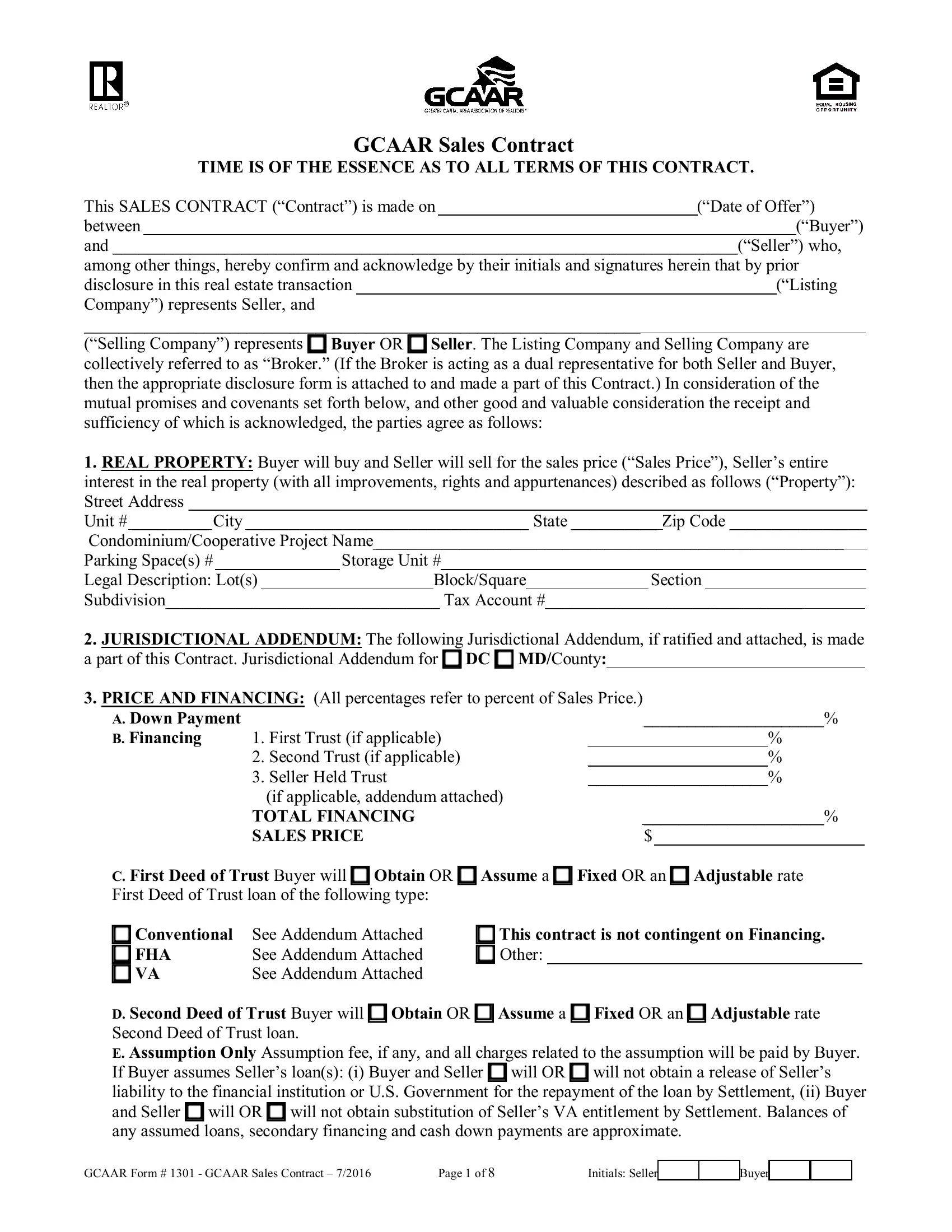

GCAAR Sales Contract

TIME IS OF THE ESSENCE AS TO ALL TERMS OF THIS CONTRACT.

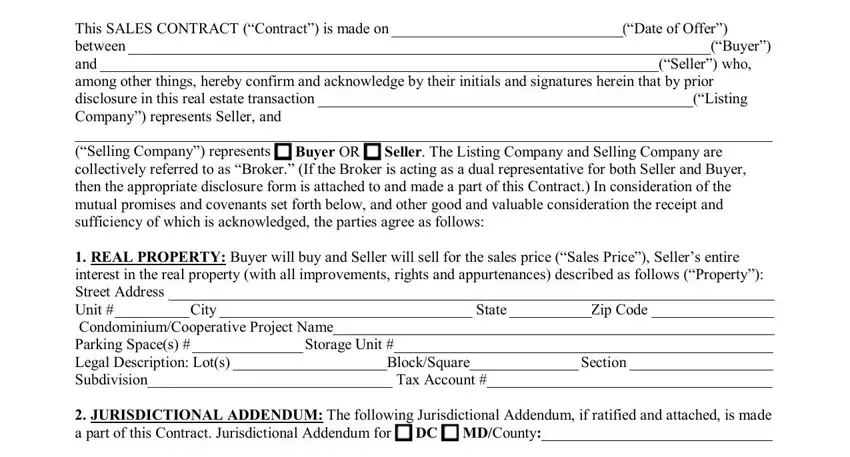

This SALES CONTRACT (“Contract”) is made on ______________________________(“Date of Offer”)

between ____________________________________________________________________________(“Buyer”)

and _________________________________________________________________________(“Seller”) who,

among other things, hereby confirm and acknowledge by their initials and signatures herein that by prior disclosure in this real estate transaction _________________________________________________(“Listing

Company”) represents Seller, and

_________________________________________________________________

(“Selling Company”) represents Buyer OR Seller. The Listing Company and Selling Company are collectively referred to as “Broker.” (If the Broker is acting as a dual representative for both Seller and Buyer, then the appropriate disclosure form is attached to and made a part of this Contract.) In consideration of the mutual promises and covenants set forth below, and other good and valuable consideration the receipt and sufficiency of which is acknowledged, the parties agree as follows:

1.REAL PROPERTY: Buyer will buy and Seller will sell for the sales price (“Sales Price”), Seller’s entire interest in the real property (with all improvements, rights and appurtenances) described as follows (“Property”): Street Address _______________________________________________________________________________

Unit # _________ City _________________________________ State __________ Zip Code ________________

Condominium/Cooperative Project Name_______________________________________________________

Parking Space(s) # ______________ Storage Unit #________________________________

Legal Description: Lot(s) ____________________Block/Square______________ Section _________________

Subdivision________________________________ Tax Account #______________________________

2.JURISDICTIONAL ADDENDUM: The following Jurisdictional Addendum, if ratified and attached, is made a part of this Contract. Jurisdictional Addendum for DC MD/County: _________________________

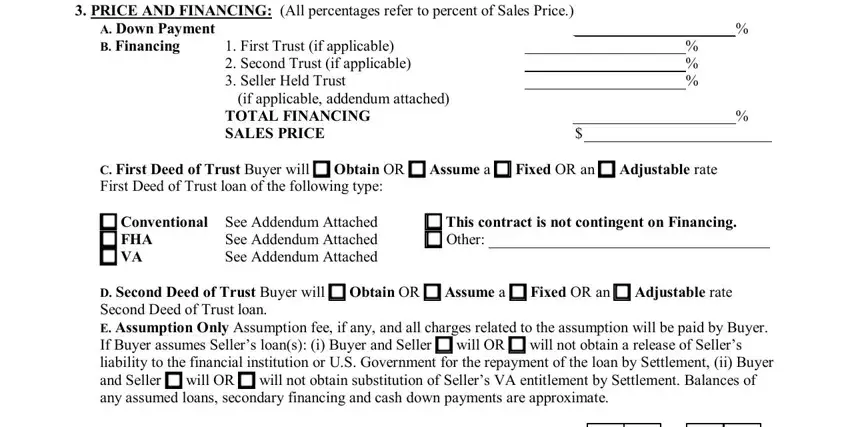

3.PRICE AND FINANCING: (All percentages refer to percent of Sales Price.)

A. Down Payment |

|

|

_____________________% |

|

B. Financing |

1. |

First Trust (if applicable) |

_____________________% |

|

|

2. |

Second Trust (if applicable) |

_____________________% |

|

|

3. |

Seller Held Trust |

_____________________% |

|

|

|

(if applicable, addendum attached) |

|

TOTAL FINANCING |

_____________________% |

|

|

SALES PRICE |

$ _____________________ |

|

|

|

|

|

|

C. First Deed of Trust Buyer will Obtain OR |

Assume a Fixed OR an Adjustable rate |

First Deed of Trust loan of the following type: |

|

|

|

|

Conventional |

See Addendum Attached |

This contract is not contingent on Financing. |

FHA |

See Addendum Attached |

Other: _________________________ |

VA |

See Addendum Attached |

|

|

|

|

D. Second Deed of Trust Buyer will Obtain OR Assume a Fixed OR an Adjustable rate Second Deed of Trust loan.

E. Assumption Only Assumption fee, if any, and all charges related to the assumption will be paid by Buyer. If Buyer assumes Seller’s loan(s): (i) Buyer and Seller will OR will not obtain a release of Seller’s liability to the financial institution or U.S. Government for the repayment of the loan by Settlement, (ii) Buyer and Seller will OR will not obtain substitution of Seller’s VA entitlement by Settlement. Balances of any assumed loans, secondary financing and cash down payments are approximate.

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 1 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

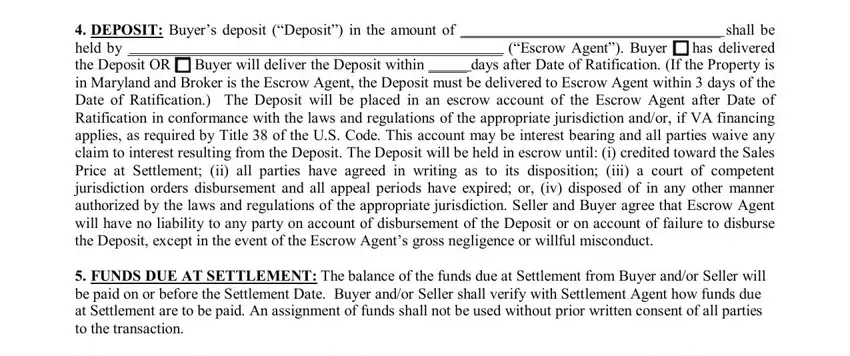

4.DEPOSIT: Buyer’s deposit (“Deposit”) in the amount of __________________________________ shall be

held by _________________________________________________ (“Escrow Agent”). Buyer has delivered the Deposit OR Buyer will deliver the Deposit within _____ days after Date of Ratification. (If the Property is in Maryland and Broker is the Escrow Agent, the Deposit must be delivered to Escrow Agent within 3 days of the Date of Ratification.) The Deposit will be placed in an escrow account of the Escrow Agent after Date of Ratification in conformance with the laws and regulations of the appropriate jurisdiction and/or, if VA financing applies, as required by Title 38 of the U.S. Code. This account may be interest bearing and all parties waive any claim to interest resulting from the Deposit. The Deposit will be held in escrow until: (i) credited toward the Sales Price at Settlement; (ii) all parties have agreed in writing as to its disposition; (iii) a court of competent jurisdiction orders disbursement and all appeal periods have expired; or, (iv) disposed of in any other manner authorized by the laws and regulations of the appropriate jurisdiction. Seller and Buyer agree that Escrow Agent will have no liability to any party on account of disbursement of the Deposit or on account of failure to disburse the Deposit, except in the event of the Escrow Agent’s gross negligence or willful misconduct.

5.FUNDS DUE AT SETTLEMENT: The balance of the funds due at Settlement from Buyer and/or Seller will be paid on or before the Settlement Date. Buyer and/or Seller shall verify with Settlement Agent how funds due at Settlement are to be paid. An assignment of funds shall not be used without prior written consent of all parties to the transaction.

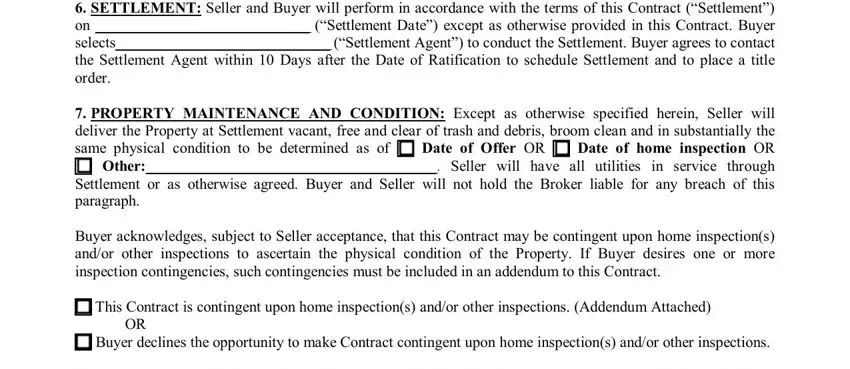

6.SETTLEMENT: Seller and Buyer will perform in accordance with the terms of this Contract (“Settlement”) on ____________________________ (“Settlement Date”) except as otherwise provided in this Contract. Buyer selects____________________________ (“Settlement Agent”) to conduct the Settlement. Buyer agrees to contact the Settlement Agent within 10 Days after the Date of Ratification to schedule Settlement and to place a title order.

7.PROPERTY MAINTENANCE AND CONDITION: Except as otherwise specified herein, Seller will deliver the Property at Settlement vacant, free and clear of trash and debris, broom clean and in substantially the

same physical condition to be determined as of Date of Offer OR Date of home inspection OR

Other:______________________________________. Seller will have all utilities in service through Settlement or as otherwise agreed. Buyer and Seller will not hold the Broker liable for any breach of this paragraph.

Buyer acknowledges, subject to Seller acceptance, that this Contract may be contingent upon home inspection(s) and/or other inspections to ascertain the physical condition of the Property. If Buyer desires one or more inspection contingencies, such contingencies must be included in an addendum to this Contract.

This Contract is contingent upon home inspection(s) and/or other inspections. (Addendum Attached)

OR

Buyer declines the opportunity to make Contract contingent upon home inspection(s) and/or other inspections.

Buyer acknowledges that except as otherwise specified in this Contract, the Property, including electrical, plumbing, existing appliances, heating, air conditioning, equipment and fixtures shall convey in its AS-IS CONDITION as of the date specified above. Buyer further acknowledges that neither the Brokers and/or their agents nor subagents are responsible for Property defects.

8.ACCESS TO PROPERTY: Seller will provide the Broker, Buyer, inspectors representing Buyer and representatives of lending institutions for Appraisal purposes reasonable access to the Property to comply with this Contract. In addition, Buyer and/or Buyer’s representative will have the right to make a final inspection within 5 days prior to Settlement and/or occupancy, unless otherwise agreed to by Buyer and Seller.

9.INCLUSIONS/EXCLUSIONS: The Property includes the personal property and fixtures as defined and identified in the attached Inclusions/Exclusions Disclosure and Addendum.

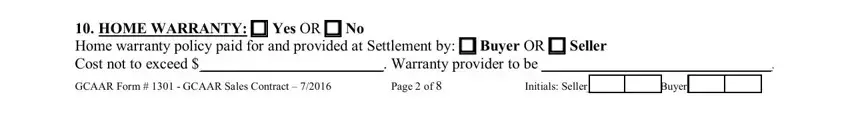

10.HOME WARRANTY: Yes OR No

Home warranty policy paid for and provided at Settlement by: Buyer OR Seller

Cost not to exceed $________________________. Warranty provider to be ______________________________.

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 2 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

11.BUYER’S REPRESENTATIONS: Buyer will OR will not occupy the Property as Buyer’s principal residence. Unless specified in a written contingency, neither this Contract nor the financing is dependent or contingent on the sale and settlement or lease of other real property. The Selling Company is OR is not authorized to disclose to the Listing Company, Seller and any lender the appropriate financial or credit information statement provided to the Selling Company by Buyer. Buyer acknowledges that Seller is relying upon all of Buyer’s representations, including without limitation, the accuracy of financial or credit information given to Seller, Broker or the Lender by Buyer.

12.WOOD-DESTROYING INSECT INSPECTION: Buyer at Buyer’s expense (except under VA financing, then at Seller’s expense) may choose to obtain a wood-destroying insect inspection of the Property by a licensed pest control firm. If Buyer elects to do so, Buyer will furnish to Seller a written report from the licensed pest control firm dated not more than 60 days prior to Settlement showing that all dwelling(s) and/or garage(s) within the Property are free of visible evidence of any wood-destroying insects, and free from visible insect damage. Any treatment and/or repairs for damage recommended in the licensed pest control firm’s report will be made at Seller’s expense. Said treatment shall be completed by a licensed pest control firm and said repairs shall be completed by a contractor licensed in the appropriate jurisdiction.

13.LEAD-BASED PAINT REGULATIONS: Federal law requires sellers of properties built before 1978 to provide buyers with the required federal disclosure regarding lead paint (GCAAR form “Lead Paint--Federal Disclosure”) and the EPA pamphlet “Protect Your Family from Lead in Your Home”. In addition, for District of Columbia properties built before 1978, sellers are required to provide buyers the District of Columbia Lead Disclosure (GCAAR form “Lead Paint--DC Disclosure”). A seller who fails to provide the required local and federal lead-based paint forms, including the EPA pamphlet, may be liable under the law for three times the amount of damages and may be subject to both civil and criminal penalties. Seller and any agent involved in the transaction are required to retain a copy of the completed lead-based paint disclosure forms for a period of six (6) years following the date of Settlement. If the dwelling(s) was built prior to 1978 or if the building date is uncertain and the Property is not exempt from the Residential Federal Lead-Based Paint Hazard Reduction Act of 1992, this Contract is voidable by Buyer until Buyer acknowledges receipt of the required federal lead-based paint form, including the EPA pamphlet, and DC Lead Disclosure if applicable, and has either taken the opportunity to incorporate a Lead-Based Paint Inspection contingency or waived such right. Buyer retains the right to unconditionally, and without risk of loss of Deposit or other adverse effects, declare Contract void until said acknowledgement occurs. Seller and Buyer acknowledge by their respective initials below that they have read and

understand the provisions of this paragraph.

_________/_________ Seller’s Initials __________/_________Buyer’s Initials

Completed Lead-Based Paint forms are attached. _____Yes _____No _____N/A

In accordance with the Lead Renovation, Repair and Painting Rule (“RRP”) as adopted by the Environmental Protection Agency (“the EPA”), effective April 22, 2010, if the improvements on the Property were built before 1978, contractor(s) engaged by Seller to renovate, repair or paint the Property must be certified by the EPA where such work will disturb more than six square feet of lead-based paint per room for interior projects, more than 20 square feet of lead-based paint for any exterior project, or includes window replacement or demolition (“Covered Work”). Before and during any Covered Work, contractor(s) must comply with all requirements of the RRP. A seller who personally performs any Covered Work on a rental property is required to be certified by the EPA prior to performing such Covered Work. No certification is required for a seller who personally performs Covered Work on a seller’s principal residence. However, seller has the ultimate responsibility for the safety of seller’s family or children while performing such Covered Work. For detailed information regarding the RRP, Seller should visit http://www2.epa.gov/lead/renovation-repair-and-painting-program. The Seller and Buyer acknowledge that they have read and understand the provisions of this section.

_________/_________ Seller’s Initials __________/_________Buyer’s Initials

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 3 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

14.FINANCING APPLICATION: If this Contract is contingent on financing, Buyer will make written application for the Specified Financing and any Lender required property insurance no later than 7 days after the Date of Ratification. Buyer grants permission for the Selling Company and the Lender to disclose to the Listing Company and Seller general information about the progress of the loan application and loan approval process. If Buyer fails to settle except due to any Default by Seller, then the provisions of the DEFAULT paragraph shall apply. Seller agrees to comply with reasonable Lender requirements except as otherwise provided in the LENDER REQUIRED REPAIRS paragraph of the applicable financing contingency addendum.

15.ALTERNATE FINANCING: Buyer may substitute alternate financing and/or an alternate lender for Specified Financing provided: (a) Buyer is qualified for alternative financing; (b) there is no additional expense to Seller; (c) the Settlement Date is not delayed; and (d) if Buyer fails to perform at Settlement except due to any Default by Seller, then the provisions of the DEFAULT paragraph shall apply.

16.DAMAGE OR LOSS: The risk of damage or loss to the Property by fire, act of God, or other casualty remains with Seller until the execution and delivery of the Deed of conveyance to Buyer at Settlement.

17.TITLE: The title report and survey, if required, will be ordered pursuant to the terms in Settlement paragraph and, if not available on the Settlement Date, then Settlement may be delayed for up to 10 Business Days to obtain the title report and survey after which this Contract, at the option of Seller, may be terminated and the Deposit will be refunded in full to Buyer according to the terms of the DEPOSIT paragraph. Fee simple title to the Property, and everything that conveys with it, will be sold free of liens except for any loans assumed by Buyer. Title is to be good and marketable, and insurable by a licensed title insurance company with no additional risk premium. Title may be subject to commonly acceptable easements, covenants, conditions and restrictions of record, if any; otherwise, Buyer may declare this Contract void, unless the defects are of such character that they may be remedied within 30 Days beyond the Settlement Date. In case action is required to perfect the title, such action must be taken promptly by Seller at Seller’s expense. The Broker is hereby expressly released from all liability for damages by reason of any defect in the title. Seller will convey the Property by Special Warranty Deed or by Personal Representative’s Deed in the event Seller is a decedent’s estate (“Deed”). Seller will sign such affidavits, lien waivers, tax certifications, and other documents as may be required by the Lender, title insurance company, Settlement Agent, or government authority, and authorizes the Settlement Agent to obtain pay-off or assumption information from any existing lenders. The manner of taking title may have significant legal and tax consequences. Buyer is advised to seek the appropriate professional advice concerning the manner of taking title. Unless otherwise agreed to in writing, Seller will pay any special assessments and will comply with all orders or notices of violations of any county or local authority, condominium unit owners’ association, and/or homeowners’ association or actions in any court on account thereof, against or affecting the Property on the Settlement Date. The parties authorize and direct the Settlement Agent to provide a copy of the Combined Settlement Statement to Seller, Buyer, Listing Company, Selling Company, Homeowner/Condominium Association, Relocation Company and/or any third-party payees reflected on the Settlement Statement.”

18.POSSESSION DATE: Unless otherwise agreed to in writing between Seller and Buyer, Seller will give possession of the Property at Settlement, including delivery of keys, if any. If Seller fails to do so and occupies the Property beyond Settlement, Seller will be a tenant at sufferance of Buyer and hereby expressly waives all notice to quit as provided by law. Buyer will have the right to proceed by any legal means available to obtain possession of the Property. Seller will pay any damages and costs incurred by Buyer including reasonable Legal Expenses.

19.FEES: Fees for the preparation of the Deed, that portion of the Settlement Agent’s fee billed to Seller, costs of releasing existing encumbrances, Seller’s legal fees and any other proper charges assessed to Seller will be paid by Seller. Fees for the title exam (except as otherwise provided), survey, recording (including those for any purchase money trusts) and that portion of the Settlement Agent’s fee billed to Buyer, Buyer’s legal fees and any other proper charges assessed to Buyer will be paid by Buyer. Fees to be charged will be reasonable and customary for the jurisdiction in which the Property is located. (Recording and Transfer Taxes are covered in the appropriate jurisdictional addendum.)

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 4 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

20.BROKER’S FEE: Seller irrevocably instructs the Settlement Agent to pay the Broker compensation (“Broker’s Fee”) at Settlement as set forth in the listing agreement and to disburse the Broker’s Fee offered by the Listing Company to the Selling Company as set forth in the multiple listing service as of the Date of Offer, and any remaining amount of Broker’s Fee to the Listing Company.

21.ADJUSTMENTS: Adjustments, including but not limited to, rents, taxes, water and sewer charges, front foot benefit and house connection charges, condominium/cooperative unit owners’ association and/or homeowners’ association regular periodic assessments (if any), are to be adjusted to the day of Settlement. Any heating or cooking fuels remaining in supply tank(s) at Settlement will become the property of Buyer. Taxes are to be adjusted according to the information provided by the collector of taxes except that recorded assessments for improvements completed prior to Settlement, whether assessments have been levied or not, will be paid by Seller. If a loan is assumed, interest will be adjusted to the Settlement Date and Buyer will reimburse Seller for any existing escrow accounts.

22.DISPUTES: In the event of any dispute between Seller and Broker and/or Buyer and Broker resulting in Broker or any agents, subagents or employees of Broker being made a party to such dispute, including but not limited to, any litigation, arbitration, or complaint and claim before the applicable Real Estate Commission, whether as defendant, cross-defendant, third-party defendant or respondent, Seller and Buyer, jointly and severally, agree to indemnify and hold Broker and any agents, subagents and employees of Broker harmless from any liability, loss, cost, damage or expense (including but not limited to, filing fees, service of process fees, transcript fees and Legal Expenses), resulting therefrom, provided that such dispute does not result in a judgment or decision against Broker, Broker’s agents, subagents or employees for acting improperly.

23.LEGAL EXPENSES:

A.In any action or proceeding between Buyer and Seller based, in whole or in part, upon the performance or non-performance of the terms and conditions of this Contract, including but not limited to, breach of contract, negligence, misrepresentation or fraud, the prevailing party in such action or proceeding shall be entitled to receive reasonable Legal Expenses from the other party as determined by the Court or arbitrator.

B.In the event a dispute arises resulting in the Broker (as used in this paragraph to include any agent, licensee, or employee of the Broker) being made a party to any litigation by Buyer or by Seller, the parties agree that the party who brought the Broker into litigation shall indemnify the Broker for all of its reasonable Legal Expenses incurred, unless the litigation results in a judgment against the Broker.

24.PERFORMANCE: Delivery of the required funds and executed documents to the Settlement Agent will constitute sufficient tender of performance. Funds from this transaction at Settlement may be used to pay off any existing liens and encumbrances, including interest, as required by lender(s) or lienholders.

25.SELLER RESPONSIBILITY: Seller agrees to keep existing mortgages free of default through Settlement. All violations of requirements noted or issued by any governmental authority, or actions in any court on account thereof, against or affecting the Property at Settlement, shall be complied with by Seller and the Property conveyed free thereof.

26.DEFAULT: Buyer and Seller are required and agree to perform at Settlement in accordance with the terms of this Contract and acknowledge that failure to do so constitutes a breach hereof. If Buyer fails to complete Settlement for any reason other than Default by Seller, at the option of Seller, the Deposit may be forfeited as liquidated damages (not as a penalty) in which event Buyer will be relieved from further liability to Seller. If Seller does not elect to accept the Deposit as liquidated damages, the Deposit may not be the limit of Buyer’s liability in the event of a Default. If the Deposit is forfeited, or if there is an award of damages by a court or a compromise agreement between Seller and Buyer, the Broker may accept and Seller agrees to pay the Broker one-half of the Deposit in lieu of the Broker’s Fee, (provided Broker’s share of any forfeited Deposit will not exceed the amount due under the listing agreement).

If Seller fails to perform or comply with any of the terms and conditions of this Contract or fails to complete Settlement for any reason other than Default by Buyer, Buyer will have the right to pursue all legal or equitable remedies, including specific performance and/or damages.

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 5 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

If either Seller or Buyer refuses to execute a release of Deposit (“Release”) when requested to do so in writing and a court finds that such party should have executed the Release, the party who so refused to execute the Release will pay the expenses, including without limitation, reasonable Legal Expenses, incurred by the other party in the litigation. Seller and Buyer agree that Escrow Agent will have no liability to any party on account of disbursement of the Deposit or on account of failure to disburse the Deposit, except in the event of the Escrow Agent’s gross negligence or willful misconduct. The parties further agree that the Escrow Agent will not be liable for the failure of any depository in which the Deposit is placed and that Seller and Buyer each will indemnify, defend and save harmless the Escrow Agent from any loss or expense arising out of the holding, disbursement or failure to disburse the Deposit, except in the case of the Escrow Agent’s gross negligence or willful misconduct.

If either Buyer or Seller is in Default, then in addition to all other damages, the defaulting party will immediately pay the Broker’s Fee in full, as well as the costs incurred for the title examination, Appraisal, and survey.

27.DISCLOSURES TO THE PARTIES: Buyer and Seller should carefully read this Contract to be sure that the terms accurately express their respective understanding as to their intentions and agreements. By signing this Contract, Buyer and Seller acknowledge that they have not relied on any representations made by the Brokers, or any agents, subagents or employees of the Brokers, except those representations expressly set forth in this Contract. Further, Brokers, their agents, subagents and employees do not assume any responsibility for the performance of this Contract by any or all parties hereto. The Broker can counsel on real estate matters, but if legal advice is desired by either party, such party is advised to seek legal counsel. Buyer and Seller are further advised to seek appropriate professional advice concerning the condition of the Property or tax and insurance matters. The following provisions disclose some matters which the parties may investigate further. These disclosures are not intended to create a contingency. Any contingency must be specified by adding appropriate terms to this Contract. The parties acknowledge the disclosures contained herein and that the Brokers, their agents, subagents and employees, make no representations nor assume any responsibility with respect to the following:

A.PROPERTY CONDITION Various inspection services and home warranty insurance programs are available. The Broker is not advising the parties as to certain other issues, including without limitation: condition of real or personal property, water quality and quantity (including but not limited to, lead and other contaminants); sewer or septic; public utilities; lot size and exact location; soil condition; flood hazard areas; possible restrictions of the use of the Property due to restrictive covenants, zoning, subdivision, or environmental laws, easements; airport or aircraft noise; planned land use, roads or highways; and construction materials and/or hazardous materials, including without limitation, flame-retardant treated plywood (FRT), radon, urea formaldehyde foam insulation (UFFI), mold, polybutylene pipes, synthetic stucco (EIFS), underground storage tanks, defective Chinese drywall, asbestos and lead-based paint. Information relating to these issues may be available from appropriate government authorities.

B.LEGAL REQUIREMENTS All contracts for the sale of real property must be in writing to be enforceable. Upon ratification and Delivery, this Contract becomes a legally binding agreement. Any changes to this Contract must be made in writing, agreed to by all parties to the Contract, and Delivered to all parties for such changes to be enforceable.

C.FINANCING Mortgage rates and associated charges vary with financial institutions and the marketplace. Buyer has the opportunity to select the lender and the right to negotiate terms and conditions of the financing subject to the terms of this Contract.

D.BROKER Buyer and Seller acknowledge that the Broker is being retained solely as a real estate agent and not as an attorney, tax advisor, lender, appraiser, surveyor, structural engineer, mold or air quality expert, home inspector or other professional service provider. The Broker may from time to time engage in the general insurance, title insurance, mortgage loan, real estate settlement, home warranty and other real estate- related businesses and services. Therefore, in addition to the Broker’s Fee specified herein, the Broker may receive compensation related to other services provided in the course of this transaction pursuant to the terms of a separate agreement/disclosure.

E.PROPERTY TAXES Your property tax bill could substantially increase following Settlement. For more information on property taxes, contact the appropriate taxing authority in the jurisdiction where the Property is located.

F.PROPERTY INSURANCE Obtaining property insurance is typically a requirement of the lender in order to secure financing. Insurance rates and availability are determined in part by the number and nature of claims and inquiries made on a property’s policy as well as the number and nature of claims made by a prospective

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 6 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

buyer. Property insurance has become difficult to secure in some cases. Seller should consult an insurance professional regarding maintaining and/or terminating insurance coverage.

G. TITLE INSURANCE Buyer may, at Buyer’s expense, purchase owner’s title insurance. The coverage afforded by such title insurance would be governed by the terms and conditions thereof, and the premium for obtaining such title insurance coverage will be determined by the extent of its coverage. Buyer may purchase title insurance at either “standard” or “enhanced” coverage and rates. For purposes of owner’s policy premium rate disclosure by Buyer’s Lender(s), if any, Buyer and Seller require that enhanced rates be quoted by Buyer’s Lender(s). Buyer understands that nothing herein obligates Buyer to obtain any owner’s title insurance coverage at any time, including at Settlement, and that the availability of enhanced coverage is subject to underwriting criteria of the title insurer.

28.ASSIGNABILITY: This Contract may not be assigned without the written consent of Buyer and Seller. If Buyer and Seller agree in writing to an assignment of this Contract, the original parties to this Contract remain obligated hereunder until Settlement.

29.FOREIGN INVESTMENT TAXES – FIRPTA: Section 1445 of the United States Internal Revenue Code of 1986 provides that a buyer of a residential real property located in the United States must withhold federal income taxes from the payment of the purchase price if (a) the purchase price exceeds Three Hundred Thousand Dollars ($300,000.00) or the purchase price is less than or equal to Three Hundred Thousand Dollars ($300,000.00) and the property will not be owner occupied, and (b) seller is a foreign person for purposes of U.S. income taxation. A foreign person includes, but is not limited to, a non-resident alien, foreign corporation, foreign partnership, foreign trust or foreign estate (as those terms are defined by the Internal Revenue Code and applicable regulations). In the event Seller is a foreign person (as described above), the Seller will be subject to the withholding provisions of FIRPTA. If Seller is not a foreign person, Seller agrees to execute an affidavit to this effect at Settlement.

30.DEFINITIONS:

A.“Appraisal” means a written appraised valuation of the Property.

