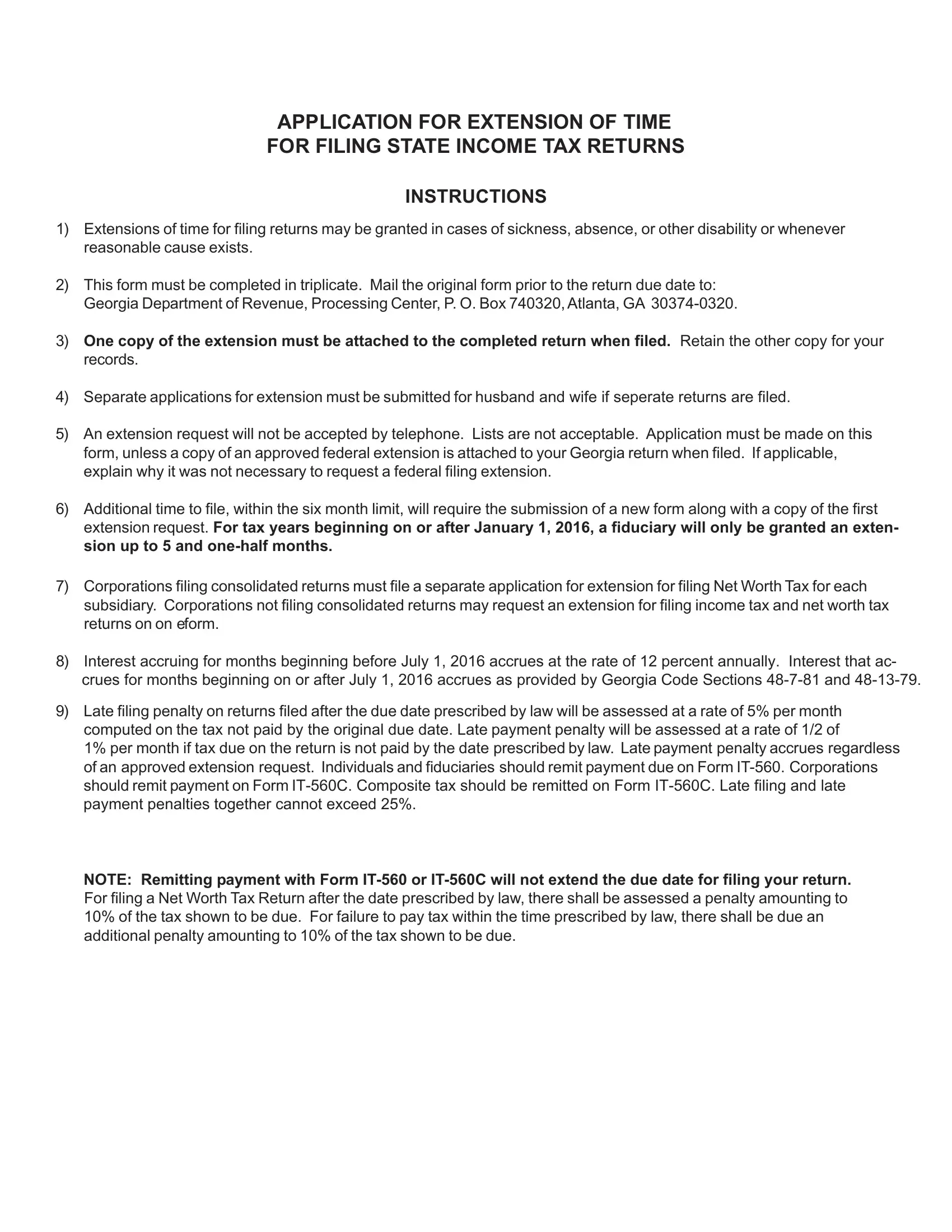

APPLICATION FOR EXTENSION OF TIME

FOR FILING STATE INCOME TAX RETURNS

INSTRUCTIONS

1)Extensions of time for filing returns may be granted n cases of sickness, absence, or other disability or whenever reasonable cause exists.

2)This form must be completed n triplicate. Mail the original form prior to the return due date to: Georgia Department of Revenue, Processing Center, P. O Box 740320,Atlanta GA 30374-0320.

3)One copy of the extension must be attached to the completed return when filed. Retain the other copy for your records.

4)Separate applications for extension must be submitted for husband and wife if seperate returns are filed.

