Any time you desire to fill out form tc 721, you won't have to install any applications - just try our online PDF editor. Our development team is always working to expand the tool and enable it to be much faster for people with its extensive functions. Bring your experience to another level with continually growing and exceptional options we provide! Getting underway is simple! Everything you should do is follow these simple steps down below:

Step 1: Click the "Get Form" button above on this webpage to get into our editor.

Step 2: With this state-of-the-art PDF editor, you can actually accomplish more than just fill in forms. Express yourself and make your forms seem perfect with custom text put in, or adjust the file's original content to excellence - all comes along with the capability to insert almost any photos and sign the document off.

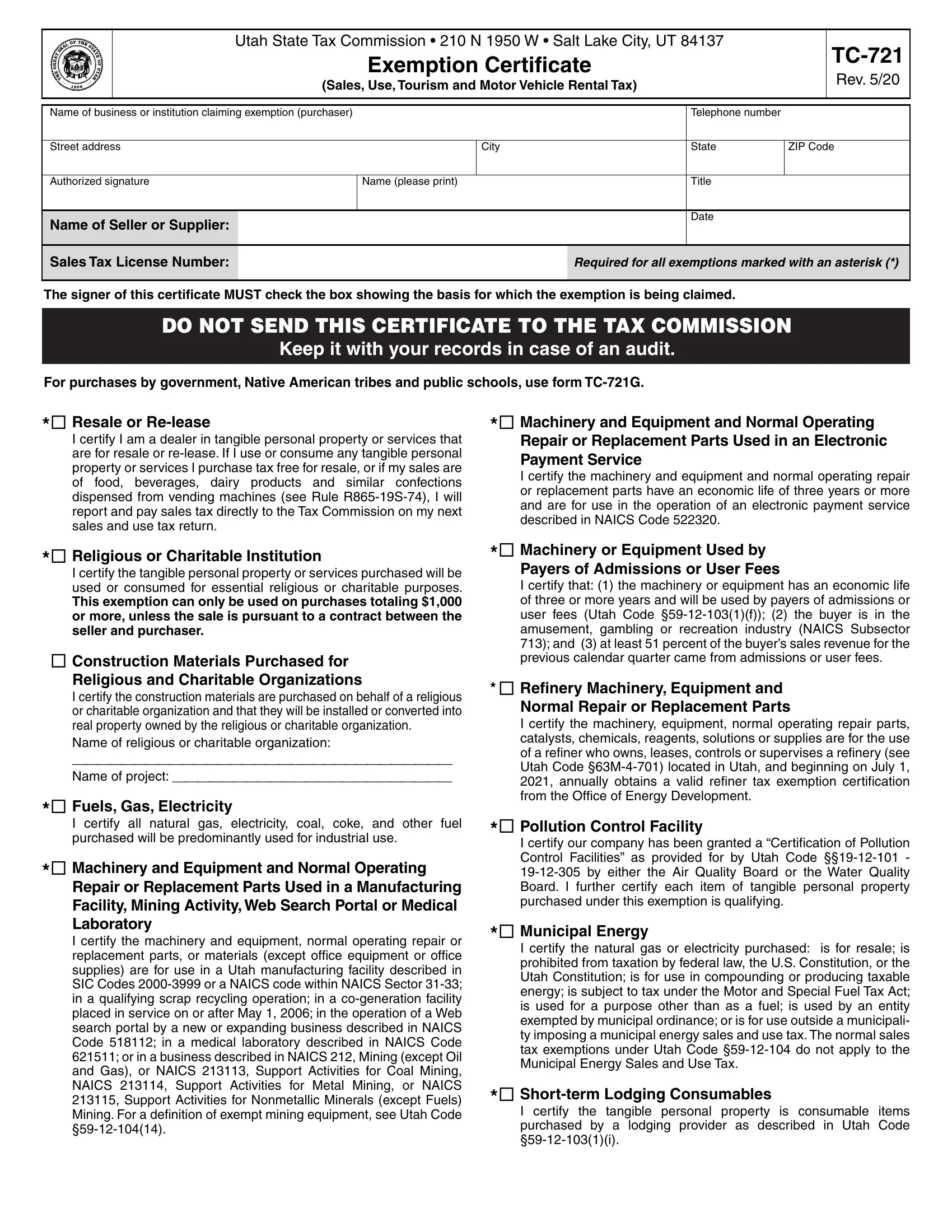

This form will need you to provide some specific details; in order to guarantee accuracy and reliability, remember to consider the next recommendations:

1. When filling out the form tc 721, be sure to include all of the important blank fields within the associated section. This will help expedite the work, enabling your information to be processed swiftly and accurately.

