Understanding the Guaranty Life Beneficiary form is crucial for anyone involved with Fidelity & Guaranty Life Insurance Company policies, whether they are policy owners, insured individuals, or beneficiaries. This comprehensive form serves multiple purposes, including the all-important task of designating or changing the beneficiary of a life insurance policy. It allows the policy owner to clearly outline who should receive the proceeds of the insurance policy upon the death of the insured. This could be a primary beneficiary, who is the first in line, or contingent beneficiaries, who are next in line if the primary beneficiary is not alive. Beyond beneficiary changes, the form also accommodates other requests such as name changes, alterations in the mode of premium payment, changes in the mailing address, adjustments to the policy's maturity date, and updates regarding the payout of dividends or change of payee for annuity payments. The importance of accurately completing this form cannot be overstressed, as it ensures that the policy's benefits will be distributed according to the owner's wishes, potentially avoiding common disputes that arise in the absence of clear instructions. The form also underlines legal requirements, including signature mandates for entities like corporations, partnerships, and trusts, ensuring that any changes or designations are valid and enforceable.

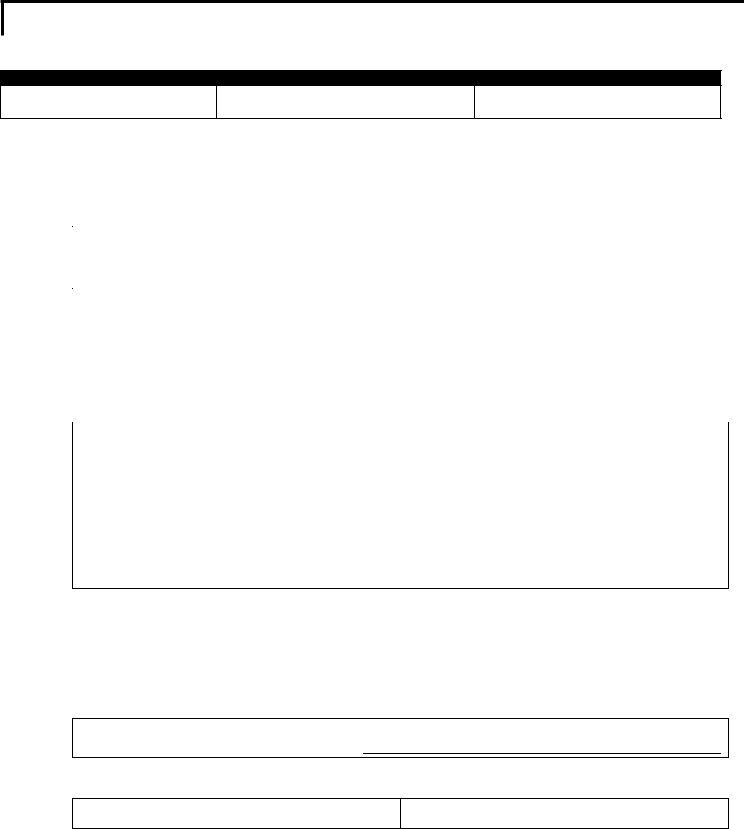

| Question | Answer |

|---|---|

| Form Name | Guaranty Life Beneficiary Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | fidelity and guaranty life death claim form, fidelity guaranty life forms 840, INSURER, fidelity guaranty life dr form |

Request for Service

INSURER: FIDELITY & GUARANTY LIFE INSURANCE COMPANY

I N S U R E D

CONTRACT NUMBER

INSURED / ANNUITANT

OWNER

1.Change Beneficiary

It is hereby requested that the beneficiary designation, including any optional settlement agreement or mode of settlement, is hereby rescinded and the following substituted therefore: (Please print, providing full address and relationship to the Insured/Annuitant.)

|

Name |

Social Security No. |

Date of Birth |

Relationship to Insured/Annuitant |

||

Primary |

|

|

|

|

|

|

Beneficiary(ies) |

Mailing Address |

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

|

Name |

Social Security No. |

Date of Birth |

Relationship to Insured/Annuitant |

||

Contingent |

|

|

|

|

|

|

Beneficiary(ies) |

Mailing Address |

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

It is understood and agreed that, unless otherwise directed, proceeds will be paid in equal shares to any primary beneficiaries who survive the insured, but if none survives, proceeds will be paid in equal shares to any contingent beneficiaries who survive the insured.

2.Change Name

Do not use this form when transferring ownership rights (use ADMIN 0177). Use this form only if owner remains the same, but the name changes.

Please change the name of the: |

From (Former Name – Please Print) |

|

Social Security Number |

|

|

Insured/Annuitant |

|

|

|

|

|

Payor |

To (New Name – Please Print) |

|

Date of Birth |

|

|

Owner |

|

|

|

|

|

|

|

|

|

|

|

Address |

|

City |

|

State |

Zip |

|

|

|

|

|

|

Reason for Change. (If other than correction, attach copy of legal evidence. Corporate name change requires proof filed with state in which corporation is domiciled.)

