In navigating the complexities of value-added tax (VAT) compliance, the VAT R6 form stands out as a critical document for lump sum contractors. Specifically tailored to meet the requirements outlined in rule 49(4), this form serves as a comprehensive return for contractors who have opted for the lump sum mode of tax payment related to their execution of work contracts. It requires detailed disclosures, ranging from the dealer's identity, encompassing the name, style of business, address, contact information, and Taxpayer Identification Number (TIN), to the economic activity code, effectively painting a full picture of the dealer's operations. Additionally, the form drills down into the specifics of work contracts executed within the period, including the nature of the contracts, the contractees’ details, the total value, and the computation of the lump sum payable. Not stopping there, it extends to the detailing of tax deducted at source by contractees, tax payable, and a meticulous account of tax deposited. The form also seeks information on the purchase value of goods both within and across state lines, the import of goods into the state, and a record of statutory declarations and certificates received, thereby encapsulating a broad spectrum of activities that affect the lump sum contractor’s tax liabilities. Moreover, it mandates the declaration of authenticity and completeness by the authorized person, underscoring the legal responsibility to ensure accuracy in the submission. Such exhaustive requirements highlight the diligence expected from contractors in maintaining their tax compliance through the VAT R6 form, reflecting both its significance in the tax framework and its role in facilitating the transparent and fair execution of tax obligations.

| Question | Answer |

|---|---|

| Form Name | Form Vat R6 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Karta, r6 form, LP-5, VAT38 |

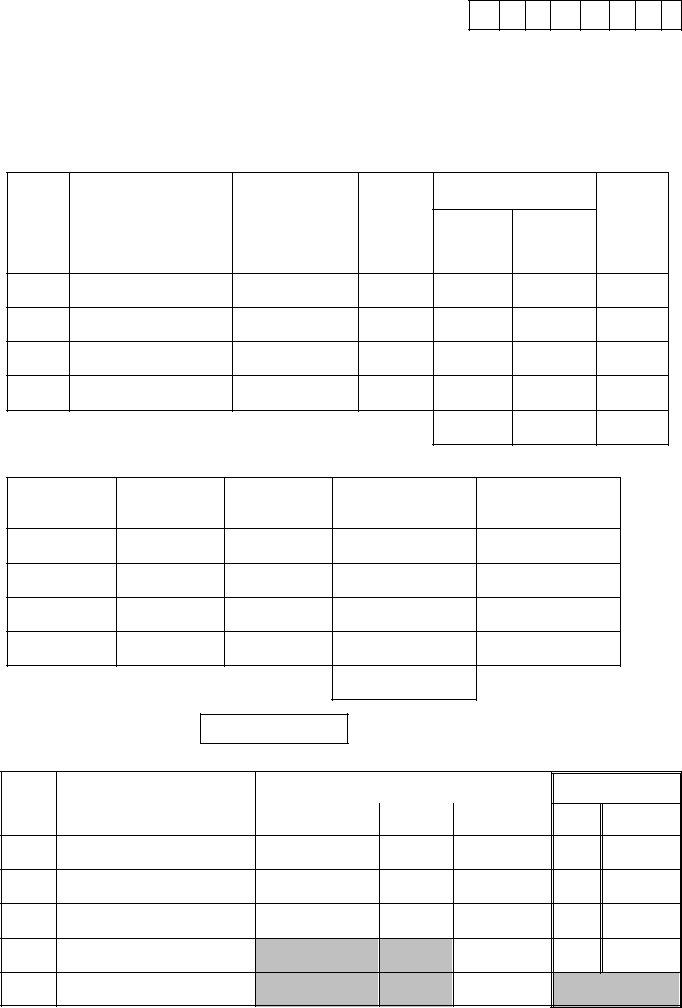

Form VAT – R6 [See rule 49(4)]

Form of return to be furnished by a Lump Sum Contractor

D D M M Y Y

Original/Duplicate copy of return for the quarter ended on:

1.Dealer’s identity

Name and style of business |

M/S |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact No. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T I N |

0 |

6 |

|

|

|

|

|

|

|

|

|

|

Economic Activity Code |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Details of execution of works contract and computation of lump sum payable

Serial

Number

(a)

Number, date and name, if any, and nature of works contract under execution during the period

(b)

Name and

complete address

of the contractee(s)

(c)

Total value of works contract

(d)

Amount receivable

During the Progressive return

period

(e)(f)

Lump sum payable

@____

of (e)

(g)

TOTAL

3. Details of tax deducted at source by the contractee(s) in respect of contracts in (2) above

Name of the contractee

(a)

Treasury receipt No.

(b)

Date

(c)

Amount

(d)

Name of Treasury

(e)

TOTAL

4.Tax payable [2(g) – 3(d)]

5.Details of tax deposited

Rs.

Serial

No.

