When buying a home, borrowers often find themselves navigating a sea of paperwork, each document playing a crucial role in the mortgage process. Among these, the Freddie Mac 1106 form stands out as a key piece in the journey towards home ownership. This form is instrumental in detailing the terms of an adjustable-rate mortgage (ARM), offering a clear understanding of the loan's costs, interest rate adjustments, and other critical financial terms. It helps borrowers make informed decisions by providing a comprehensive look at how their interest rates might change over time, ensuring there are no surprises down the road. The Freddie Mac 1106 form, therefore, not only provides peace of mind for prospective homeowners but also adds a layer of transparency and trust between lenders and borrowers. By demystifying the complexities of ARM loans, this document plays an essential role in the home buying process.

| Question | Answer |

|---|---|

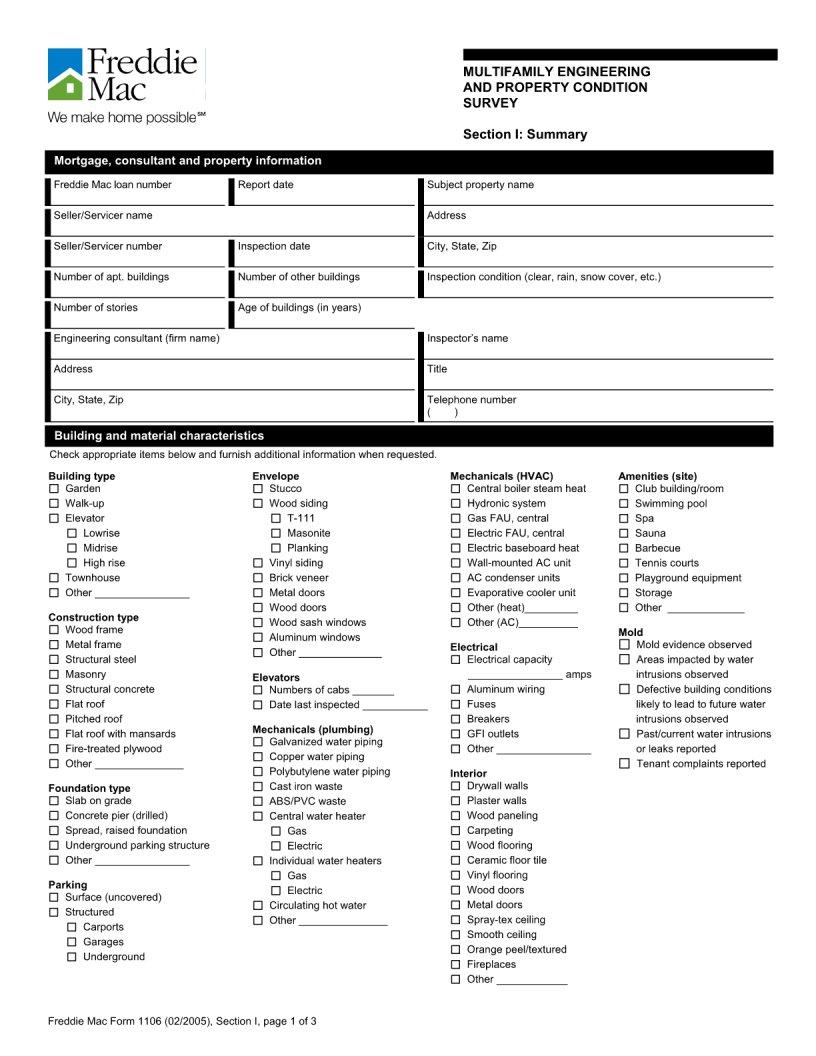

| Form Name | Freddie Mac Form 1106 |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | f1106 freddie mac form 1106 |