5)An extension request will not be accepted by telephone. Lists are not acceptable. Application must be made on this form, unless a copy of an approved federal extension is attached to your Georgia return when filed. If applicable, explain why t was not necessary to request a federal filing extension.

6)Additional time to file, within the six month imit, will require the submission of a new form along with a copy of the first extension request. For tax years beginning on or after January 1, 2016, a fiduciary will only be granted an exten- sion up to 5 and one-half months.

7)Corporations filing consolidated returns must file a separate application for extension for filing Net Worth Tax for each subsidiary. Corporations not filing consolidated returns may request an extension for filing income tax and net worth tax returns on on eform.

8)Interest accruing for months beginning before July 1, 2016 accrues at the rate of 12 percent annually. Interest that ac- crues for months beginning on or after July 1, 2016 accrues as provided by Georgia Code Sections 48-7-81 and 48-13-79.

9)Late iling penalty on returns iled after he due date prescribed by aw will be assessed at a rate of 5% per month computed on the tax not paid by the original due date. Late payment penalty will be assessed at a rate of 1/2 of

1% per month f ax due on he return s not paid by he date prescribed by law. Lat e payment penal ty accrues regardless of an approved extension request. Individuals and fiduciaries should remi t payment due on Form IT-560. Corporations shoul d remi t payment on Form IT-560C. Composite tax should be remitted on Form IT-560C. Late filing and late payment penalties together cannot exceed 25%.

NOTE: Remitting payment with Form IT-560 or IT-560C will not extend the due date for filing your return. For filing a Net Worth Tax Return after the date prescribed by law, there shall be assessed a penalty amounting to 10% of the tax shown to be due. For failure to pay tax within the time prescribed by law, there shall be due an additional penalty amounting to 10% of the tax shown to be due.

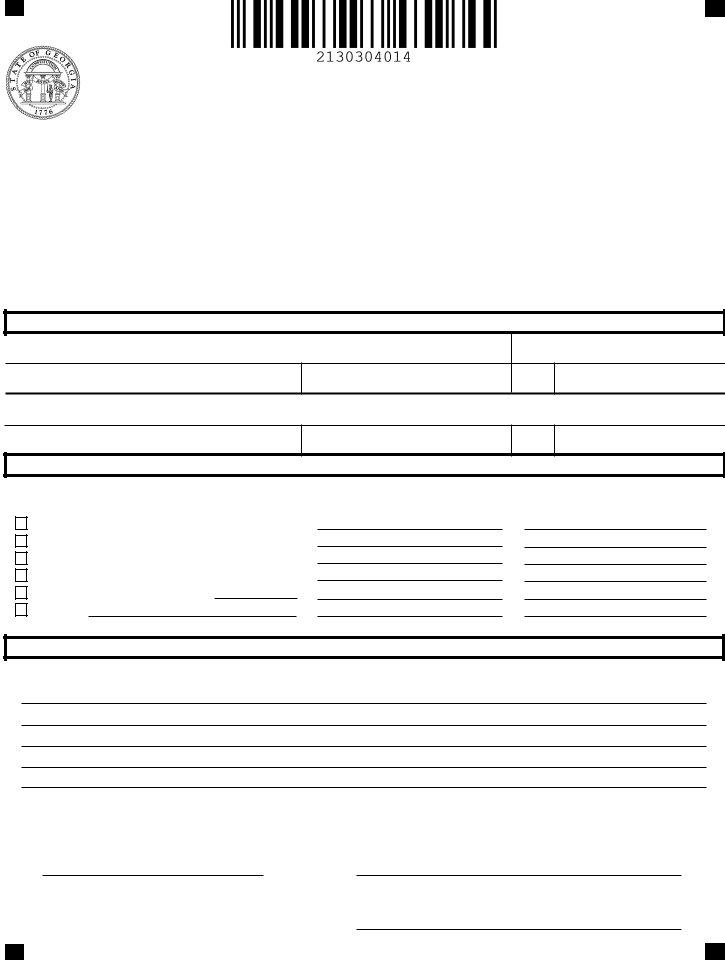

Form IT-303(Rev. 07/23/20)

MAIL TO:

