Each year, businesses in Georgia tackle the important task of complying with state tax obligations, a process that includes familiarizing themselves with the Georgia Form 600S. Revised as of June 20, 2020, this form is a crucial document for S Corporations operating within the state, serving dual purposes as both a Corporation Tax Return and a Net Worth Tax Return for the applicable tax year. It encompasses a comprehensive review of an S Corporation's financial activities including income tax computation and net worth assessment, while also allowing for modifications such as amended returns and adjustments following an IRS audit. Moreover, it calls for detailed disclosures ranging from nonresident withholding tax payments to net worth computations exclusively for foreign corporations. By breaking down the components related to income allocation for Georgia purposes, the form addresses how S Corporations can compute their taxable income through various schedules detailing federal ordinary income, adjustments to federal income, and income apportionment. Furthermore, it outlines specific procedures for claiming tax credits and breaks down the process for direct deposit options, emphasizing the importance of electronic filing for certain claims. The intricate design of Form 600S underscores the importance of accurate and comprehensive financial reporting, adhering to Georgia's tax laws, and facilitating a smoother taxation process for S Corporations.

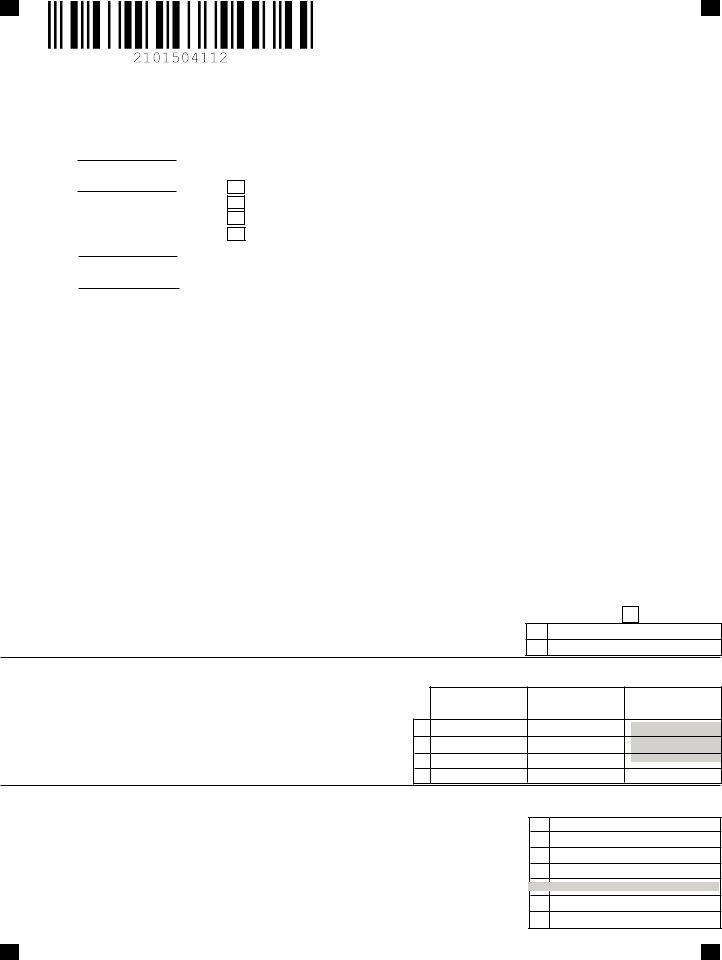

| Question | Answer |

|---|---|

| Form Name | Ga Form 600S |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | dor.georgia.govdocumentdocumentGeorgia Form 500 (Rev. 06/20/20) - Georgia Department of Revenue |

Georgia Form 600S (Rev. 06/20/20)

Corporation Tax Return

Georgia Department of Revenue

2020 Income Tax Return

Beginning

Ending

2021 Net Worth Tax Return

Beginning

Ending

PAGE 1

Amount of nonresident withholding tax paid by the S Corporation:

|

|

|

|

|

|

|

|

|

|

|

Original Return |

|

UET Annualization Exception attached |

|

|

|

|||||

|

|

|

|

|||||||

Amended Return |

|

Initial Net Worth |

|

C Corp Last Year |

|

|

Extension |

|||

|

|

|

|

|||||||

Amended due to IRS Audit |

|

|

Address Change |

|

Name Change |

|

Composite |

|||

|

|

|

|

|||||||

Final Return (Attach explanation) |

|

PL |

|

QSSS Exempt |

|

Return Filed |

||||

A. Federal Employer ID Number |

B. Name (Corporate title) Please give former name if applicable. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. GA Withholding Tax Acct. Number |

