1099R can be filled in online without any problem. Simply make use of FormsPal PDF editor to complete the job in a timely fashion. FormsPal development team is always working to expand the editor and insure that it is much easier for clients with its many functions. Uncover an endlessly innovative experience now - explore and discover new opportunities along the way! With just several easy steps, you are able to begin your PDF editing:

Step 1: Just click on the "Get Form Button" above on this page to launch our form editor. This way, you will find everything that is needed to work with your file.

Step 2: When you start the tool, you'll notice the form made ready to be filled out. In addition to filling in various fields, you can also do other actions with the file, namely putting on any words, modifying the original text, inserting graphics, putting your signature on the document, and more.

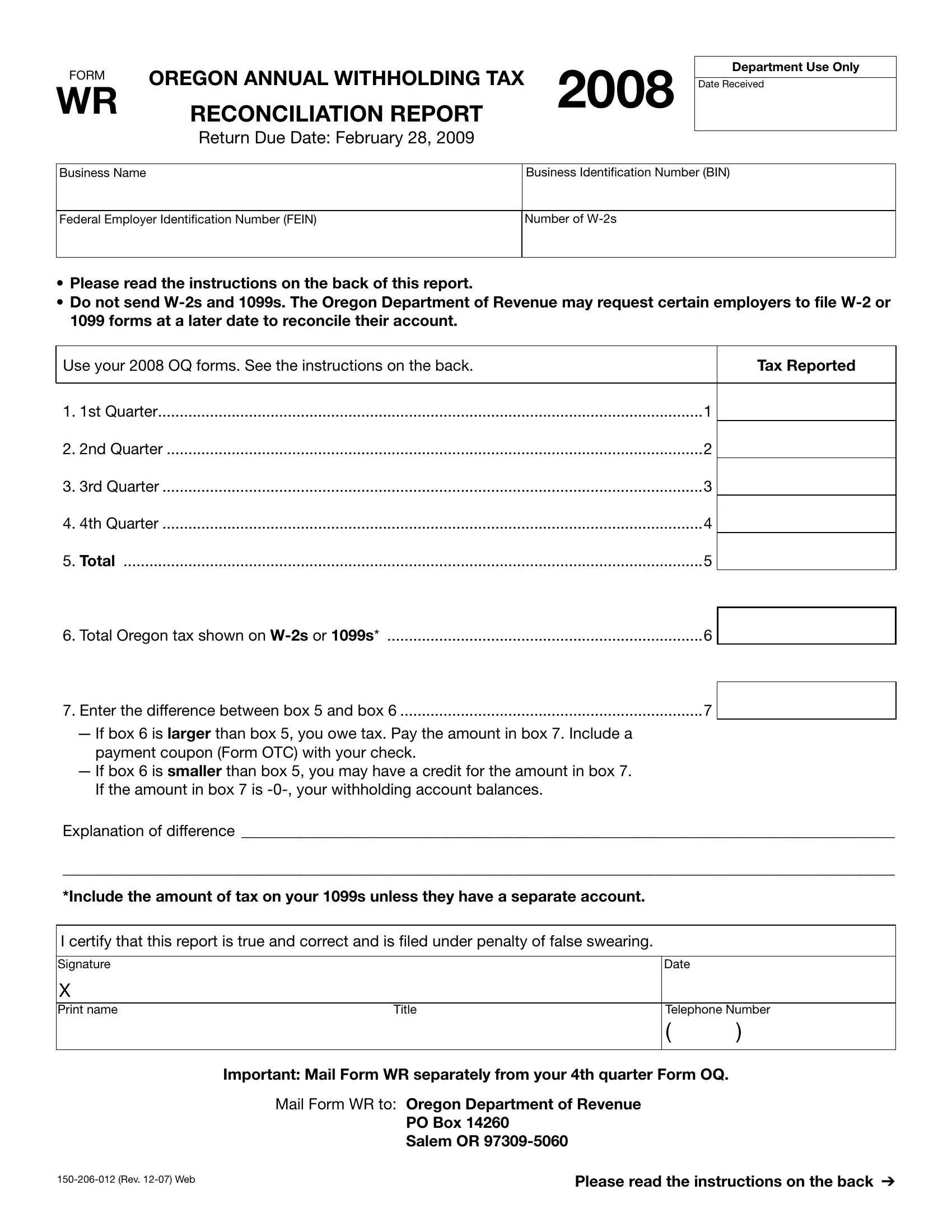

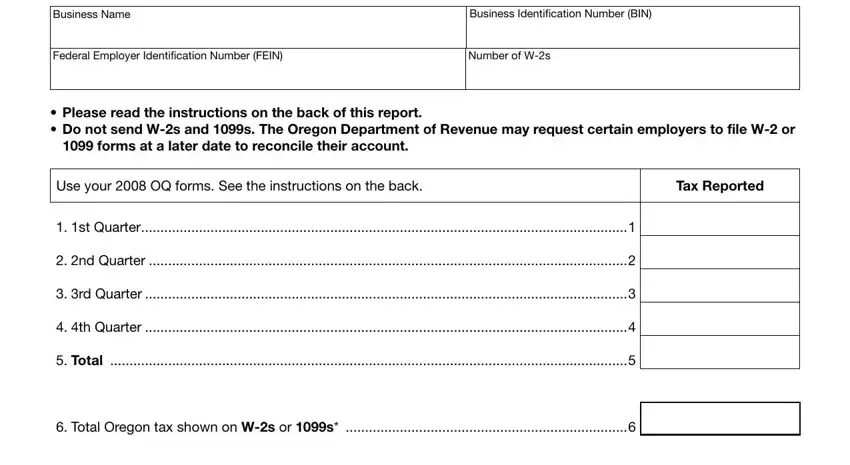

For you to complete this form, be sure you provide the necessary information in each and every field:

