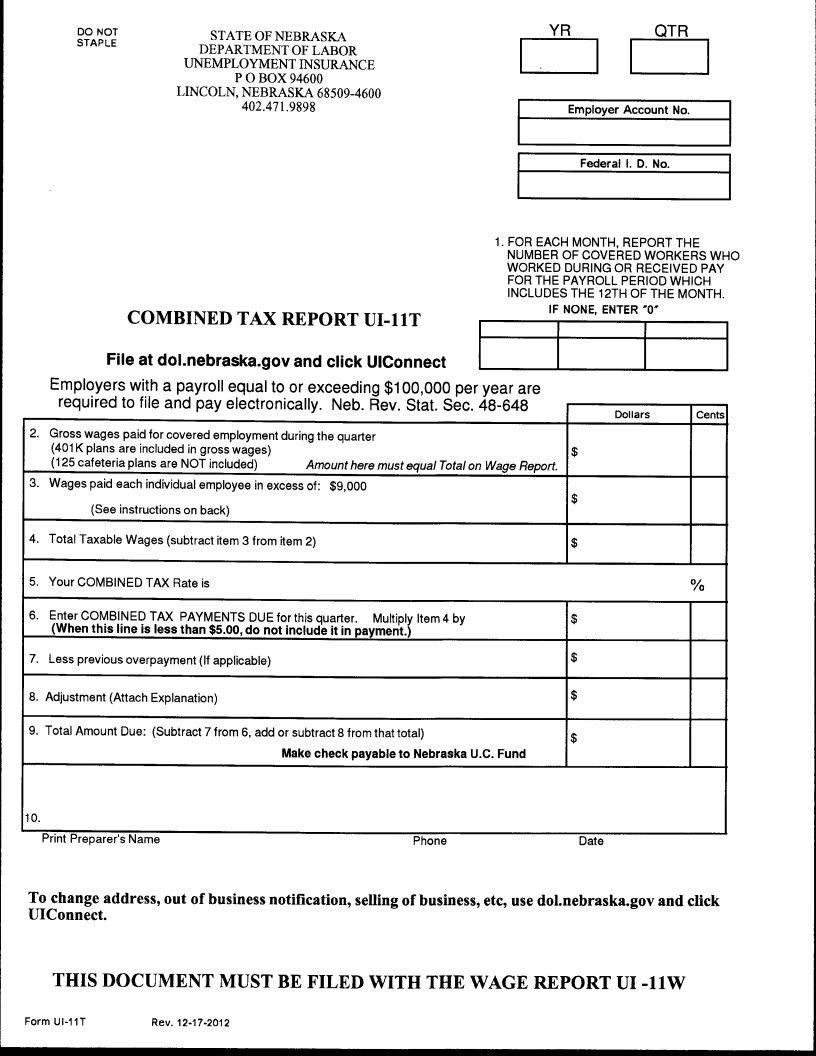

The intricacies of the Ui 11T form serve a vital purpose for individuals and businesses navigating the complexities of unemployment insurance. As a document central to the process, the Ui 11T form is instrumental for reporting and reconciling unemployment insurance taxes, a necessity for employers across the spectrum. Through its comprehensive structure, the form facilitates accurate reporting of wages paid and taxes owed, ensuring compliance with state and federal regulations. It also plays a critical role in maintaining the integrity of unemployment insurance funds, by enabling authorities to assess and collect the correct amount of contributions. For employers, understanding and accurately completing the Ui 11T form is crucial to avoid penalties, maintain good standing, and support the overall unemployment insurance system. By delving into the major aspects of the Ui 11T form, individuals and businesses can gain insights into its significance, the procedural requirements it entails, and the impact it has on the broader context of employment and economic stability.

| Question | Answer |

|---|---|

| Form Name | Form Ui 11T |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | u1-11t, fillable ui 11t nebraska, nebraska form ui 11t, ui11 |