When you wish to fill out fsa s land online, you won't have to download any sort of programs - simply try our PDF tool. Our professional team is ceaselessly endeavoring to develop the tool and insure that it is even easier for users with its handy functions. Take your experience one step further with constantly developing and great opportunities we offer! It just takes several basic steps:

Step 1: Press the orange "Get Form" button above. It's going to open up our tool so that you could begin filling in your form.

Step 2: As soon as you start the online editor, you'll notice the document ready to be filled out. In addition to filling in different blank fields, you can also do many other things with the Document, namely adding any textual content, editing the original textual content, inserting illustrations or photos, placing your signature to the form, and more.

It is actually straightforward to fill out the form following this detailed tutorial! Here is what you should do:

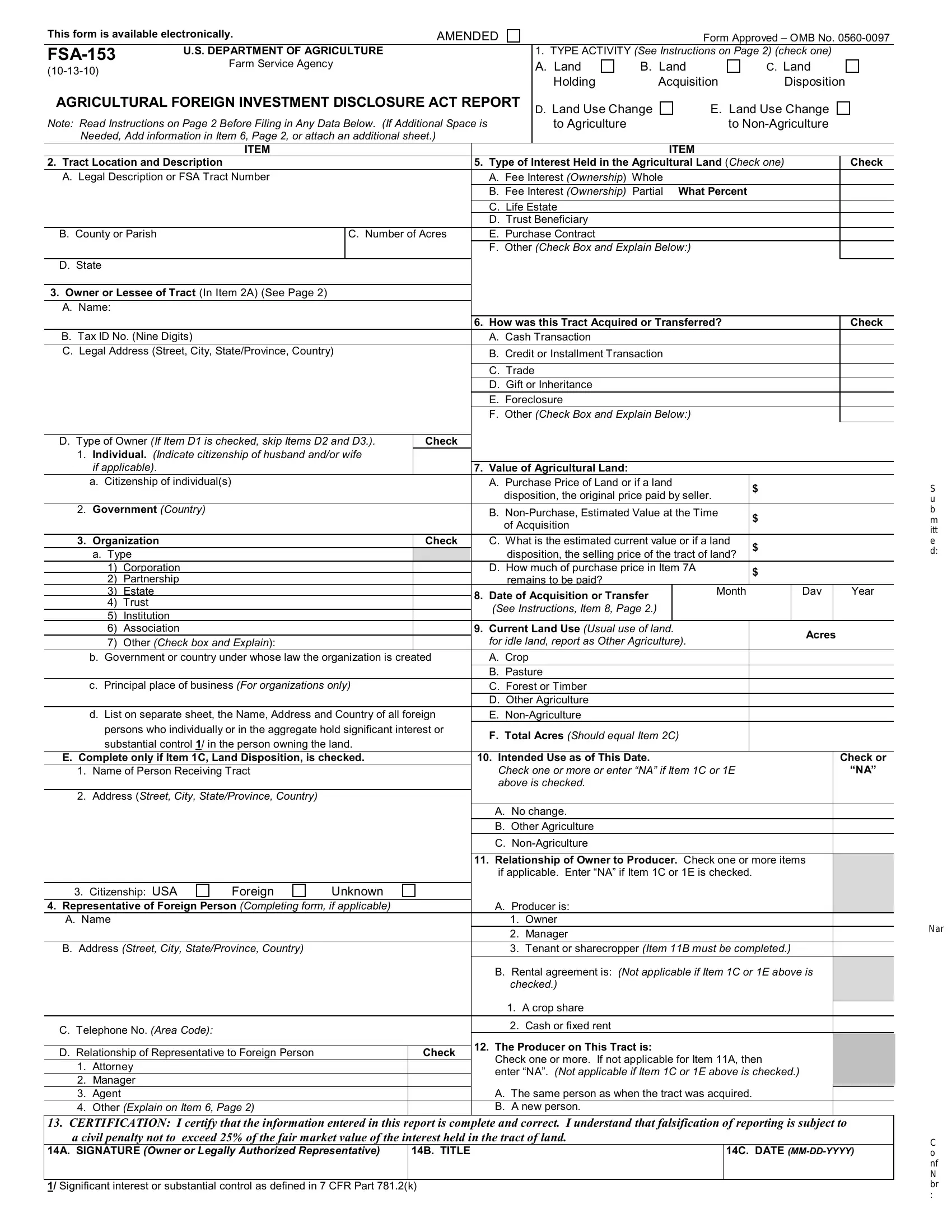

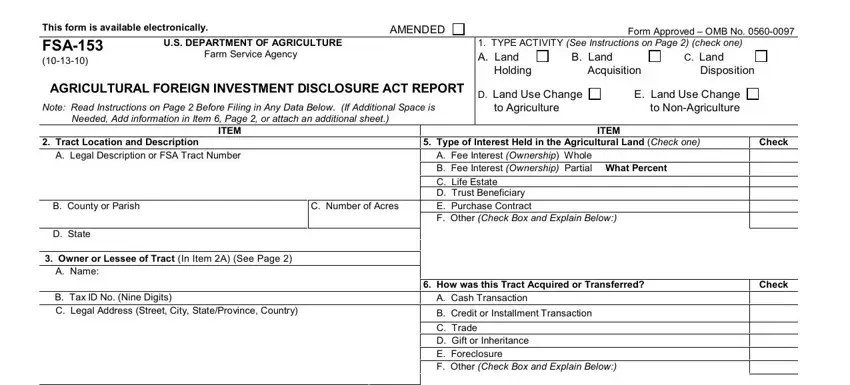

1. Fill out your fsa s land online with a selection of essential blank fields. Consider all of the important information and ensure not a single thing omitted!

