You'll be able to fill out prorated without difficulty using our PDF editor online. FormsPal development team is relentlessly working to improve the editor and help it become much faster for people with its extensive features. Enjoy an ever-evolving experience now! If you're looking to get going, this is what it's going to take:

Step 1: First of all, access the editor by pressing the "Get Form Button" above on this page.

Step 2: As you open the editor, you will see the document made ready to be filled out. In addition to filling out different fields, it's also possible to perform many other things with the file, namely putting on custom textual content, editing the original text, inserting illustrations or photos, affixing your signature to the form, and much more.

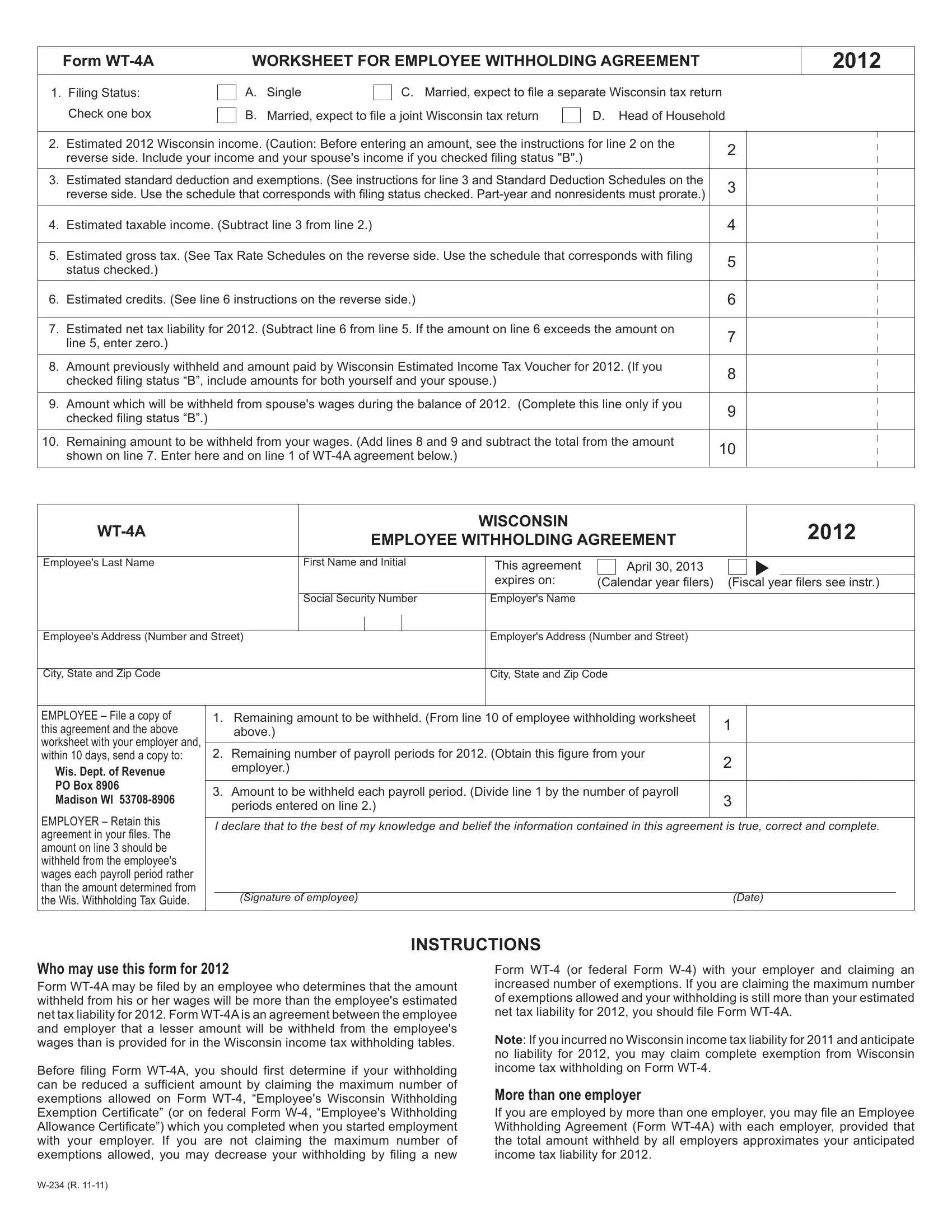

If you want to complete this form, make certain you provide the necessary details in every area:

1. You should complete the prorated correctly, therefore be attentive when working with the parts that contain these blanks:

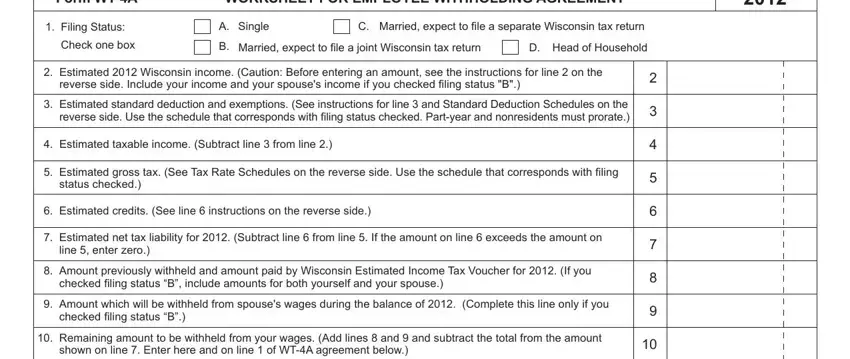

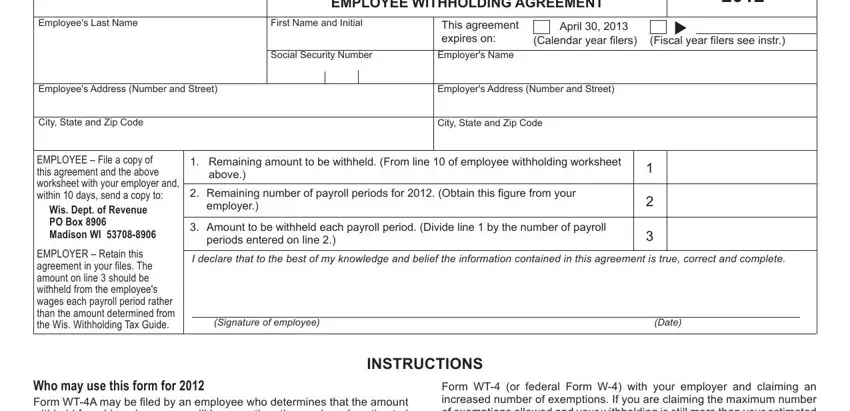

2. When the prior part is done, proceed to enter the applicable information in these: WTA, EMPLOYEE WITHHOLDING AGREEMENT, Employees Last Name, First Name and Initial, Social Security Number, This agreement expires on, Employers Name, April, Calendar year ilers, Fiscal year ilers see instr, Employees Address Number and Street, Employers Address Number and Street, City State and Zip Code, City State and Zip Code, and EMPLOYEE File a copy of this.

It's easy to make an error while filling in the Fiscal year ilers see instr, so make sure that you go through it again before you'll submit it.

Step 3: Soon after taking another look at the entries, press "Done" and you're good to go! Sign up with us right now and immediately get access to prorated, prepared for download. Every edit you make is conveniently saved , letting you modify the form at a later stage as required. Whenever you work with FormsPal, you'll be able to fill out documents without stressing about personal information leaks or data entries getting shared. Our secure system helps to ensure that your personal data is stored safely.