With the help of the online PDF tool by FormsPal, it is possible to complete or modify NCAS right here and now. The tool is constantly updated by our staff, receiving additional functions and growing to be a lot more versatile. It merely requires a couple of easy steps:

Step 1: Access the PDF file inside our editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: The tool grants the opportunity to work with the majority of PDF files in various ways. Transform it with customized text, adjust what's originally in the PDF, and include a signature - all possible within a few minutes!

This PDF requires particular info to be entered, thus make sure to take some time to provide precisely what is expected:

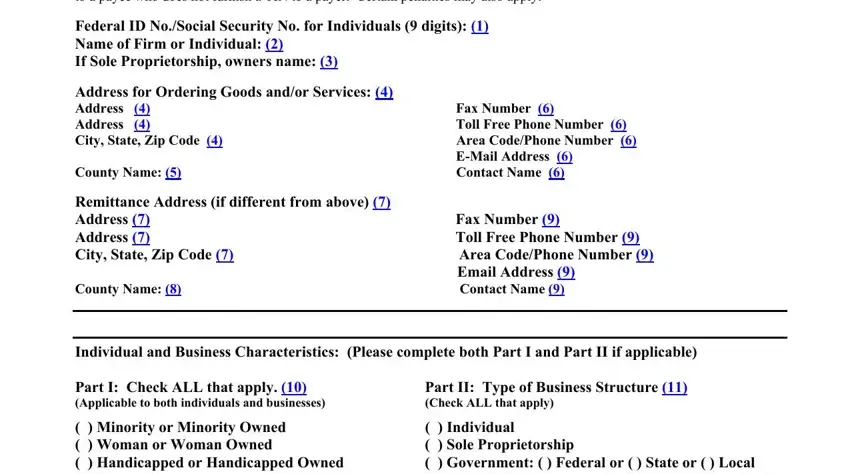

1. The NCAS will require specific information to be entered. Ensure that the subsequent blank fields are completed:

2. Right after performing the last step, go on to the subsequent stage and enter the essential particulars in all these blank fields - Section of the Internal Revenue, Individual Sole Proprietorship, NotforProfit Corporation, Goods Only, Services Only, Both Goods and Services, VendDP Rev, and Yes.

When it comes to Both Goods and Services and Section of the Internal Revenue, ensure you don't make any errors in this section. These could be the key ones in this page.

Step 3: Make sure the details are correct and click on "Done" to complete the process. After creating afree trial account with us, you'll be able to download NCAS or email it right off. The form will also be easily accessible from your personal account menu with your every change. FormsPal ensures your information confidentiality by having a secure method that never records or distributes any type of private information used. Rest assured knowing your docs are kept protected any time you work with our tools!