FSA-2330 (05-05-16) |

Page 5 of 7 |

9. SPECIAL PROGRAM INFORMATION: |

|

Certain FSA programs are, by law, designed to reach targeted applicants. If you are interested in any of the programs described here, or have questions about these programs and whether you may qualify for a specific program, the FSA office processing your application will help you.

A.SOCIALLY DISADVANTAGED APPLICANTS : A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to applicants who have been subjected to racial, ethnic or gender prejudice because of their identity as a member of a group, without regard to individual qualities. Under the applicable law, groups meeting this condition are: American Indians/Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians/Other Pacific Islanders, Hispanics and women. In addition, FSA has a down payment program, which receives special funding.

B.BEGINNING FARMER ASSISTANCE: FSA has the authority to assist beginning farmers through the farm ownership, operating, and conservation loan programs. A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to beginning farmers. In addition, FSA has a down payment program, which receives special funding. In some States, FSA has agreements with State beginning farmer programs to help meet the credit needs of beginning farmers.

C.LIMITED RESOURCE LOANS : Limited resource farm ownership and operating loans are available to qualified applicants. This program provides loans at reduced interest rates to low-income farmers whose operations and resources are so limited that they cannot pay the regular rates for FSA loans. The program is also intended to provide beginning farmers the opportunity to start a successful farming operation.

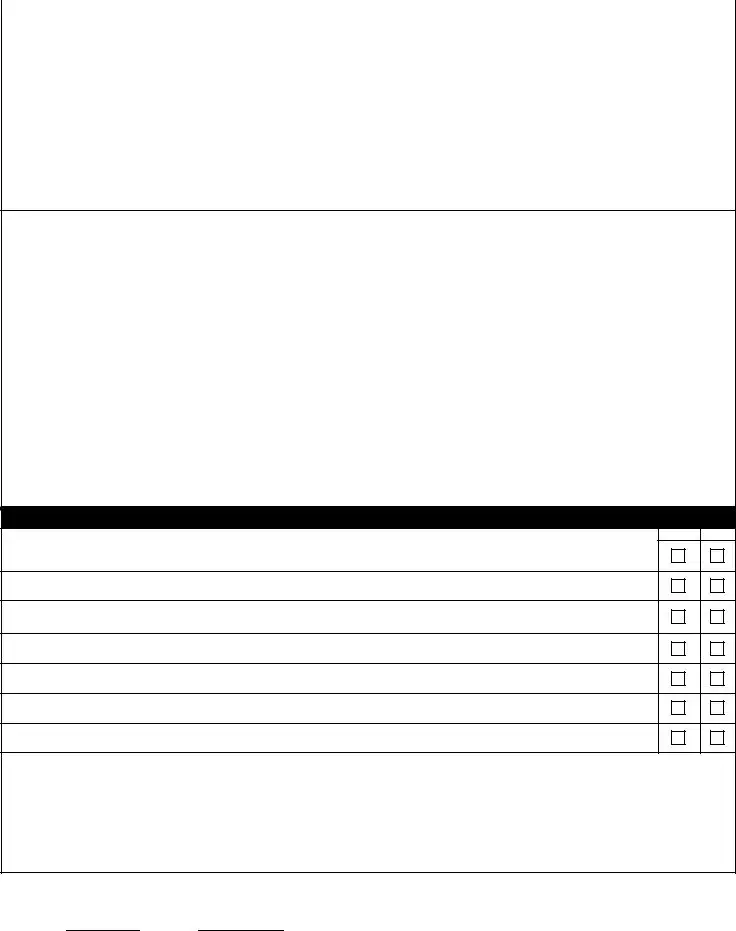

10.RIGHTS AND POLICIES :

A.RIGHT TO FINANCIAL PRIVACY ACT OF 1978 (Public Law 95-630): FSA has a right of access to financial records held by financial institutions in connection with providing assistance to you as well as collecting on loans made to you or guaranteed by the Government. Financial records involving your transaction will be available to FSA without further notice or authorization but will not be disclosed or released by this institution to another Government Agency or Department without your consent except as required by law.

B.THE FEDERAL EQUAL CREDIT OPPORTUNITY ACT: Prohibits creditors from discriminating against applicants on the basis of race, color, religion, sex, national origin, marital status, age (provided the applicant has the capacity to enter into a binding contract), because all or a part of the applicant's income derives from any public assistance program, or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

C.FEDERAL COLLECTION POLICIES: Delinquencies, defaults, foreclosures and abuses of mortgage loans involving programs of the Federal Government can be costly and detrimental to your credit, now and in the future. The mortgage lender in this transaction, its agents and assigns as well as the Federal Government, its agencies, agents and assigns, are authorized to take any and all of the following actions in the event loan payments become delinquent on the mortgaged loan described in the attached application: (1) Report your name and account information to a credit bureau; (2) Assess additional interest and penalty charges for the period of time that payment is not made; (3) Assess charges to cover additional administrative costs incurred by the Government to service your account; (4) Offset amounts owed to you under other Federal programs; (5) Refer your account to a private attorney, collection agency or mortgage servicing agency to collect the amount due, foreclose the mortgage, sell the property and seek judgment against you for any deficiency; (6) Refer your account to the Department of Justice for litigation; (7) If you are a current or retired Federal employee, take action to offset your salary, or civil service retirement benefits; (8) Refer your debt to the Department of the Treasury for cross-servicing and offset against any amount owed to you by any Federal Agency such as an income tax refund; and (9) Report any resulting written-off debt to the Internal Revenue Service as taxable income. All of these actions can and will be used to recover debts owed to the Federal Government when in its best interests.

11.RESTRICTIONS AND DISCLOSURE OF LOBBYING ACTIVITIES:

A.The applicant:

(1)Certifies that if any funds, by or on behalf of the applicant, have been or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member, an officer or employee of Congress, or an employee of a Member of Congress in connection with the awarding of any Federal contract, the making of any Federal grant or Federal loan, and the extension, continuation, renewal, amendment, or modification of any Federal contract, grant, or loan, the applicant shall complete and submit Standard Form - LLL, "Disclosure of Lobbying Activities," in accordance with its instructions.

(2)Shall require that the language of this certification be included in the award documents for all sub-awards at all tiers (including contracts, subcontracts, and subgrants, under grants and loans) and that all subrecipients shall certify and disclose accordingly.