In the realm of tax compliance within West Virginia, the Consumers Sales and Use Tax Application for Direct Pay Permit, known officially as form WV/CST-250, emerges as a pivotal document for businesses seeking the authority to pay consumer sales and use taxes directly to the West Virginia State Tax Department. Crafted to streamline the process, this form mandates comprehensive disclosure, including the legal business name, the principal owner’s details (if sole ownership applies), and extensive contact information. Such requisite data extends to a declaration by the applicant, affirming the entity’s compliance with Chapter 11 of the West Virginia Code tax obligations and the validity of its Business Registration Certificate. Predominantly, eligibility hinges on the entity’s engagement in specific business activities, ranging from manufacturing to the provision of health care services, ensuring a broad spectrum of applicants. The direct pay permit, bestowed upon approval, not only facilitates a direct tax remittance pathway but also imposes a spectrum of duties on the holder, including the maintenance of meticulous records and the prompt notification to vendors regarding the permit status. Furthermore, this document delineates requisites for application validity, the implications of permit approval or denial, and the procedural steps following permit issuance, encasing all necessary guidelines for applicants to navigate the process. As such, form WV/CST-250 stands as a testament to tax regulation intricacy and the proactive measures businesses must undertake to ensure compliance within West Virginia’s tax framework.

| Question | Answer |

|---|---|

| Form Name | Form Wv Cst 250 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | thereon, 20th, wv form cst 250, CST-250 |

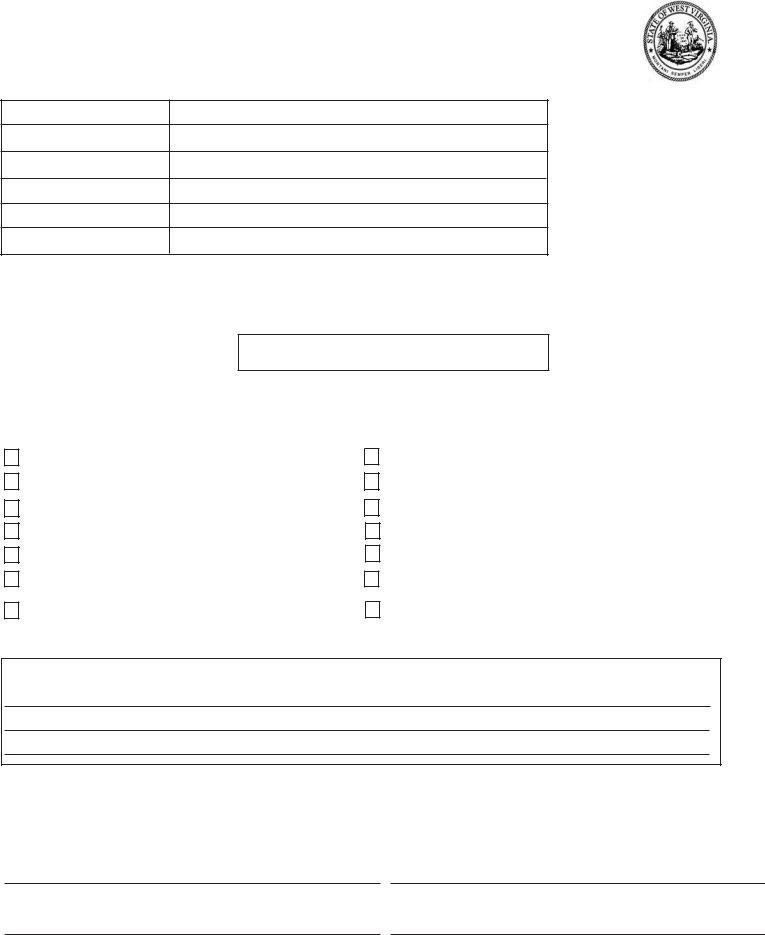

WEST VIRGINIA STATE TAX DEPARTMENT CONSUMERS SALES AND USE TAX APPLICATION FOR DIRECT PAY PERMIT

WESTVIRGINIAACCOUNT

IDENTIFICATIONNUMBER

LEGAL BUSINESS OR

CORPORATENAME

OWNER’SNAME (IF SOLE OWNER)

