virgin island tax return can be filled in online without difficulty. Simply try FormsPal PDF editor to get the job done without delay. To make our tool better and easier to use, we continuously implement new features, taking into consideration suggestions from our users. Starting is simple! Everything you need to do is stick to the next simple steps directly below:

Step 1: Firstly, access the tool by clicking the "Get Form Button" in the top section of this page.

Step 2: With the help of our handy PDF tool, you may do more than merely fill in blank form fields. Express yourself and make your forms appear perfect with custom text incorporated, or optimize the original content to perfection - all that comes along with the capability to incorporate stunning pictures and sign it off.

It really is an easy task to complete the pdf adhering to our detailed guide! Here is what you want to do:

1. Start completing your virgin island tax return with a group of essential blanks. Get all of the information you need and ensure nothing is neglected!

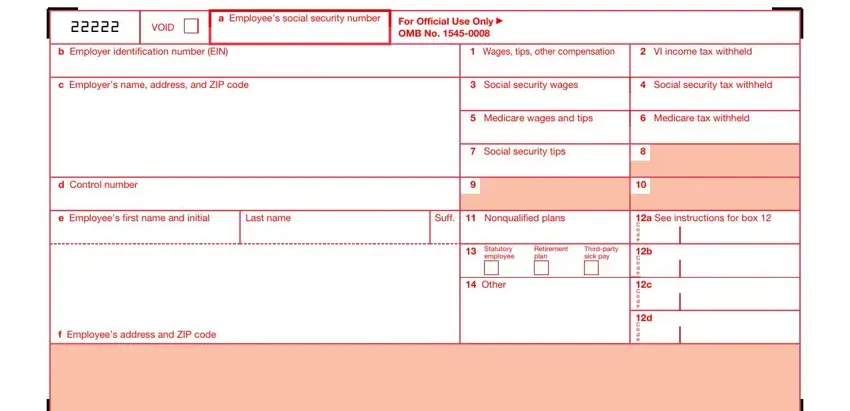

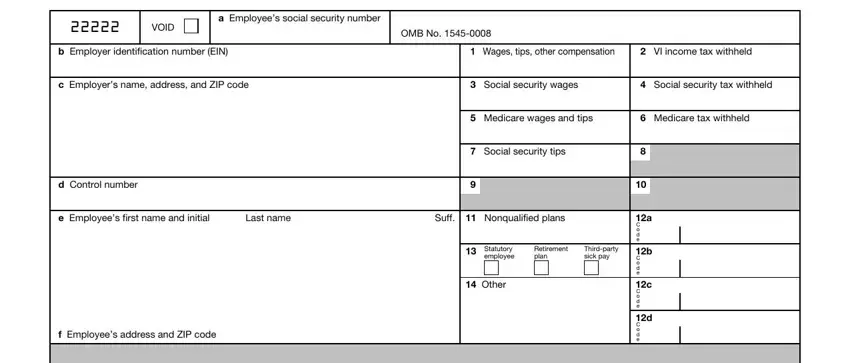

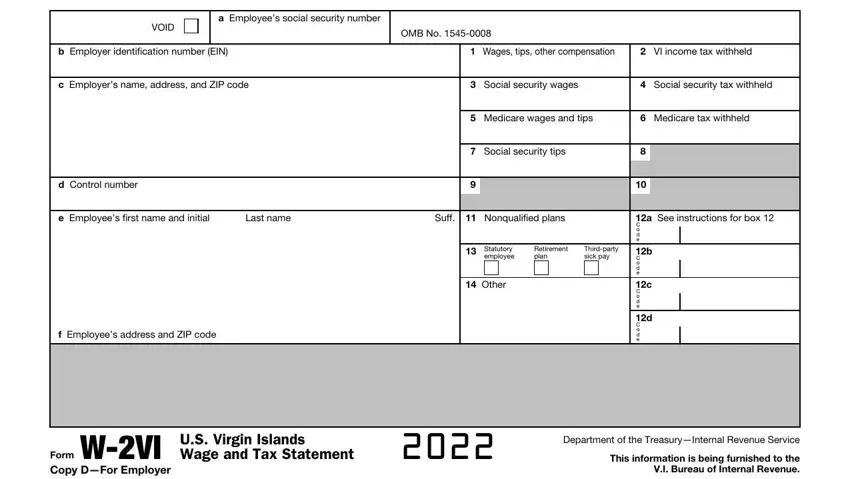

2. Once your current task is complete, take the next step – fill out all of these fields - VOID, a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, VI income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, Medicare wages and tips, Medicare tax withheld, d Control number, Social security tips, e Employees first name and initial, and Last name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