D. Business Street Address |

|

|

|

|

|

|||||

Payroll WH Number |

Nonresident WH Number |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. GA Sales Tax Reg. Number |

F. City or Town |

|

|

G. State |

H. ZIP Code |

I. Foreign Country Name |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. NAICS Code |

|

K. Date of Incorporation |

L . Incorporated under laws of what state |

M. Date admitted into GA |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

N. Location of Records for Audit (City & State) |

O. Corporation’s Telephone Number |

P. Type of Business |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Q. Total Shareholders |

R. Total Nonresident |

|

S. Federal Ordinary Income |

T. Latest taxable year |

U. And when reported |

||||||

|

|

Shareholders |

|

|

|

|

adjusted by IRS |

to Georgia |

|||

|

|

|

|

|

|

|

|

|

|

|

|

V. S Corporation Representative |

|

W. S Corporation Representative’s |

X. S Corporation Representative’s |

||||||||

|

|

|

|

|

|

Telephone Number |

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

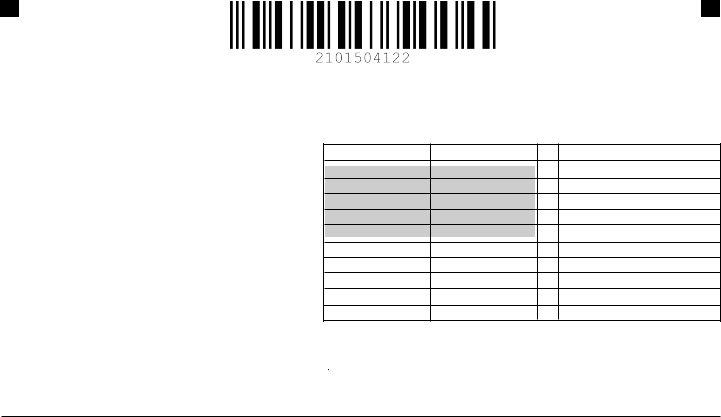

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 1 |

|||||||||

By checking the box, the S Corporation elects to pay the tax on behalf of its shareholders due to a Georgia audit.

1.Georgia Taxable Income (see instructions)

2.Tax 5.75% x Line 1 ............................................................................................................................................................................................................

1.

2.

COMPUTATION OF NET WORTH RATIO(to be used by Foreign Corporations only) |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

1.Total value of property owned (Total assets from Federal balance sheet)

2.Gross receipts from business ....................................................................

3.Totals (Line 1 + 2)........................................................................................

4.Georgia ratio (Divide Line 3A by 3B)........................................................

C. GA (A/B) DO NOT

ROUND COMPUTE TO

A. WITHIN GEORGIA B. TOTAL EVERYWHERE SIX DECIMALS

1.

2.

3.

4.

COMPUTATION OF NET WORTH TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 3 |

1.Total Capital stock issued ......................................................................................................

2.Paid in or Capital surplus .......................................................................................................

3.Total Retained earnings..........................................................................................................

4.Net Worth (Total of Lines 1, 2, and 3) ....................................................................................

5. Ratio (GA and Dom. For. |

5. |

|

|

6.Net Worth Taxable by Georgia (Line 4 x Line 5)

7.Net Worth Tax (from table in instructions)....................................................................................................................................................

1.

2.

3.

4.

6.

7.

