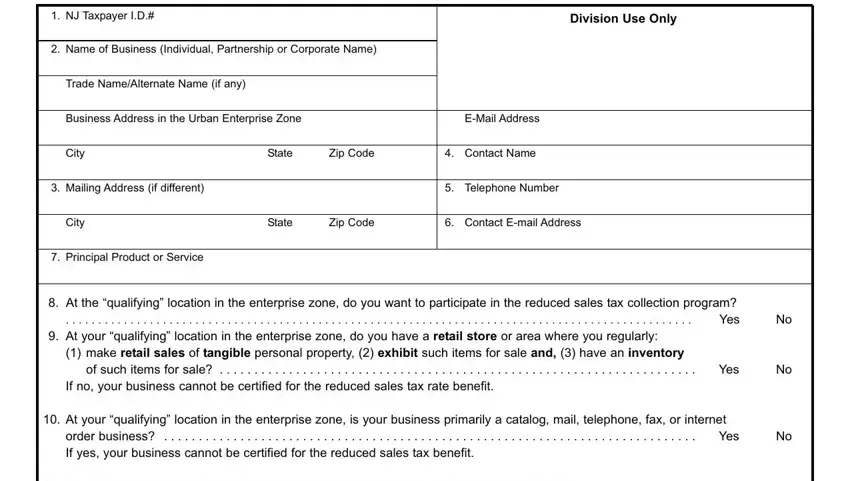

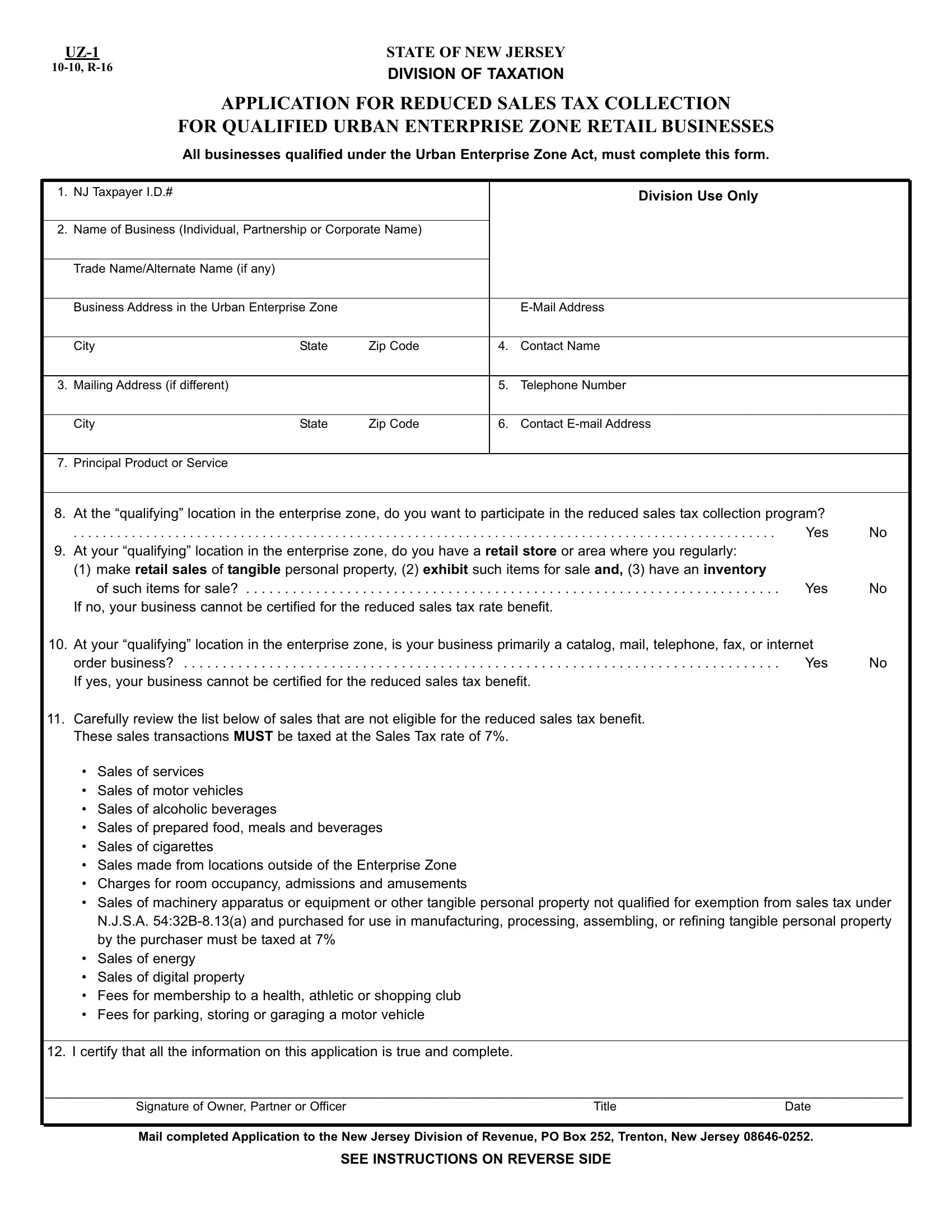

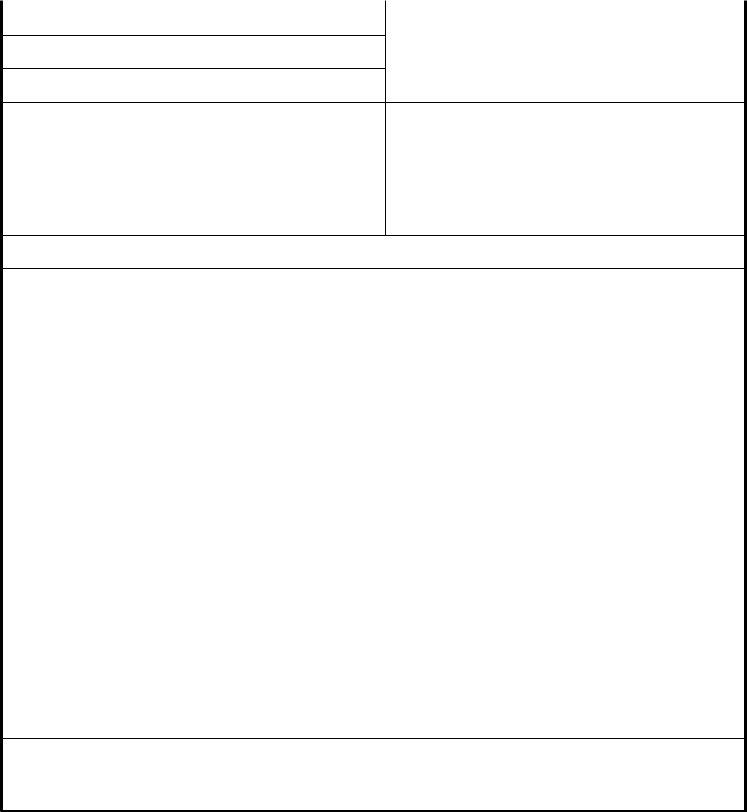

UZ-1 |

STATEOFNEWJERSEY |

10-10,R-16 |

DIVISION OF TAXATION |

|

|

APPLICATIONFORREDUCEDSALESTAXCOLLECTION |

|

FORQUALIFIEDURBANENTERPRISEZONERETAILBUSINESSES |

|

All businesses qualified under the Urban Enterprise Zone Act, must complete this form. |

|

|

1. NJ Taxpayer I.D.# |

Division Use Only |

2.Name of Business (Individual, Partnership or Corporate Name)

Trade Name/Alternate Name (if any)

Business Address in the Urban Enterprise Zone |

|

|

E-Mail Address |

|

|

|

|

|

City |

State |

Zip Code |

4. |

Contact Name |

|

|

|

|

|

3. Mailing Address (if different) |

|

|

5. |

Telephone Number |

|

|

|

|

|

City |

State |

Zip Code |

6. |

Contact E-mail Address |

7.Principal Product or Service

8.At the “qualifying” location in the enterprise zone, do you want to participate in the reduced sales tax collection program?

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

Yes |

No |

9. |

At your “qualifying” location in the enterprise zone, do you have a retail store or area where you regularly: |

|

|

|

(1) make retail sales of tangible personal property, (2) exhibit such items for sale and, (3) have an inventory |

|

|

|

of such items for sale? |

Yes |

No |

|

