You are able to complete 2020 iowa 1040 fillable form without difficulty with the help of our PDFinity® online tool. FormsPal expert team is continuously endeavoring to expand the editor and make it even easier for clients with its multiple functions. Capitalize on today's innovative prospects, and find a trove of unique experiences! All it requires is a couple of easy steps:

Step 1: Click the "Get Form" button above. It's going to open up our tool so that you can begin filling in your form.

Step 2: As soon as you access the tool, you will find the form made ready to be completed. In addition to filling out various fields, you might also perform various other things with the file, that is adding your own textual content, editing the initial text, adding images, placing your signature to the document, and more.

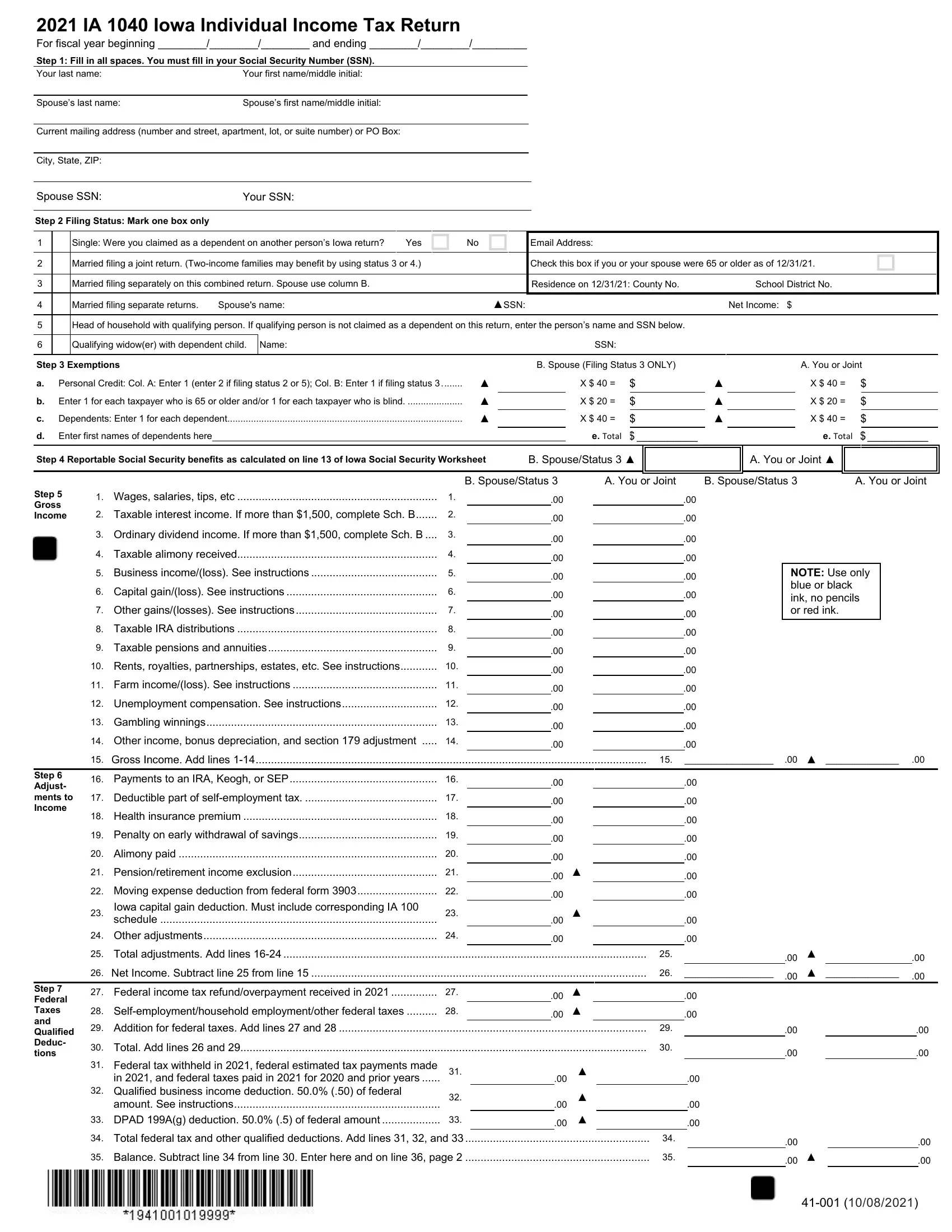

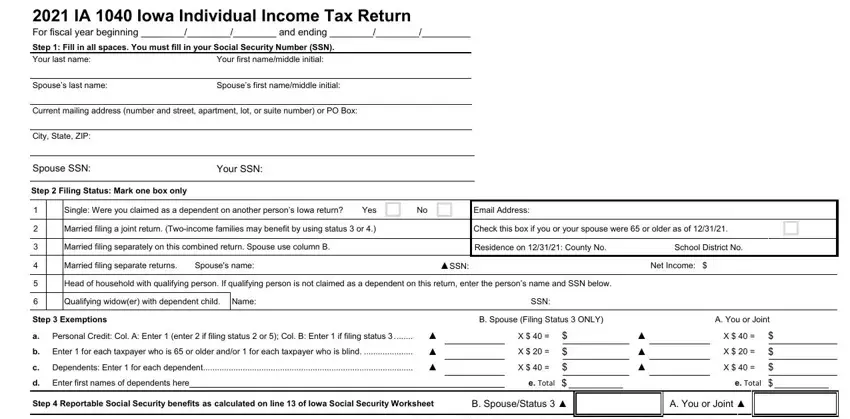

In order to fill out this form, be sure you provide the right details in every single blank field:

1. Fill out the 2020 iowa 1040 fillable form with a selection of essential fields. Consider all of the information you need and ensure there's nothing overlooked!

