Through the online PDF editor by FormsPal, you are able to fill out or modify missiori federal tax exemption for lodging right here and now. FormsPal team is constantly working to develop the editor and insure that it is much easier for clients with its extensive functions. Make the most of present-day innovative opportunities, and discover a heap of unique experiences! This is what you will have to do to get started:

Step 1: Access the PDF doc in our tool by hitting the "Get Form Button" in the top part of this page.

Step 2: As soon as you access the tool, you will find the form ready to be completed. Apart from filling out various fields, you can also perform some other actions with the form, including adding custom text, editing the initial text, adding images, signing the document, and much more.

It will be easy to fill out the form with this practical guide! Here is what you need to do:

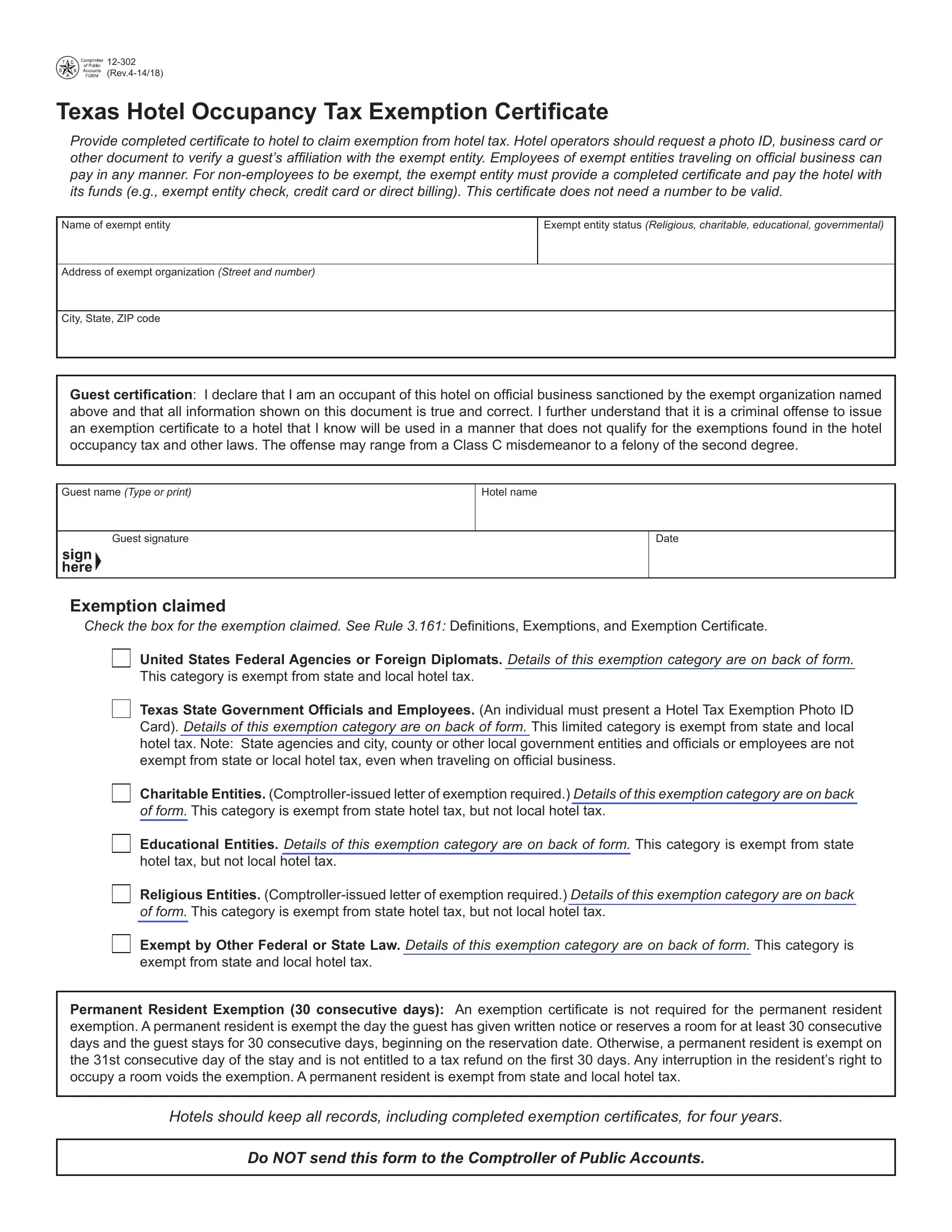

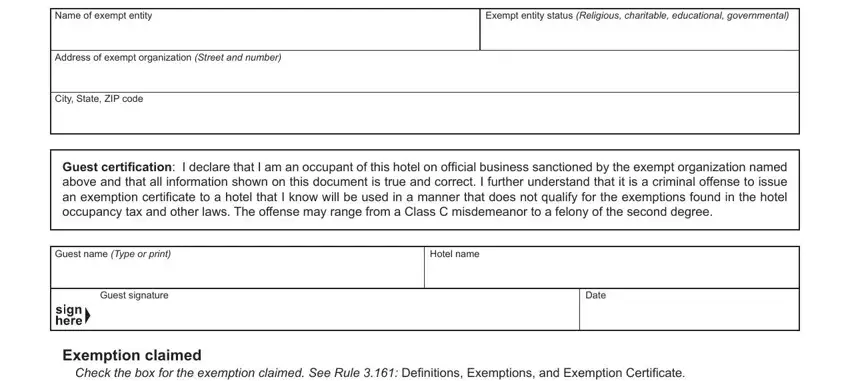

1. Begin completing your missiori federal tax exemption for lodging with a group of essential fields. Collect all the important information and make certain there's nothing overlooked!

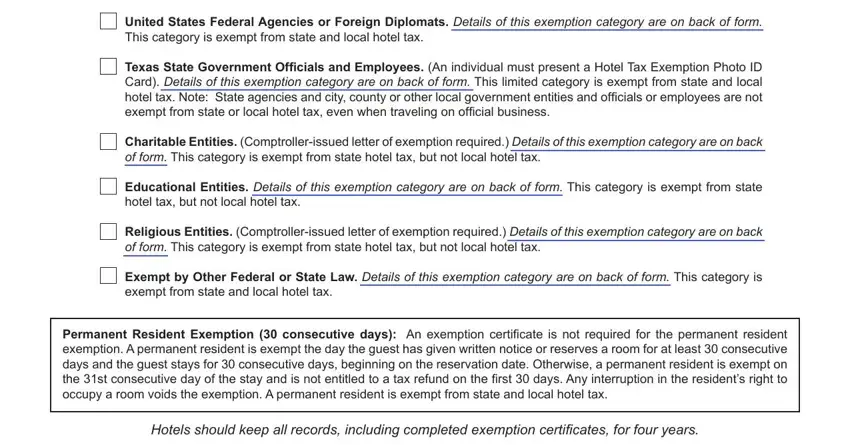

2. Once your current task is complete, take the next step – fill out all of these fields - United States Federal Agencies or, Texas State Government Officials, Charitable Entities, Educational Entities Details of, Religious Entities, Exempt by Other Federal or State, Permanent Resident Exemption, and Hotels should keep all records with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning Educational Entities Details of and Charitable Entities, be sure that you do everything correctly in this section. These are considered the most important ones in this form.

Step 3: Right after taking one more look at your fields, click "Done" and you're all set! Sign up with us now and easily get access to missiori federal tax exemption for lodging, available for downloading. Every modification you make is conveniently preserved , which enables you to edit the file at a later point as required. FormsPal is dedicated to the privacy of all our users; we make sure that all information going through our editor is confidential.