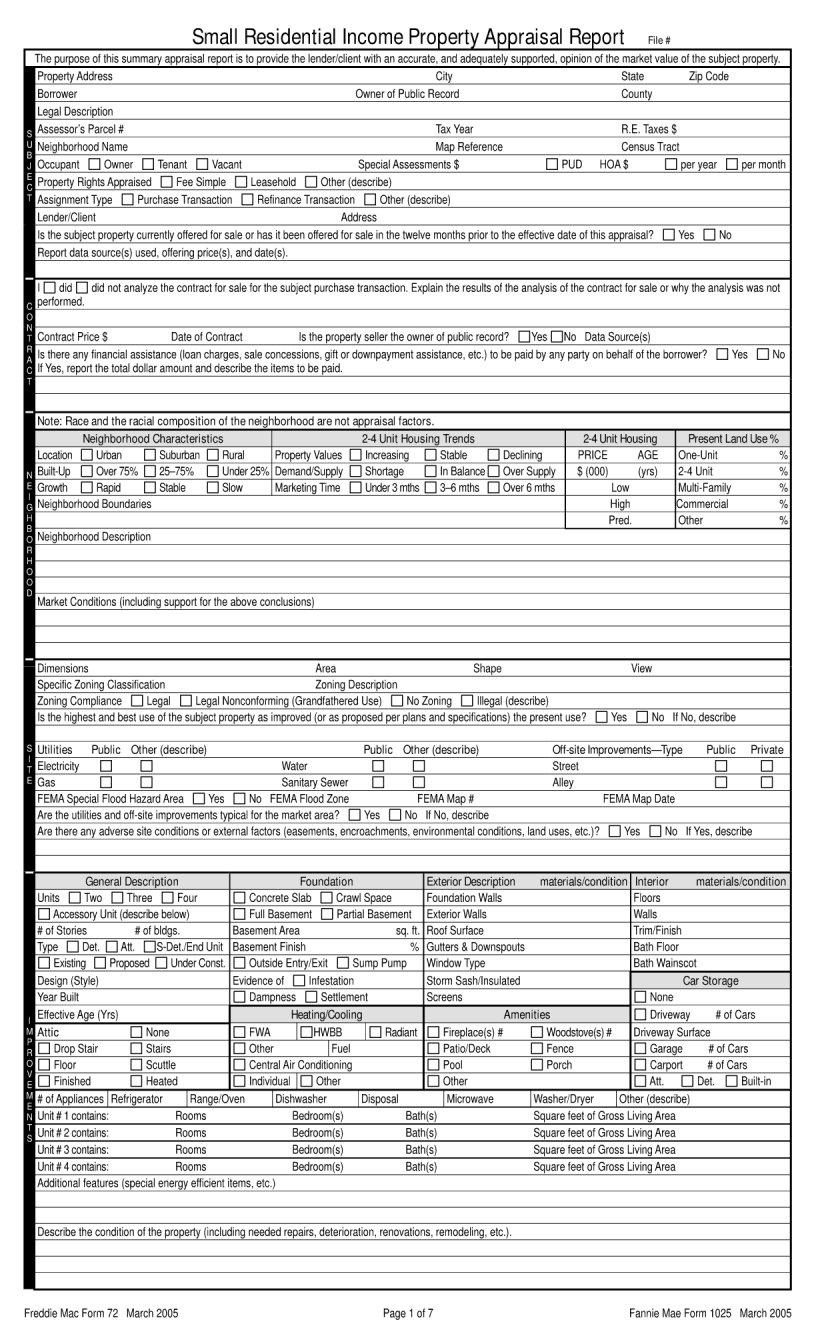

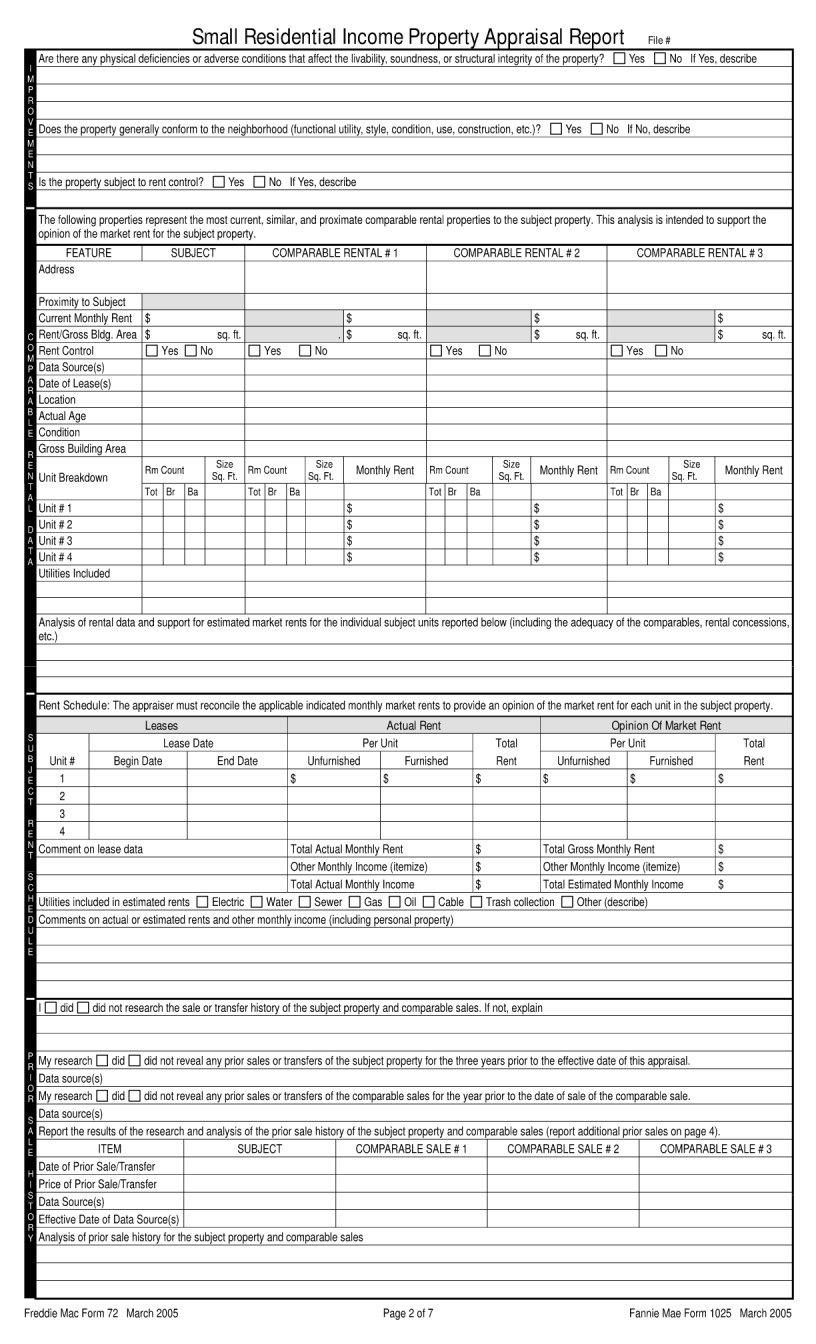

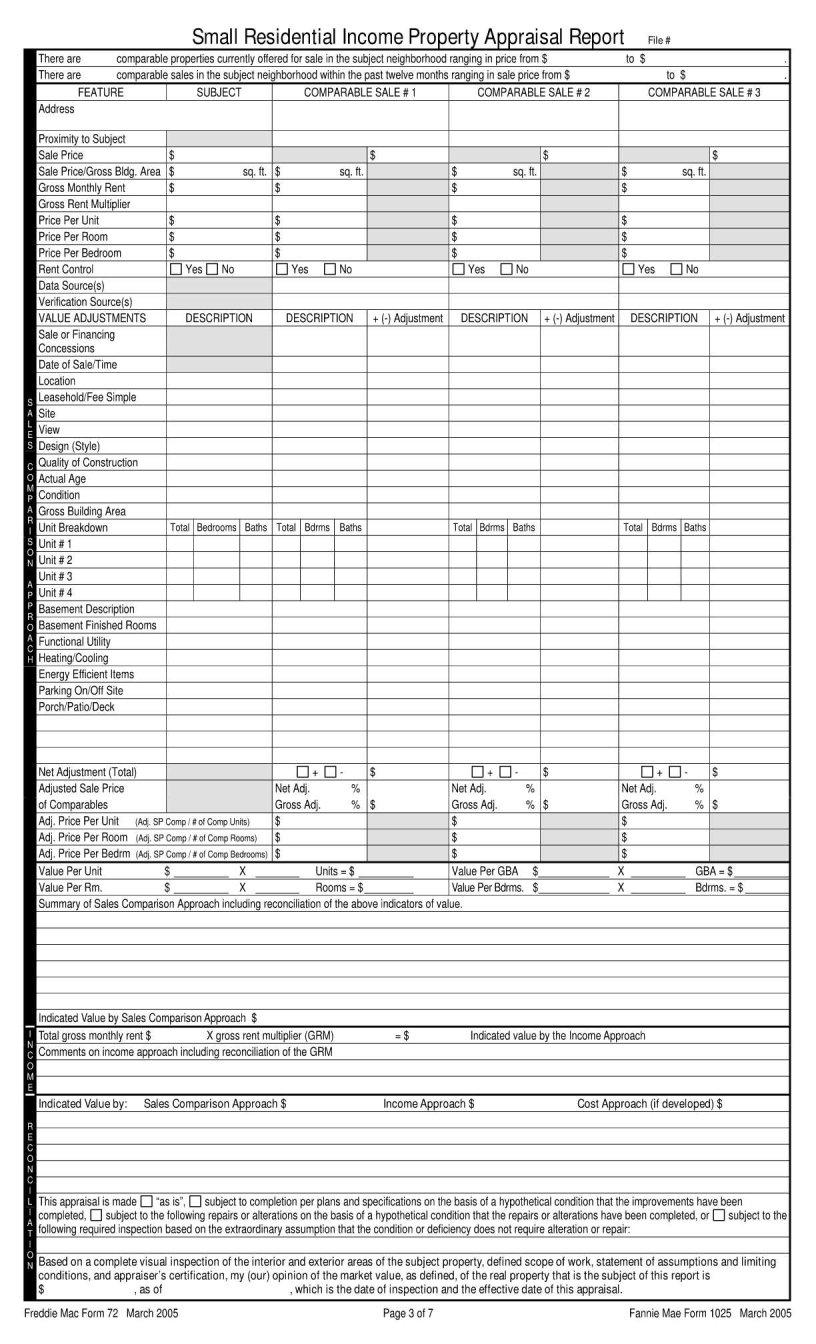

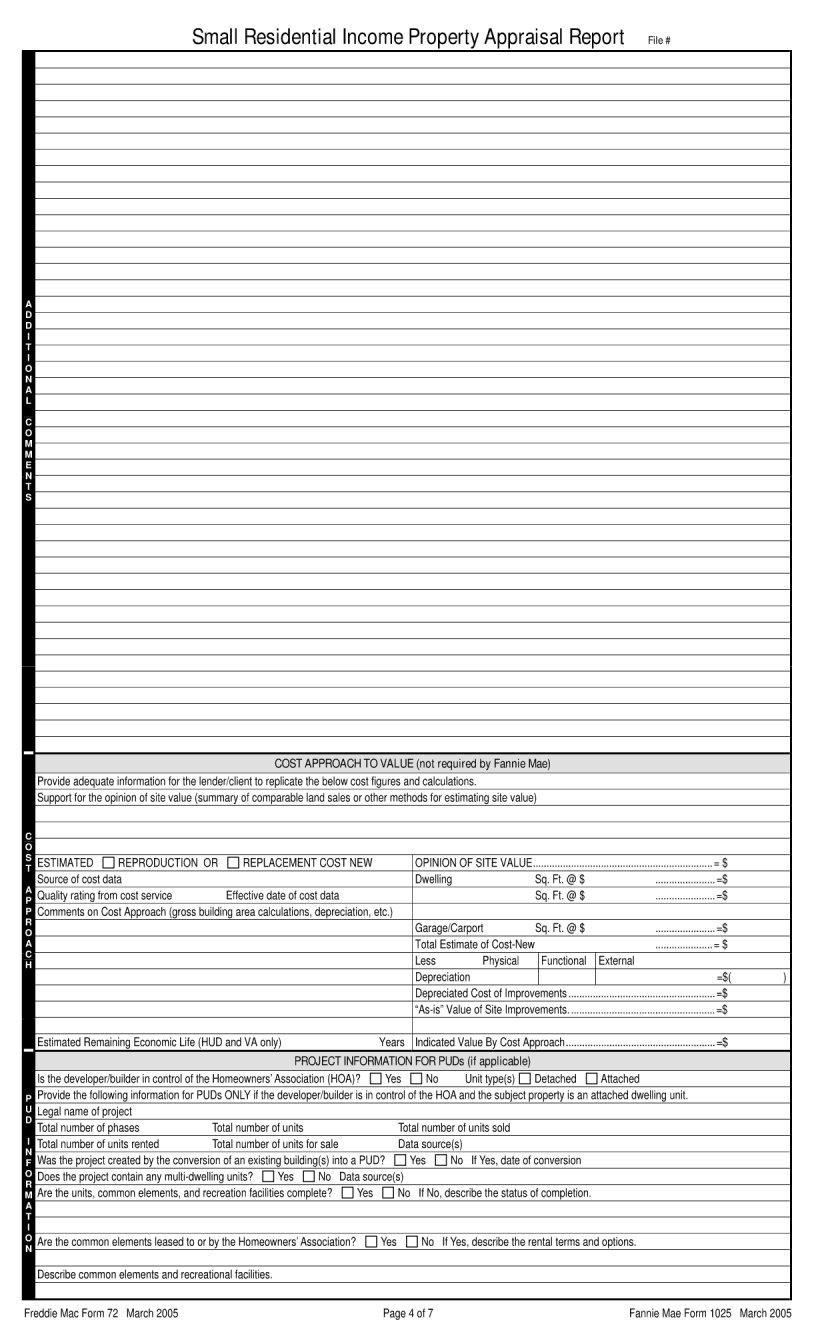

In the complex landscape of real estate transactions, a crucial document often comes to the forefront for those involved in the mortgage process: the Freddie Mac 72 form. This form, a detailed application for residential mortgage lending, serves as a cornerstone for understanding the borrower's financial landscape, employment history, and overall creditworthiness. As part of Freddie Mac's broader suite of tools designed to streamline and standardize the home lending process, the Form 72 encapsulates a wide array of data points that lenders must evaluate in their decision-making process. It not only provides a structured approach to assessing a potential borrower's risk profile but also ensures compliance with both federal and agency guidelines. By meticulously detailing the borrower's income, debts, assets, and liabilities, alongside specific property information and transaction details, the form plays a pivotal role in the mortgage underwriting process. The implications of this form are far-reaching, affecting everything from the interest rates offered to the terms of the loan, thereby underlining its significance in paving the path towards homeownership.

| Question | Answer |

|---|---|

| Form Name | Freddie Mac Form 72 |

| Form Length | 7 pages |

| Fillable? | Yes |

| Fillable fields | 901 |

| Avg. time to fill out | 36 min 24 sec |

| Other names | form 72, fhlmc form 72, freddie mac form 72 or 1000, form 1000 appraisal |