With the help of the online tool for PDF editing by FormsPal, you may complete or edit gst 101a here and now. Our professional team is relentlessly endeavoring to enhance the editor and make it much better for users with its extensive features. Take advantage of the latest progressive prospects, and discover a heap of unique experiences! If you are looking to start, here is what it will require:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to access our pdf editing tool. This way, you'll find everything that is needed to fill out your file.

Step 2: With this state-of-the-art PDF editor, it's possible to do more than just complete blank fields. Express yourself and make your documents appear sublime with custom textual content added, or fine-tune the file's original input to perfection - all that comes with an ability to add any type of graphics and sign the document off.

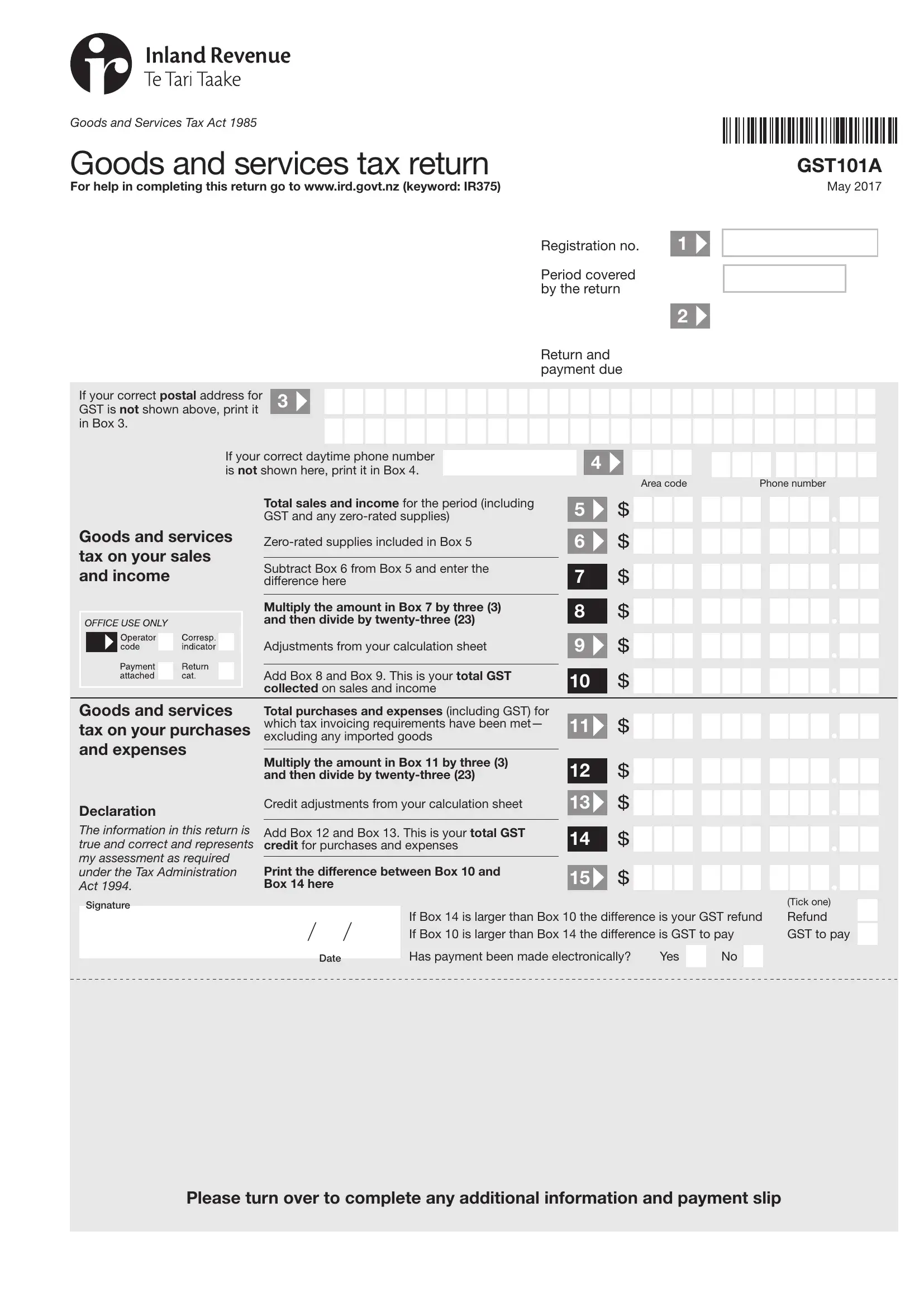

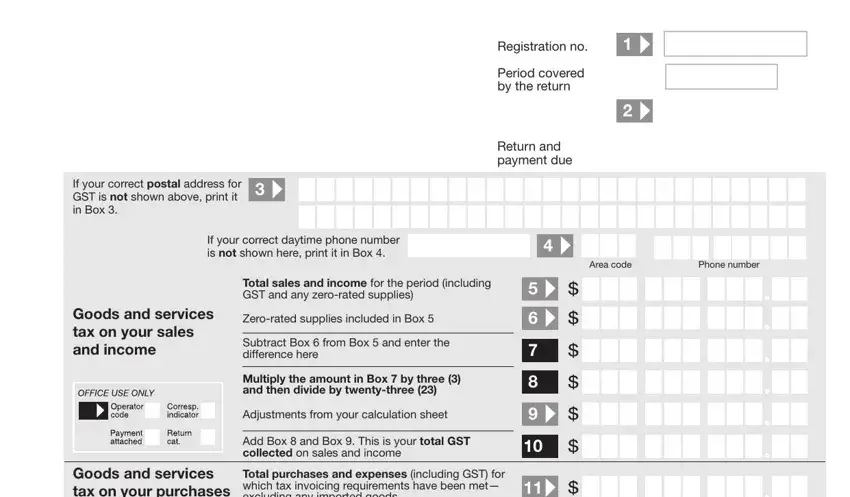

This document requires particular details to be entered, thus you should take whatever time to enter precisely what is expected:

1. You'll want to fill out the gst 101a accurately, therefore take care while filling in the segments that contain these fields:

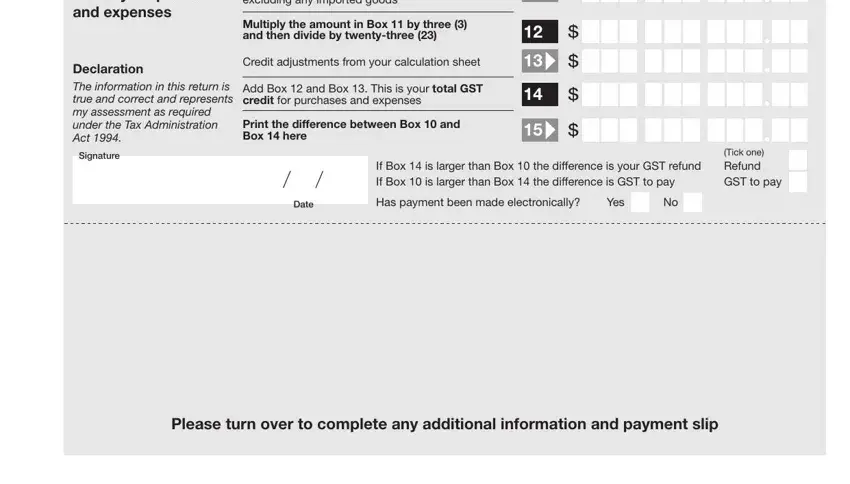

2. After the last part is completed, it is time to put in the needed details in Total purchases and expenses, Multiply the amount in Box by, Credit adjustments from your, Add Box and Box This is your, Print the difference between Box, Goods and services tax on your, Declaration, The information in this return is, Signature, Date, If Box is larger than Box the, Tick one Refund, If Box is larger than Box the, GST to pay, and Has payment been made so you can move forward further.

As to Print the difference between Box and Tick one Refund, be sure you take a second look in this current part. Both of these are the most significant fields in this PDF.

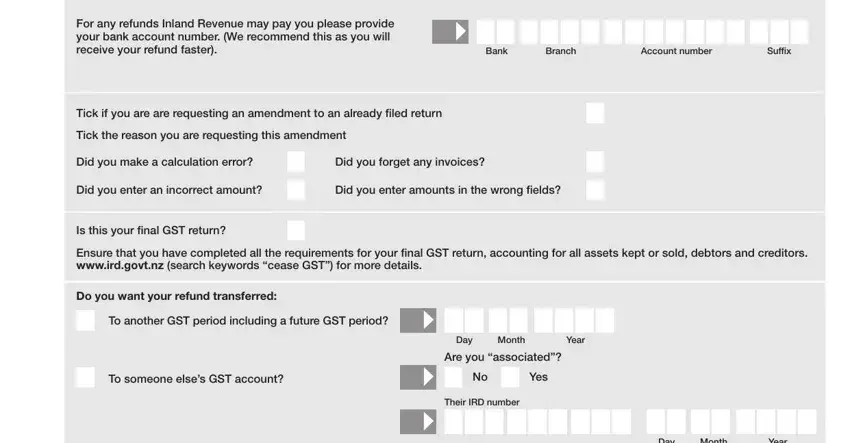

3. Within this stage, examine For any refunds Inland Revenue may, Bank, Branch, Account number, Suffix, Tick if you are are requesting an, Tick the reason you are requesting, Did you make a calculation error, Did you forget any invoices, Did you enter an incorrect amount, Did you enter amounts in the wrong, Is this your final GST return, Ensure that you have completed all, Do you want your refund transferred, and To another GST period including a. Each one of these will have to be taken care of with highest awareness of detail.

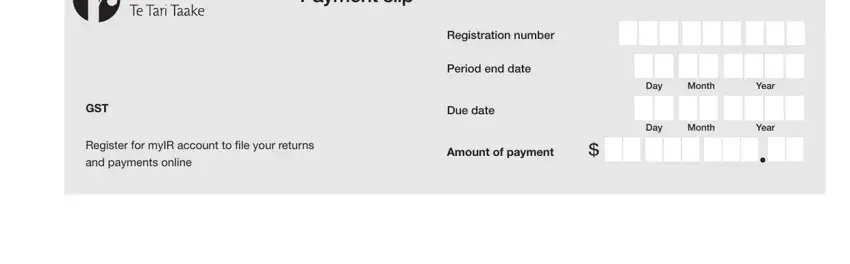

4. You're ready to fill in this fourth segment! Here you'll have all these Payment slip, GST, Register for myIR account to file, and payments online, Day, Month, Year, Day, Month, Year, Registration number, Period end date, Due date, and Amount of payment empty form fields to fill out.

Step 3: Ensure the information is right and then simply click "Done" to complete the process. After getting a7-day free trial account here, you'll be able to download gst 101a or email it right away. The PDF form will also be easily accessible in your personal account page with your every edit. We don't sell or share any information you provide while completing documents at our website.