Georgia Form 600S/2020

PAGE 2

(Corporation) Name |

|

|

|

FEIN |

|

|

|

|

|

|

|

||

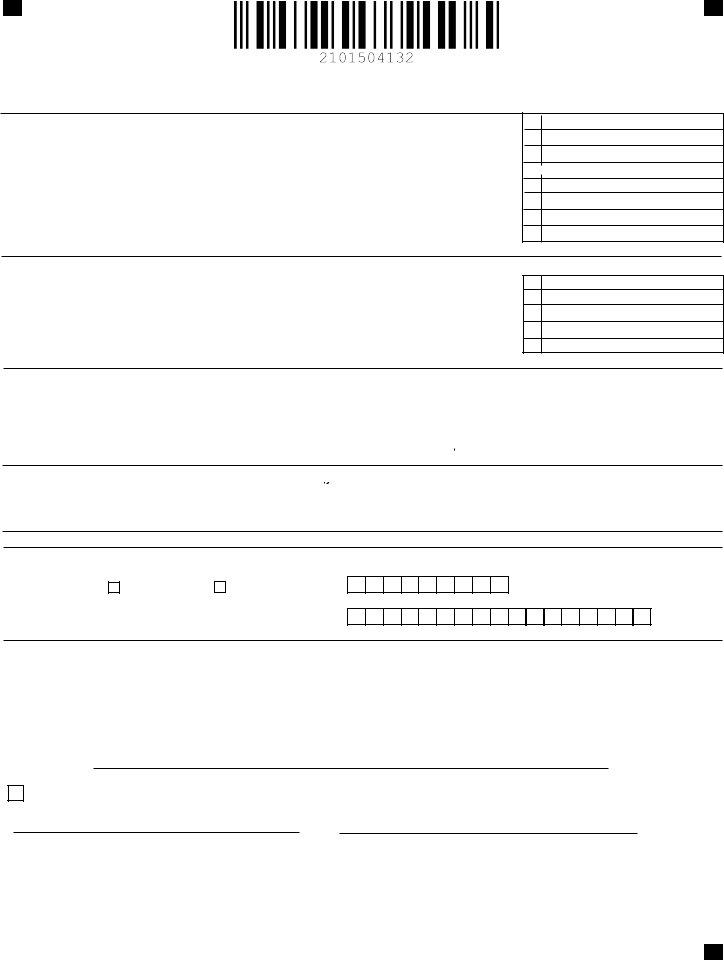

COMPUTATION OF TAX DUE OR OVERPAYMENT |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

|

||

1.Total Tax (Schedule 1, Line 2 and Schedule 3, Line 7) ........

2.Credits and payments of estimated tax .................................

3.Credits used from Schedule 10* (must be filed electronically)

4.Withholding Credits

5.Balance of tax due (Line 1, less Lines 2, 3 and 4 ) ................

6.Amount of overpayment (Lines 2, 3 and 4 less Line 1) ........

7.Interest due (See Instructions) .................................................

8.Form 600 UET (Estimated tax penalty) ...................................

9.Other penalty due (See Instructions) .......................................

10.Balance of tax, interest and penalty due with return ................

11.Amount to be credited to 2021 estimated tax (Line 6 less Line 8)

A. Income Tax |

B. Net Worth Tax |

C. Total |

1.

2.

3.

4.

5.

6.

7.

8. 9. 10.

Refunded 11

*NOTE: Any tax credits from Schedule 10 may be applied against income tax liability only, not net worth tax liability.

SEE PAGE 3 SIGNATURE SECTION FOR DIRECT DEPOSIT OPTIONS

|

COMPUTATION OF GEORGIA NET INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

|

|

SCHEDULE 5 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Income for Georgia purposes (Line 11, Schedule 6) |

|

|

|

|

|

1. |

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||||

2. |

Income allocated everywhere (Must Attach Schedule) |

|

|

|

|

2. |

|

|

|

|

|||||

|

3. Business Income subject to apportionment (Line 1 less Line 2) |

|

|

|

|

3. |

|

|

|

|

|||||

4. |

..........................................................Georgia Ratio (Schedule 9, Column C) |

4. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||||

|

5. Net business income apportioned to Georgia (Line 3 x Line 4) |

|

|

|

|

5. |

|

|

|

|

|||||

|

6. Net income allocated to Georgia (Attach Schedule) |

|

|

|

|

6. |

|

|

|

|

|||||

|

7. Total Georgia net income (Add Line 5 and Line 6) |

|

|

|

|

7. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTATION OF TOTAL INCOME FOR GEORGIA PURPOSES |

|

(ROUND TO NEAREST DOLLAR) |

|

|

|

|

SCHEDULE 6 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Ordinary income (loss) per Federal return |

|

|

|

|

1. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2. Net income (loss) from rental real estate activities |

|

|

|

|

2. |

|

|

|

|

|||||

3. |

a. Gross income from other rental activities |

|

3a. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||||

|

|

b. Less: expenses |

|

3b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

..........................................c. Net business income from other rental activities (Line 3a less Line 3b) |

