form 700 california can be filled out online effortlessly. Just try FormsPal PDF editing tool to complete the job promptly. Our editor is consistently developing to give the very best user experience achievable, and that is thanks to our commitment to continuous enhancement and listening closely to user feedback. If you are looking to start, this is what it will take:

Step 1: Press the orange "Get Form" button above. It's going to open our tool so that you can start completing your form.

Step 2: The editor lets you work with your PDF form in a range of ways. Transform it by writing your own text, correct what is originally in the PDF, and put in a signature - all at your convenience!

It is straightforward to finish the pdf with this helpful tutorial! Here's what you need to do:

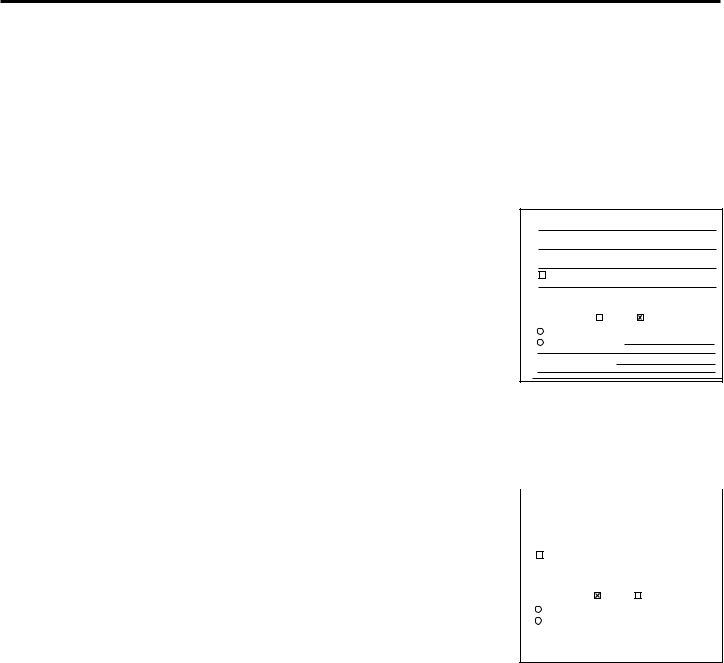

1. First, once filling out the form 700 california, start with the form section that features the next blank fields:

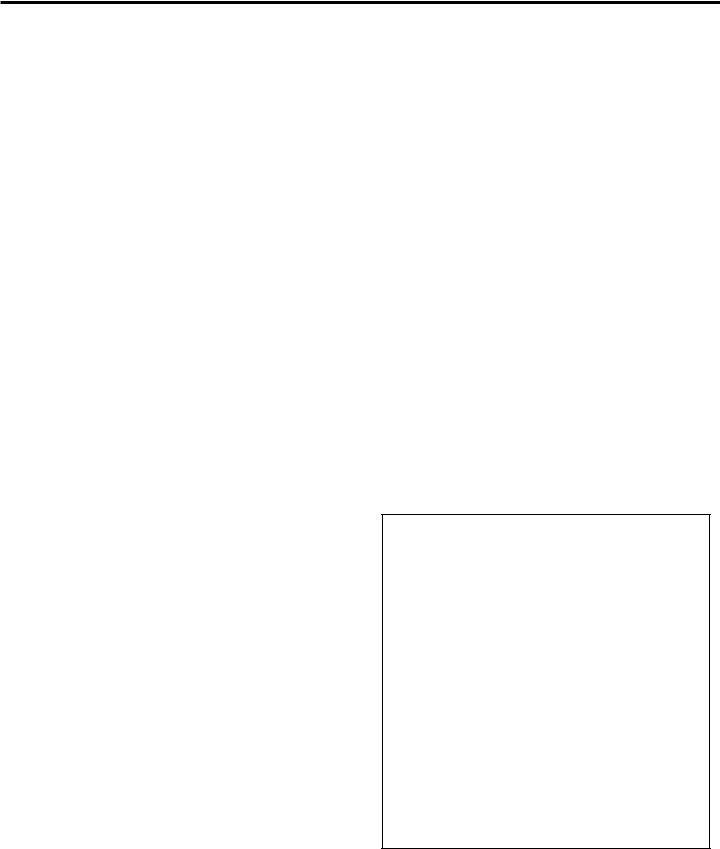

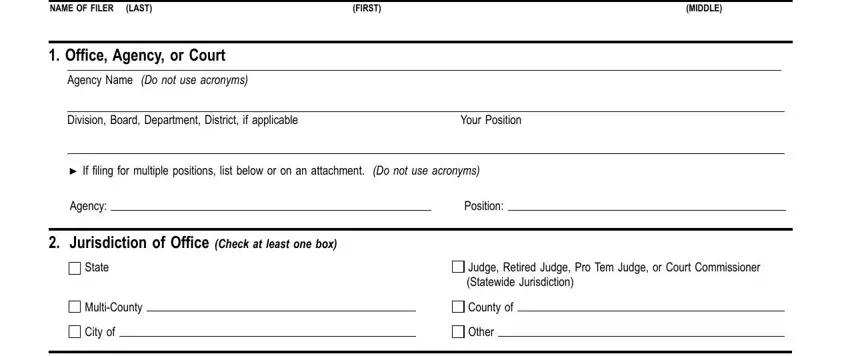

2. Once your current task is complete, take the next step – fill out all of these fields - Type of Statement Check at least, Annual The period covered is, December, The period covered is December, through, Assuming Office Date assumed, Leaving Office Date Left, Check one circle, The period covered is January, The period covered is the date of, through, Candidate Date of Election, and office sought if different, Schedule Summary must complete, and Total number of pages including with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