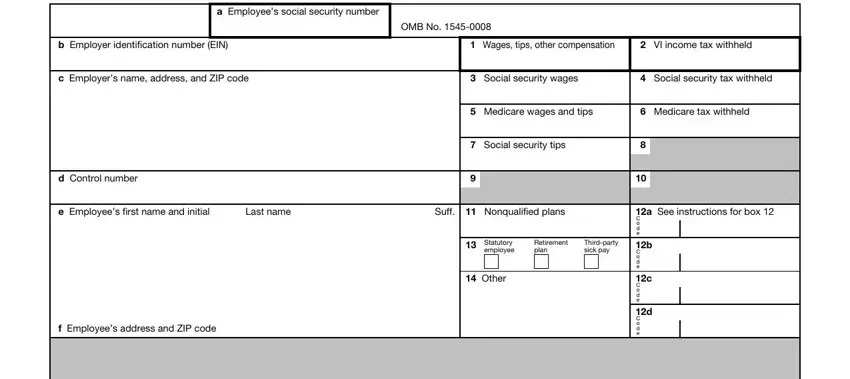

3. Within this step, review a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, VI income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, Last name, and Suff. All of these will need to be completed with highest accuracy.

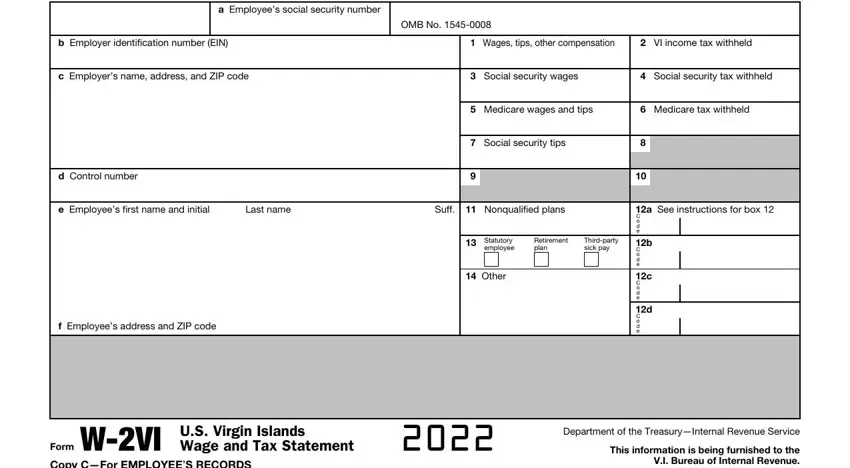

4. Completing a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, VI income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, Last name, and Suff is vital in the fourth stage - be certain to take your time and fill out each and every blank area!

5. To finish your document, this particular area includes a few extra blanks. Filling in VOID, a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, VI income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, and Last name will conclude the process and you can be done quickly!

Always be really attentive when filling out a Employees social security number and Wages tips other compensation, since this is the part where most users make a few mistakes.

Step 3: Be certain that your details are accurate and click on "Done" to complete the project. After creating afree trial account here, you'll be able to download virgin island tax return or send it via email at once. The document will also be available from your personal account page with your every edit. We do not share any details that you provide whenever filling out forms at our website.