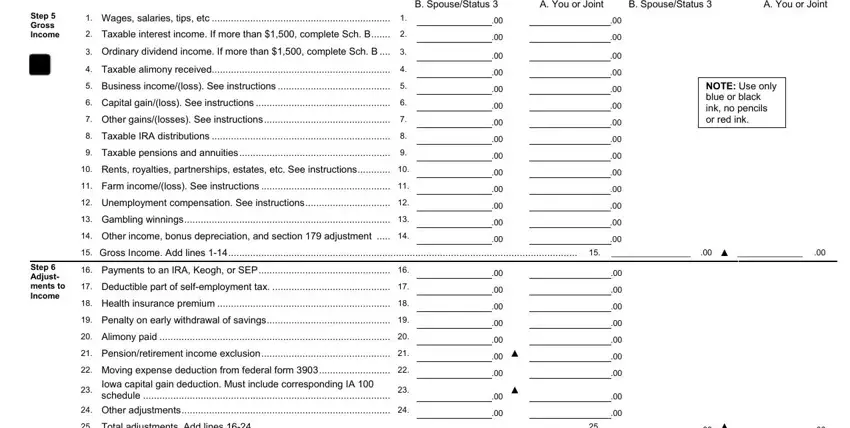

2. Now that the last array of fields is complete, you have to add the required specifics in B SpouseStatus, A You or Joint, B SpouseStatus, A You or Joint, Step Gross Income, Wages salaries tips etc, Taxable interest income If more, Ordinary dividend income If more, Taxable alimony received, Business incomeloss See, Capital gainloss See instructions, Other gainslosses See, Taxable IRA distributions, Taxable pensions and annuities, and Rents royalties partnerships so that you can move forward to the next part.

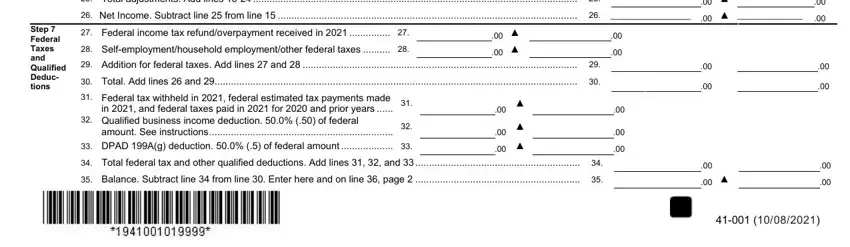

3. This next section focuses on Total adjustments Add lines, Net Income Subtract line from, Step Federal Taxes and Qualified, Federal income tax, Selfemploymenthousehold, Addition for federal taxes Add, Total Add lines and, Federal tax withheld in federal, Qualified business income, amount See instructions, DPAD Ag deduction of federal, Total federal tax and other, and Balance Subtract line from line - fill in all these blanks.