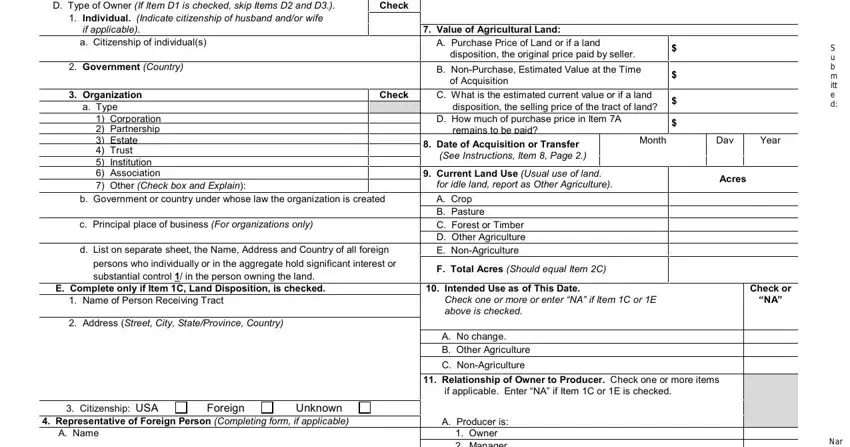

2. Now that the previous part is completed, it's time to put in the necessary details in D Type of Owner If Item D is, Check, Individual Indicate citizenship, if applicable a Citizenship of, Government Country, Organization, a Type, Corporation Partnership Estate, b Government or country under, c Principal place of business For, d List on separate sheet the Name, persons who individually or in the, E Complete only if Item C Land, Name of Person Receiving Tract, and Address Street City StateProvince allowing you to progress to the third step.

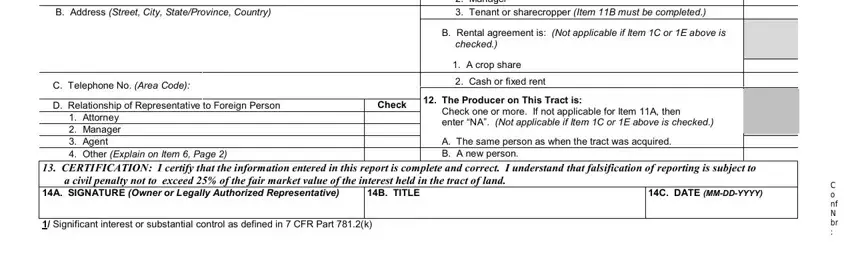

3. This 3rd segment should also be pretty simple, B Address Street City, C Telephone No Area Code, D Relationship of Representative, Check, Attorney Manager Agent Other, Owner Manager Tenant or, B Rental agreement is Not, checked, A crop share, Cash or fixed rent, The Producer on This Tract is, Check one or more If not, A The same person as when the, CERTIFICATION I certify that the, and a civil penalty not to exceed of - all of these blanks will have to be filled in here.

