Form Ui Har can be filled in online with ease. Simply try FormsPal PDF tool to do the job without delay. Our editor is continually evolving to provide the best user experience possible, and that's thanks to our commitment to continuous enhancement and listening closely to feedback from customers. Here's what you would need to do to start:

Step 1: Press the orange "Get Form" button above. It's going to open our pdf editor so that you can begin filling in your form.

Step 2: With this advanced PDF editor, it's possible to do more than merely fill out blank form fields. Edit away and make your docs look high-quality with customized text put in, or optimize the original input to perfection - all accompanied by an ability to add almost any photos and sign the PDF off.

It is actually simple to finish the document with this practical tutorial! This is what you should do:

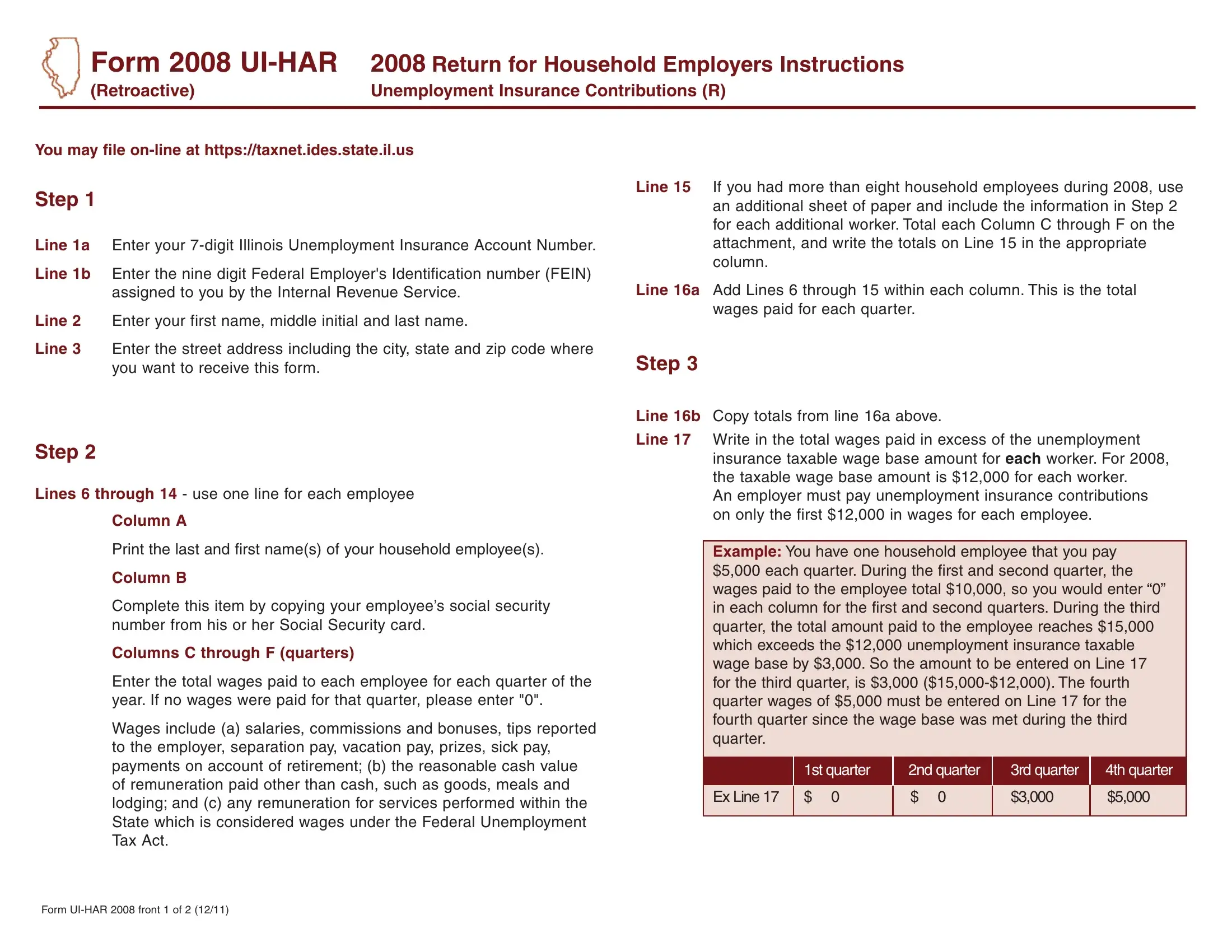

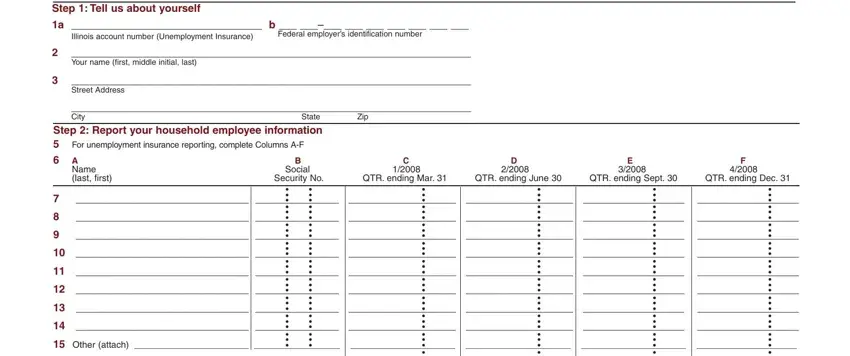

1. You need to fill out the Form Ui Har accurately, therefore be careful when filling out the segments comprising these specific blanks:

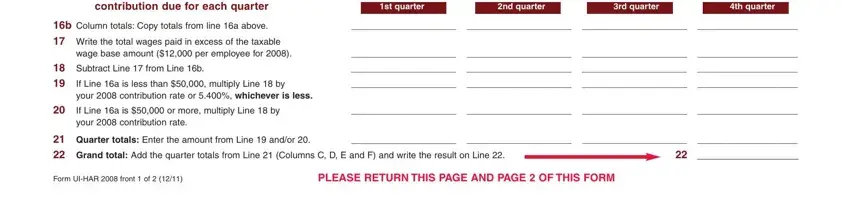