1. Whenever filling out the 1099R, be certain to incorporate all of the needed blanks in the corresponding section. This will help to speed up the work, allowing for your details to be handled promptly and correctly.

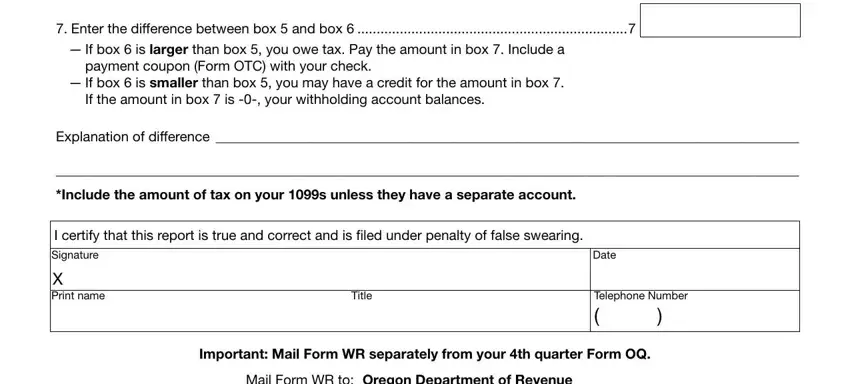

2. Just after the previous part is completed, proceed to enter the applicable details in all these: Enter the difference between box, If box is larger than box you, payment coupon Form OTC with your, If box is smaller than box you, If the amount in box is your, Explanation of difference, Include the amount of tax on your, I certify that this report is true, Signature, X Print name, Title, Date, Telephone Number, Important Mail Form WR separately, and Mail Form WR to Oregon Department.

It's easy to get it wrong when completing your Enter the difference between box, therefore be sure you look again before you decide to finalize the form.

Step 3: Ensure your information is right and click "Done" to conclude the project. Grab the 1099R as soon as you subscribe to a 7-day free trial. Immediately get access to the pdf form within your FormsPal account page, with any modifications and adjustments conveniently synced! We don't share any information you type in whenever filling out forms at our site.