Name of treasury where tax deposited or

Bank on which DD / Pay order drawn or Office from where RAO issued etc.

Treasury receipt (TR) / DD / PO / RAO

Type of |

No. |

Date |

Amount |

|

Instrument |

||||

|

|

|

||

|

|

|

|

For office use

DCR |

Date |

|

No. |

||

|

Excess paid brought forward from last return

Total

Date : |

[Signature of Authorised Person] |

6.Value of goods purchased in the State from VAT dealers

7.Value of goods purchased in the course of interstate trade

Part A and Part B of

List

8. |

Value of goods imported into the State. |

|

List |

|

|

|

|

9.Account of forms printed under the Government authority/ required to be authenticated by the assessing authority

Serial |

Type of |

Opening stock at the |

Blank forms received or |

Number of forms used |

Aggregate of amount of |

|

beginning of the return |

authenticated during the |

during the return |

transactions for which forms |

|||

No. |

Form |

|||||

period |

return period |

period |

used |

|||

|

|

|||||

|

|

|

|

|

|

|

(1) |

ST- |

|

|

|

|

|

38(In) |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

(2) |

VAT - D3 |

|

|

|

|

|

(In) |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

(3) |

VAT - D1 |

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

VAT |

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

C |

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

F |

|

|

|

|

|

|

|

|

|

|

|

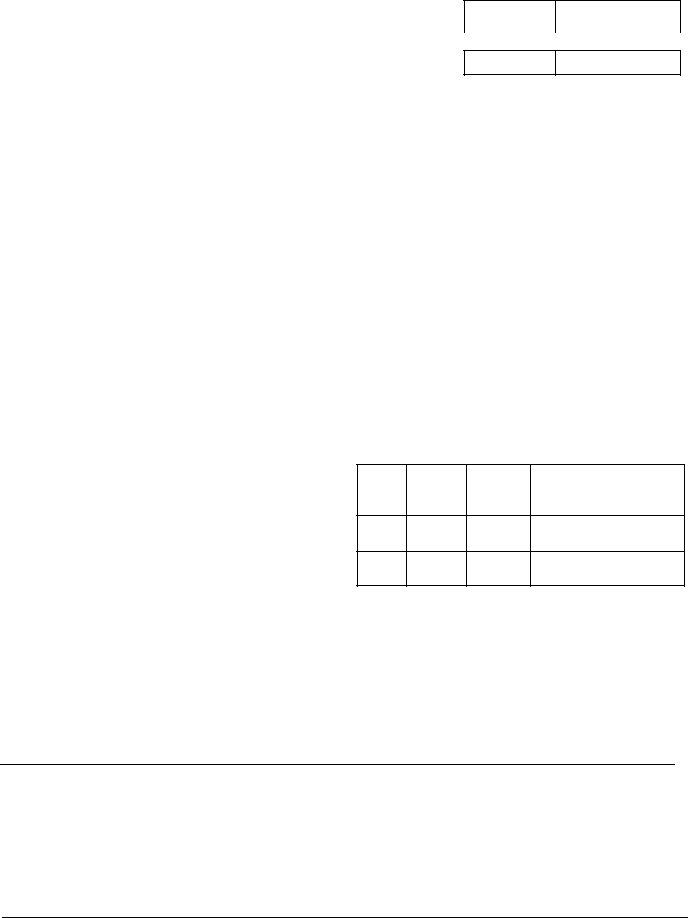

10.Statutory declarations and certificates received from other dealers furnished with the return

Serial |

Type of |

No. of |

Aggregate of amount of |

|

forms |

transactions for which |

|||

No. |

form |

|||

furnished |

forms furnished |

|||

|

|

|||

|

|

|

|

|

(1) |

VAT- |

|

|

|

|

38(out) |

|

|

|

|

|

|

|

|

(2) |

VAT- |

|

|

|

|

|

|

|

Serial |

Type of |

No. of |

Aggregate of amount of |

|

forms |

transactions for which forms |

|||

No. |

form |

|||

furnished |

furnished |

|||

|

|

(3)C

(4)D

Declaration

I, _________________________________ (name in CAPITALS), hereby, solemnly affirm that I am authorised

to furnish this return and all its contents including tables, lists, statements, declarations, certificates & other documents appended to it or filed with it are true, correct and complete and nothing has been concealed therein.

Place:

Date:[Signature]

Status: Tick (a) applicable [Karta, proprietor, partner, director, president, secretary, manager, authorised officer]

(For use in the office of the assessing authority)

(1)Date of data entry in

(2)Signature of the official making the data entry: (Affix stamp of name and designation)

(3)Signature of the assessing authority with date: (Affix stamp of name and designation)

Acknowledgement

The undersigned acknowledges having received the original of this return on the date mentioned below:

(1) Date of receipt of return: |

(2) [Signature with stamp of name and designation of receipt clerk] |

|

|