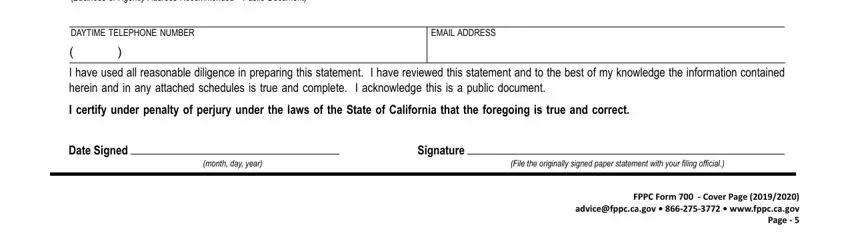

3. This step will be easy - complete all the form fields in MAiLiNg ADDRESS business or Agency, DAYTiME TELEPhONE NuMbER I have, EMAiL ADDRESS, Date Signed, month day year, Signature, File the originally signed paper, and FPPC Form Cover Page to finish this segment.

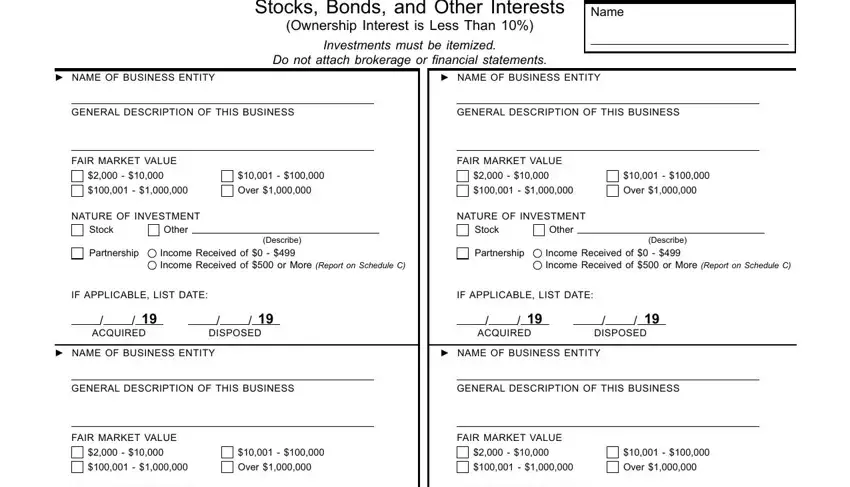

4. Filling out Stocks Bonds and Other Interests, Ownership Interest is Less Than, CALIFORNIA FORM FAIR POLITICAL, Investments must be itemized, Do not attach brokerage or, NAME OF BuSINESS ENTITY, NAME OF BuSINESS ENTITY, GENERAL DESCRIPTION OF THIS, GENERAL DESCRIPTION OF THIS, FAIR MARkET vALuE, NATuRE OF INvESTMENT, Over, FAIR MARkET vALuE, NATuRE OF INvESTMENT, and Over is crucial in this fourth form section - make sure to spend some time and fill in every single empty field!

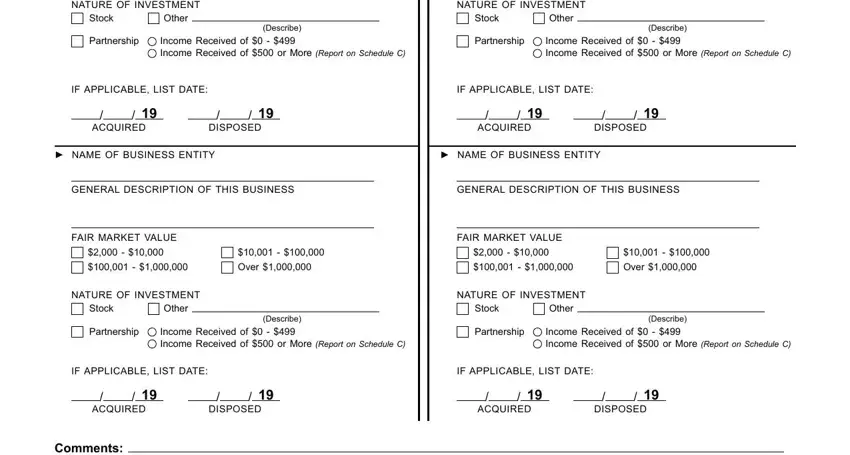

5. The pdf has to be finalized by filling in this segment. Here you will notice a detailed list of fields that need to be filled out with specific details to allow your document submission to be accomplished: NATuRE OF INvESTMENT, NATuRE OF INvESTMENT, Stock, Partnership, Other, Describe Income Received of, Stock, Partnership, Other, Describe Income Received of, IF APPLICABLE LIST DATE, IF APPLICABLE LIST DATE, ACquIRED, DISPOSED, and ACquIRED.

People frequently make errors while filling in Other in this area. Ensure you double-check whatever you type in here.

Step 3: Right after you've reread the information provided, simply click "Done" to finalize your FormsPal process. Go for a 7-day free trial subscription at FormsPal and acquire instant access to form 700 california - downloadable, emailable, and editable from your personal account page. Here at FormsPal.com, we do everything we can to guarantee that all your details are maintained secure.