3. |

Change of Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Please change the address of the: |

Insured/Annuitant |

Payor |

Owner |

|

|

|

|

|

|

|

|

|

|

To (New Address) |

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

4.Change Mode of Payment of Premium

Change to: |

Annual |

Quarterly |

COM (Attach COM Authorization Card) |

Change Universal Life Planned Premium to:

5.Change Maturity Date

From (Year)

To (Year)

CONTINUED ON REVERSE

ADMIN 0840 |

Fidelity & Guaranty Life Insurance Company Baltimore, MD |

REV |

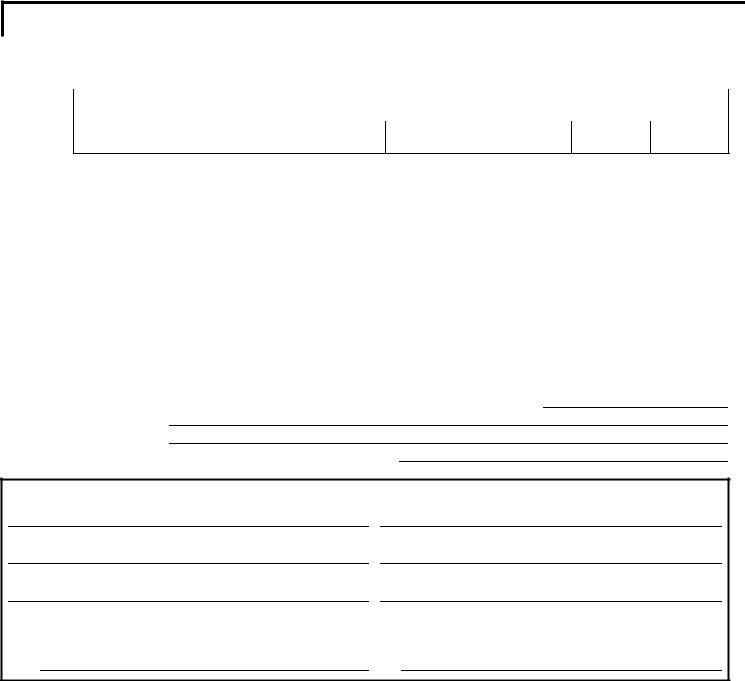

Request for Service

INSURER: FIDELITY & GUARANTY LIFE INSURANCE COMPANY

6.Change Designation of Payee

The Payee is the person who will receive periodic annuity payments.

New Payee (Name) |

Social Security No. |

Date of Birth |

|

|

|

Address

City

State

Zip

7.Request for Change of Dividend Option / Surrender of Dividends

a.Change Dividend Option to:

Cash

Reduction of Premium (not applicable to special monthly modes)

Accumulate at Interest

One Yr. Term (evidence of insurability required)

b.Surrender Dividend Value of:

Dividends held on deposit to accumulate at interest. If partial surrender, indicate amount:

$ |

|

on Policy No. |

|

on the life of |

|

. |

If said cash surrender value is to be applied to any other Fidelity and Guaranty Life Insurance policy, give details here; otherwise value will be paid to Owner:

Social Security / Tax Identification Number (Required):

Under penalties of perjury, I certify that the Tax ID information provided above is correct and true.

Date

Witness to All Signatures

Assignee (if any)

Owner(s)

Other Signatures (if any)

Other Signatures (if any)

Acknowledged and accepted by Fidelity and Guaranty Life Insurance Company

Date:By:

BENEFICIARY – SPECIAL INSTRUCTIONS AND SPECIMEN DESIGNATIONS

Signature Requirements. Reverse side of this form must be signed by person(s) having the right to change the Beneficiary.

1.If a policy owned by a

2.If policy owned by a

3.If policy owned by Trustee of Pension or

Insured’s Estate - “Executors or Administrators of the Insured’s Estate.”

One Primary and One Contingent – “Mary J. Doe, Insured’s wife, if living at Insured’s death, otherwise equally to such lawful children of Insured (Or

Delayed Payment (Common Disaster) Clause – “Mary J. Doe, Insured’s wife, if living on the 30th day after the death of the Insured; otherwise . . .

“

Corporation – “The Brown Paper Company, Inc., a Maryland Corporation, its successors and assigns.”

Partnership – “John Doe and Sons, a partnership consisting of John Doe, James Doe, and Robert Doe, its successors or assigns.”

Corporate Trustees – “First National Bank, Baltimore, MD, Trustee, or its successors in trust, under Trust Agreement dated February 15, 1989.” Individual Trustee – “John J. Jones Insurance Trust naming Mary Smith as Trustee under Trust Agreement dated February 15, 1989.”

ADMIN 0840 |

Fidelity & Guaranty Life Insurance Company Baltimore, MD |

REV |