If no, your business cannot be certified for the reduced sales tax rate benefit. |

|

|

10. |

At your “qualifying” location in the enterprise zone, is your business primarily a catalog, mail, telephone, fax, or internet |

|

|

order business? |

Yes |

No |

|

If yes, your business cannot be certified for the reduced sales tax benefit. |

|

|

11.Carefully review the list below of sales that are not eligible for the reduced sales tax benefit. These sales transactions MUST be taxed at the Sales Tax rate of 7%.

•Sales of services

•Sales of motor vehicles

•Sales of alcoholic beverages

•Sales of prepared food, meals and beverages

•Sales of cigarettes

•Sales made from locations outside of the Enterprise Zone

•Charges for room occupancy, admissions and amusements

•Sales of machinery apparatus or equipment or other tangible personal property not qualified for exemption from sales tax under N.J.S.A. 54:32B-8.13(a) and purchased for use in manufacturing, processing, assembling, or refining tangible personal property by the purchaser must be taxed at 7%

•Sales of energy

•Sales of digital property

•Fees for membership to a health, athletic or shopping club

•Fees for parking, storing or garaging a motor vehicle

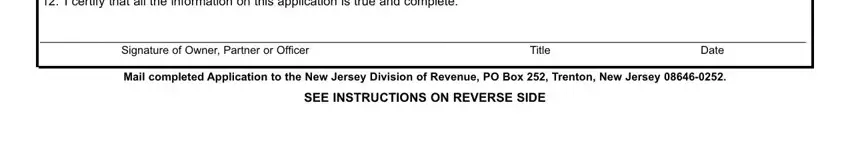

12.I certify that all the information on this application is true and complete.