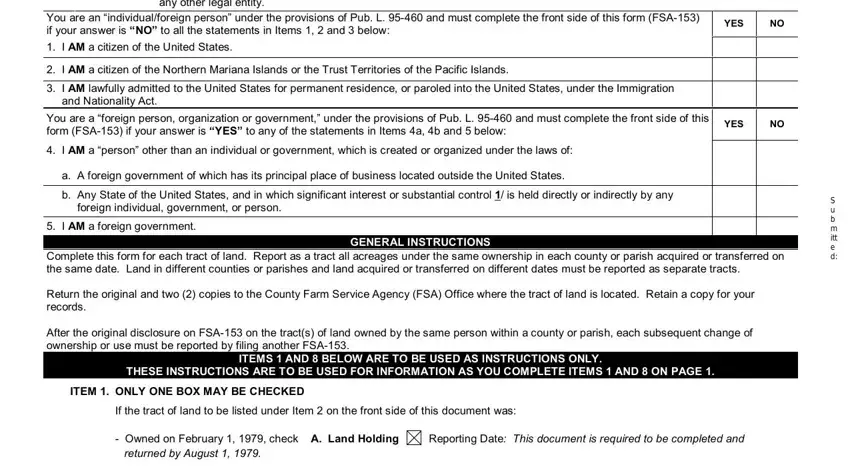

4. It's time to begin working on this fourth portion! Here you'll get all these DEFINITION, Person means any individual, You are an individualforeign, YES, I AM a citizen of the Northern, I AM lawfully admitted to the, and Nationality Act, You are a foreign person, YES, a A foreign government of which, b Any State of the United States, foreign individual government or, I AM a foreign government, Complete this form for each tract, and GENERAL INSTRUCTIONS fields to fill in.

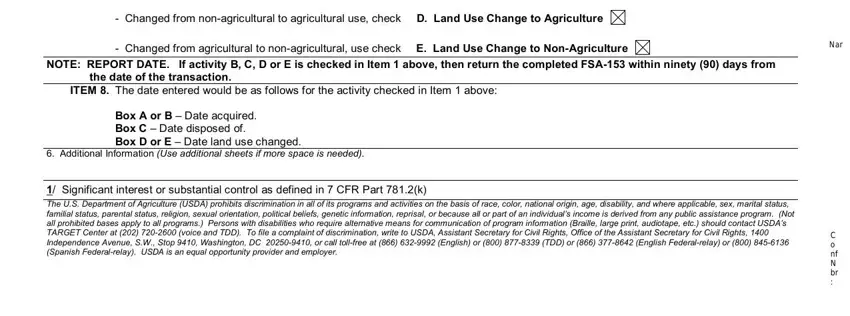

5. Lastly, this final section is what you have to complete before submitting the form. The blanks at this point include the following: Changed from nonagricultural to, Changed from agricultural to, NOTE REPORT DATE If activity B C D, the date of the transaction, ITEM The date entered would be as, Box A or B Date acquired Box C, Additional Information Use, and Significant interest or.

When it comes to NOTE REPORT DATE If activity B C D and Significant interest or, make certain you review things in this section. These are the most significant fields in the page.

Step 3: After you've reviewed the information provided, simply click "Done" to conclude your form. Get hold of your fsa s land online as soon as you subscribe to a free trial. Immediately access the document within your personal account page, together with any modifications and adjustments automatically synced! At FormsPal.com, we do our utmost to make sure all your information is kept protected.