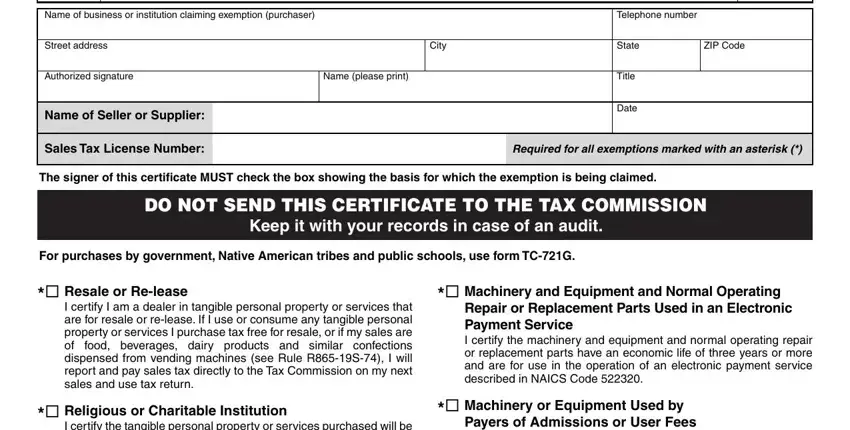

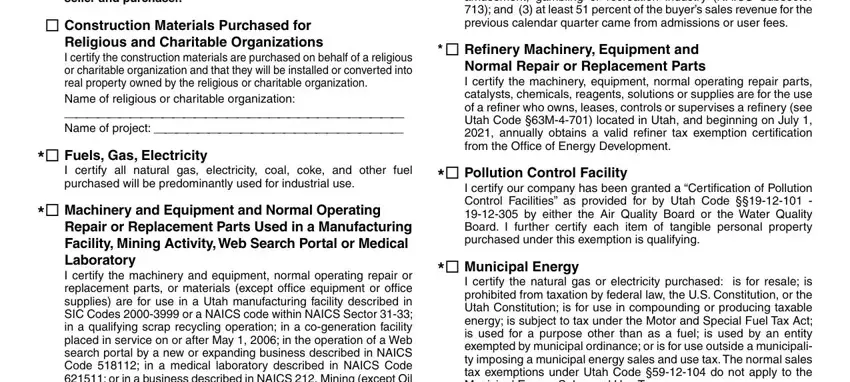

2. Your next stage is usually to fill in all of the following blanks: I certify the tangible personal, Construction Materials Purchased, Fuels Gas Electricity, I certify all natural gas, Machinery and Equipment and, Repair or Replacement Parts Used, Machinery or Equipment Used by, Refinery Machinery Equipment and, Pollution Control Facility, I certify our company has been, Municipal Energy, and I certify the natural gas or.

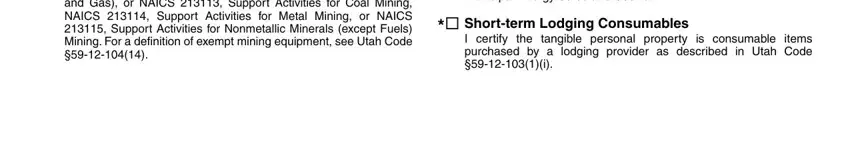

3. Completing Repair or Replacement Parts Used, I certify the natural gas or, Shortterm Lodging Consumables, and I certify the tangible personal is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

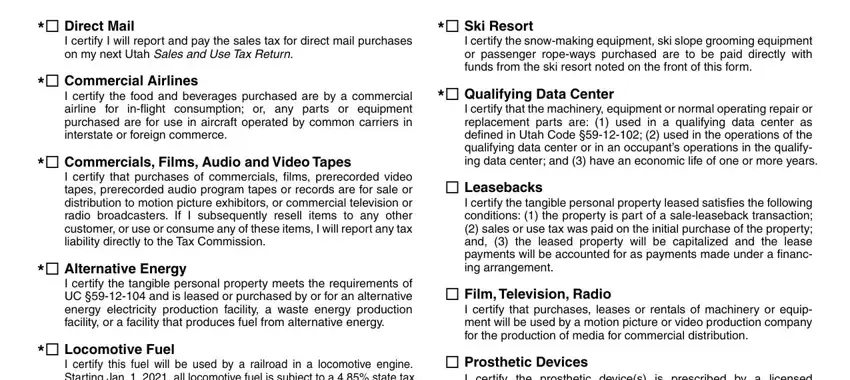

4. Filling out Direct Mail, I certify I will report and pay, Commercial Airlines, I certify the food and beverages, Commercials Films Audio and, I certify that purchases of, Alternative Energy, I certify the tangible personal, Locomotive Fuel, I certify this fuel will be used, Ski Resort, I certify the snowmaking equipment, Qualifying Data Center, I certify that the machinery, and Leasebacks is paramount in the next form section - make certain that you be patient and fill in every field!

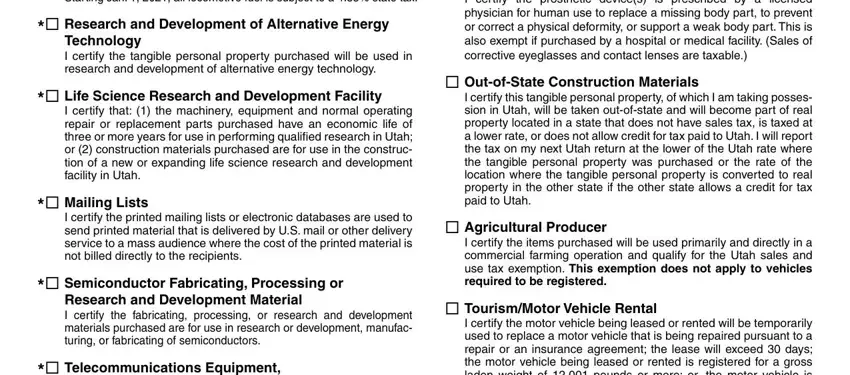

5. This form should be wrapped up with this part. Here you'll find a comprehensive listing of fields that require specific information to allow your document submission to be complete: I certify this fuel will be used, Research and Development of, Technology I certify the tangible, Life Science Research and, I certify that the machinery, Mailing Lists, I certify the printed mailing, Semiconductor Fabricating, Research and Development Material, Telecommunications Equipment, I certify the prosthetic devices, OutofState Construction Materials, I certify this tangible personal, Agricultural Producer, and I certify the items purchased will.

It is possible to get it wrong while completing your Research and Development Material, hence be sure to go through it again before you'll finalize the form.

Step 3: Proofread all the details you have inserted in the blank fields and hit the "Done" button. Right after registering afree trial account with us, you'll be able to download form tc 721 or send it via email directly. The file will also be easily accessible through your personal cabinet with all your edits. FormsPal is devoted to the confidentiality of all our users; we make sure that all information used in our system is kept protected.