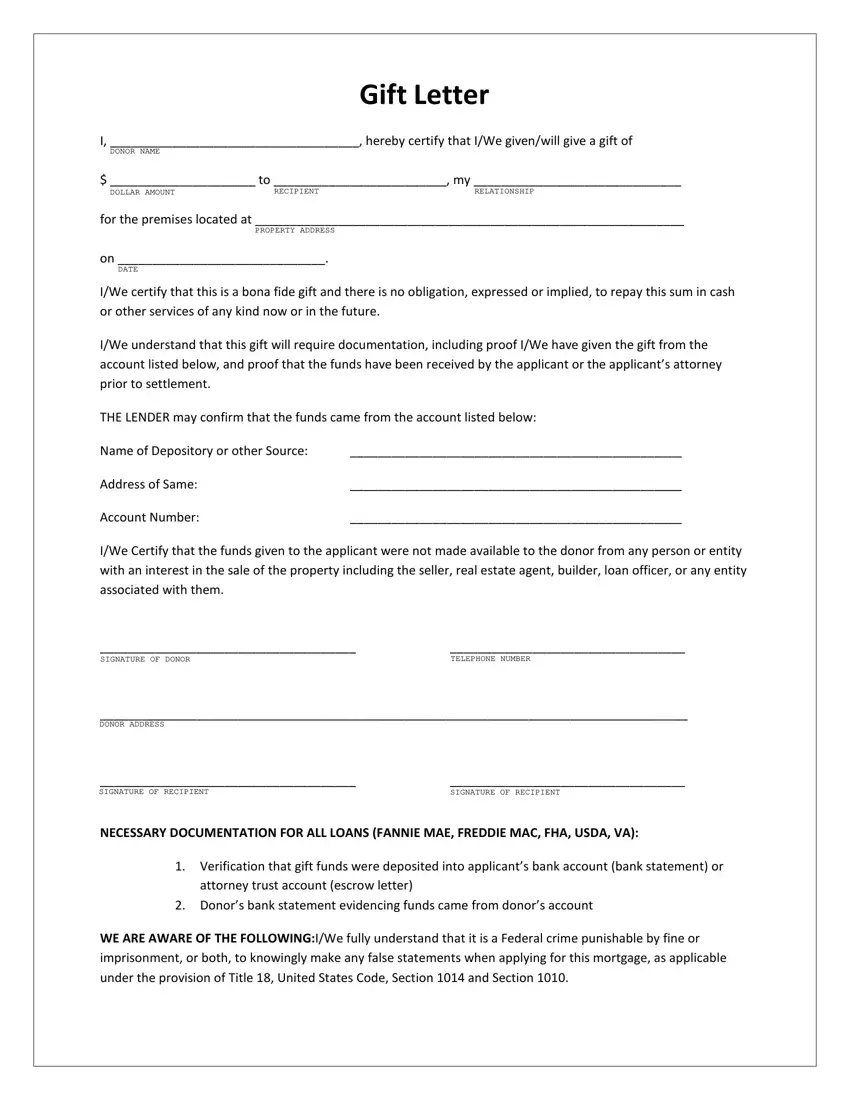

It is easy to fill out forms through our PDF editor. Editing the gift letter template form is not hard in case you keep up with the following actions:

Step 1: The very first step will be to press the orange "Get Form Now" button.

Step 2: At the moment you're on the form editing page. You may modify and add information to the form, highlight words and phrases, cross or check specific words, add images, insert a signature on it, get rid of unwanted fields, or take them out entirely.

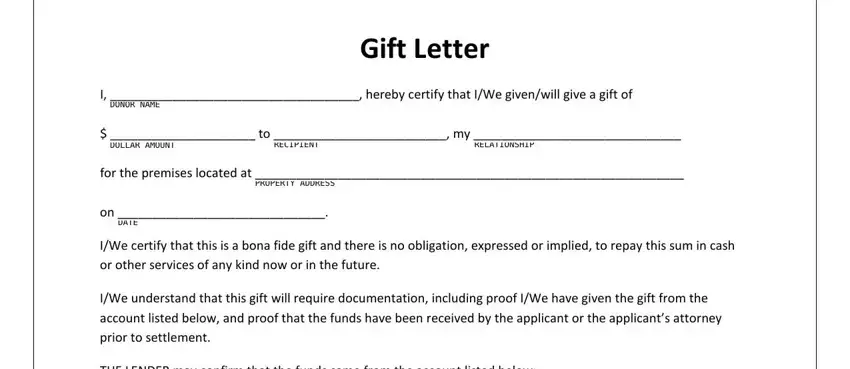

For every single segment, create the data demanded by the system.

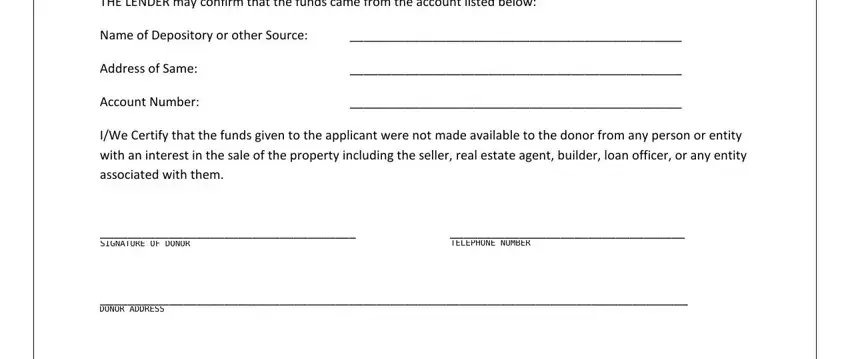

Type in the details in the THE LENDER may confirm that the, Name of Depository or other Source, Address of Same, Account Number, and IWe Certify that the funds given field.

You will be required to write down the particulars to help the system complete the part NECESSARY DOCUMENTATION FOR ALL, Verification that gift funds were, attorney trust account escrow, Donors bank statement evidencing, and WE ARE AWARE OF THE FOLLOWINGIWe.

Step 3: Press the button "Done". Your PDF form may be transferred. It is possible to download it to your computer or send it by email.

Step 4: In order to avoid probable future challenges, be certain to have a minimum of a pair of duplicates of each and every document.