With the online tool for PDF editing by FormsPal, it is possible to fill in or alter Form Wi Z right here. To make our editor better and easier to utilize, we constantly develop new features, taking into consideration feedback coming from our users. To get the ball rolling, go through these simple steps:

Step 1: Click the orange "Get Form" button above. It will open our tool so that you could begin filling in your form.

Step 2: Using our handy PDF editor, you could do more than just fill in forms. Express yourself and make your forms appear high-quality with customized text put in, or optimize the file's original content to perfection - all that backed up by the capability to insert any pictures and sign it off.

Completing this form calls for thoroughness. Ensure all necessary blank fields are completed correctly.

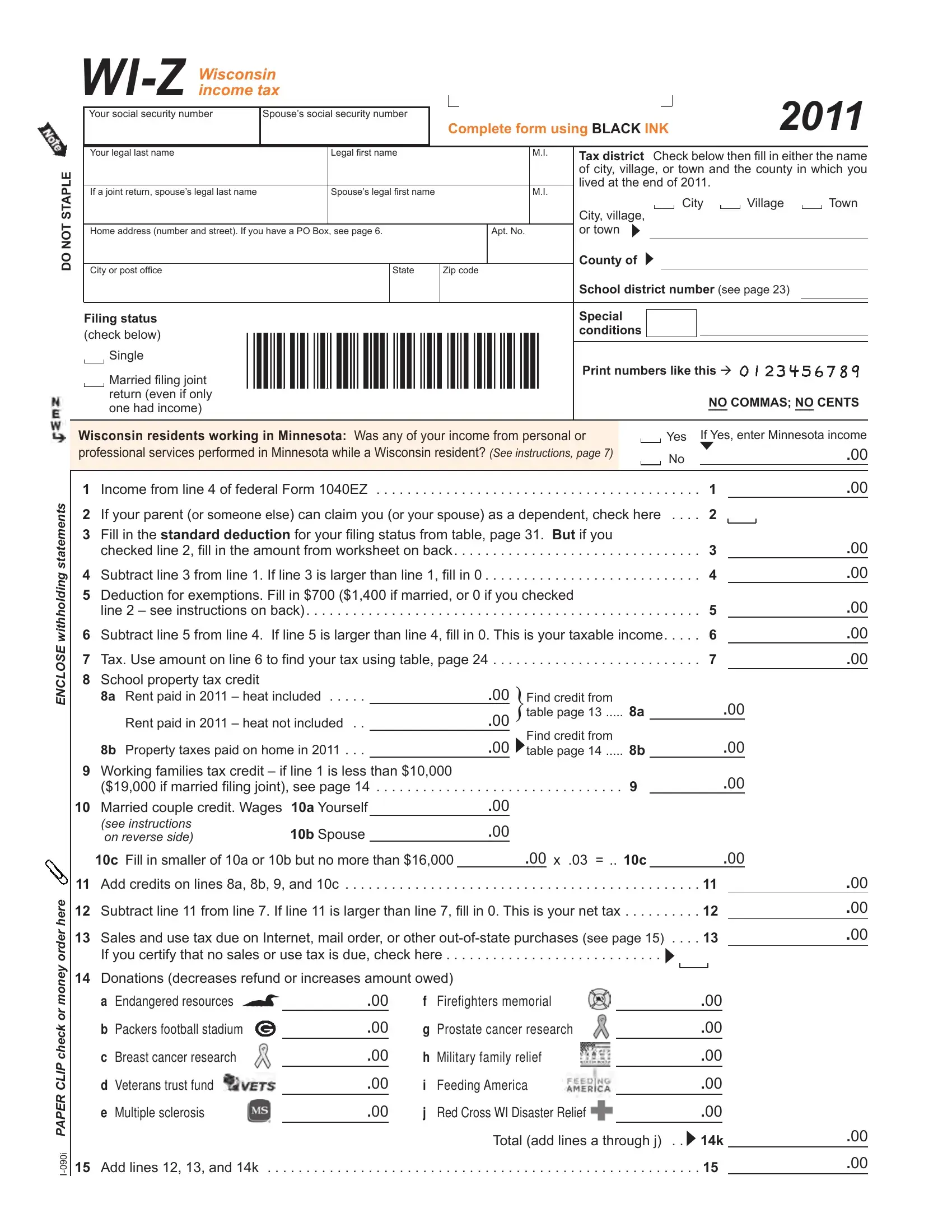

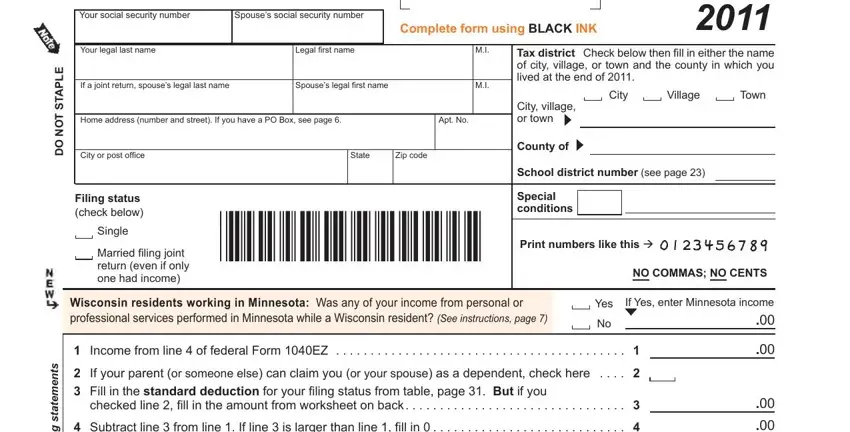

1. When submitting the Form Wi Z, make certain to incorporate all necessary blanks within the relevant part. This will help to hasten the process, allowing for your information to be processed fast and appropriately.

