With the online editor for PDFs by FormsPal, it is possible to complete or change Georgia Form 600 T right here. Our tool is constantly developing to deliver the best user experience possible, and that's due to our commitment to continuous enhancement and listening closely to comments from users. This is what you'll need to do to get going:

Step 1: Just click on the "Get Form Button" in the top section of this site to launch our pdf file editor. Here you'll find all that is needed to work with your file.

Step 2: As soon as you start the PDF editor, you'll see the document made ready to be filled in. Besides filling out different blanks, you could also do many other actions with the form, namely putting on any textual content, modifying the initial text, adding graphics, putting your signature on the document, and much more.

It is actually straightforward to finish the form with this practical tutorial! This is what you should do:

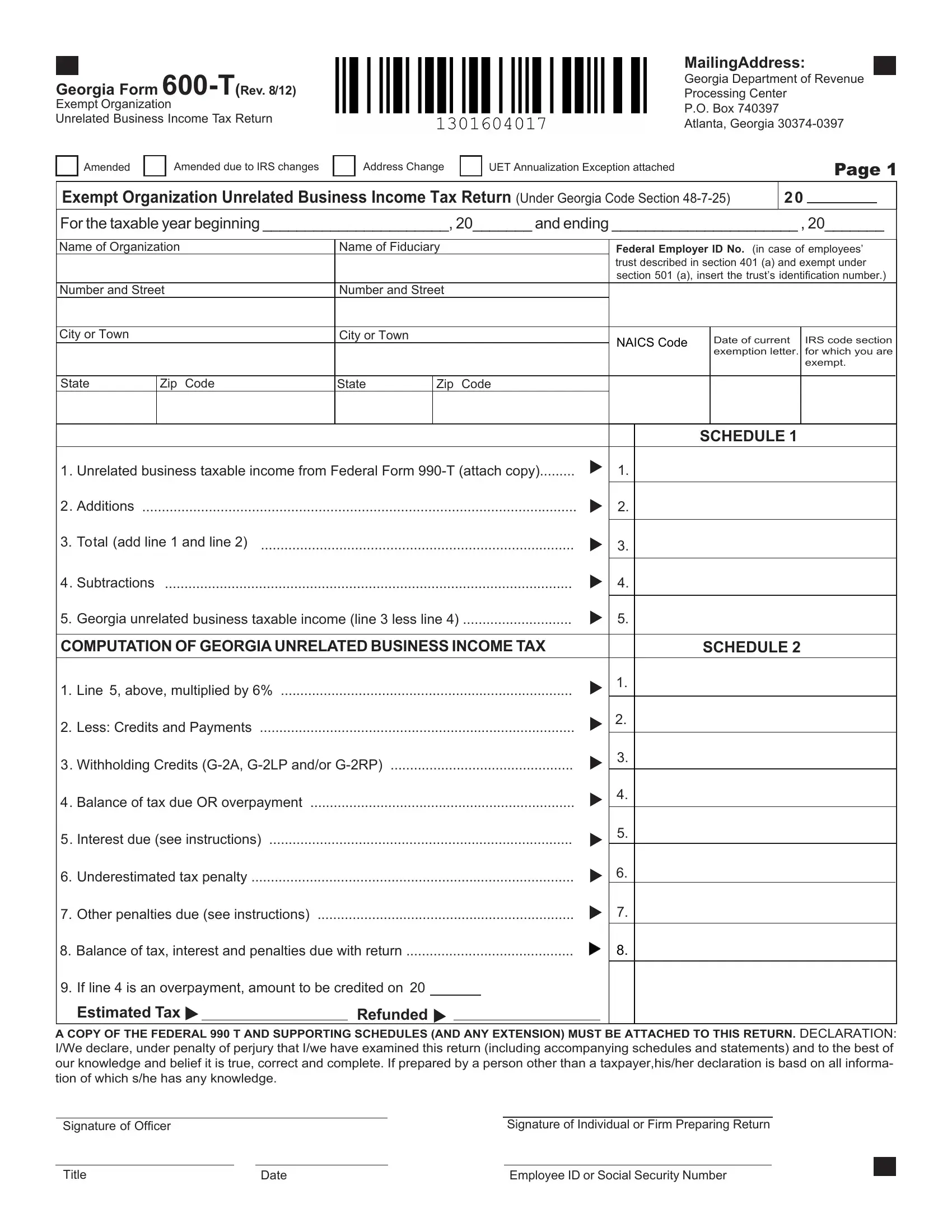

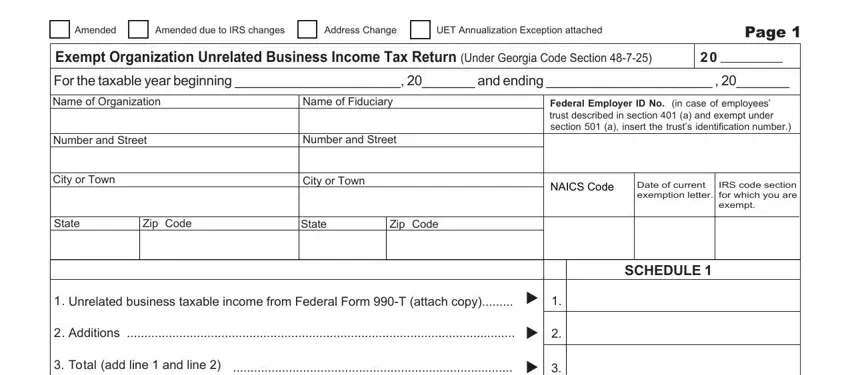

1. To get started, once completing the Georgia Form 600 T, beging with the form section that features the subsequent blanks:

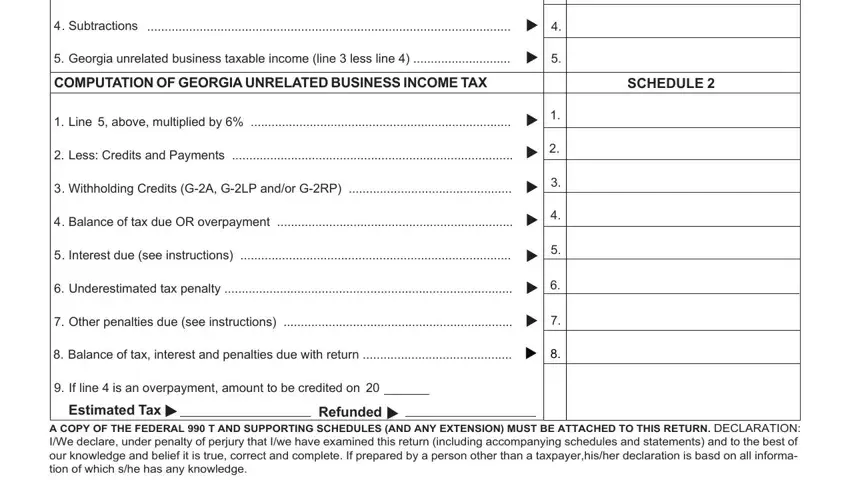

2. Given that the previous array of fields is completed, it is time to put in the required specifics in Subtractions, Georgia unrelated business, COMPUTATION OF GEORGIA UNRELATED, SCHEDULE, Line above multiplied by, Less Credits and Payments, Withholding Credits GA GLP andor, Balance of tax due OR overpayment, Interest due see instructions, Underestimated tax penalty, Other penalties due see, Balance of tax interest and, If line is an overpayment amount, Estimated Ta, and dednufeR so that you can go to the third step.

3. This third step should be pretty uncomplicated, reciffOfoerutangiS, eltiT, etaD, and rebmuNytiruceSlaicoSroDIeeyolpmE - each one of these blanks has to be filled in here.

People who work with this PDF frequently make some errors when filling out etaD in this area. Ensure that you reread what you type in here.

Step 3: As soon as you have looked over the information in the blanks, click on "Done" to finalize your form at FormsPal. Go for a free trial option with us and acquire instant access to Georgia Form 600 T - downloadable, emailable, and editable inside your FormsPal cabinet. We do not share or sell the information you provide while filling out documents at our website.