____________________________________________________________________________________________________________________________

Signature of Owner, Partner or Officer |

Title |

Date |

Mail completed Application to the New Jersey Division of Revenue, PO Box 252, Trenton, New Jersey 08646-0252.

SEE INSTRUCTIONS ON REVERSE SIDE

UZ-1Instructions (10-10)

PLEASE READ THESE INSTRUCTIONS CAREFULLYBEFORE COMPLETING THIS FORM. PRINT OR TYPE ALLINFORMATION.

FAILURE TO PROPERLYCOMPLETE THE ENTIRE APPLICATION MAYHINDER YOUR QUALIFICATION FOR THIS SALES TAX BENEFIT.

INSTRUCTIONS

Application For Reduced Sales Tax Collection

for Qualified Urban Enterprise Zone Retail Businesses

GeneralInstructions

Before applying for a reduced rate collection certification from the Division of Taxation, your business must be designated as a “qualified business” with the New Jersey Department of Community Affairs. The purpose of this application is to determine whether or not your business qualifies for and would benefit from collecting New Jersey Sales Tax at the reduced rate as provided under the New Jersey Urban Enterprise Zones Act (N.J.S.A. 52:27H-60 , et seq)

The reduced rate of sales tax applies only with respect to retail sales of tangible personal property made within the zone. The sale categories listed in Item 9, on the front of this application do not qualify for reduced rate collections.

If your zone business is certified for reduced rate collection you will be required to report and remit the tax collected on a monthly basis. All sales made from your zone business location must be accounted for according to the rate of tax which applies to those sales, 7% or 3.5% respectively. In addition, a Combined State Sales and Use Tax/Urban Enterprise Zones Sales Tax Monthly Return (UZ-50) must be filed for each zone location. Certified sellers cannot file the Standard Sales and Use Tax Returns (ST-50/51) or on a Consolidated Return.

The following instructions refer to the numbered entry items on the application. If you should have any questions concerning this application or instructions contact the Division of Revenue at 609-984-6150.

SpecificInstructions

ITEM 1 Enter the NJ Taxpayer ID# your business received when you registered your business for state tax purposes, with the Client Registration Branch (NJ Division of Revenue). This must be the ID# used for state tax filings for the exact location completing this application. Sole proprietors who do not have a NJ Taxpayer ID# may provide their social security numbers with the three digit suffix as provided by the Division of Revenue.

ITEM 2 Enter the name of the business, and trade/alternative name, if any, as registered with the Division of Taxation and the address where the business is located within the zone. Also provide the e-mail address of the business. If you are an Inc., LLC, LLP, or LP, the trade/alternative name, if different from the business name, must be registered with Commercial Recording. Sole proprietors and general partnerships are not required to register their trade/alternative names on a state level, but may be required to register them on a County and local level.

ITEM 3 Enter the mailing address, if different from the business location, in which correspondence is to be sent.

ITEM 4 Enter the name of a person knowledgeable about the business and available to contact.

ITEM 5 Enter the business location’s telephone number where the person entered in item 4 can be reached.

ITEM 6 Enter an e-mail address for the contact person.

ITEM 7 Enter the principal product your business sells or the principal service your business provides.

ITEM 8 If you do not want to participate in the reduced sales tax collection program answer no and sign box 12. You will then be

expected to collect the 7% sales tax rate. If you answer yes, please continue to complete items 9 through 12.

ITEM 9 You should answer “no”, for example, if you sell only meals, sandwiches or other prepared foods or beverages, services, energy, rooms or admissions, or if you sell only for resale. (Note: If you answer incorrectly and, after receiving your UZ-2 certificate, you collect only 3.5% sales tax, you will be liable for the other 3.5% sales tax plus penalties and interest.).

ITEM 10 Answer “yes” if more than 50% of gross receipts from all retail sales from the “qualified business” location in the enterprise zone are transacted by mail, telephone or electronically, without the customer coming to the location in the zone to pick up the order. (Note: Items ordered by mail, telephone, etc., and delivered without the customer coming to your “zone” location are ineligible for reduced sales tax.)

ITEM 11 If a “qualified business” is predominantly engaged in sales transactions that are ineligible for reduced sales tax (or that are not subject to sales tax), you may not want the reduced sales tax certificate. The separate accounting and monthly filing requirements may not warrant your participation as a reduced rate seller. If you do not wish to participate, answer “no” to question 7. Your business will be qualified for all the other benefits of the program.

ITEM 12 The application must be signed by the owner if a sole proprietorship, by a partner if a partnership, or in the case of a corporation, by a duly authorized officer.