ga payment form can be filled in online easily. Simply open FormsPal PDF editor to do the job right away. In order to make our editor better and less complicated to utilize, we constantly implement new features, considering feedback coming from our users. To get started on your journey, take these simple steps:

Step 1: Click on the "Get Form" button in the top section of this webpage to open our PDF editor.

Step 2: With the help of this advanced PDF file editor, you may accomplish more than simply complete blanks. Express yourself and make your docs appear high-quality with custom textual content added in, or optimize the file's original content to perfection - all supported by an ability to incorporate any images and sign the file off.

This PDF doc will require you to type in some specific details; in order to guarantee consistency, remember to take note of the next steps:

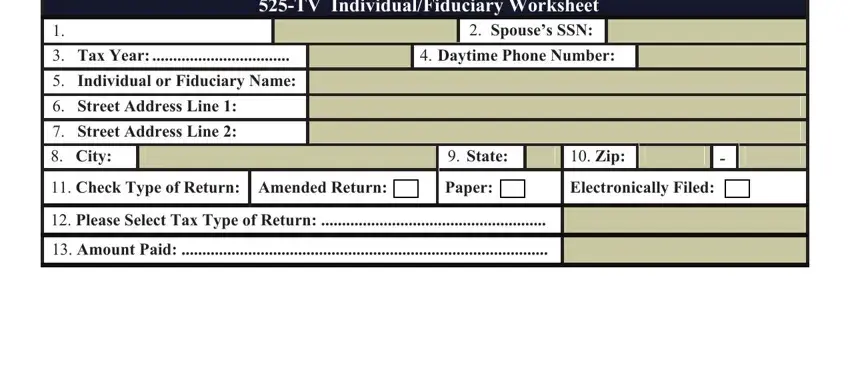

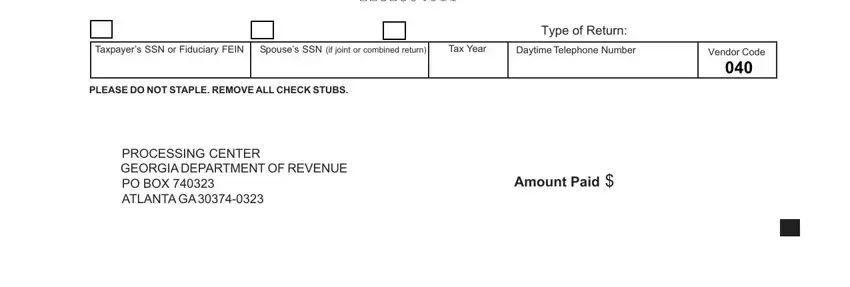

1. Complete the ga payment form with a selection of major blank fields. Consider all the required information and make sure not a single thing neglected!

2. The subsequent stage is usually to fill in the next few blank fields: Taxpayers SSN or Fiduciary FEIN, Spouses SSN if joint or combined, Tax Year, Day t ime Telephone Number, Type of Return, Vendor Code, PLEASE DO NOT STAPLE REMOVE ALL, PROCESSING CENTER GEORGIA, and Amount Paid.

People who work with this PDF frequently get some things incorrect while completing Amount Paid in this area. Ensure you re-examine everything you enter right here.

Step 3: Before moving on, you should make sure that blanks are filled out properly. Once you’re satisfied with it, press “Done." After starting a7-day free trial account here, it will be possible to download ga payment form or send it via email right away. The form will also be available in your personal account with your edits. FormsPal guarantees your data privacy by having a protected system that in no way saves or shares any type of personal data involved. Be assured knowing your docs are kept protected each time you work with our services!