At the heart of maintaining accurate records for both employees and the Unemployment Insurance Fund (UIF) in South Africa stands the UI-19 form, a crucial document required under the Unemployment Insurance Act 63 of 2001. This form serves as a monthly update that employers must submit to inform the UIF commissioner of any changes in the employer's contact details or alterations in employees' remuneration details. Such diligence ensures that the UIF remains updated on employee dynamics, including changes in salary, termination, or any new hires that occurred within the previous month. It is detailed, mandating employers provide comprehensive information ranging from employer and employee details to specific remuneration figures and employment status. The necessity to submit accurate and timely information underscores the form's role in upholding the integrity of the unemployment insurance system. Furthermore, it's a legal requirement that the completed UI-19 form is delivered to the UIF offices in Pretoria by the seventh day of each month, either physically or electronically, reinforcing the commitment to operational transparency and compliance. Failure to adhere to these requirements is not only an offence but may significantly impede employees' ability to claim unemployment benefits—all of which emphasizes the form’s pivotal place within South Africa's employment and social security landscape.

| Question | Answer |

|---|---|

| Form Name | Form UI-19 |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 104 |

| Avg. time to fill out | 21 min 3 sec |

| Other names | ui19 form download, download ui19 form, ui19 form 2021 download, ui19 form 2021 |

|

|

UNEMPLOYMENT INSURANCE ACT 63 OF 2001 |

|

Change of information about employees |

FAX NO (012) |

Information to be supplied in terms of Section 56(3) read with Regulation 13(2)

An employer must before the seventh day of each month inform the commissioner of any change arising during the previous month regarding the employer's contact details or employees remuneration details. The employer must forward this form to the Unemployment Insurance Fund, 94 Church Street, Pretoria, 0001.

1.EMPLOYER DETAILS

1.1 |

UIF Employer Reference. No |

|

|

|

Branch No |

|

1.2 Name of employer: |

|

|

|

|

|

|||||||

1.3 |

Physical address |

|

|

|

|

|

|

1.4 |

Postal address: |

|

|

|

|

|

|||||

1.5 |

Address where employees listed in Item 2 work |

|

|

|

|

1.6 |

PAYE Reference No. |

|

|

|

|

||||||||

(if different to the above address) |

|

|

|

|

|

(If registered with SARS) |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

1.7 Company Registration No: |

|

|

|

|

||||

1.8 |

E mail address |

|

1.9 Fax number |

|

|

1.10 Tel number |

|

|

|

1.11 Authorised person_1 |

|

||||||||

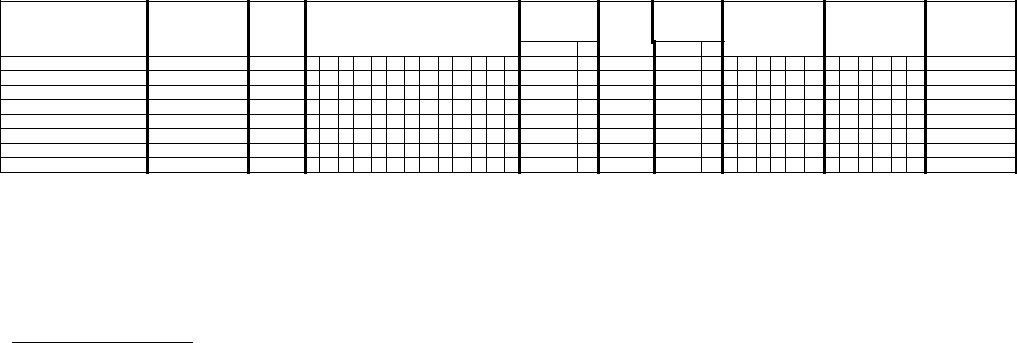

2.EMPLOYEE DETAILS

A.

Surname

B.

Name

C.

Clock No

D.

ID Number

(13 Digit RSA ID No.)

E.

Remuneration2

F.

Frequency

3

G.

Contribution

Amount 4

H.

Starting

Date

I.

Termination Date

J.

Reason for

Termination

R

c

Rc

I, ___________________________________, ID NO __________________, declare that the above information is true and correct. I understand that it is an offence to make a false statement.

(Name of Employer)

EMPLOYER SIGNATURE ___________________________________________________ |

DATE _________________________ |

1If the employer is not resident in the RSA, or is a body corporate not registered in the RSA, an authorised person must carry out the duties of the employer in terms of this Act.

2 Remuneration is defined in terms of section 1 of the Unemployment Insurance Contributions Act

3. Frequency of salary/wage payment ie. M=Monthly, W=Weekly, D=Daily and H=Hourly

4 Total contribution = the amount payable by both employer and employee i.e. 2% X amount of column G

5 Employers may also submit these details electronically from their payrolls or on the UIF’s Website at www.uif.gov.za – Telephone no (012) 337 1680.