Are you a small business owner who is looking to get your company online? If so, you may be wondering how to go about creating a website. While there are many options available, one of the most popular ways to create a website is by using WordPress. In this blog post, we will discuss some of the benefits of using WordPress for your small business website. We will also provide you with some tips on how to get started. So if you are ready to take your business online, keep reading!

| Question | Answer |

|---|---|

| Form Name | Form Vp 1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | printable hawaii vp 1 form, hawaii vp 1g, hawaii vp 1, hawaii tax form vp 1 |

FORM |

STATE OF HAWAII |

GENERAL EXCISE/USE, EMPLOYER’S |

|

(REV. 2012) |

WITHHOLDING, TRANSIENT ACCOMMODATIONS |

|

AND RENTAL MOTOR VEHICLE & |

|

TOUR VEHICLE SURCHARGE |

|

TAX PAYMENT VOUCHER |

|

GENERAL INSTRUCTIONS |

INTERNET FILING

Form

6)Make your check or money order payable in U.S. dollars to the “Hawaii State Tax Collector”. Make sure your name, tax type, filing period, and Hawaii Tax I.D. No. appear on your check or money order. Do not postdate your check. Do not send cash.

PURPOSE OF FORM

Use this form if you are submitting Form

HOW TO COMPLETE FORM

1)Print your name in the space provided.

2)Enter the last 4 digits of your FEIN or SSN in the space provided.

3)Check the appropriate “Tax Type” box.

4)Check the appropriate “Filing Type” box and fill in the period or year in the space provided.

If you are filing a Form

5)Print your Hawaii Tax I.D. No. and the amount of your payment in the space provided. If you are applying for a new number, please leave this area blank.

WHERE TO FILE

Detach Form

GENERAL EXCISE/USE TAX

HAWAII DEPARTMENT OF TAXATION

P.O. BOX 1425

HONOLULU, HI

WITHHOLDING TAX

HAWAII DEPARTMENT OF TAXATION

P.O. BOX 3827

HONOLULU, HI

TRANSIENT ACCOMMODATIONS TAX

AND

RENTAL MOTOR VEHICLE & TOUR VEHICLE SURCHARGE TAX

HAWAII DEPARTMENT OF TAXATION

P.O. BOX 2430

HONOLULU, HI

FORMS

HAWAII DEPARTMENT OF TAXATION

P.O. Box 1425

HONOLULU, HI

— — — — |

— — — — — — DETACH HERE — — — — — — — — — |

|

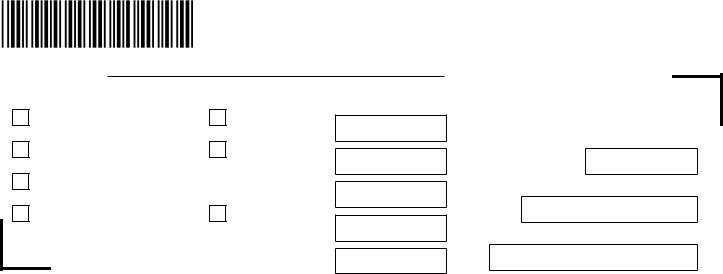

Form (Rev. 2012) |

STATE OF HAWAII — DEPARTMENT OF TAXATION |

DO NOT WRITE OR STAPLE IN THIS SPACE |

|

||

|

||

TAX PAYMENT VOUCHER |

|

|

DO NOT SUBMIT A PHOTOCOPY OF THIS FORM

XBB121

Name (Please print):

Tax Type (check only 1) |

|

Filing Type (check only 1) Enter Date as MM DD YY |

|

|

|

Print the amount of your payment in the space provided. ATTACH THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO “HAWAII STATE TAX COLLECTOR” Write the tax and filing types, and your Hawaii Tax I.D.

General Excise (GE)

Transient Accommodations (TA)

Hawaii Withholding (WH)

Rental Motor & Tour Vehicle (RV)

License Fee 1st Period End Periodic Return Period Begin

Period End

Annual Return

Tax Year Begin

Tax Year End

Number on your check or money order.

Last 4 Digits of Your FEIN or SSN

Hawaii Tax I.D. Number

W

Amount of Payment