3c. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Portfolio income (loss): |

a. Interest Income |

|

|

|

|

4a. |

|

|

|

|||||

|

|

|

b. Dividend Income |

|

|

|

|

|

4b. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Royalty Income |

|

|

|

|

|

4c. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

d. Net |

4d. |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

e. Net |

4e. |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

f. Other portfolio income (loss) |

|

4f. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Net gain (loss) under section 1231 |

....................................................................................................... |

|

|

|

|

5. |

|

|

|

|

||||

6. |

Other Income (loss) |

|

|

|

|

|

6. |

|

|

|

|

||||

7. |

Total Federal Income (Add Lines 1 through 6) |

|

|

|

|

7. |

|

|

|

|

|||||

8. |

Additions to Federal Income (Schedule 7) |

|

|

|

|

8. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Total (Add Lines 7 & 8) |

|

|

|

|

|

9. |

|

|

|

|

||||

10. |

Subtractions from Federal Income (Schedule 8) |

.................................................... |

|

|

|

10. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

11. |

Total Income for Georgia purposes (Subtract Line 10 from Line 9) |

11. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia Form 600S/2020

PAGE 3

(Corporation) Name |

|

|

FEIN |

|

|

|

|

|

|

||

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 7 |

|

||

1.State and municipal bond interest (other than Georgia or political subdivision thereof)

2.Net income or net profits taxes imposed by taxing jurisdictions other than Georgia ................

3.Expense attributable to tax exempt income .................................................................................

4.Reserved......................................................................................................................................

5.Intangible expenses and related interest costs ...........................................................................

6.Captive REIT expenses and costs ...............................................................................................

7.Other Additions (Attach Schedule) .............................................................................................

8.TOTAL - Enter here and on Line 8, Schedule 6 ......................................................................................

1.

2.

3.

4.

5.

6.

7.

8.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 8 |

|

|

|

1. Interest on obligations of United States (must be reduced by direct and indirect interest expense) ..

2. Exception to intangible expenses and related interest costs (Attach

3. Exception to captive REIT expenses and costs (Attach

4. Other Subtractions (Must Attach Schedule) .......................................................................................

5. TOTAL- Enter here and on Line 10, Schedule 6 ...............................................................................

1.

2.

3.

4.

5.

APPORTIONMENT OF INCOME |

|

|

|

|

SCHEDULE 9 |

|

|

|

|

|

|

|

|

A. WITHIN GEORGIA |

B. EVERYWHERE |

C. DO NOT ROUND COL (A)/ COL (B) |

|

|

|

|

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

1. |

|

|

|

|

|

|

|

|

||

|

|

|

|

||

2. Georgia Ratio (Divide Column A by Column B) |

2. |

|

|

|

|

A copy of the Federal Return and supporting schedules must be attached if filing by paper. No extension of time for filing will be allowed unless a copy of the request for a Federal extension or Form

Make check payable to: Georgia Department of Revenue

Mail to: Georgia Department of Revenue, Processing Center, PO Box 740391, Atlanta, Georgia

DIRECT DEPOSIT OPTIONS

A. Direct Deposit (ForU.S.AccountsOnly) See booklet for further instructions. If Direct Deposit is not. selected, a paper check will be issued.

|

|

Routing |

Type: Checking |

Savings |

Number |

|

|

Account |

|

|

Number |

Declaration: I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge. Georgia Public Revenue Code Section

By providing my

Check the box to authorize the Georgia Department of Revenue to discuss the contents of this tax return with the named preparer.

SIGNATURE OF OFFICER |

SIGNATURE OF INDIVIDUAL OR FIRM PREPARING THE RETURN |

|||||

|

|

|

|

|

|

|

TITLE |

FIRM PREPARING THE RETURN |

|||||

|

|

|

|

|

|

|

|

|

DATE |

|

IDENTIFICATION OR SOCIAL SECURITY NUMBER |

||

|

|

|

|

|

|

|

Georgia Form 600S/2020

PAGE 4

(Corporation) Name |

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

CREDIT USAGE AND CARRYOVER |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 10 |

|||

|

|

|

|

|

|

|

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY

Georgia Form 600S/2020

PAGE 5

(Corporation) Name |

|

|

FEIN |

|

|

|

|

|

|

|

|||

|

CREDIT ALLOCATION TO OWNERS |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 11 |

|

|

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY

Georgia Form 600S/2020

PAGE 6

(Corporation) Name |

|

|

FEIN |

|

|

|

|

|

|

|

|

||

|

ASSIGNED TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 12 |

|

||

|

|

|

|

|

|

|

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY