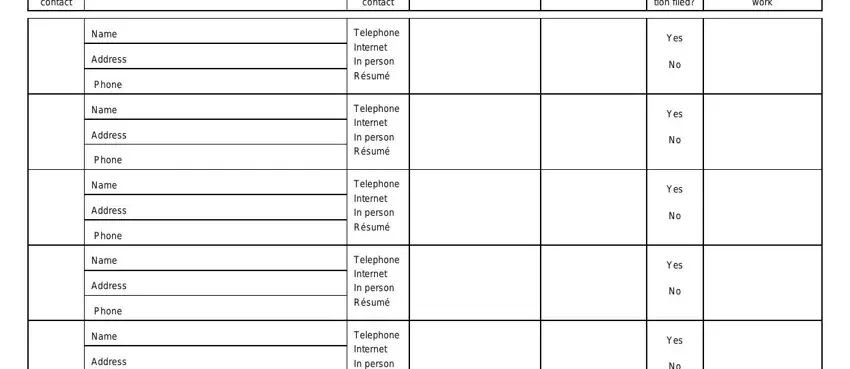

The system will demand you to put down certain valuable particulars to conveniently fill out the field Date of contact, Name, Address, Phone, Name, Address, Phone, Name, Address, Phone, Name, Address, Phone, Name, and Address.

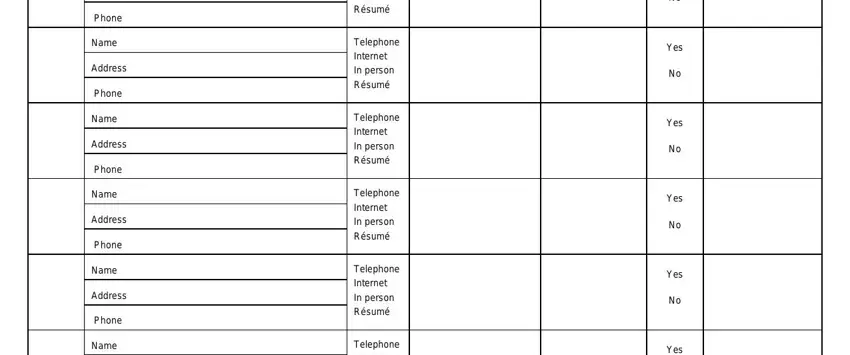

When it comes to field Phone, Name, Address, Phone, Name, Address, Phone, Name, Address, Phone, Name, Address, Phone, Name, and Telephone Internet In person Résumé, identify the rights and responsibilities.

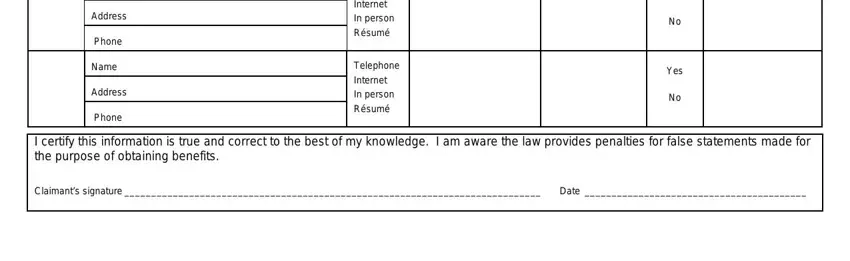

End by checking the next fields and filling them in correspondingly: Address, Phone, Name, Address, Phone, Telephone Internet In person Résumé, Telephone Internet In person Résumé, Yes, Yes, I certify this information is true, and Claimants signature Date.

Step 3: The moment you hit the Done button, your ready file is conveniently exportable to any type of of your gadgets. Alternatively, you may deliver it via mail.

Step 4: Attempt to make as many duplicates of the form as possible to avoid future worries.