2. The subsequent step is to fill in these particular fields: contribution due for each quarter, b Column totals Copy totals from, Write the total wages paid in, st quarter, nd quarter, rd quarter, th quarter, wage base amount per employee for, Subtract Line from Line b If, your contribution rate or, If Line a is or more multiply, your contribution rate, Quarter totals Enter the amount, Form UIHAR front of, and PLEASE RETURN THIS PAGE AND PAGE.

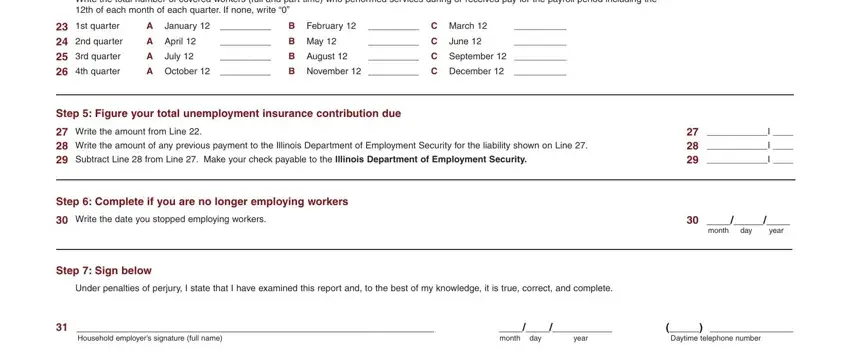

3. This third step is normally relatively easy, Write the total number of covered, st quarter nd quarter rd, A January, B February, C March, A April, B May, C June, A July, B August, C September, A October, B November C December, Step Figure your total, and Write the amount from Line - all these form fields is required to be filled out here.

People often make some errors while filling in B August in this section. Remember to read twice everything you type in here.

Step 3: You should make sure your details are correct and then simply click "Done" to complete the process. Download the Form Ui Har when you sign up for a free trial. Immediately gain access to the pdf document within your personal cabinet, with any edits and changes automatically saved! Here at FormsPal.com, we do our utmost to ensure that your details are stored protected.