Georgia Department of Revenue

Processing Center

PO Box 740320

Atlanta, GA 30374-0320

Georgia Department of Revenue

APPLICATION FOR EXTENSION OF TIME

FOR FILING STATE INCOME TAX RETURNS

IMPORTANT! ACCEPTANCE OF FEDERAL EXTENSIONS

AFEDERAL EXTENSION WILL BEACCEPTEDAS AGEORGIAEXTENSION IF: (1) THE RETURN IS RECEIVED WITHIN THE TIMEAS EXTENDED BY THE NTERNAL REVENUE SERVICE, AND (2) A COPY OF THE FEDERAL EXTENSION(S) S ATTACHED TO THE RETURN WHEN FILED. NOTE:

THERE S NO EXTENSION FOR PAYMENT OF TAX. INCOME TAX OR CORPORATE NET WORTH TAX MUST BE PAID BY THE PRESCRIBED DUE DATE TOAVOID THE ASSESSMENT OF LATE PAYMENT PENALTIES AND INTEREST.

THIS IS NOT A PAYMENT FORM! REMIT PAYMENT ON FORM IT-560 OR IT-560C.

COMPLETE THIS FORM IN TRIPLICATE. MAIL THE ORIGINAL PRIOR TO THE RETURN DUE DATE AND KEEP 2 COPIES. ATTACH ONE COPY TO RETURN WHEN FILED AND RETAIN ONE COPY FOR YOUR RECORDS. WE WILL NOTIFY YOU ONLY IF YOUR EXTENSION REQUEST IS DENIED.

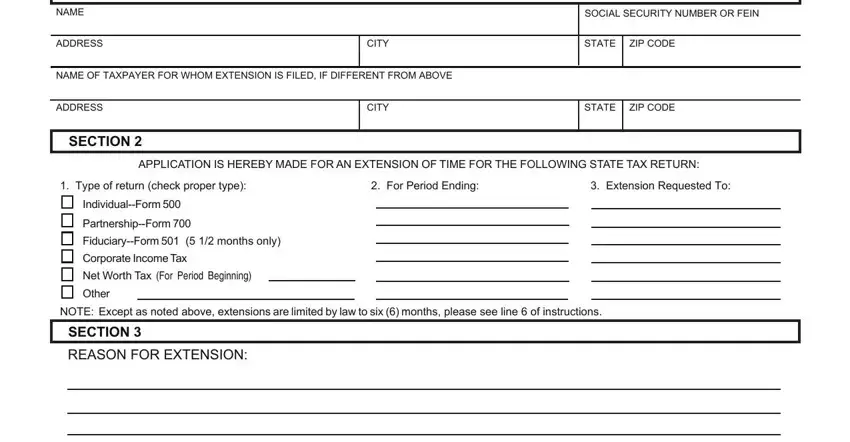

SOCIAL SECURITY NUMBER OR FEIN

NAME OF TAXPAYER FOR WHOM EXTENSION IS FILED, IF DIFFERENT FROM ABOVE

SECTION 2

APPLICATION IS HEREBY MADE FOR AN EXTENSION OF TIME FOR THE FOLLOWING STATE TAX RETURN:

1. Type of return (check proper type):2. For Period Ending:3. Extension Requested To:

Individual--Form 500

Partnership--Form 700

Fiduciary--Form 501 (5 1/2 months only)

Corporate IncomeTax

Net Worth Tax (For Period Beginning)

Other

NOTE: Except as noted above, extensions are limited by law to six (6) months, please see line 6 of instructions.

SECTION 3

REASON FOR EXTENSION:

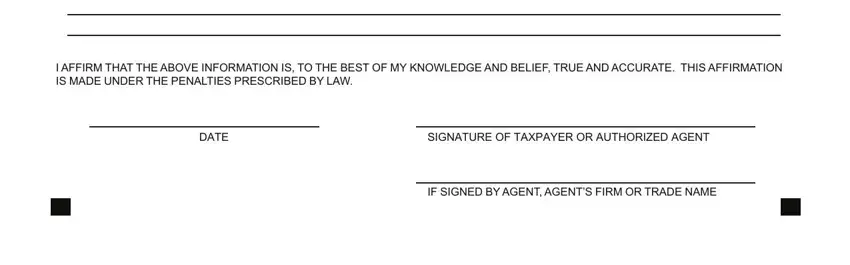

I AFFIRM THAT THE ABOVE INFORMATION IS, TO THE BEST OF MY KNOWLEDGE AND BELIEF, TRUE AND ACCURATE. THIS AFFIRMATION IS MADE UNDER THE PENALTIES PRESCRIBED BY LAW.

DATE |

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT |

IF SIGNED BYAGENT, AGENT’S FIRM OR TRADE NAME