This PDF editor allows you to create the ies file. It will be easy to create the file efficiently by using these simple actions.

Step 1: This page contains an orange button saying "Get Form Now". Click it.

Step 2: The moment you access our ies editing page, there'll be each of the actions you can take regarding your form in the upper menu.

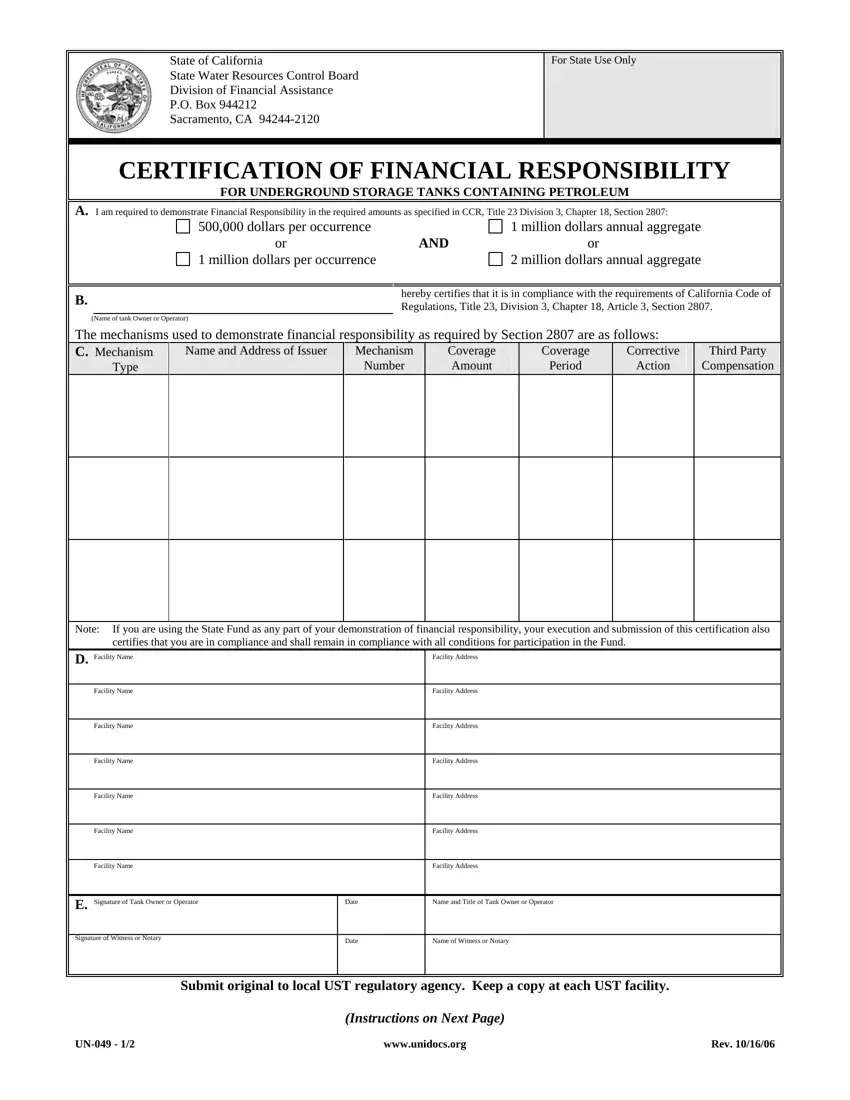

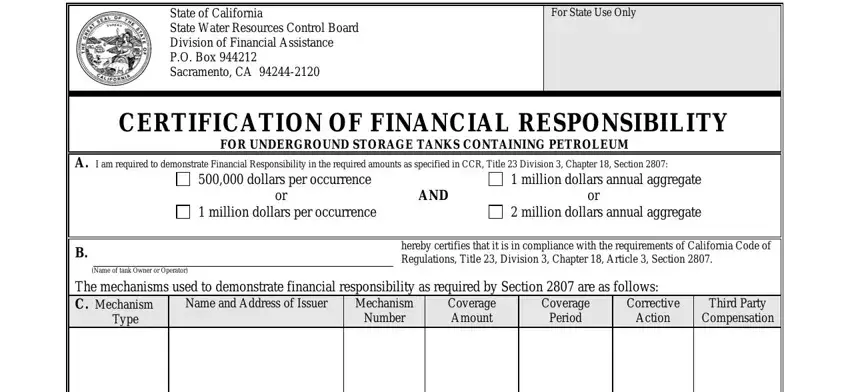

You have to provide the following information if you would like prepare the document:

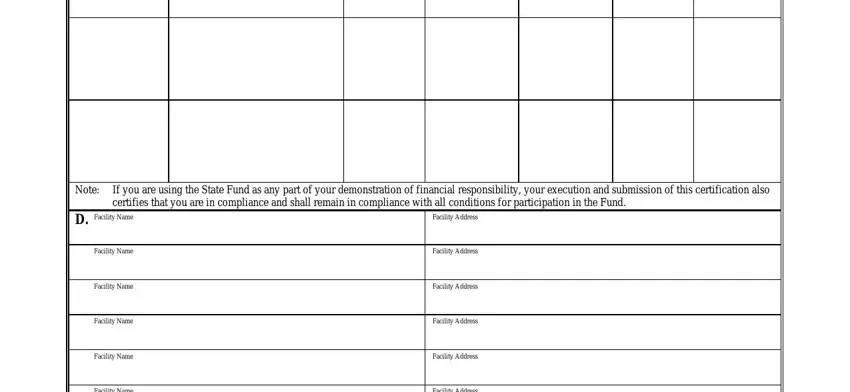

Complete the Note, If you are using the State Fund as, D Facility Name, Facility Name, Facility Name, Facility Name, Facility Name, Facility Name, Facility Address, Facility Address, Facility Address, Facility Address, Facility Address, and Facility Address section with all the details asked by the software.

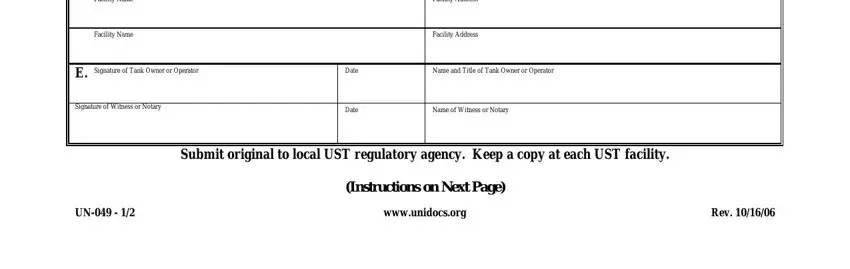

Outline the essential information in the Facility Name, Facility Name, Facility Address, Facility Address, E Signature of Tank Owner or, Signature of Witness or Notary, Date, Date, Name and Title of Tank Owner or, Name of Witness or Notary, Submit original to local UST, Instructions on Next Page, wwwunidocsorg, and Rev area.

Step 3: Choose "Done". It's now possible to export your PDF file.

Step 4: To prevent yourself from any sort of headaches in the long run, be sure to generate no less than several copies of your file.