STREETADDRESS

CITY, STATE, & ZIP CODE

NAMEANDTELEPHONENUMBER

OF CONTACTPERSON

TO BE COMPLETED BY OWNER, PARTNER OR OFFICER OF CORPORATION

I, the undersigned, hereby certify that:

The above business has a valid

Business Registration Certificate #

The above business is not delinquent on the payment of any taxes imposed by Chapter 11 of the West Virginia Code; and This business satisfies one or more of the following conditions (check all applicable boxes):

Engaged in the business of manufacturing

Engaged in the business of producing natural resources

Engaged in the business of communication

Engaged in providing or operating a public utility service

A nationally chartered fraternal or social organization

Engaged in the business of generation, production or selling of electric power

A volunteer fire department organized and incorporated under the laws of West Virginia

Engaged in the business of gas storage

Engaged in the business of transportation

Engaged in the business of transmission

Engaged in the operation of a public utility business

Engaged in the business of research and development

A bona fide charitable organization that makes no charge whatsoever for service rendered

A health care provider purchasing drugs, durable medical goods, mobility enhancing equipment and prosthetic devices that are to be dispensed upon prescription

Give a detailed description of your business activity within West Virginia:

On behalf of the above business, I am hereby applying for a direct pay permit.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

Signature of applicant |

Date |

Name of applicant (please print or type) |

Title (Owner, Partner, Officer of Corporation) |

Telephonenumber |

REV 5/08

The State Tax Commissioner may, in his discretion, authorize a person that is a user, consumer, distributor or lessee to which sales or leases of tangible personal property are made or services provided, to pay consumers sales and/or use tax directly to the West Virginia State Tax Department thereby waiving the collection of the tax by that person’s vendor. (W.Va. Code §

The issuance of a Direct Pay Permit imposes certain requirements on the holder of such permit. These requirements include:

1.Notification of each vendor from whom tangible personal property is purchased or leased or from whom services are purchased of his Direct Pay Permit Number and that any tax thereon will be paid directly to the Tax Commissioner. If the Direct Pay Permit Number is changed by the Tax Commissioner, all vendors must be renotified.

2.Filing a Direct Pay Consumers Sales or Use Tax Return on or before the 20th day of the month for the proceeding month’s or quarter’s transaction. Direct Pay Consumers Sales and Use Tax Returns not filed by the due date will be subject to interest and penalties and the permit may be cancelled.

3.Maintenance of books, records and invoices (including vendor lists) for inspection by the West Virginia State Tax Depart ment.

4.A Direct Pay Permit may not be used to purchase food, gasoline or special fuel.

INSTRUCTIONS FOR APPLICANT

This application is NOT valid unless all entries are completed.

Upon review of the application, the West Virginia State Tax Department will determine whether you are entitled to receive a Direct Pay Permit. Upon approval of your application, a numbered Direct Pay Permit will be mailed to you. Should your application be rejected, you will be notified in writing.

Direct Pay Consumers Sales and Use Tax Returns will be forwarded to you by the Department for remitting tax. If you do not receive a Direct Pay Consumers Sales and Use Tax Return within sixty (60) days after you receive your Direct Pay Permit, you must notify the West Virginia State Tax Department.

A Direct Pay Permit will continue to be valid until it is surrendered by you or cancelled. You will be notified by the State Tax Department of any change in your Direct Pay Permit number.

Upon surrender or cancellation of the Direct Pay Permit, the holder must promptly notify, in writing, the specified vendors from whom tangible personal property is purchased or leased or by whom services are rendered of such surrender or cancellation.

MAIL TO:

WEST VIRGINIASTATE TAX DEPARTMENT INTERNALAUDITINGDIVISION

PO BOX 425

CHARLESTON, WEST VIRGINIA

FOR ASSISTANCE CALL:

(304)

INTERNET ADDRESS

http://www.state.wv.us/taxdiv