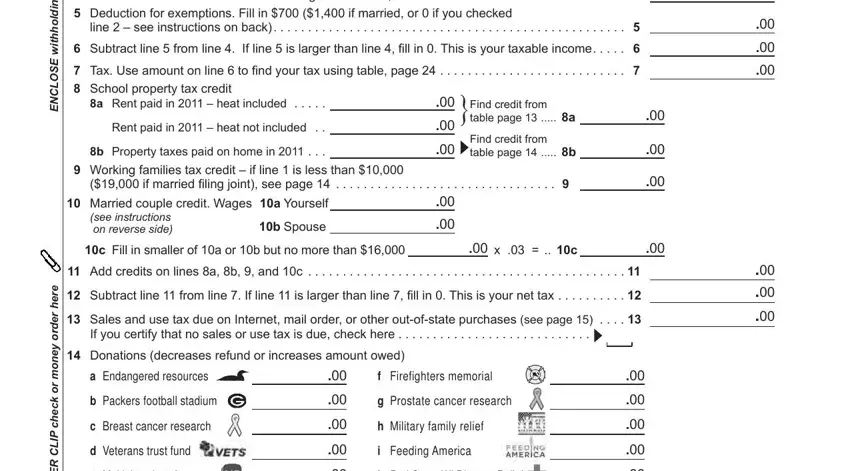

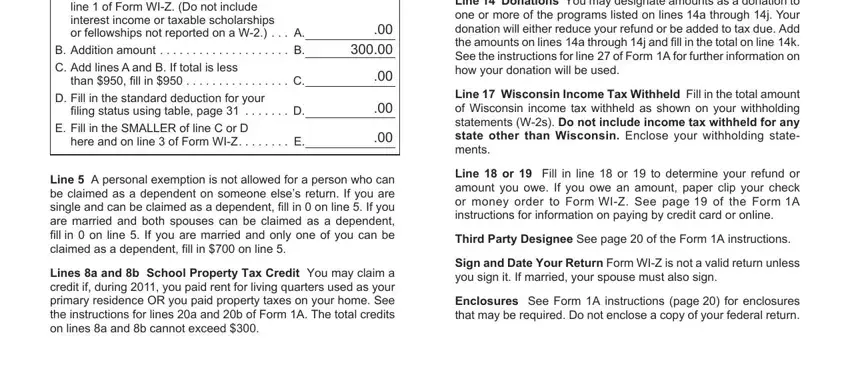

2. Once your current task is complete, take the next step – fill out all of these fields - s t n e m e t a t s g n d o h h t i, w E S O L C N E, e r e h r e d r o y e n o m, r o k c e h c P L C R E P A P, If your parent or someone else, a Rent paid in heat included, Find credit from table page a, Find credit from table page b, if married iling joint see page, Rent paid in heat not included, b Property taxes paid on home in, Working families tax credit if, see instructions on reverse side c, b Spouse, and Add credits on lines a b and c with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really mindful while filling in If your parent or someone else and a Rent paid in heat included, as this is where many people make errors.

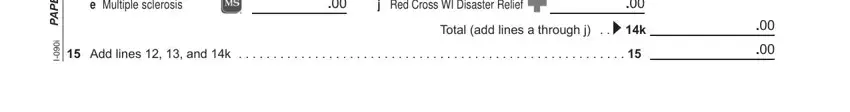

3. Completing r o k c e h c P L C R E P A P, e Multiple sclerosis, j Red Cross WI Disaster Relief, and Total add lines a through j k is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

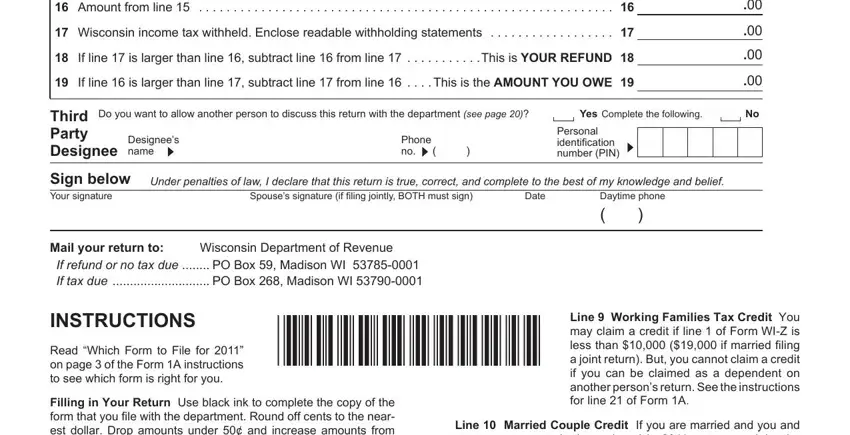

4. This next section requires some additional information. Ensure you complete all the necessary fields - Amount from line, Wisconsin income tax withheld, If line is larger than line, If line is larger than line, Do you want to allow another, Yes Complete the following, Third Party Designee, Designees name, Phone no, Personal identiication number PIN, Sign below Under penalties of law, Spouses signature if iling jointly, Date, Daytime phone, and Mail your return to If refund or - to proceed further in your process!

5. While you draw near to the last parts of the form, there are just a few more things to do. Mainly, A Wages salaries and tips included, than ill in C, iling status using table page, Line A personal exemption is not, Lines a and b School Property Tax, Line Donations You may designate, Line Wisconsin Income Tax, Line or Fill in line or to, Third Party Designee See page of, Sign and Date Your Return Form WIZ, and Enclosures See Form A instructions must be filled in.

Step 3: Right after proofreading your filled out blanks, press "Done" and you are done and dusted! Right after creating afree trial account here, you'll be able to download Form Wi Z or email it right away. The document will also be accessible via your personal cabinet with your every change. When you work with FormsPal, you can fill out forms without needing to worry about data leaks or entries getting shared. Our secure software helps to ensure that your personal data is maintained safe.