Be very attentive while filling out Net Income Subtract line from and Federal tax withheld in federal, as this is the part where many people make errors.

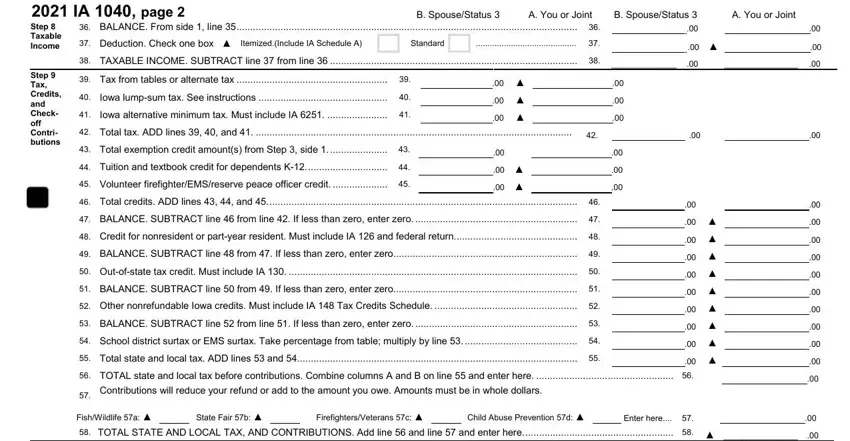

4. This next section requires some additional information. Ensure you complete all the necessary fields - IA page Step Taxable Income, BALANCE From side line, ItemizedInclude IA Schedule A, Standard, TAXABLE INCOME SUBTRACT line, B SpouseStatus, A You or Joint, B SpouseStatus, A You or Joint, Tax from tables or alternate tax, Iowa lumpsum tax See instructions, Iowa alternative minimum tax Must, Total tax ADD lines and, Total exemption credit amounts, and Tuition and textbook credit for - to proceed further in your process!

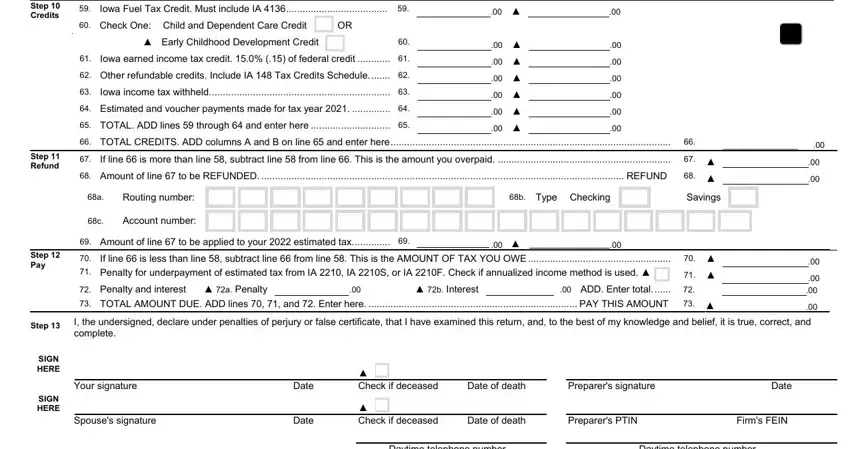

5. As a final point, the following final portion is what you will have to wrap up before submitting the document. The blanks here include the following: Step Credits, FishWildlife a TOTAL STATE AND, Iowa Fuel Tax Credit Must include, Check One Child and Dependent, Early Childhood Development Credit, Iowa earned income tax credit of, Other refundable credits Include, Iowa income tax withheld, Estimated and voucher payments, TOTAL ADD lines through and, TOTAL CREDITS ADD columns A and B, Step Refund, If line is more than line, Amount of line to be REFUNDED, and Routing number.

Step 3: Reread what you've inserted in the blank fields and then click on the "Done" button. Download the 2020 iowa 1040 fillable form the instant you sign up for a free trial. Quickly gain access to the pdf form in your personal cabinet, with any edits and adjustments being automatically saved! FormsPal is invested in the privacy of our users; we make sure all personal data coming through our editor is secure.