B.“Day(s)” or “day(s)” means calendar day(s) unless otherwise specified in this Contract.

C.“Business Days”, whenever used, means Monday through Friday, excluding federal holidays.

D.For the purpose of computing time periods, the first Day will be the Day following Delivery and the time period will end at 9 p.m. on the Day specified.

E.If the Settlement Date falls on a Saturday, Sunday, or legal holiday, then the Settlement will be on the prior Business Day.

F.“Date of Ratification” This Contract shall be deemed ratified when the Contract, all addenda and any modifications thereto have been signed and initialed, where required, by all parties, and Delivered to the other party pursuant to the Notices paragraph.

G.The masculine includes the feminine and the singular includes the plural. “Buyer” means “Purchaser” and vice versa.

H.“Legal Expenses” means attorney fees, court costs, and litigation expenses, if any, including but not limited to, expert witness fees and court reporter fees.

I.“Specified Financing” means the financing as set forth in the financing addendum attached hereto.

31.NOTICES: Notice means a unilateral communication from one party to another. All Notices required under this Contract will be in writing. Notices to Seller shall be effective when Delivered to Seller or an agent of Seller named in the Contract or that agent’s supervising Manager. Notices to Buyer shall be effective when Delivered to Buyer or an agent of Buyer named in the Contract or that agent’s supervising Manager. “Delivery” means sent by wired or electronic medium which produces a tangible record of the transmission (such as “fax” or email which includes an attachment with an actual copy of the executed instruments being transmitted), hand carried, sent by overnight delivery service or U.S. Postal mailing. In the event of overnight delivery service, Delivery will be deemed to have been made on the next Business Day following the sending, unless earlier receipt is acknowledged in writing. In the event of U.S. Postal mailing, Delivery will be deemed to have been made on the third Business Day following the mailing, unless earlier receipt is acknowledged in writing. The provisions of this paragraph regarding Delivery of Notices shall also be applicable to Delivery of resale packages for condominiums, co-operatives and/or homeowners associations as may be required in a separate addendum. Resale

GCAAR Form # 1301 - GCAAR Sales Contract – 7/2016 |

Page 7 of 8 |

Initials: Seller |

______/ |

______ |

Buyer |

______/ |

______ |

packages may also be Delivered to the parties identified above by Seller or agent of Seller through an electronic link provided by the management association.

32.MISCELLANEOUS: This Contract may be signed in one or more counterparts, each of which is deemed to be an original, and all of which together constitute one and the same instrument. Documents obtained via fax or as a PDF attachment to an email will also be considered as originals. Typewritten or handwritten provisions included in this Contract will supersede all pre-printed provisions that are in conflict.

33.VOID CONTRACT: If this Contract becomes void and of no further force and effect, without Default by either party, both parties will immediately execute a Release directing that the Deposit be refunded in full to Buyer according to the terms of the DEPOSIT paragraph.

34.ENTIRE AGREEMENT: This Contract will be binding upon the parties and each of their respective heirs, executors, administrators, successors and permitted assigns. The provisions not satisfied at Settlement will survive the delivery of the Deed and will not be merged therein. This Contract, unless amended in writing, contains the final and entire agreement of the parties and the parties will not be bound by any terms, conditions, oral statements, warranties or representations not herein contained. The interpretation of this Contract will be governed by the laws of the jurisdiction where the Property is located.

_____________________________________________

SellerDate

_____________________________________________

________________________________________

BuyerDate

________________________________________

Date of Ratification (see DEFINITIONS)

*******************************************************************************************

For informational purposes only: |

|

Seller’s Address_____________________________ |

Buyer’s Address_________________________________ |

Seller’s Email Address_________________________ Buyer’s Email Address____________________________ |

Seller’s Telephone Number_____________________ |

Buyer’s Telephone Number________________________ |

Listing Company’s Name and Address: |

Selling Company’s Name and Address: |

___________________________________________ |

_____________________________________________ |

___________________________________________ |

_____________________________________________ |

Office #_____________________________________ Office # ______________________________________

Agent Name _________________________________ Agent Name __________________________________

Agent Cell # _________________________________ Agent Cell # __________________________________

Agent Email Address __________________________ Agent Email Address ___________________________

Agent License # and Jurisdiction_________________ Agent License # and Jurisdiction__________________

Broker License # and Jurisdiction_________________ Broker License # and Jurisdiction__________________

Team Leader/Agent ___________________________ Team Leader/Agent ____________________________

©2016 This is a suggested form owned by certain REALTOR® Associations ("Associations"). This form has been created and printed exclusively for the use of REALTORS® and members of the Associations, who may copy or otherwise reproduce this form in identical form with the addition of their company logo and with any other changes being set forth in a clearly marked separate addendum. Any other use of this form is prohibited without prior written authorized consent of the Associations.

GCAAR Form # 1301 - GCAAR Sales Contract – MC & DC |

Page 8 of 8 |

7/2016 |