You could fill out wv 2848 without difficulty in our PDF editor online. FormsPal team is focused on providing you with the absolute best experience with our editor by consistently introducing new functions and enhancements. With all of these updates, using our editor becomes easier than ever! With just a couple of simple steps, it is possible to begin your PDF editing:

Step 1: Just click the "Get Form Button" at the top of this site to start up our form editor. Here you will find all that is required to fill out your document.

Step 2: When you access the tool, there'll be the form made ready to be completed. Besides filling out various blank fields, you may also perform some other things with the Document, specifically writing your own textual content, editing the original text, inserting graphics, signing the PDF, and much more.

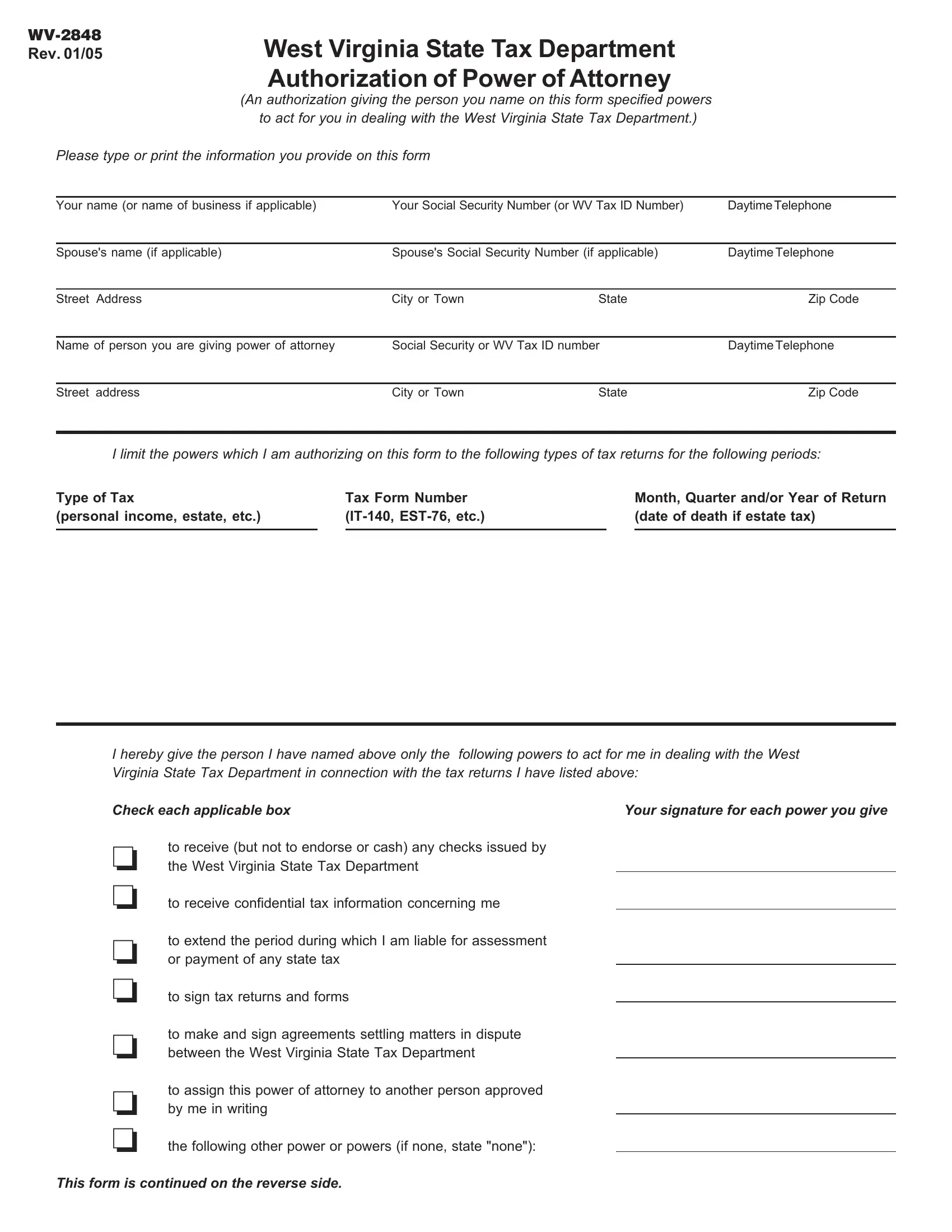

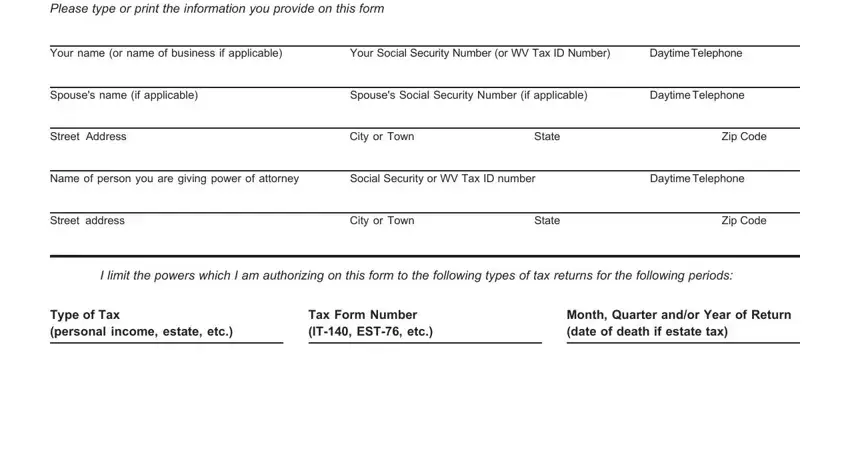

So as to fill out this PDF document, make sure you type in the right information in each field:

1. For starters, when filling in the wv 2848, begin with the section that includes the next blanks:

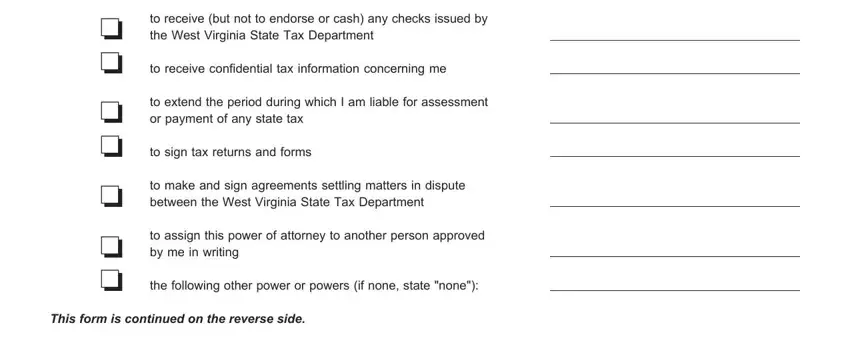

2. Once this array of fields is done, it's time to put in the necessary particulars in to receive but not to endorse or, to receive confidential tax, to extend the period during which, to sign tax returns and forms, to make and sign agreements, to assign this power of attorney, the following other power or, and This form is continued on the so you're able to proceed further.

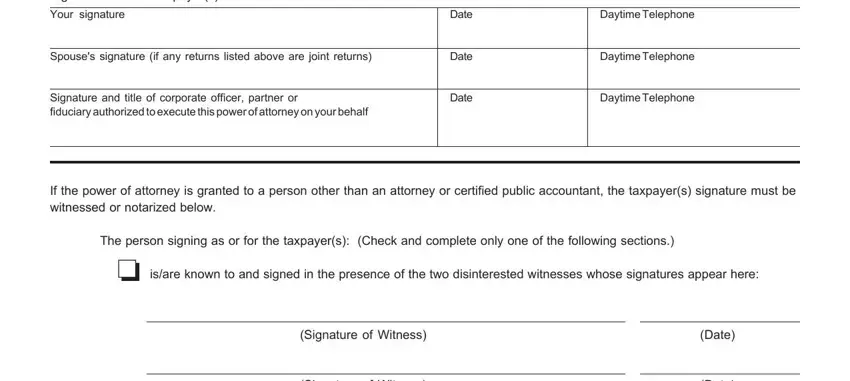

3. Within this step, look at Signature of or for taxpayers, Your signature, Spouses signature if any returns, Signature and title of corporate, Date, Date, Date, Daytime Telephone, Daytime Telephone, Daytime Telephone, If the power of attorney is, The person signing as or for the, isare known to and signed in the, Signature of Witness, and Signature of Witness. All these are required to be taken care of with highest awareness of detail.

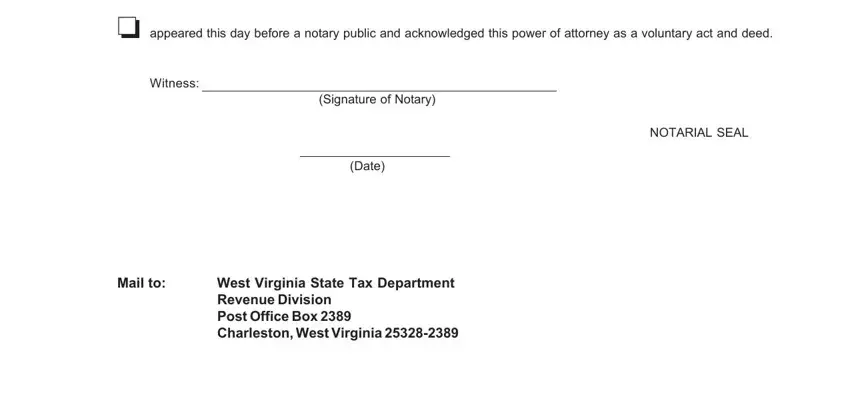

4. To move onward, the next stage requires typing in several blanks. These comprise of appeared this day before a notary, Witness, Signature of Notary, Date, NOTARIAL SEAL, Mail to, and West Virginia State Tax Department, which are integral to carrying on with this process.

As to Signature of Notary and West Virginia State Tax Department, make sure that you double-check them in this section. These could be the most important ones in the form.

Step 3: Make certain the information is correct and then click "Done" to continue further. Create a 7-day free trial account at FormsPal and get immediate access to wv 2848 - downloadable, emailable, and editable in your personal account. When using FormsPal, you can certainly complete documents without worrying about data leaks or records being distributed. Our protected platform ensures that your personal data is maintained safe.